May 9, 2022

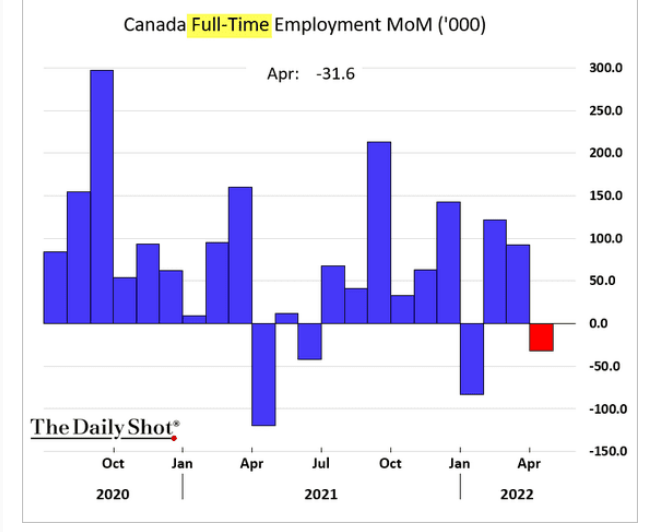

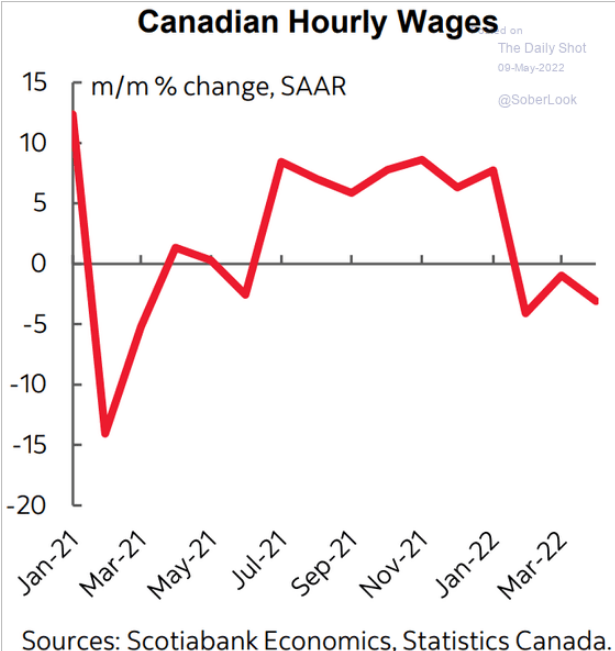

Canada Employment

- The number of jobs available increased in Canada.

- Full time employment numbers released last week show decline.

- Nominal wage growth declined, real wage growth is continuing its stagnation.

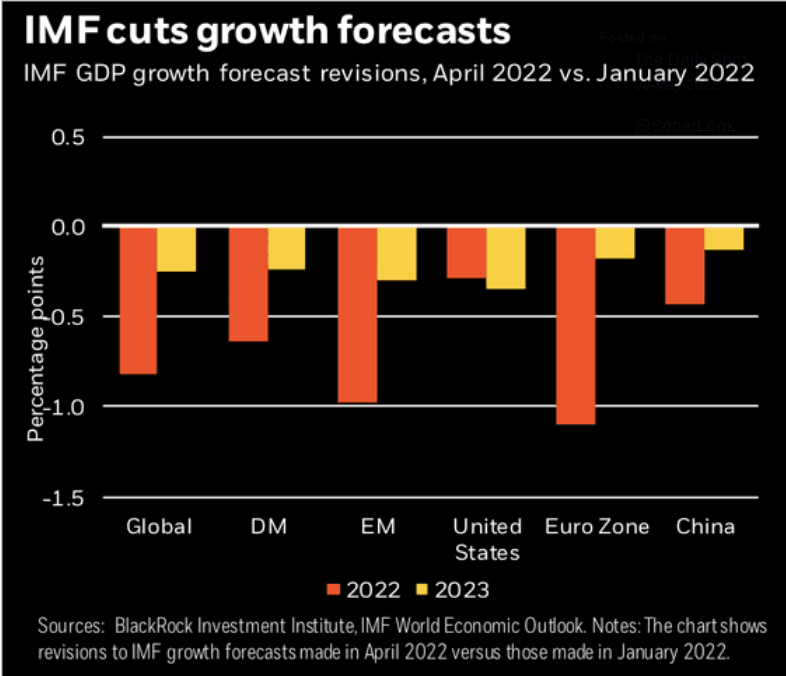

Currency exchange rates in focus as price of dollar rises

- As central bank interest rate targets rise, the USA dollar is driven higher.

- As the USA dollar increases, costs of purchasing goods and services in those dollars increase for other countries – including debt repayment.

- All other countries now have to worry about their own currencies falling too far behind.

- Neoclassical monetary guidance suggests increasing their own interest rates to address the price increases driven by exchange rates with the USA dollar.

- This goes for UK and Japan as much as it does for non-OECD economies – where both the state and the corporate sector are highly leveraged after decades of artificially low interest rates.

- Another reminder of the impact of hegemony caused by USA dollar dominance.

Sweden is making the wrong choice for the wrong reasons on NATO

- The move the to the right of the Nordic countries is no clearer than in their debate about NATO.

- Polling driven by foreign propaganda has clouded the debate.

- Finland continues down the same path.

- Joining NATO comes with more issues than just creating a less safe world with Russia. It means fewer countries that can act in peace negotiations between hegemonic imperialist powers and their targets for violent politics.

- Nuclear weapons is at the heart of the NATO agreement. Any increase in membership pushes us farther away from disarmament.

After 200 years of not having fought a war and decades of public commitments to peacemaking and nuclear disarmament, it is hard to overstate the importance of military non-alignment to the soul of Swedish Social Democrats.

“For the Social Democrats, this is a religious issue,” said Hans Wallmark, MP for the opposition centre-right Moderates and a long-time supporter of Nato membership. “They need to be converted.”

One of the main reasons for this reluctant conversion is Finland’s decision on joining Nato and its lobbying to get Stockholm to follow suit. “They are begging us,” said one Swede close to the talks.

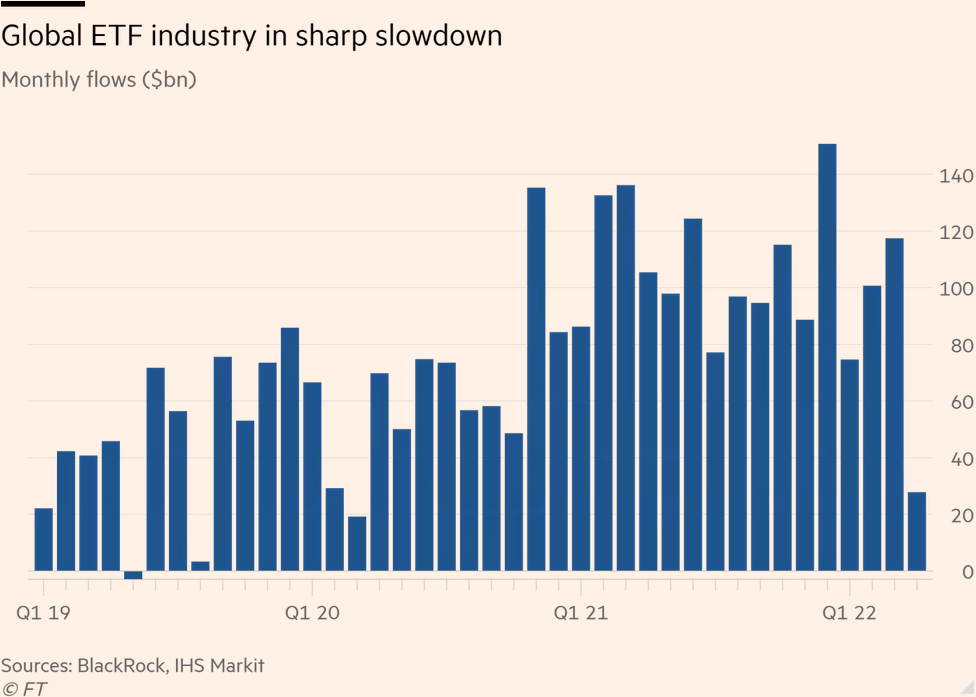

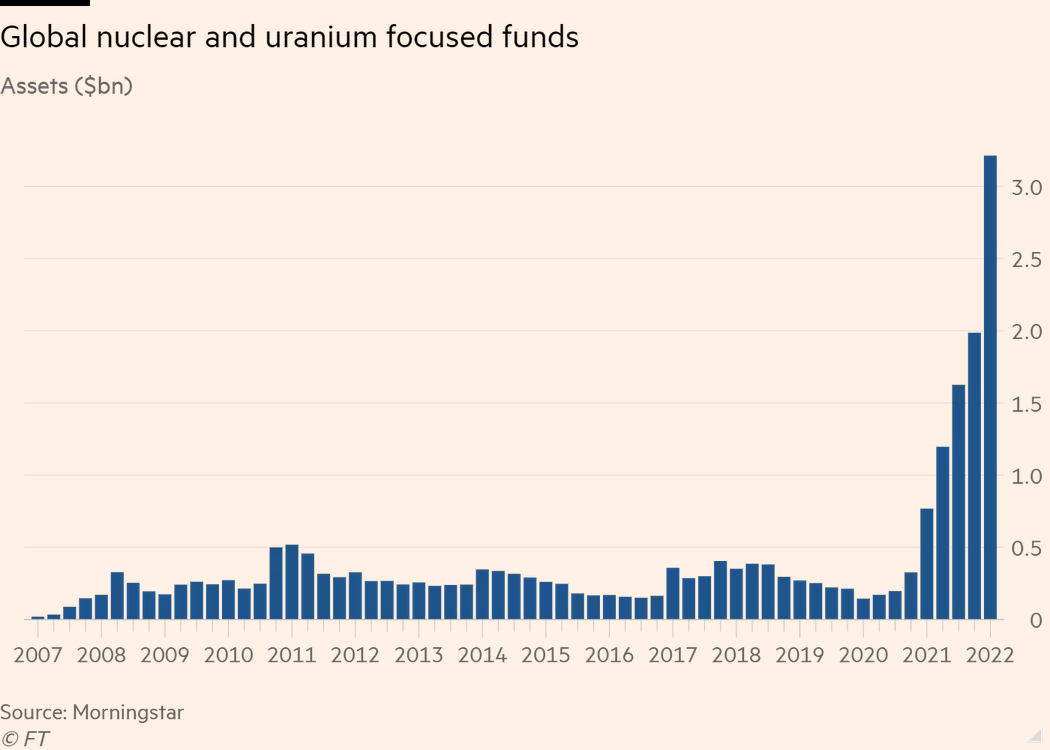

Uranium miners enter the exchange traded fund scheme

- Just as ETF investments lose their appeal in the broader market (as the "market" unwinds), niche ETFs are popping up.

- With the bet on nuclear being at the heart of a transition away from Coal for base-load energy production, more investors are looking at moving investment money to ETFs in the nuclear industry.

- Nuclear energy is part of the "Green" energy mix in the EU.

- This is not the first time this has happened. Interest usually subsides after some nuclear disaster – which tend to be irregular, but unfortunately not as uncommon as we would like.

- Nuclear energy will be part of our future if we are to have a future, but it is not something that the private sector should be betting or making profit on.

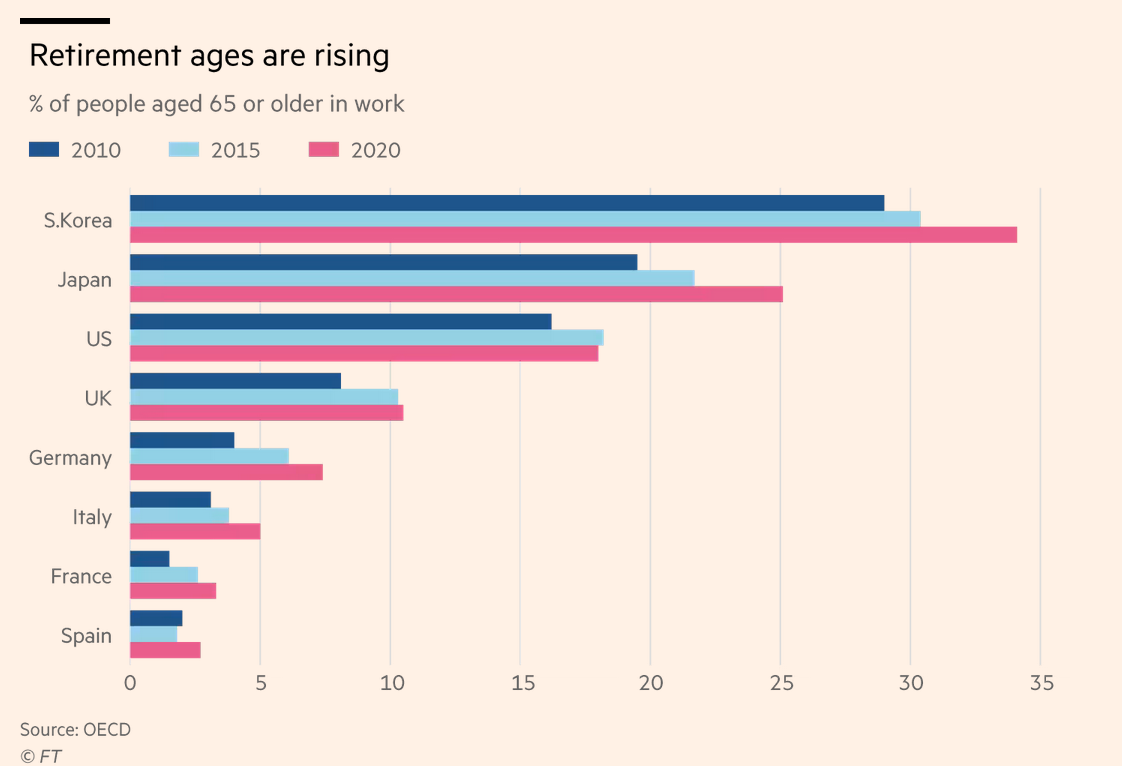

Careful about pension advice

- Retirement age is rising in many advanced capitalist countries

- With mortgages getting more expensive and a lot of "savings" trust put in the value of homes in the OECD countries, this creates a bit of a problem.

- Extending mortgages while folks work later into their lives puts pressure on the housing debt/leveraged industry.

- Second mortgages are now common place to help with sudden costs or buying homes for children. The impact of this large increase in cost has not been included broadly in economic models.

- In the UK, five directors of a pension firm are being punished for giving bad advice to pensioners.

- It seems that when the state is actually on the hook private investment losses it suddenly cares about limiting them.

The directors “failed to act with integrity having either acted dishonestly or recklessly” in offering their advice, causing customers “to place their pensions in high-risk financial products in self-invested personal pensions”, the FCA said on Monday.

“This scheme caused significant losses of over £50mn to over 2,000 consumers who have been compensated now by the Financial Services Compensation Scheme,” it added.

Food