May 7, 2024

Dividends

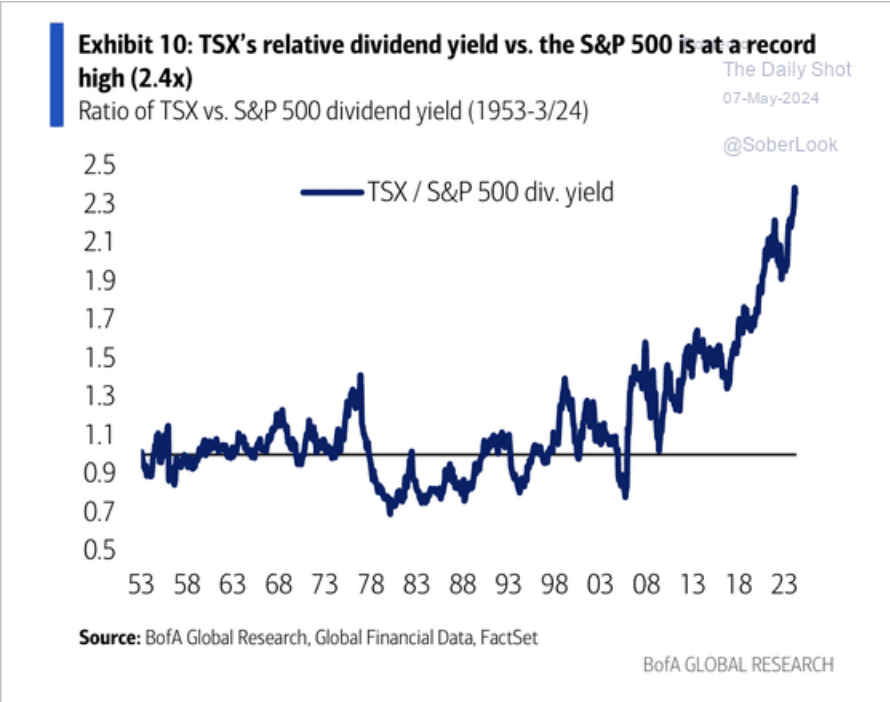

The Toronto Stock Exchange (TSX) has companies giving much higher dividend yields than other exchanges, especially the USA's NYSE.

Since the financial crisis of 2008, Canadian publicly traded companies have been on an aggressive program of giving shareholders profits in this form.

There are more than a few reasons for this, but the payouts, like share buybacks come at a cost of reinvestment of that money into ongoing production, including wages.

Dividend payouts usually come at the expense of jobs, as we have seen with high-profile layoffs in BCE, Loblaws, energy companies, and many other firms while passing money to their capital owners.

Profit rates are at their hightest average level over the previous quarter meaning that the process of dividend yield growth will continue with less fanfare. That is unless workers continue to focus on profit rates at the bargaining table and compare them to job losses, investment, and wages more specifically.

If you look across dividend rich companies, they tend to be energy companies and those with near-utility level stability in revenue streams. Every time you wonder why the infrastructure in Canada just seems to not work well, remember that there are reasons that companies didn't invest to make it better: there is no profit in it. So, they gave the money away.

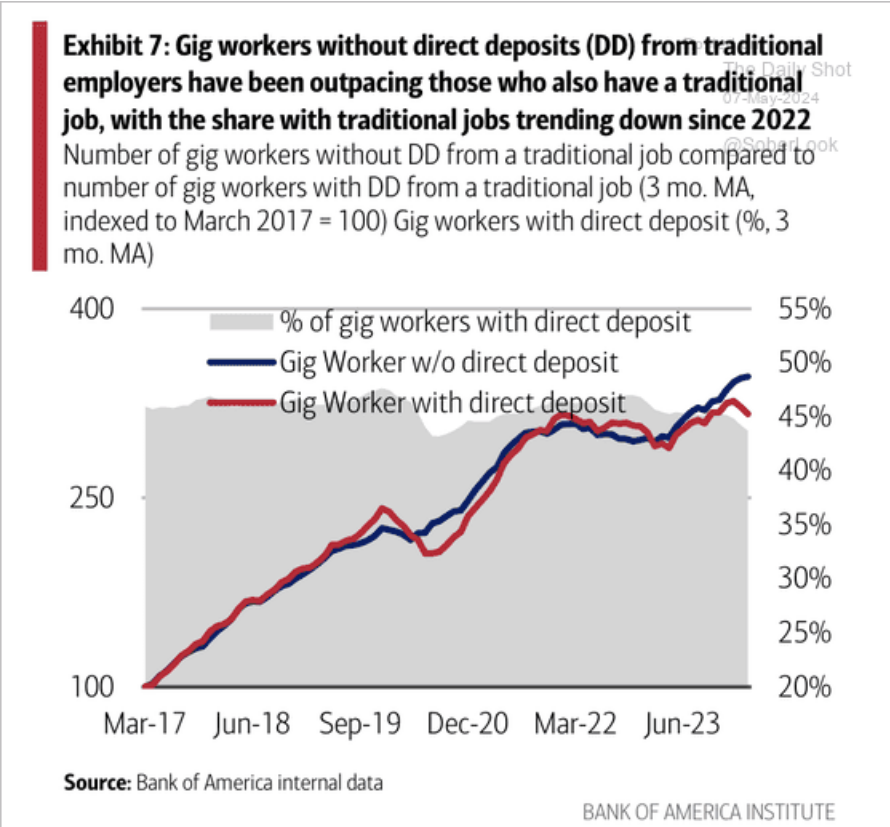

More Americans are in gig jobs

There is a slow growth of American workers only having gig work.

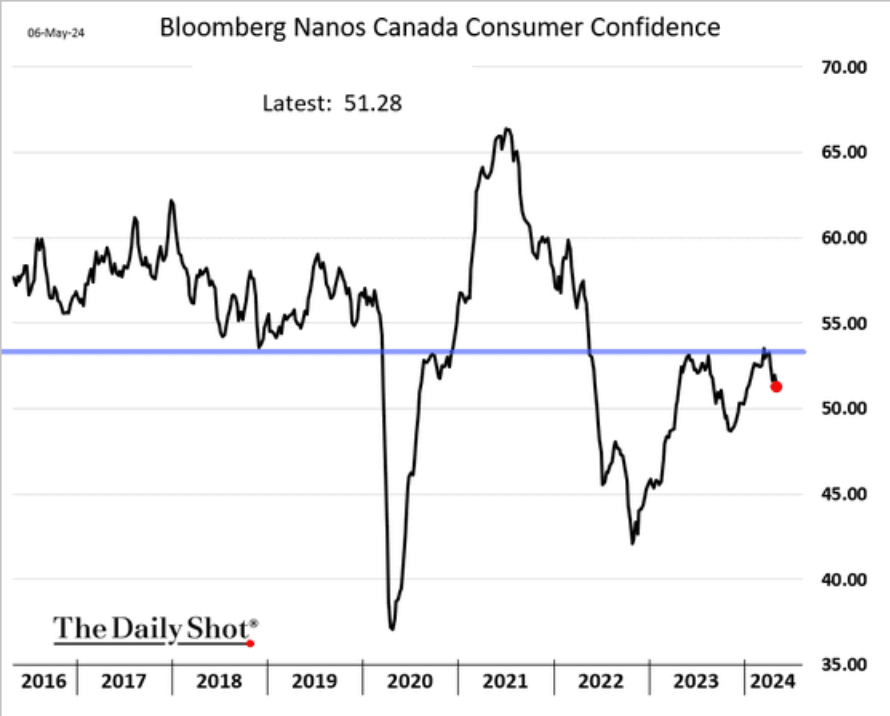

Canada consumer confidence

In positive territory, but not by much.

This is backed-up with the Retail Commodity Survey by StatCan showing mixed results.