May 31, 2022

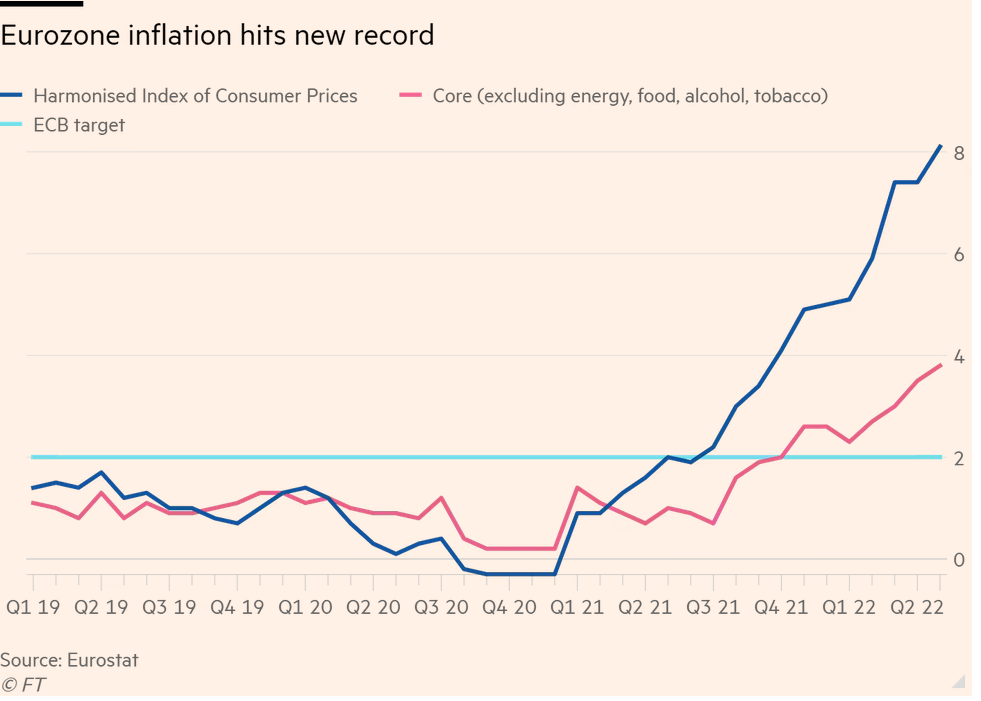

Europe's prices continue to rise – hit 8.1%

- Europe is in a tough place with inflation, the war, and the job market all acting to undermine Post-Keynesian and monetarists policy options.

- Central bank interest rates will go up as that is really the only thing that they can do.

- This means that the war in Ukraine will have the triple hit to Europe's economy: overspending on new NATO commitments for nuclear weapons, a recession, high inflation eating at workers unindexed wages.

Everyone is calling "peak inflation", does not mean it will go down

- I think almost all commentators are now calling peak growth of general price increases.

- They might be correct that the big number doesn't increase much, but that doesn't mean price increases are going to come down quickly.

- The Central Banks are still going to push the economies of the world into recession. Just so they can transfer more wealth to capital. Capital needs more profits if they are going to invest coming out of the recession.

- Then there are dumb reasons for a larger push into recession. In Canada, where political interference in Central Banks is the new sport of those who historically demanded its independence (The Tories). Poilievre is to blame for the coming recession/slow down being bigger than necessary – he seems convinced that workers are getting it too good.

Bank of Canada Faces Credibility Test in Political Firestorm Over Inflation

- Macklem may have to ‘overdo it’ on rate hikes to repair trust

- Second of three consecutive half-point moves expected June 1

Most recently, the front-runner to win the Tory leadership, Pierre Poilievre, announced he would fire Macklem should he ever take power, which is within the realm of possibility.

In Canada, look no further than the central bank’s renewal of its inflation-targeting mandate last year, which looked uncomfortably political to many.

- The other reason that price increases may settle is that China is opening again. Though, people always over estimate the time lag between production and delivery of goods.

In a speech at Goethe University in Frankfurt, Germany on Monday, Christopher Waller, a Fed governor, said he backed increasing interest rates by another 50 basis points “for several meetings” and would not stop that pace “until I see inflation coming down closer to our 2 per cent target”.

“By the end of this year, I support having the policy rate at a level above neutral so that it is reducing demand for products and labour, bringing it more in line with supply and thus helping rein in inflation,” Waller said.

- But, seriously, do we really think that we are "peak inflation" when graphs like this are present?

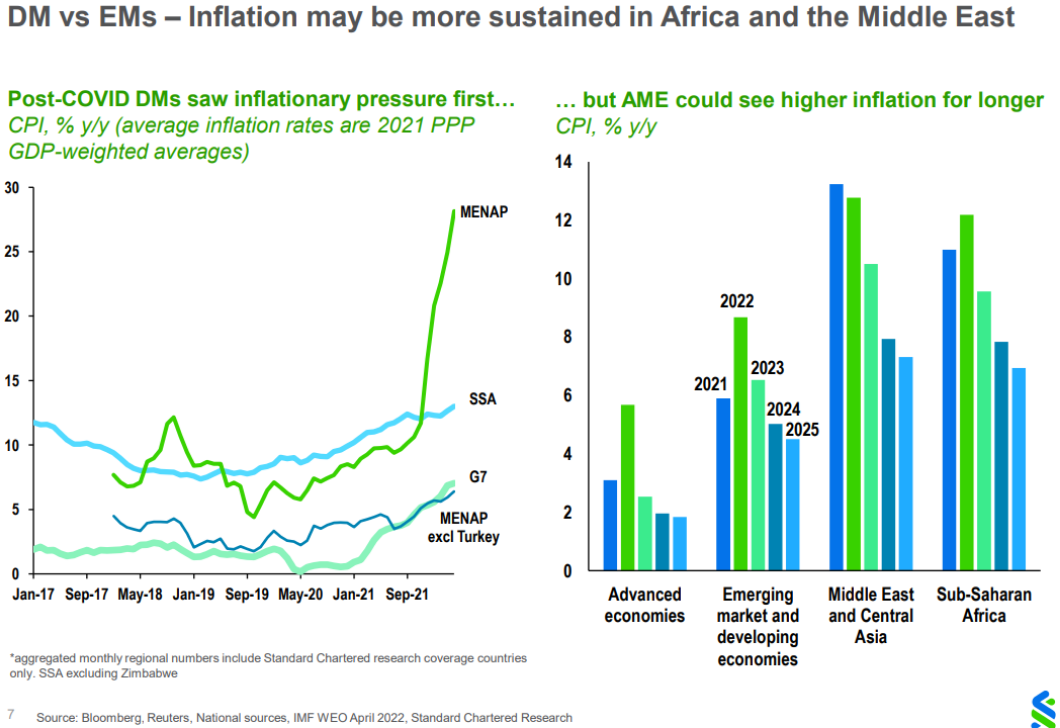

Also, there is the ongoing issue of inflation staying around in emerging markets.

Other Price measures

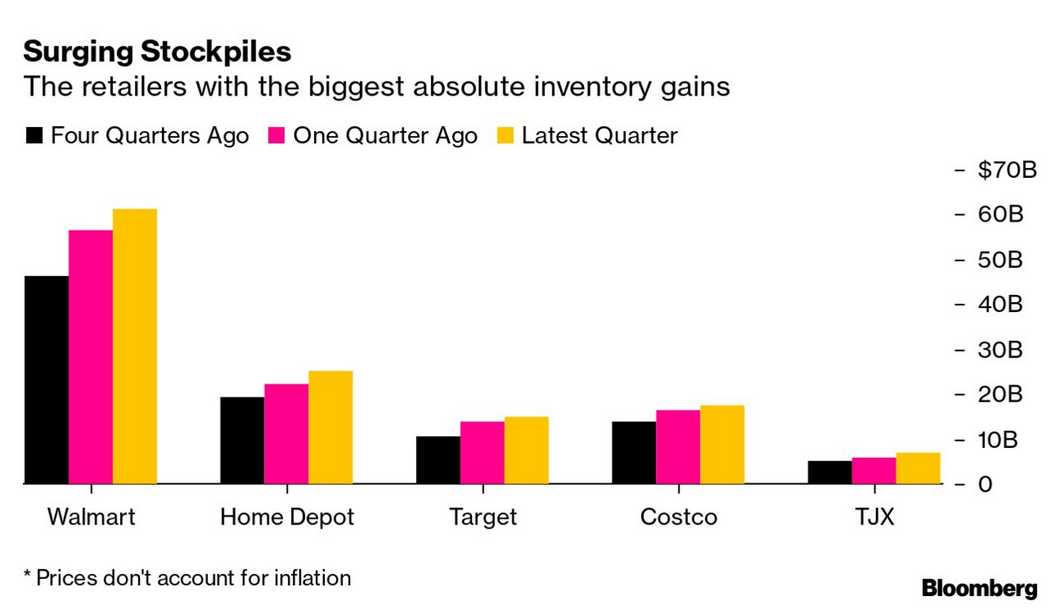

The indication of slowing growth of inflation are present in "other" price measures used by "very important people" like the Personal Consumption Expenditures Price Index, inventory-to-sales ratios, and jobless claims.

- Again, these things are not correlated to growth or inflation at all in real life, but that doesn't stop the orthodox economists getting excited:

[The] personal consumption expenditures price index, which the Fed prefers to the CPI inflation measure, as it covers more prices and adopts more quickly to changes in consumption patterns. On Friday the April number came in at 6.3 per cent, a decline from March. The core number (excluding food and energy) was down for the second month in a row

The rise in the inventory-to-sales ratio understates the bulging of inventories, since sales of goods have gone up by so much as well. Last time I looked aggregate goods demand in the US was still some 20 per cent above pre-pandemic trend.

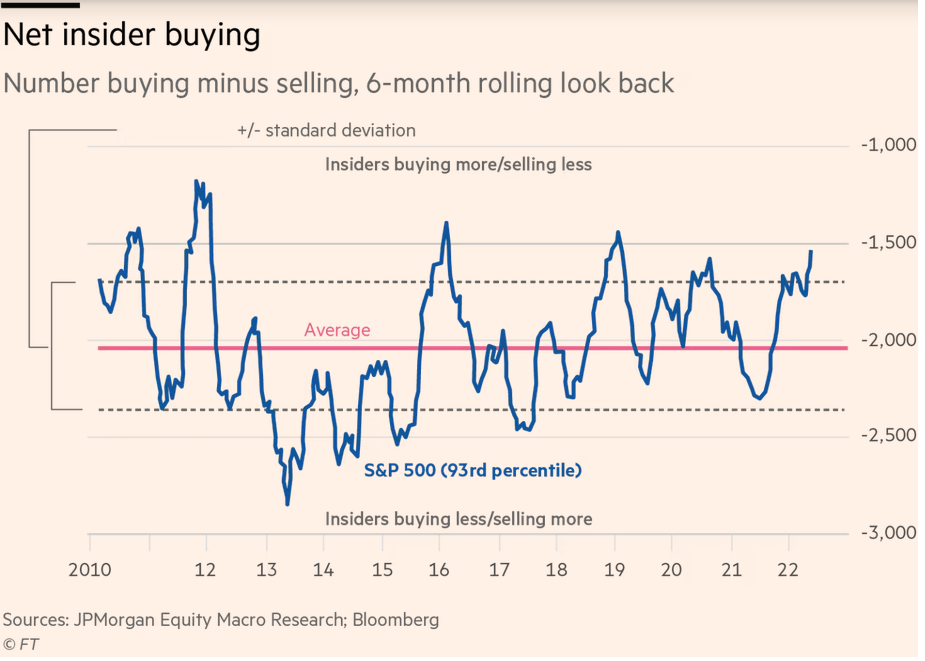

Meanwhile, CEOs are buying their own stocks: dipping into the buy from the dip

- Is it insider trading or clear market signals?

- Both, but don't worry. When CEOs do insider trading it is called "insider buying".

- Does that mean you should? No. No, it doesn't.

- All the current betting on longer-term stock growth is being done with your money as CEOs purchase stock with money pulled out of stocks earlier in the year – which was an effective transfer of wealth from retail investors who tried to "buy that dip". So, it is a rather easy bet to make.

- Also, it may be buying the current dip (as markets almost always overshoot), but that doesn't mean they won't go back down when you are not looking.

- As one commentator at the FT put it:

Even in an indiscriminate selling environment, picking long-term winners is tough. Anyone without technical expertise should look elsewhere. But a risk-happy fund with scientists on the payroll could make a bundle.

Largest ever May Storm to hit Mexico

- Oaxaca tourist areas are going to be hit directly.

- Was a category 3, now a 2. But, those numbers are not really telling of the damage it will cause.

- May isn't really known for this kind of thing.