November 1, 2024

UK budget

Is the UK budget inflationary?

In the continued effort by (finance) capital to complain about any government spending, the UK Labour government is facing a bit of pressure on the costs of their public debt.

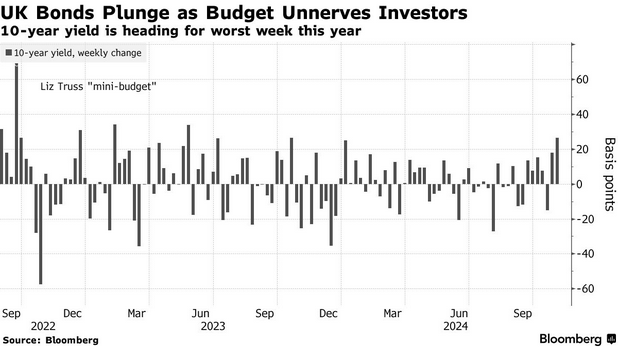

Government bond traders have responded to the UK's soft social democratic budget from the 1990s with classic angst that has driven up borrowing costs for the government.

While there are some increases in taxes on the wealthy, there is also a large expansion of borrowing to fund the economic program that Labour has put forward.

This is not an activist budget. In fact, one might argue that it is as close as possible to the budget that Conservatives would have put forward. It is essentially on par with what Macron and his right-wing minority puppet government put forward in France.

Reeves’ measures unveiled on Wednesday included a £70 billion ($90 billion) annual increase in public spending and an extra £100 billion of expenditure on capital projects. Official projections suggest around an extra £142 billion of borrowing will be needed over the next five years as a result.

The governments in Europe have been caught in the wrong part of the spending cycle, interrupted by the pandemic and the recessionary economic activity. There is also more to spend money on, such as repairing cuts to social programs (which funded tax cuts) made just before the pandemic, large quantities of borrowing throughout the pandemic, a sputtering restart to the economy post-pandemic, and a massive amount of money that has to be spent retooling the economy in response to climate change and geopolitical instability.

However, private capital is not spending on anything but retooling, and this does not really boost economic activity (at least not yet). Therefore, the government must spend.

However, paying for that spending is a challenge for politicians steeped in neoliberal dogma, and faced with pressure from a far too powerful financial sector steeped in the idea that profit subsidies are the norm.

Many investors view the budget as inflationary, and shorter-dated notes were pummelled as traders raced to price fewer interest rate cuts from the Bank of England next year. The two-year yield surged some 30 basis points this week to 4.46%.

The representatives of finance capital wring their hands over the current budget, which they claim is inflationary. They put forward as proof the pandemic inflation, which they think was caused by high government spending.

The notion of "normal" government spending on support for infrastructure and health being inflationary is ridiculous, and they know it.

The real reason they are mad is that the proportion of spending flowing directly to them as profit subsidies is lower than they "expected". The bond market has responded as it typically does, by making government borrowing more expensive, and effectively subsidizing their own profits.

USA jobs report and hurricanes

You will see graphs like the one below today and through the weekend from progressive news organizations trying to spin the (likely) terrible jobs numbers released later today.

I have some sympathy for this. You want to compare apples to apples when looking at the jobs data. Liberals are very concerned that Harris' economic credentials could be negatively affected going into the polls.

However, there is something not quite correct about casting aside reality by removing data points you don't like.

Hurricanes happen. More deadly and destructive ones are going to happen. A climate crisis is the planet's response to humanity pumping more and more carbon emissions into the air. This has continued under both Democratic and Republican presidents.

The effects are real. People have had to apply for unemployment benefits and have not been working, because the places where they work and live, and their lives generally, have been damaged or destroyed.

But the Boeing strike is also being included by the left to say that the "real" employment numbers—those without climate impacts and without the strikes—are good.

David Mericle, chief US economist at Goldman Sachs, believes the strikes will have an impact on 41,000 jobs, with the storms impacting up to 50,000. Once those temporary losses are added back to the 95,000 jobs he expects for the month, he said the “underlying trend is a respectable number”.

Unfortunately, that is just not how the economy works.

The hurricanes' damage to the Southeastern USA and the Boeing strike are the fault of the government (and capital). The government in the USA thinks that it can support the things that support the economy (profit subsidies and burning fossil fuels), but ignore things that hurt the economy (poorly run state-financed aerospace companies and climate change).

There is one more point going unmentioned by the USA news agencies and politicians alike: The health of the American population.

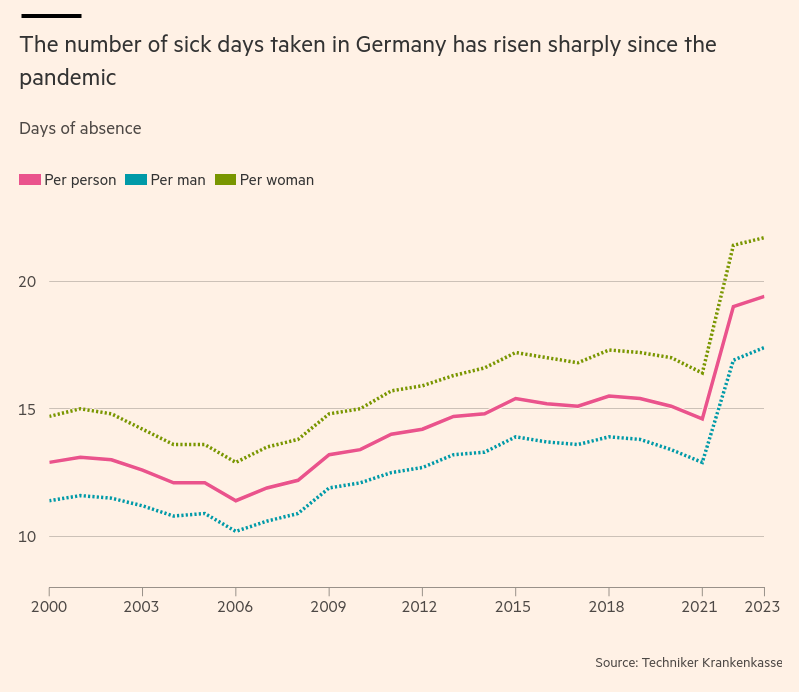

Here is some data from Germany:

The number of people who are ill and have removed themselves from the working population in advanced capitalist countries has grown, and it is unlikely to come down any time soon. The mental health and addiction crises, underfunded health services, and an aging population in need of care before retirement age—these all produce a further drag on those productivity numbers that bankers are so concerned with.

The blabbermouths of capital have responded with their regular uncaring and unhelpful comments:

There has been growing criticism of pandemic-era rules enabling patients to receive sick notes from a doctor by telephone without a face-to-face examination. (FT)

Health outcomes have instead been linked to "too lax" social policies, by which we pretend to be helping addicts by decriminalizing drug use, without spending anywhere near enough to support the people caught in that crisis. Decriminalization works, but by itself has no impact on the number of drug users. Only heavily subsidized social programs can reduce that.

This is a snapshot of how things are going to be. Climate change, health, and economic crises (even minor ones like the Boeing strike) are going to have political impacts. You cannot wish them away, saying "Those are anomalies and not our fault."

In a better world, we could clearly link reductions in job performance levels to climate change (which will get much worse if Trump is elected).

In a better world, we could clearly link the negative health outcomes and increased rates of addiction during the Trump administration to its anti-worker and anti-community policies.

In a better world, we could clearly link worker struggles against a behemoth like Boeing to the disastrous economic policies of a Trump administration.

Unfortunately, we have not yet built that better world.

Bank of Canada note on wages

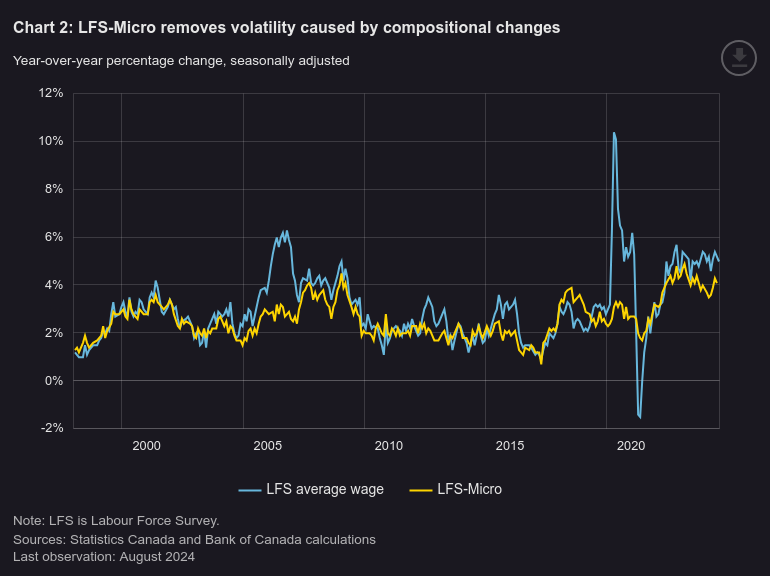

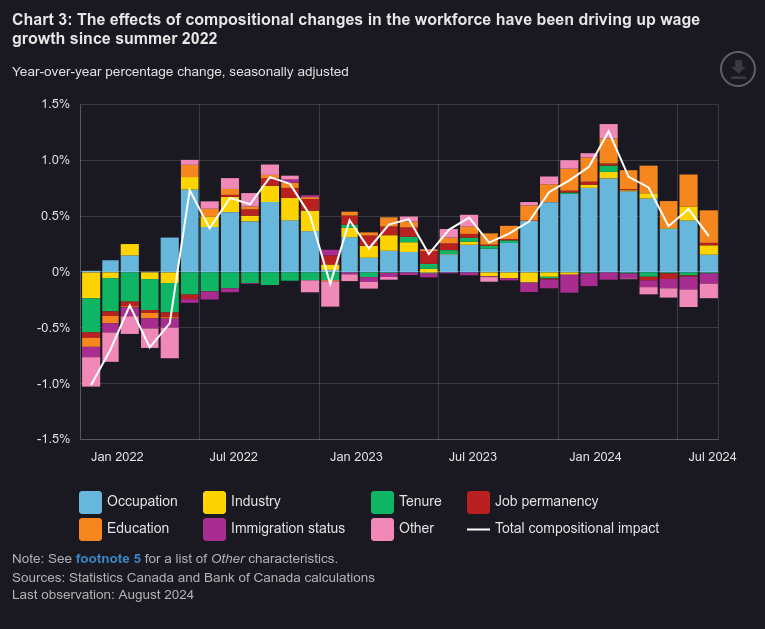

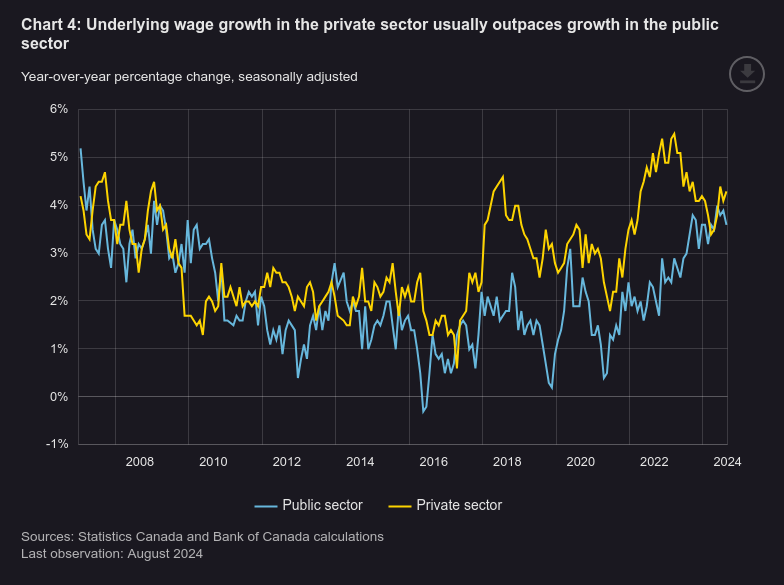

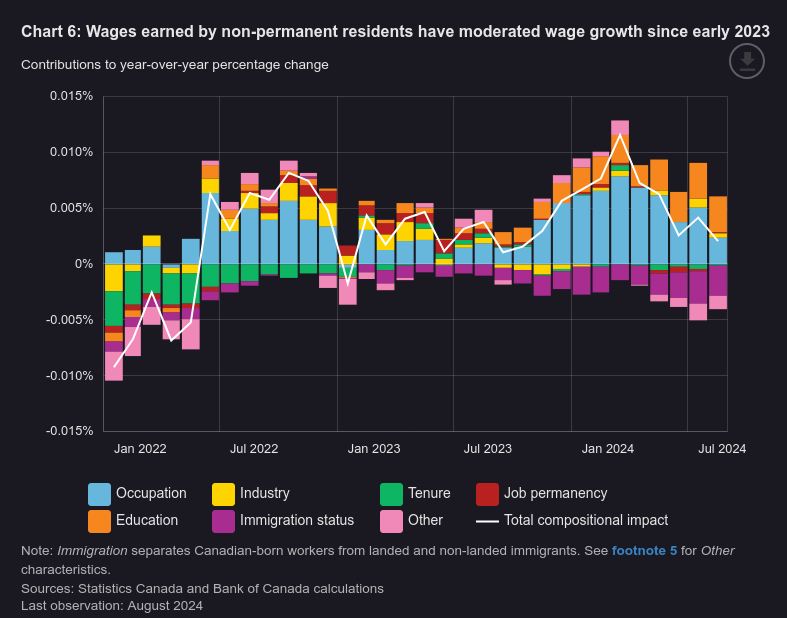

A few graphs from a Bank of Canada note.

They align with what we have been saying about wages, immigration, and the need for unions to maintain wage growth pressure to ensure workers can make up lost ground from the post-pandemic inflation.