November 14, 2024

On hold

The impact of Trump is already being felt across the investment community on one particular way. Investors have put their plans on hold.

In Mexico, the investors in supply chain parts "forwarding" have paused their investments to wait and see what the old-new president has in store for them. Comments by both the Ontario Progressive Conservatives and the federal Liberals make it clear that Canada thinks it can throw Mexico under the bus as it tries to steer the focus of Trump's anti-trade tirades.

"Friendshoring" was the word of the day over the previous four years, but that is going to change as Trump targets everyone with general tariffs. Friendshoring and onshoring are different because they come from different places. Friendshoring is about geopolitics, onshoring is about American jobs and protectionism. It is not clear which will win out in the end with Trump.

Investors are also downgrading input production facilities (such as car part manufacturers) because of uncertainty about trade deals. For example, TD (bank) Cowen analysts downgraded Linamar Corp to hold instead of buy simply because their models for investment and growth cannot predict Trump trade tantrums.

Importers and warehousing is expected to be at full capacity between now and February to get as many cheap goods into the USA before the promised tariffs come into effect.

All this means that the global economy is in a bit of mess as capacity utilization is pushed up, but investment is not being made. Such a situation increased risk of (this is our classical analysis) inflation.

Dock workers and automation

In what might be the first test of the Republican's new found support from workers, dock workers on the east coast will be pushing the strike button again. There is no reason for the Democrats to save capital this time.

Trump and the Republicans have expressed "support" for their calls against automation of the ports. There are many things behind this that have nothing to do with support for dock workers, however.

Ports are becoming automated very quickly around the world. The automation is because of a Chinese companies like ZPMC which have automated cranes to a significant degree and automated "inside the gate" trucking and container movement.

It is important to note that ports operators are automating operations not to save money, but to undermine unions. The large companies that operate ports are very clear that this is the reason. Indeed, most analyses show that port automation is actually more expensive than using dockworkers.

The issue at play in the USA is that the ports are operated by international conglomerates and they need Chinese technology on crane and automation. The FBI, national security agencies, and Congress investigations have said they uncovered "spying" by Chinese automation technology.

The spying here is that the technology phones home and sends information back to the companies that built and manage the cranes. Can this be used for spying on USA ports? Absolutely. Are they doing that? Probably, but the real worry is that there is an off switch that Chinese spies can press if they want to start a conflict in the USA.

But, to automate ports cheap automation is necessary. Also, ports are automating everywhere else in the world.

So, port operators are in a fight with the unions and the government, but are also in competition with other ports of entry into the Americas. South America is seeing a large shift in purchasing to Chinese companies.

Depending on what is being moved, goods movement can determine where the investment is made in using those goods.

It will be interesting how this all unfolds.

Palantir is going to be everywhere

If there was a company first in line for managing the next USA gulag, it is Palantir. But, it's lack of morals and close connection with the Republicans and Trump means it will be used to expand the surveillance state and privatize digital operations of government.

The focus? Selling AI systems to every government official that can make such a decision, especially those who do not know what that is.

Canada's Economy

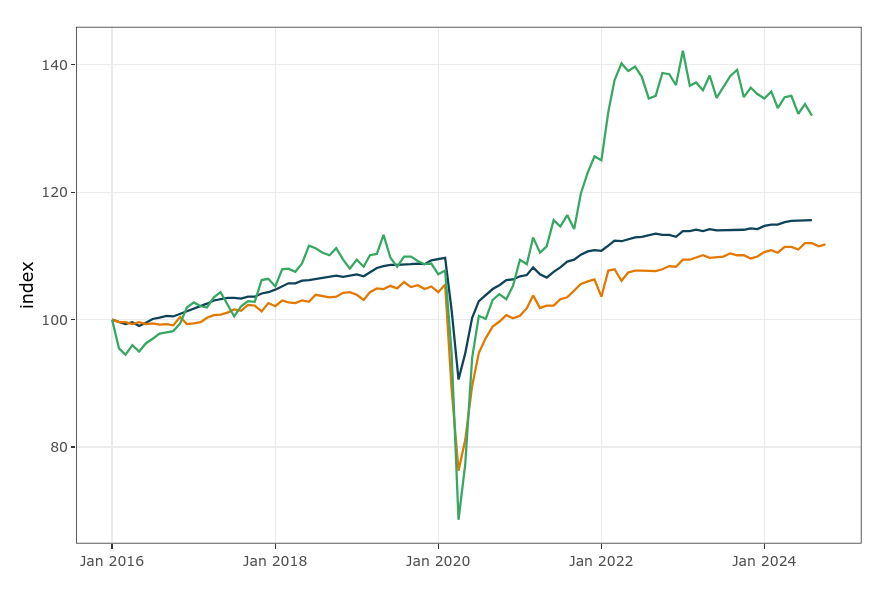

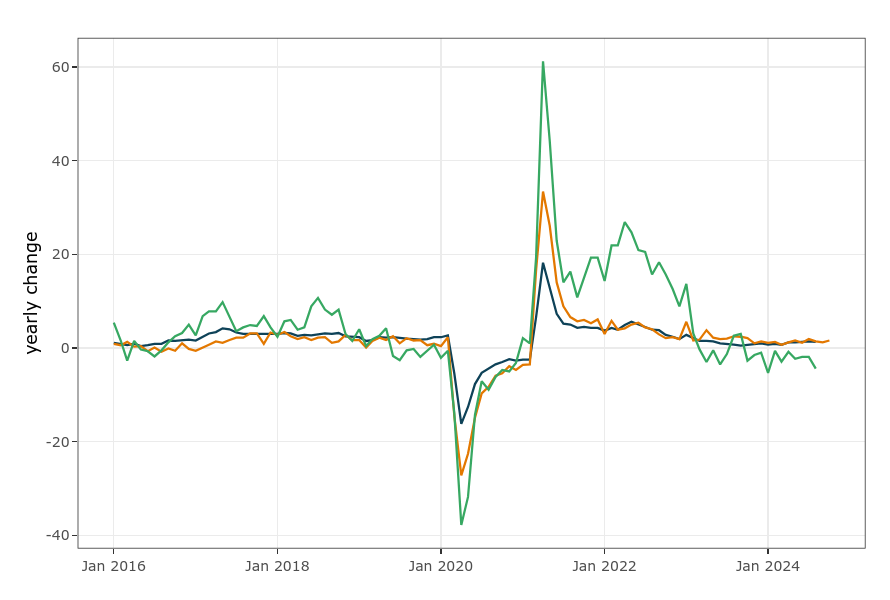

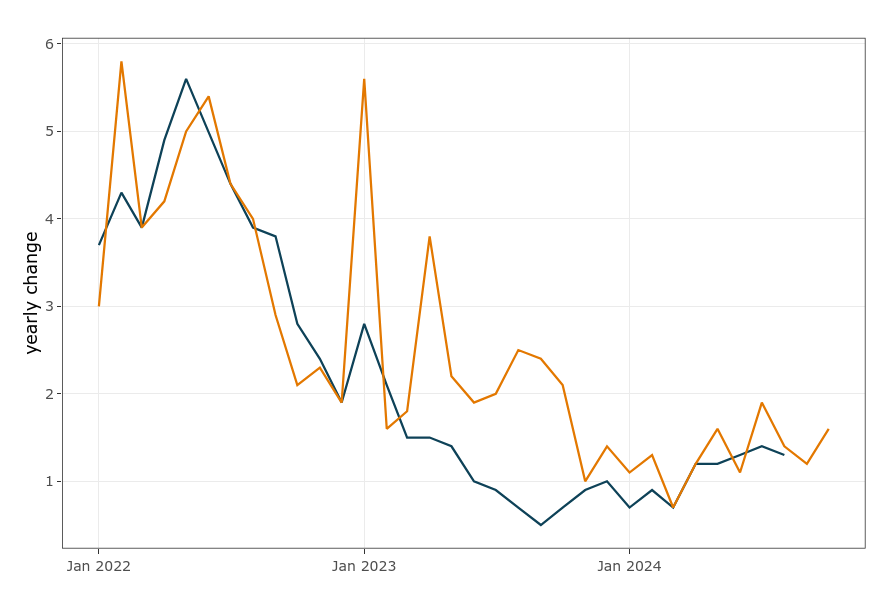

Some data show that Canada's economy is generally not great.

The long term trend is low, but the short term shows some signs of slow growth this year.