November 12, 2024

It is all defence spending today

Beyond the appointment of "hawks" (just call them far-right, "hawks" implies some strategic position), the main topic for investors right now is defence spending. The re-election of Trump means that there will be more global instability, more unsophisticated geopolitical games, and in the end more conflict.

Trump is also soft on Nato spending outside the USA. In response, EU defense spending is going to continue its upward trajectory.

Defence spending has increased since the Russian invasion of Ukraine.

What is hidden in these numbers is the preparation to spend that is also going on inside the EU.

- Infrastructure builds directed towards defence developments,

- bills being passed to allow increased allocations

- EU funds (as opposed to national) funds being allocated

- supply chain reorganization

- Ammunition production supply chain security

- semiconductor "friend shoring"

This is all supposedly because of "underspending" on defence.

The defence sector estimates $1.4tn would be required to meet Nato criteria to make up for the previous 30 years.

This year was just $23bn in additional spending.

Nato’s European members are also increasing their spend. This year, 23 of 32 members are expected to meet or exceed the 2 per cent of GDP target; together, European allies and Canada will spend a combined 2.02 per cent of GDP, up from 1.43 per cent a decade ago. (FT)

Do not worry though, that money is coming from private sector investors. Much of it labelled "ESG" in Europe after they set and then relaxed the ESG standards.

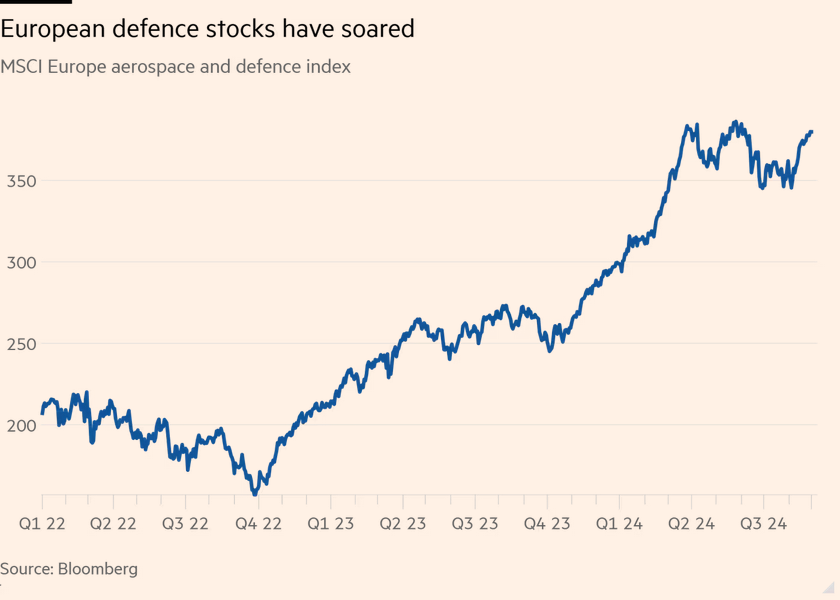

And, who can blame the value leeches from shifting focus, defence is where the equity values are growing in Europe.

In the US, the value of ESG funds’ exposure to aerospace and defence rose to €1.2bn in the second quarter of 2024, up from €779mn in the second quarter of 2022, according to Morningstar.

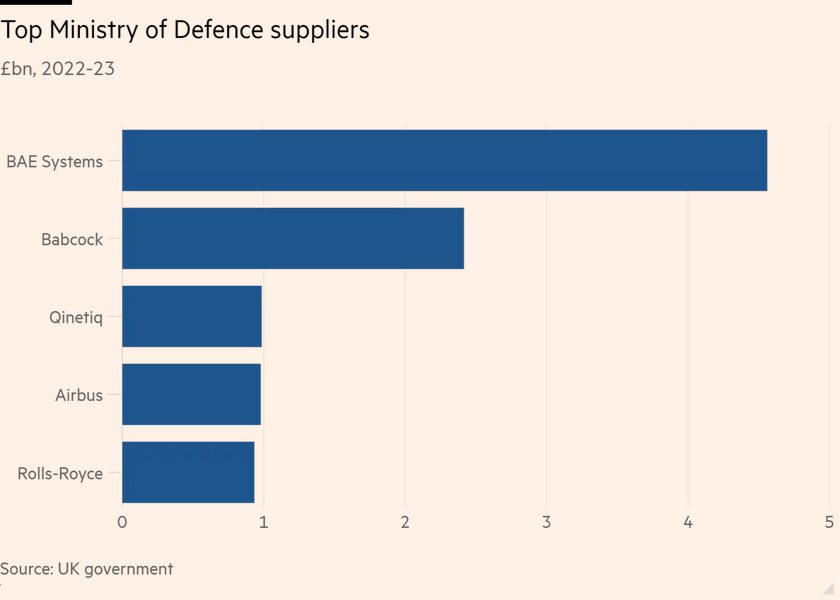

In the UK (not part of the EU, remember), the Labour government has been hard at work removing spending limits on Defence. Changes to the Ministry of Defence and additional powers have been given to the Defence secretary.

Who is making all this money?

However, the supply chains are vast. The German Leopard 2 tank requires inputs from near 1500 companies.

Producers are not happy about that number as they would prefer to have it all made by few centralized companies. However, to build-up capacity of large aerospace and defence companies takes even more public money to make up for the inefficiencies that result.

How about Canada?

- 1.33 per cent of GDP last year to 1.76 per cent of GDP by 2029-2030

- This year's promise: an additional $73 billion in defence spending over the next two decades.

- Budget 2022: A total $8 billion new funding over five years

- Budget 2021: $1 billion of new funding

That's a 70% increase in defence spending over a decade.

UK Labour is increasing tuition fees

- This year's fees: £9,250 (domestic students)

- Next year: £9,535 (an increase of £285)

A rise in line with inflation next year. It is the first increase since 2017.

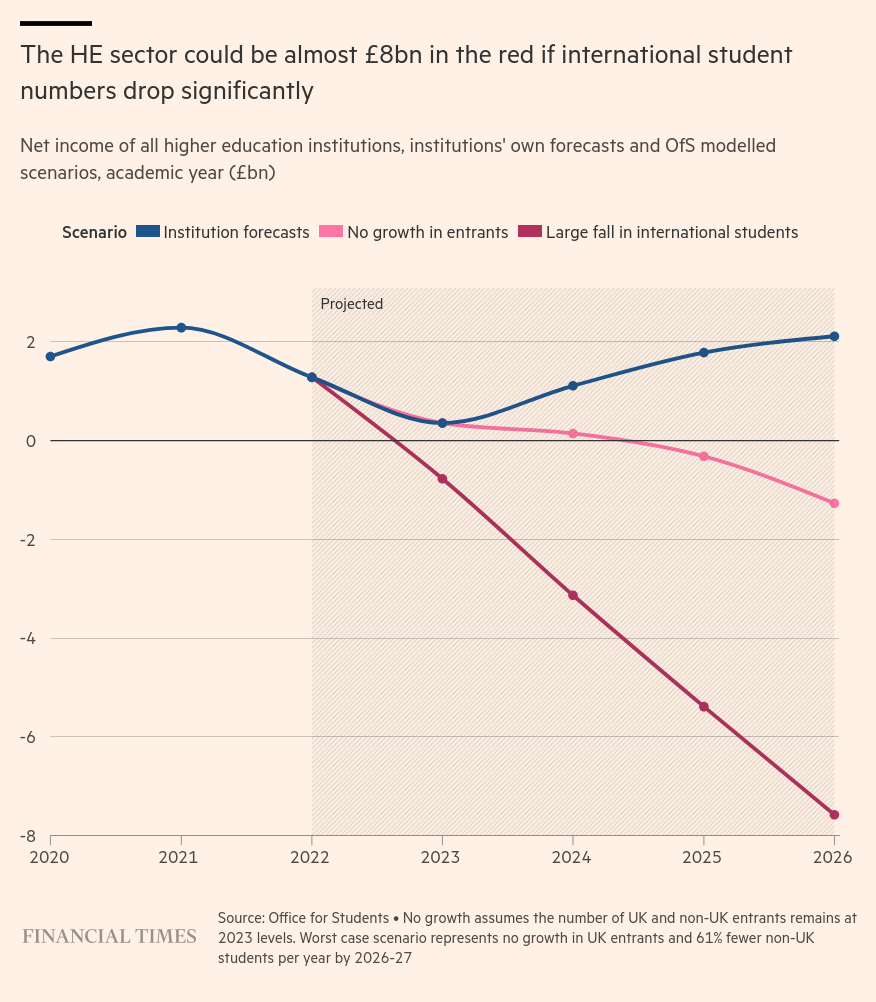

Universities in the UK have become dependent on international student fees to survive.

That's only half the story.

Major institutions are so dependent of international students that it dwarfs domestic student focus. Oxford, Cambridge, and University College London relied on domestic undergraduate tuition fees for about 5% of their income.

The funding model in the UK is broken just at a time when we need more students going to higher education. The result is that small institutions are going bankrupt and will have to merge or close.

For students, it is hard to care about university budgets.

The UK has income contingent loan repayment. Meaning you pay what you can, but that lower income student stay in debt for 40 years when the loan if finally written off.

The British Medical Association's Medical Students Committee, said the move would lift total student debt for medical degrees above £100,000.

It amounts to funding universities through borrowing, but pretending student borrowing isn't public borrowing. That's a great fib and the way that it is done means it is a regressive tax.

Generative AI and climate

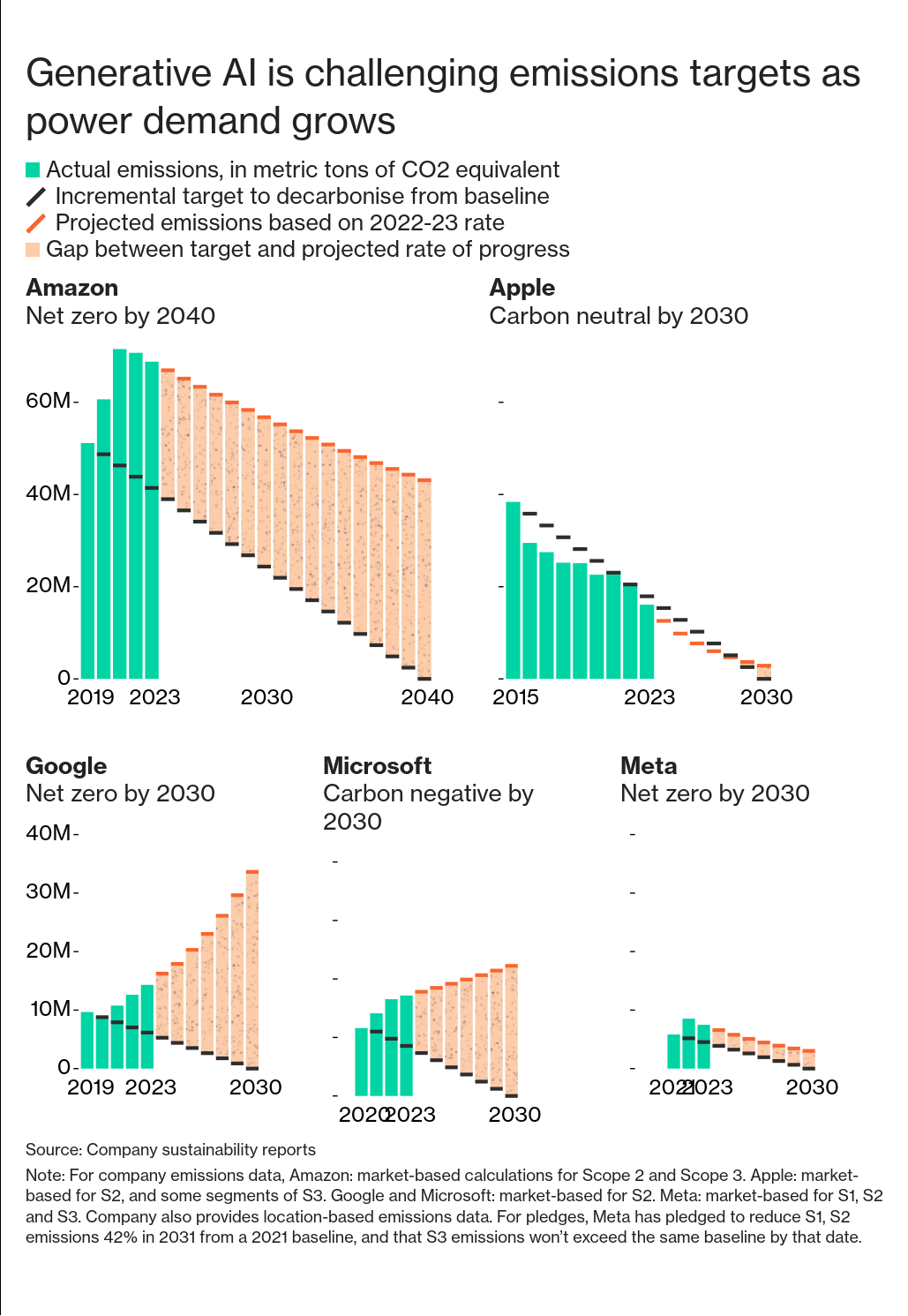

Here are some fancy graphs showing the absolutely ridiculous estimations of large tech companies about how they plan to reach net zero by 2030.

There are efficiencies for AI in the works, but they are not going to arrive in major centres before 2030.

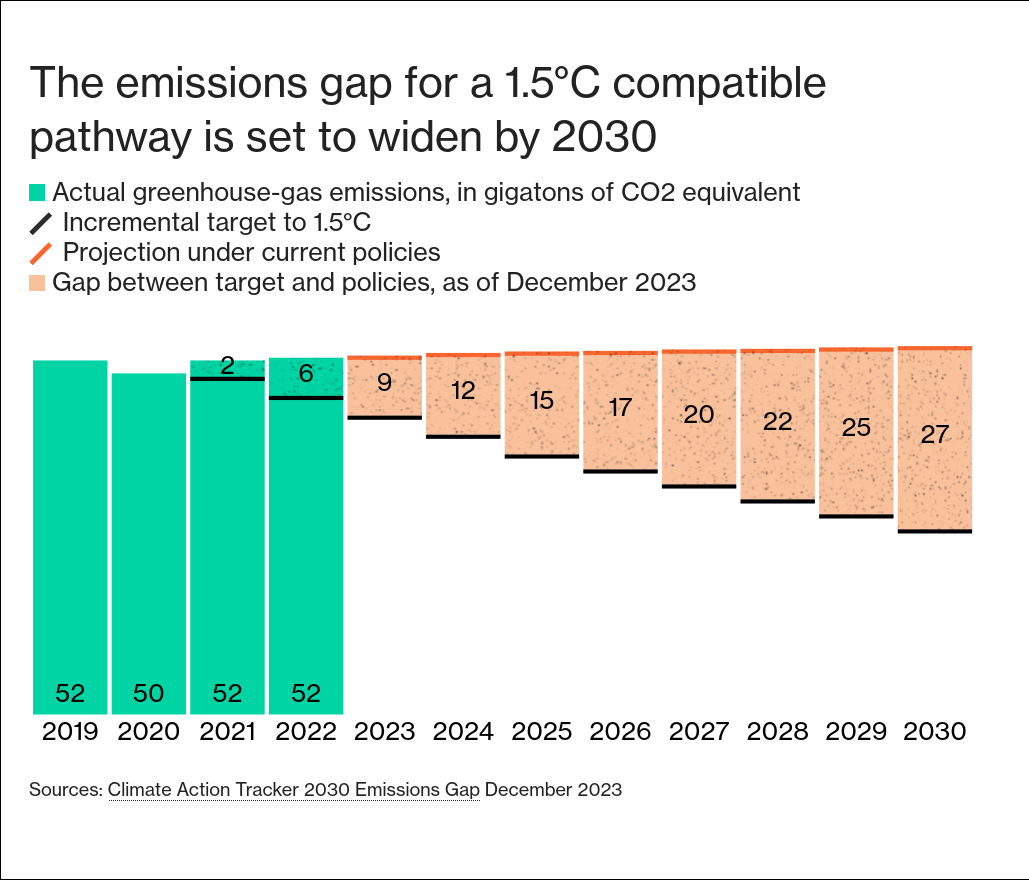

This is only one place that the world is off "target" for saving the species from climate change.

At the national level the gap between aspiration and reality could not be larger.

As the COP ongoing now announces a cap and trade program worth a measly $1.5B, Trump being in favour of accelerationism, it is rather difficult to see how this is going to change.