May 30, 2024

Economic impacts of war

Bloomberg has an interesting article about the economic impacts of war.

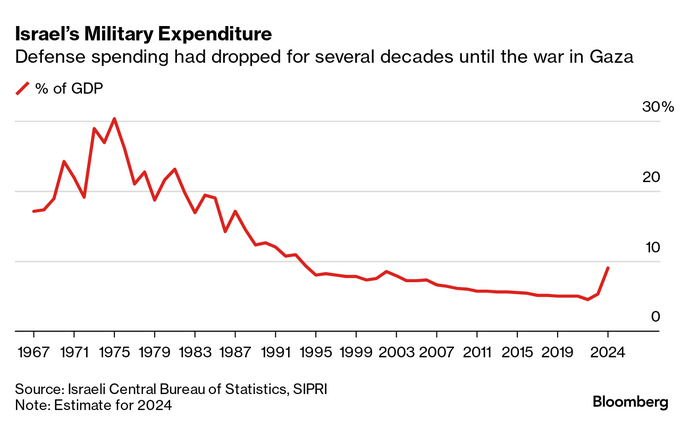

Last time Israel spent this much money killing people it lead to a lost decade of economic growth.

Compare this to:

- 3.4% for the US

- 1.5% for Germany

defense spending, which averaged almost 29% of gross domestic product in 1973-1975. The side effects were devastating. The government deficit grew to 150% of GDP, fueling 500% annual inflation. The period, known in economic circles as “the lost decade,” ended in the 1980s when the country enlisted outside specialists to help draft tough reforms that slashed state spending, stabilized the shekel and attracted foreign investment.

While things might be different in the economy right now, the economic concern is that ultra-Orthodox, fascist-style military spending parties continue to dominate Israeli politics. The negative impacts are already obvious:

- The fourth quarter of 2023 saw a 21.7% annualized drop in economic output.

- Economic growth is set to be 2% this year

- debt to GDP ratio is expected to rise to 67% from 62% this year.

- emigration of high-earning, high-skilled workers is a major concern as students question the benefits of putting their lives on hold fighting an endless conflict.

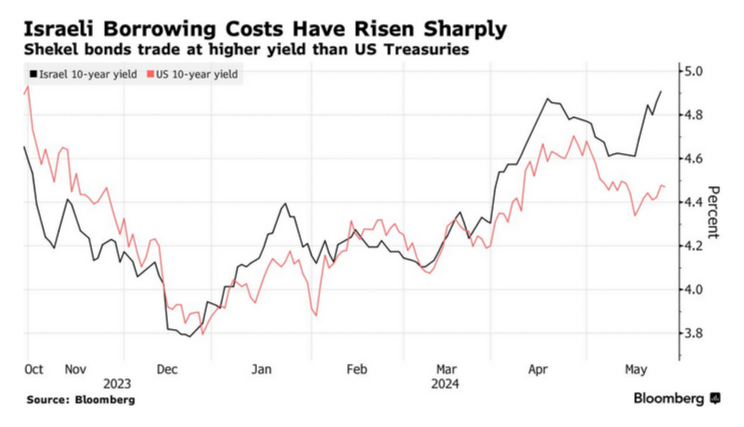

This is happening in the context of global inflation and high rates. The central bank is holding rates high and cost of borrowing has separated from the rest of the world.

Economists for Israeli Democracy have released a report warning of some uniquely Israeli economic conditions outside of the costs of war. Demographics play a large part in the state subsidy and expenditure regime. This plays into the type of society and economy that economists predict for the state, and this from a group that cannot be described as "progressive" economists.

Not speak to the other side of this atrocity—if we ever get there—but all of the economic problems also exist after the war. Dealing with the aftermath of this scale of destruction, death, and the increased regional insecurity will cost dearly.

While imperialist war and conquest of rich lands and poor people might result in extraction of wealth and expansion of areas of exploitation, war against an already hyper oppressed and exploited people results in no economic benefit.

While economics continues to not be the focus of anyone right now, it is worth bringing-up on the anti-war side of things. There are so many better things to spend money on than genocide, atrocities, destruction, and death.

One might point to anything actually.

South Africa

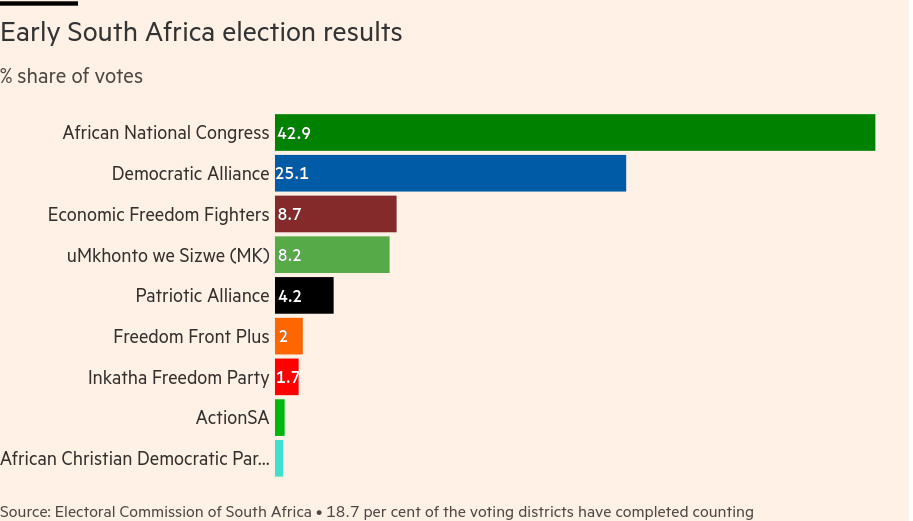

South African voters have punished the ANC in the recent election. The party of Mandela is on course to lose its majority.

The protest vote is leaning to the left populist parties which has spooked investors who thought that a continued neoliberal ANC was a surefire way to increase business interests in South Africa. Apparently the people think that this is a terrible idea.

The only path for South Africa is for the state to re-establish itself as a program of development, remove corrupt business interests from the heights of their economy, and restructure the pay systems to bring people who are interested in fixing problems than simply exploiting them for their own gain.

That will take a redistribution program as promised by the original ANC charter. Unfortunately, that does not seem to be in the cards right now.

Shipping rates

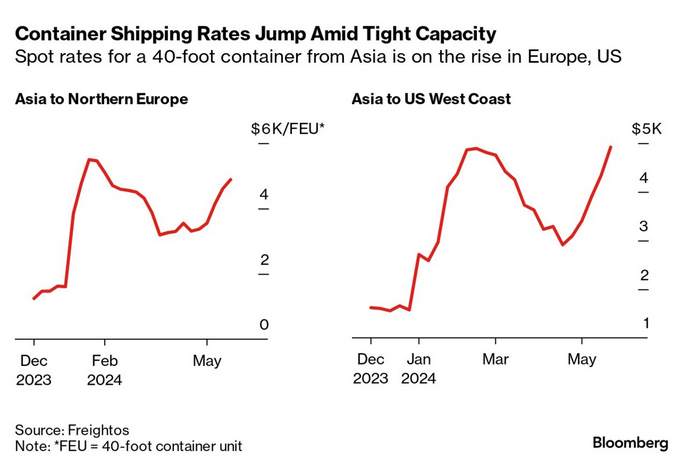

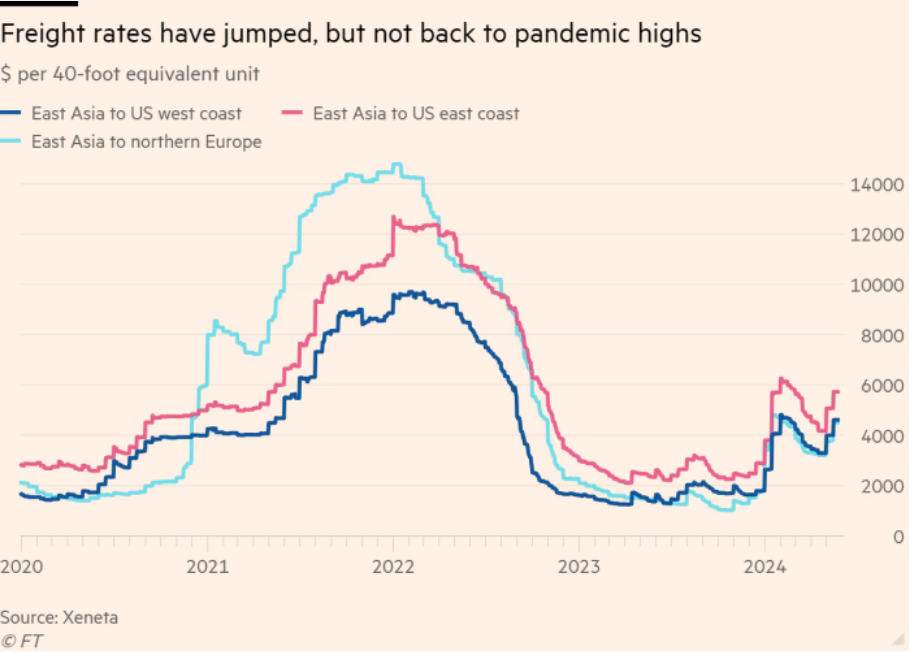

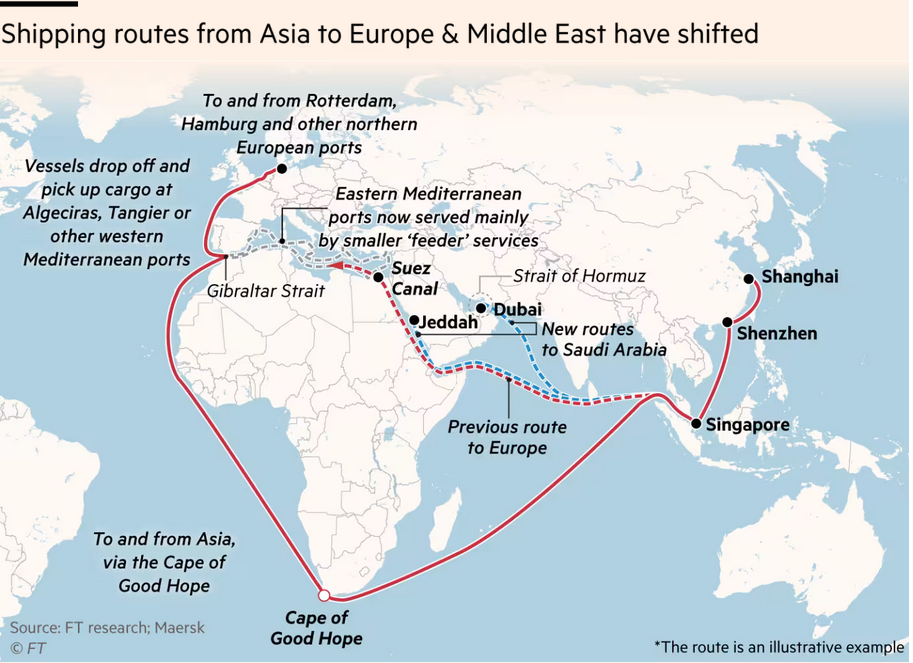

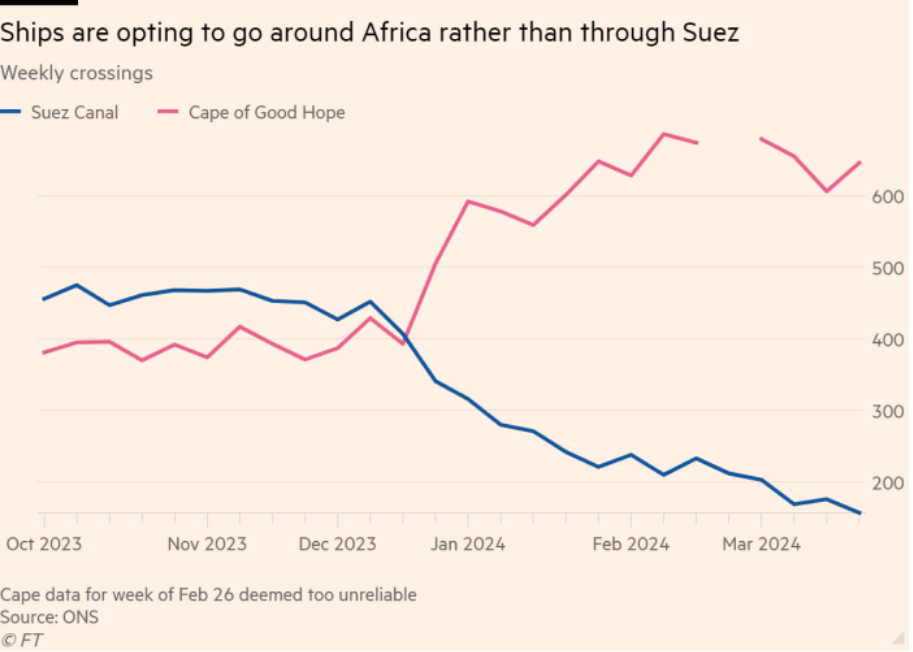

Looks like the attacks in the Red Sea are having an impact on shipping rates. Most shippers are avoiding the route adding as much as 25% to the transit time and significant cost to shippers.

Putting that into some historical context where shipping rates were contributing significantly to inflation and supplychain pressures:

Global supply chains are at significant risk of disruption. But, they are systemic issues that are surfacing that are the threat: climate change, global conflict, shifts away from "just in time", technological change, and changes in areas of production investment away from China.

The increased risk to disruption is giving large employers a hammer to attack the right to strike, but we must be clear that there is a difference between:

- Systemic versus localized disruption.

- Expected localized disruption (strike) versus unexpected localized disruption.

The focus must be on resilience of supply chains to disruption. This takes increased investment and more and better paid workers, not fewer with reduced rights.

It is a message that the left needs to push on as we gear-up for an increasingly unpredictable future.