May 5, 2022

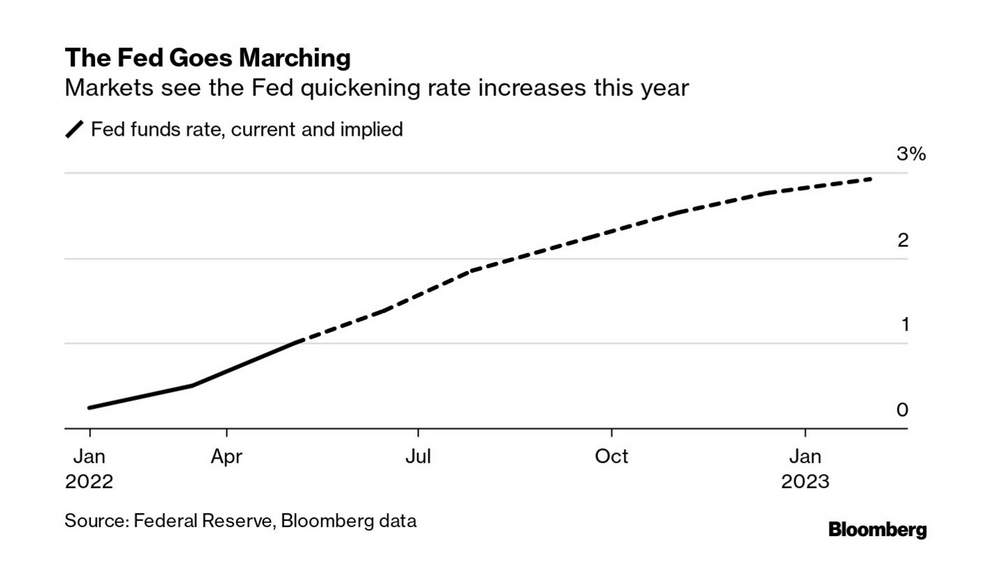

Financial news in one line: The USA central bank increased rates 0.5%; markets feigned surprise

- The Federal Reserve made their totally unsurprising and long announced increase to their interest rate to 0.75-1%.

- The feigned surprise was "oh, we thought it might (highly unlikely) be higher!".

- So, markets were jubilant pretending that they have been saved and cheap money will keep flowing.

- It is ridiculous, but this is the world of eternal optimism that we are all living in, right?

- Well, if you actually read what has been said, most analysts agree: recession (focused on workers) is coming. So, the market is not wrong to be happy.

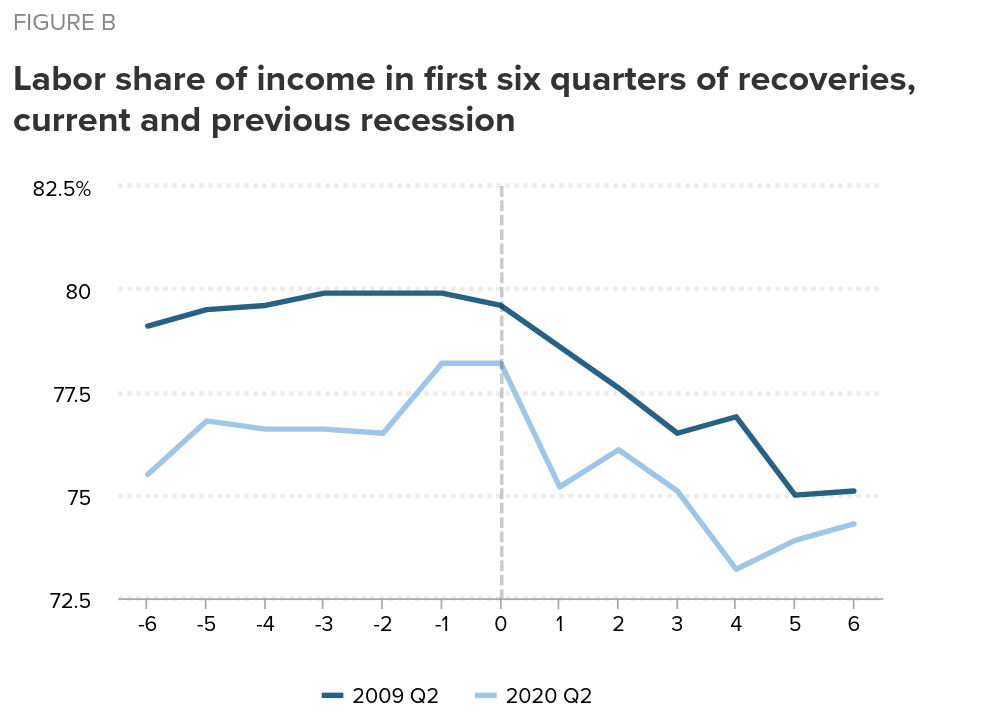

The main issue for me is that this is all anti-historical thinking. The interest rate is artificially low in the first place – that's one of the reasons why we have inflation. This artificial rate is a subsidy to capital, driving financial capital largess, and providing room for governments to provide profit subsidies of all kinds.

There has been little benefit for workers, unless you count having a job at a world-competitive firm a positive – as most liberals and Social Democrats do. However, suppression of wage-growth was part of that mix, so the benefit of having a job deteriorated as profits took most of the increased growth.

All that is happening now is that this is going to continue, but without the growth being as positive. Workers will simply notice that their wages are negatively growing because goods and services will be getting more expensive rather debt burdens growing. And, now many workers will just not have a wage (because recessions create unemployment).

For workers, it was bad but now it is worse.

UK government wants recession

Bank of England warns of recession as it lifts interest rate Cost of borrowing increases by a quarter point to 1%, the highest level since 2009

- The UK government has been very clear: recession is the only way out for capitalism in the UK.

- Workers will have their pockets picked one way or another to pay for the excesses of capital profit subsidies handed-out over the pandemic.

- Energy prices are affecting everything in the UK (and Europe) as major firms get the green light to sustain profit margins and pass those costs on to consumers.

- U.S. households could see a 30% to 40% hike in monthly energy bills this year if high natural gas prices persist, according to new analysis from Barclays.

- On the other side, steel production is predicted to drop precipitously (near 10%).

Russian oil

- Brent Crude is at $110/barrel.

- Shell profits (like BP's last week) hit their highest levels in 14 years.

- The Russian budget: dependent on oil revenues 45% of its total income in 2021.

- Government will break even at $44/barrel or more.

- Russian oil is currently trading at $70 a barrel.

- Currently, 60% of Russia’s oil exports go to Europe — three times the quantity that goes to China.

- The real question is can this shift in export be achieved at the current per barrel rate?

- The answer – weirdly – is dependent on continuing sanctions affect on oil prices globally and interest rates on new investments.

- Russian economic contraction is near 10%.

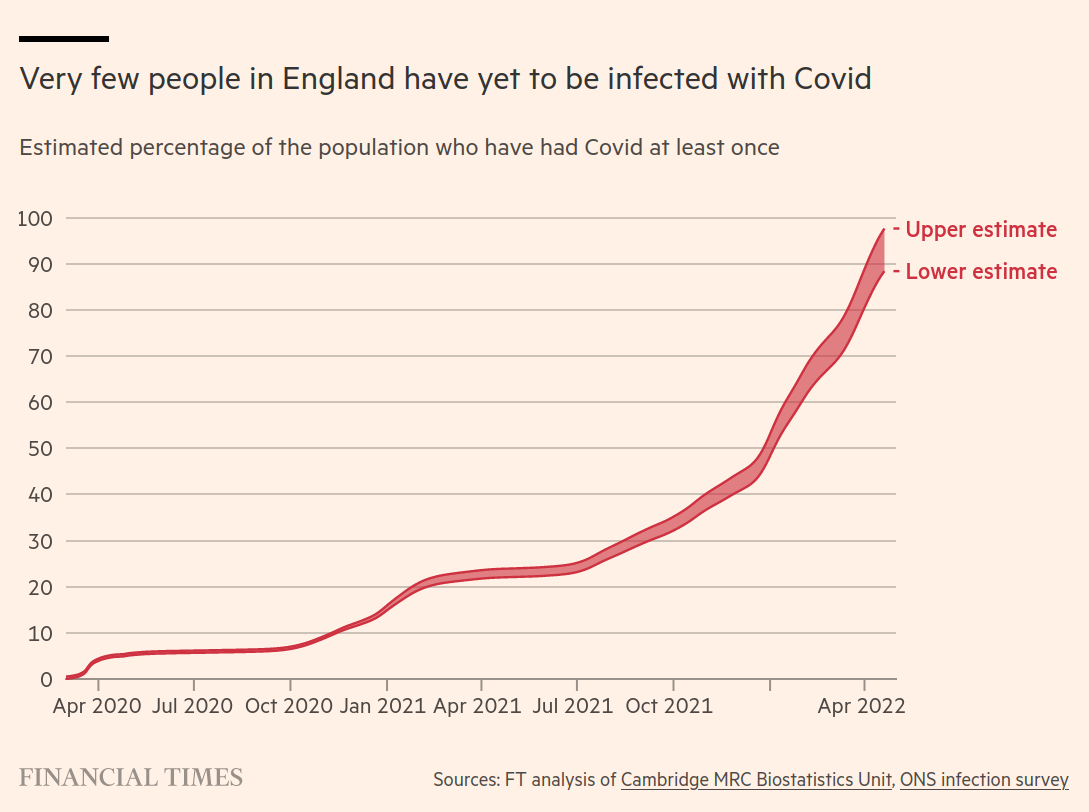

Covid infections

If you live in England, you have had it at least once.

Meaning, of course, that many people are dead or disabled who didn't need to be.

Who is to blame? Well, the Conservatives are:

A YouGov poll of around 2,000 people, commissioned by three main health charities and shared exclusively with the FT, found that only 55 per cent of people in England were aware they should avoid contact with vulnerable people if they have Covid, and just 63 per cent realised they should work from home if they have symptoms.

If you are immunocompromised, it basically means you have been left on your own to self-isolate and become a shut-in. Or, roll the dice and hope you are not one of the unlucky ones.

Coronavirus pandemic far deadlier than official count, WHO estimate suggests

Health body says 15mn people died by the end of 2021, nearly three times official death toll

Home prices?

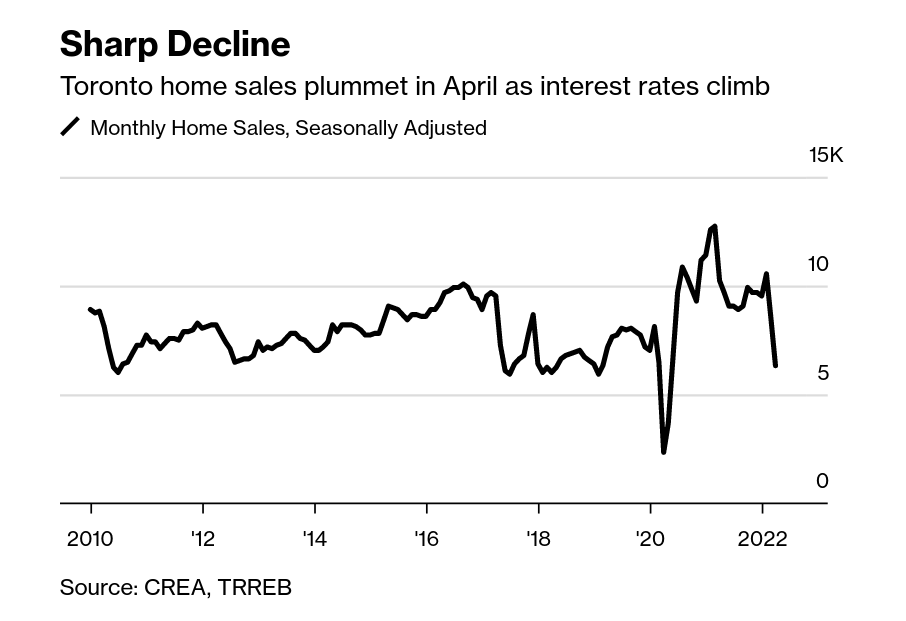

Canada’s 50% rise in home prices in the past two years was driven in part by emergency-low rates that helped the economy through the Covid crisis. The rate reversal has left the nation’s housing market, and particularly places that saw massive gains such as Toronto, looking increasingly vulnerable.