November 1, 2023

Recession, but central bank impact not at 100% yet

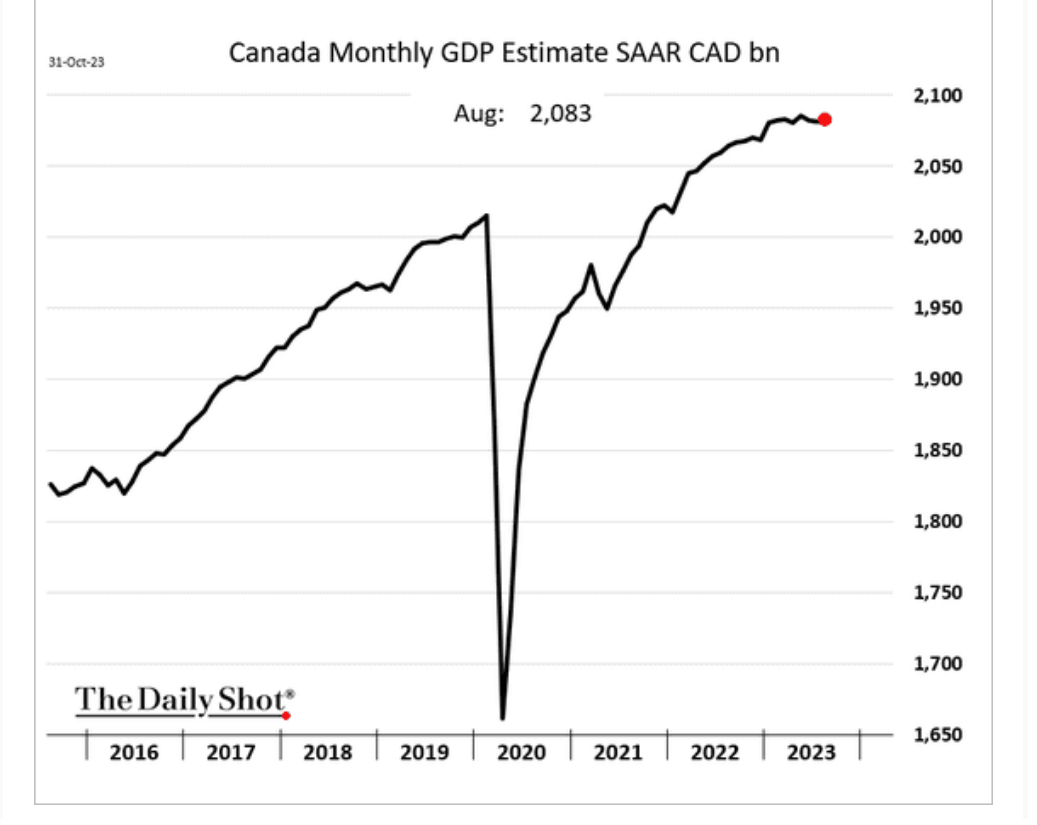

Canada's economic activity has stalled as measured by growth (which is the only measure that matters in capitalism).

In a flash estimate, the economy was likely also unchanged in September, and Statscan officials said that translated into an annualized 0.1% decline in the third quarter, marking a second consecutive quarter of negative growth after a 0.2% decrease in the previous quarter.

The statistics agency said high interest rates, inflation, forest fires and drought conditions hurt growth in August. The central bank has said its previous rate hikes are sinking in. (Reuters)

We are (likely) in a technical recession, supposedly driven by higher interest rates at the Bank of Canada and a terrible summer. While that is not the whole story, the central bank has played a hand in delivering part of what they were trying to do: a slowdown of the economy, a decline in hiring, and a worker-paid-for decline in inflation.

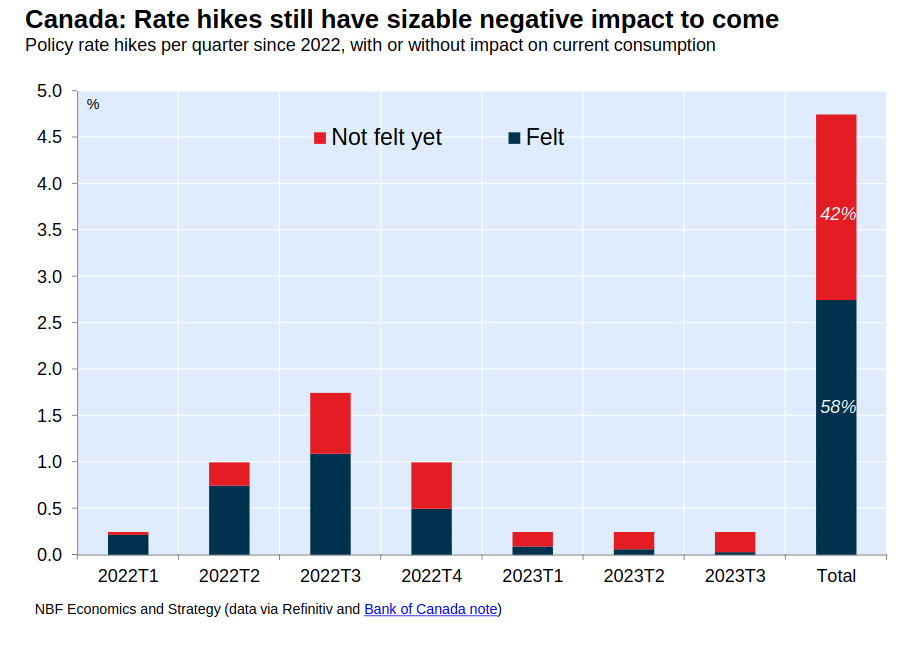

However, the tightening caused by increasing interest rates is not even fully being felt yet—according to the banks own estimates.

the Bank of Canada estimates that the impact of a rate hike on consumption is only entirely felt after 8 quarters (National Bank of Canada)

There are large caveats to this from a classical perspective. The decline in subsidy to finance capital has, of course, reduced the amount of free money flying around. However, the cause of the recession is not just because of Canada's policy program.

The world's economy is slowing because of a variety of world events and there are reasons to believe that central bank subsidies are unlikely to be able to continue to save it from that slowdown.

True costs of production of necessities are going up because real costs of the inputs are going up, not just because there is inflation caused by "too much money".

Climate change, war, shifts in trade patterns, changes to investment in production, changes in supply chain resilience, and declining direct profit subsidies for global finance, and an increase in profit subsidies locally. These all have an impact on costs of production and thus have an impact on costs. The impact of these shifts are not immediate and they do not happen at the same time.

One more thing is going to hit growth and really drive us into recession: government spending cuts.

Canada's central bank has said that the government is working at "cross purposes" for a while now, supposedly spending too much and causing inflation to rise. The opposite is true, of course. Canada is not spending enough on real production supports. Apart from some direct subsidies for auto (to compete with the USA) and oil & gas (because they do as they are told), there has been little over-spending on needed endemic Canadian production.

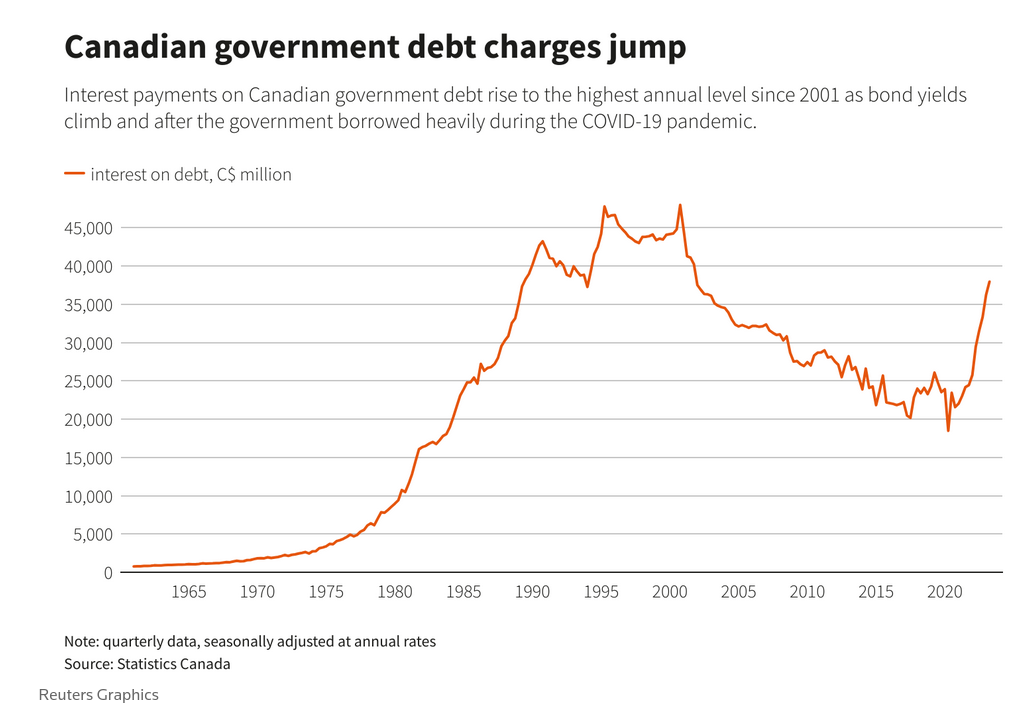

However, you will be shown this kind of graph a lot in the coming weeks:

Costs of debt. It makes it look like spending is out of control. Of course, it is simply a graph of the interest rates using different numbers.

Canada's general government net debt, which includes provincial and municipal borrowing but is reduced by pension assets, is the lowest by far among the G7 countries, but its gross debt, at an estimated 106.4% of GDP in 2023, is higher than that of Germany and the UK, IMF data shows. (Reuters)

Net debt or gross debt as a percentage of GDP, which is important? Neither.

It isn't the size of the debt compared to GDP that is important. GDP is affected by recessions and the price of (and the purchasing of Canadian) oil, cost of debt goes up because of borrowing costs, and neither has anything to do with total or net government spending in relation to it.

The issue is what the government is spending on, what (finance) capital are asking it to make cuts to and who is being asked to foot the bill.

And, one has to keep remembering that the connection between interest rates, inflation, and unemployment are not what the neoclassicals think they are, making the conversation very confused.

Neoclassical, MBA-trained economists are also going to be going on and on about wage gains by striking and militant workers. A narrative that had gone away for a while as the data did not match the story. However, it is now back because wage gains from the UAW strike and other bargaining has finally caught-up with some inflation losses.

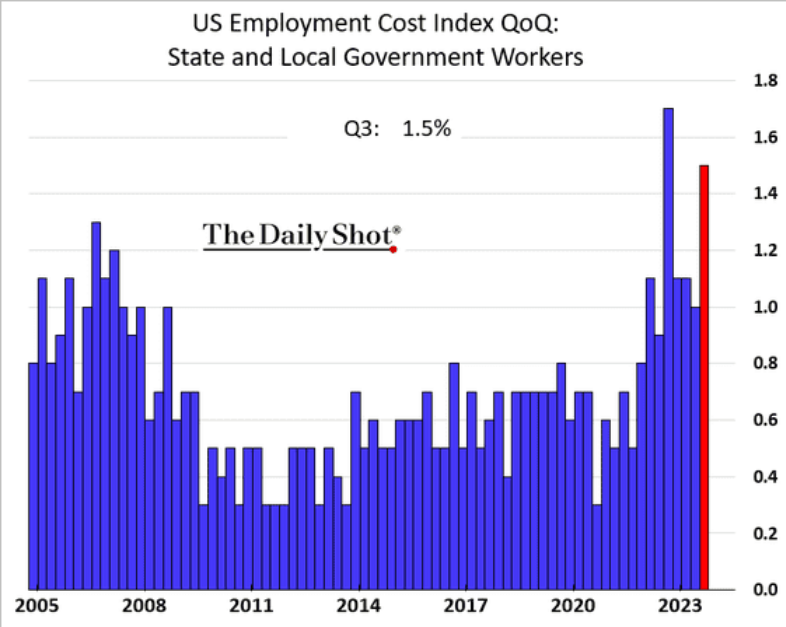

And, there is this kind of graph:

But, that wage growth is cause by teachers' salaries finally kicking in, not production wages.

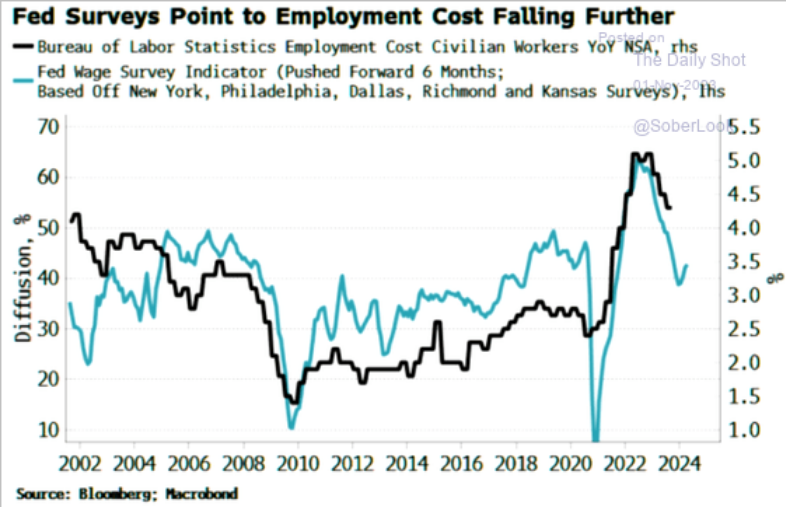

Here is a real graph of wages and expected wages based on settlements in the USA:

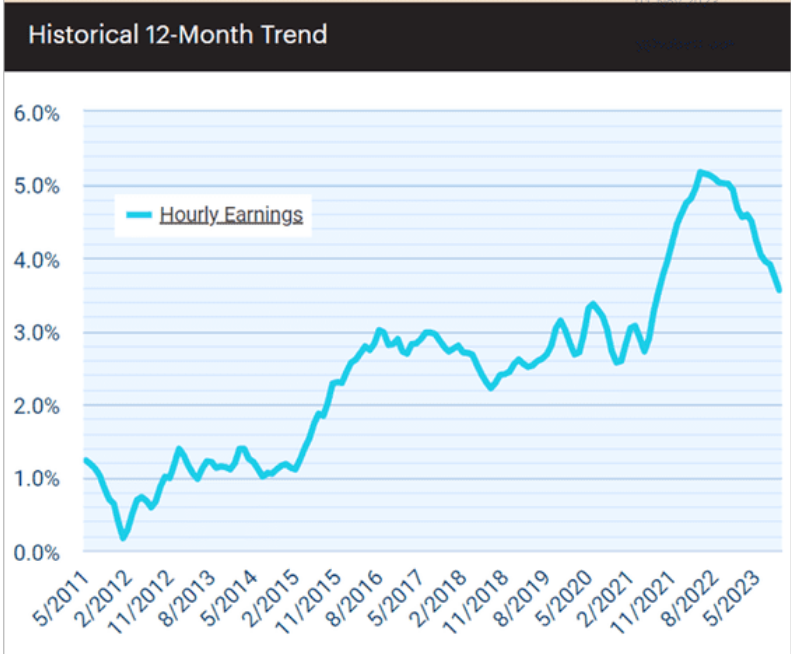

And, small business wage data in the USA:

No, wage growth isn't headed in the direction of the narrative, and we have to remembers there is no causal relationship between wages and prices, because wages are in competition with profits not just added to prices.

Here is what is happening that we need to be concerned with:

- Capital is getting direct profit subsidy hand-outs.

- Finance is awash in cash (though still complaining).

- Prices of necessary goods are increasing because costs are increasing. (Yes, yes. Profits are high, but it isn't the cause of the price increases).

- And, people are focused on finding an individual to blame for what is mostly a global problem under capitalism.

We have attempted to kick the recession can down the road, but as has been stated by many classical economists, we are in a depression, not just a recession. There is a structural problem in the current economy. We have attempted to pump-up the economy in a 1950s Keynesian-style spending. Unfortunately, like back then, we have run out of road and reality is reasserting itself.

The USA is attempting to vault over the declining profit rates by spending big on bringing production home and retooling its economy. However, it is running into internal opposition to spending.

There was a hope that AI's productivity boost was going to help shift profitability, but it seems clear it is not going to save the economy as the shift in productive investment in this area is still happening too slowly.

War, however, might be what capital is looking for. Not that (most) individuals want war, but there is something to be said about all the bad things landing in one place.

We should be very concerned where things are going. Capitalism finds away around a crisis eventually, but the way around never ends well for workers, the planet, and in general.

Cuts to spending, re-directed spending on war efforts, and a focus on workers' wages is a neoclassical trap. If we do fall into this trap, we will be faced with profit subsidies paid for by workers who are then asked to either build the weapons of war or use them on the battlefield killing other workers.

And, none of this deals with the existential crisis of climate change.