May 30, 2023

Debt

We have talked previously about debt and climate change. Emerging markets are starting to reach a tipping point.

Changes that are relevant:

- New York, which sets laws for most of the world's debt markets, is attempting to change the laws that govern restructuring debt.

- The current laws allow creditors (those who lend money) to delay restructuring indefinitely. Mostly we are talking about hedge funds who demand to be fully repaid even if a country is in default.

- Proponents of the new restructuring laws have said that this is untenable and that there should be a mechanism to allow restructuring under a particular time frame.

Why is this happening?

One of the outcomes of artificially low interest rates was a lot of borrowing—both private companies, consumers, and whole countries.

Much of that debt now has to be repaid. With the rise of climate disasters (and some wars) this is becoming rather impossible.

A thing to remember:

When it comes to debt for necessary investment, it is either bourne by the government as public debt, or it is bourne by the private sector and consumer.

When neoclassical economists talk about too high of a debt-to-GDP ratio for countries, they mean that private debt is not high enough.

When public debt is "too high" it means that the government is investing in production (socialism) or they are borrowing unsustainable to try to do some public policy thing without taxing (liberal social democracy).

For poorer countries, the debts are caused by giving money to the private sector for "development". That is, profit guarantees paid for through debt. But, profit guarantees given to businesses that fail result in the government being indebted without the hoped-for productive capacity growth. Which just leaves debt on their books and nothing to show for it.

Borrowing to fund private capital has been the "development" program for the IMF and World Bank for decades. It leads to structural adjustment, extremely high debt repayments, and forced privatization.

With climate change, the pandemic, and increasing interest rates around the world, the debt issue is becoming much worse.

There is a slow moving sovereign debt crisis brewing.

And, this only speaks to half of the issue. Much of the debt is private in poorer countries. Farmers and small businesses in many "developing" countries are just providing privatized public services. These "businesses" have taken on the debt because the government created an incentive for them to do so. However, the terms of that debt did not foresee such frequent collapses in their ecology.

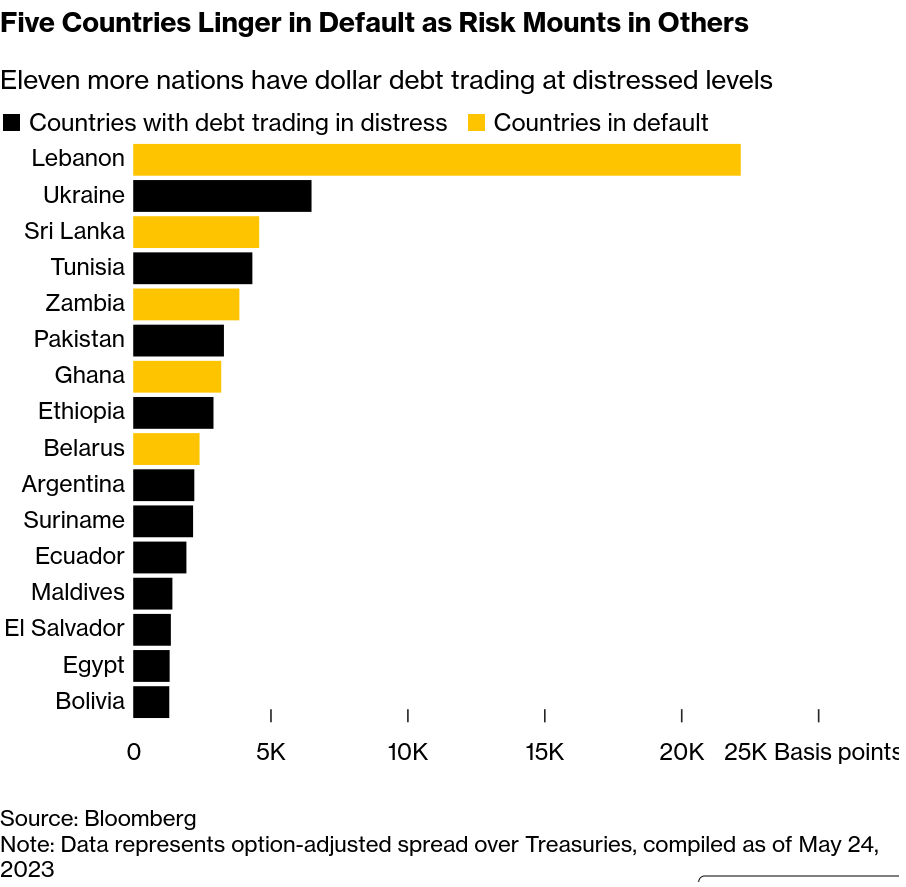

Major climate crises in Pakistan and Zambia. Shifts in geopolitics and economic distress in Lebanon and Ukraine. The list of countries are familiar. They are the countries targeted for neoliberal "development programs" a decade ago.

With money tied-up at the national level, governments are no longer able to bail-out privately indebted farmers through national "insurance" banks. So, everyone becomes burdened by debt they cannot really pay back.

The same thing is going on in advanced capitalist countries faced by climate and other disasters. Governments before the pandemic attempted to shift the burden of debt to growth to the private actor (read: consumer) and off government budgets.

Then the pandemic hit and governments printed money to save their economies. This caused inflation along with the production crisis that caused price increases.

There were a lot of problems created by artificially low interest rates. The additional issue with those problems is that we now have to finance not just a climate response, but also finance the destruction caused by climate, health, and demographic crises.

What New York is trying to do is make restructuring work faster and save the private debt markets. But, it is deck chairs on a very large sinking ship.

We need debt forgiveness as a policy lever. However, this will drive up private borrowing costs. So, with any debt forgiveness we need a public investment regime that does not rely on private debt.

In the end, this is a paradigm shift that has not landed. But, I do not think it is avoidable without some barbarism.

So, I guess capital will be pushing barbarism.