November 14, 2023

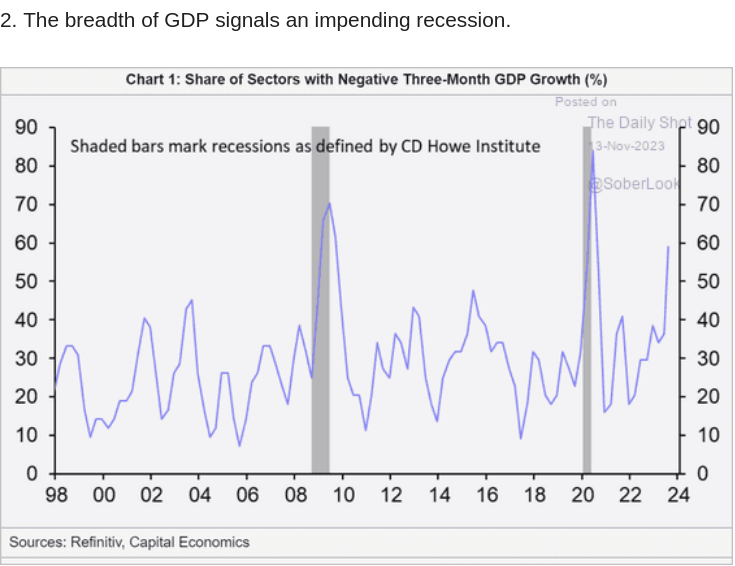

Canadian economic growth

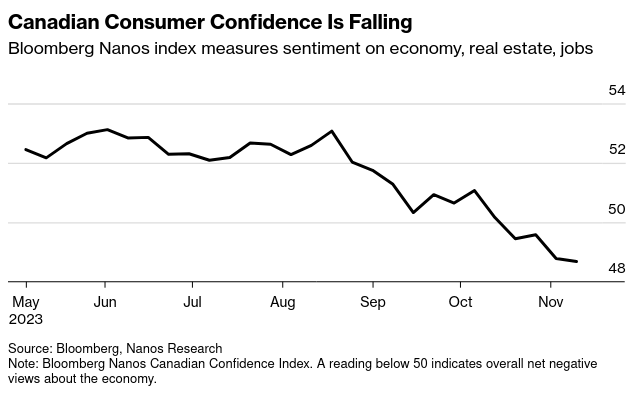

One challenge for policymakers in North America is that people are bracing for more inflation in the future, eroding confidence.

In Canada, while inflation expectations have eased, they’re still well above the Bank of Canada’s own inflation forecast, which sees inflation returning to around 2% in the latter part of 2025. (BN)

Canada has had a continuing declining "consumer sentiment" as interest rates rise. Major consumer product companies are reporting a decline of sales in the non-essential goods area compared to the last couple of years in BC and Ontario. The guess is that interest rates are impacting those provinces with higher mortgage costs.

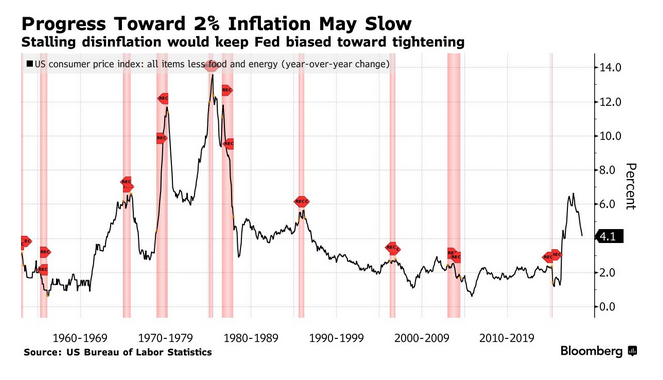

Inflation numbers are about to be released in the USA with most business economists predicting a slowing of the rate of decline. A move "sideways" for the inflation measure. Such a move would put pressure on the central bank to think about slowing down their interest rate cuts or even pushing them up again.

“After showing encouraging progress this summer, disinflation in year-over-year core CPI likely stalled, while the monthly pace has been creeping up toward something more consistent with an annualized inflation pace of 3%-4% than 2%,” Wong and Paul said.

“Officials most likely will leave open the possibility of future rate hikes as long as core CPI is running at the current monthly pace.” (BN)

Canadian mining and EV production

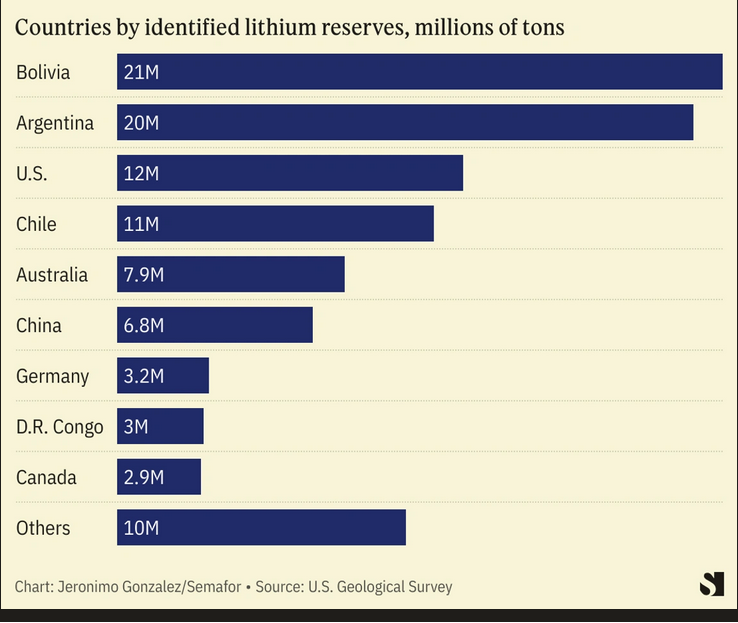

Lithium and other minerals needed in the transition to electric vehicles will be a major theme in the coming years. While Lithium is plentiful on the planet, there are rich deposits and there are poor deposits and capital is really only interested in mining rich deposits.

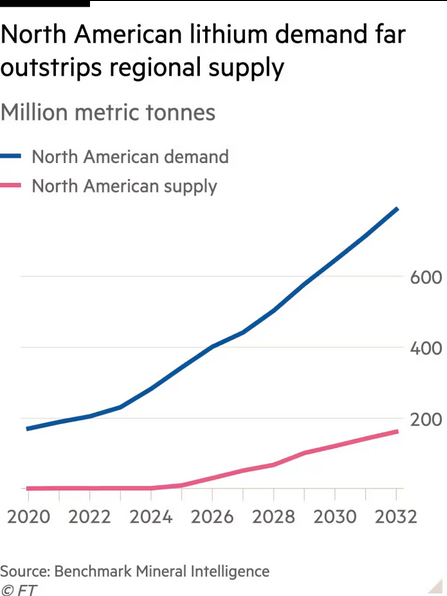

As such, demand is expected to outstrip supply for some time in North America.

However, things may shift if there is a move to solid state batteries for cars or new capacity to build other salt batteries for industrial or grid-level energy storage.

The main issues for Canada are:

- that Canadians do not own the mines

- that indigenous communities and others that care about the environment are not very excited about digging-up Canada's Northern peatbogs

Canada is in the top 10 for Lithium (and other minerals) necessary for energy storage solutions.

“Minerals deposited in the Ring of Fire are worth between $60 billion and $90 billion according to most estimates. Excluding the additional economic activity generated in extracting those resources, the value of the deposits alone are equal to about 2.75% to 4.25% of GDP - creating a meaningful source of potential growth. Global shortages of nickel and copper have the potential to push that estimate far higher if energy transition targets are taken seriously.” — Stuart Paul, Bloomberg Economics, US and Canada

Long quote from a Bloomberg article about investment and regulation "hurdles" (notice, not that anyone expects them to do anything but slow-down investment).

To the First Nations communities that inhabit Canada’s far north, the Ring of Fire is instead known as the “breathing lands”—5,000 kilometers (3,107 miles) of peat and wetlands that store an estimated 35 billion tons of carbon ever year. It’s also a critical habitat for wildlife including caribou, wolverines and migratory birds.

Projects in the area have, as a result, been held back by a slew of permitting reviews and litigation. Six separate governmental studies are underway to permit the infrastructure to support the Ring of Fire. Some First Nations communities have launched lawsuits to prevent the projects from moving forwards. Australian billionaire Andrew Forrest, whose company Wyloo Metals Pty Ltd. owns the most promising mining asset there, has warned that his project is at risk due to the glacial pace of regulatory approvals.

The miners say time is of the essence if Canada is to help the global economy move away from diesel-fueled vehicles. The region has the potential to be “Canada’s next great mineral hub and produce the metals critical to decarbonizing our planet,” Wyloo Metals Chief Executive Officer Luca Giacovazzi has said.

Skeptics of the effort say it’s better to study the impact of mining thoroughly.

“It would be stupid to rush ahead and make a decision on this,” said Kate Kempton, a lawyer representing indigenous groups in Ontario. “The peatlands are among the most effective carbon sinks in the world. We can’t afford to get this wrong.” (BN)

Exxon mobile

Good luck trying to divest from fossil fuel companies and invest in new EV ESG supporting companies.

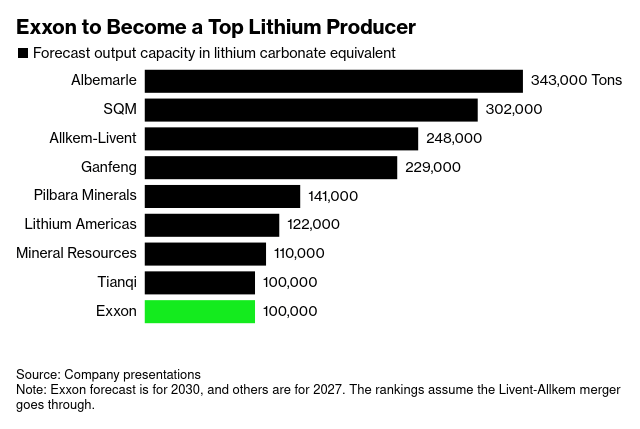

Even Exxon is looking to invest in their future by building Lithium mining concerns.

Exxon Aims to Produce Lithium in Rare Foray From Fossil Fuel

- Oil giant plans first lithium production from Arkansas by 2027

Project would help offset decline in gasoline, diesel demand

- “If you look at the approach we’re taking to production, where you’re drilling wells 10,000 feet underground into these saltwater reservoirs — that’s obviously directly in our wheelhouse and capability set,” said Ammann.

- By 2030 Exxon wants to be producing about 100,000 tonnes of lithium carbonate equivalent annually, it said — or enough to charge 1mn EVs.

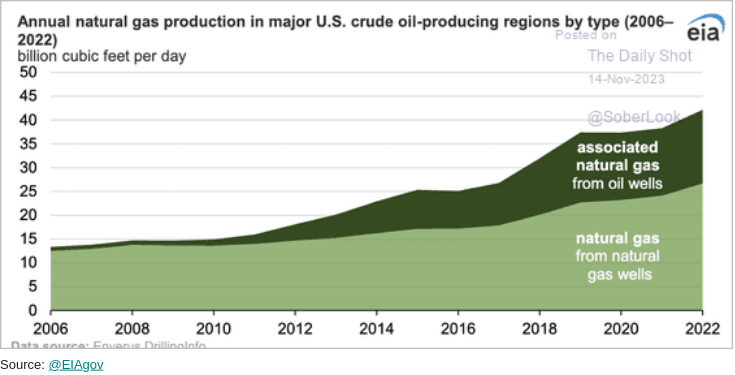

Energy sector

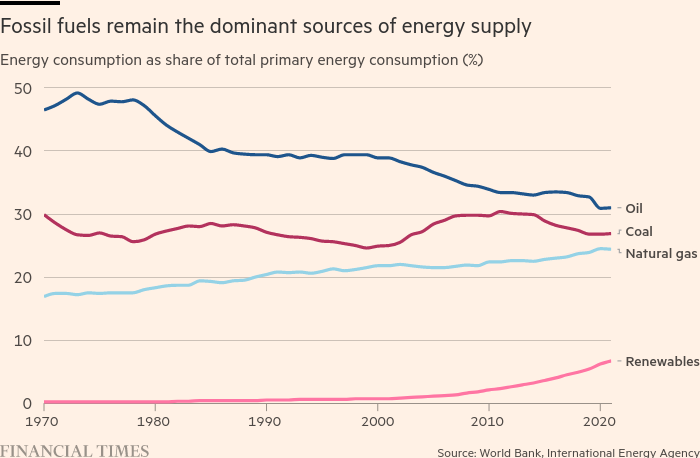

The energy sector is surviving the supposed push to greening our economy. Although, this is mostly because we are not actually greening our economies.

Either way, the large fossil fuel companies are surviving and kind of thriving through massive mergers and quick shifting investments to maintain both a steady supply of fuel products, increased efficiency of production (through automation), and keeping prices in the "nicely profitable" range.

They are of course, not supportive of the "peak oil" analysis coming out of the International Energy Agency. The oil companies are not interested in shifting their investments yet and so they see fossil fuel growth continuing for decades.

That doesn't mean that they are not going to hedge their bets.

Methane report

A new report that will be released this week estimates that methane is a major source of climate change. We have stated this for a long while, but now the analysis is coming from an industry consultant with a goal to investment to reduce escaping natural gas along the pipeline.

Environmental Defense Fund (USA) is actually launching a satellite to try to monitor methane release.

A 2022 study by The Royal Society of Chemistry estimated actual methane emissions from the UK oil and gas sector could be five times current estimates.

The potent greenhouse gas, however, is responsible for almost a third of the emissions-induced increase in global temperatures since the start of the industrial era, according to a report by Wood Mackenzie. (Mission Invisible: tackling the oil and gas industry’s methane challenge. FT)