May 3, 2024

Emissions

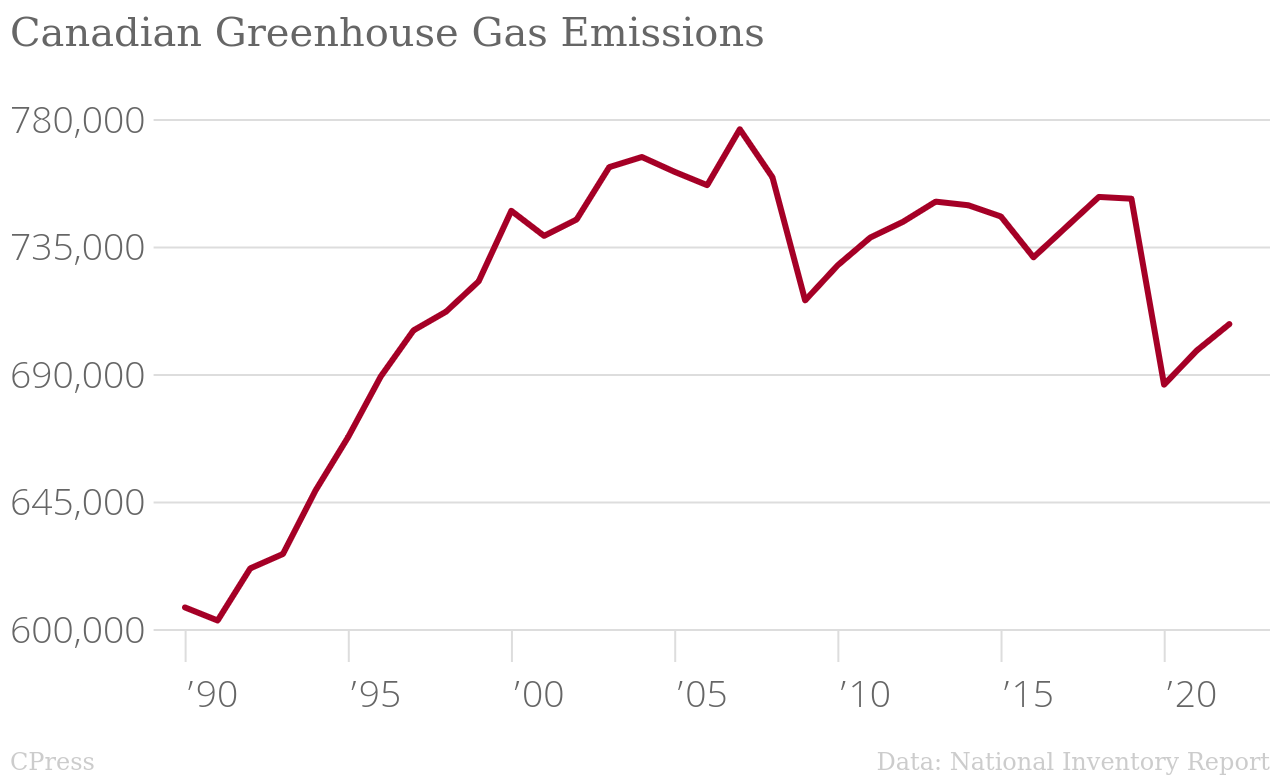

Canada's emissions are not just up, they are not coming down.

It is a little easier to see where we are from 2019 to today compared with the historical record if you take out 2020 and 2021. The line goes down, but it is in-line the variation of emissions for the previous two decades.

_Emissions_chartbuilder.png)

Here with the breakdown.

_ENERGY_(Right)_INDUSTRIAL_PROCESSES_AND_PRODUCT_USE_AGRICULTURE_WASTE_LAND_USE,_LAND-USE_CHANGE_AND_FORESTRY_chartbuilder.png)

It is not just that they are up, they are up to essentially pre-pandemic levels. And, some of the measures that have brought the number down are not real/lasting.

- Fugitive emissions are down in this report, but other reports show that they are way up because we are not counting areas that increase.

- Public electricity production is down, but only because we turned of a coal plant and replaced it with gas. We cannot turn off many more of those to bring emissions down.

- Oil and Gas Extraction is the highest it has ever been.

- Agriculture is the highest it has ever been.

- Other Transportation (basically transportation not in a car) is the highest it has ever been.

- Road transportation is back to 2004 levels, but only slightly below 2019 levels

- And, our "forest land" sequestration number in 2022 is way up. Which is ridiculous. Also completely undone in 2023 given we burned the forests that year.

So, it is actually worse than it looks.

USA Labour market not great

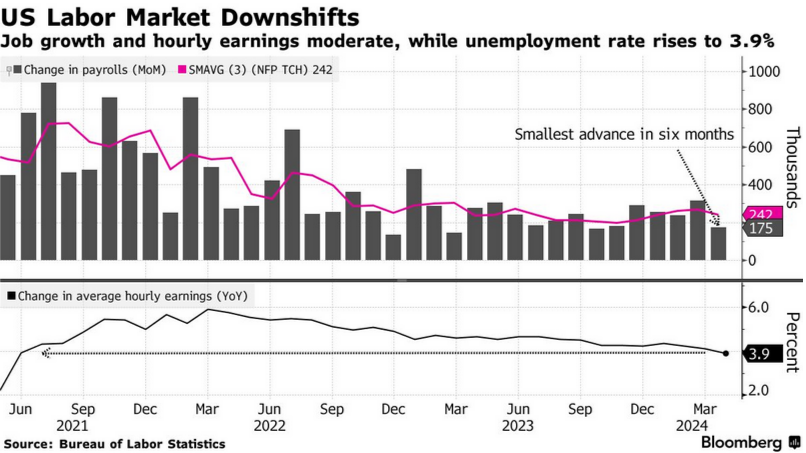

Official data are out and corroborate what we have been saying for a while: US labour is not doing great.

Hourly earnings are down and slowing growth in job creation. Both are kicking the chair out of wage growth potentials for this year even in the face of sustained inflation growth.

This is below "expectations", but inline with what orthodox economists want to happen. That is, putting the cost of inflation onto the backs of workers.

Average hourly earnings climbed 0.2% from March and 3.9% from a year ago, the slowest pace since June 2021

Employment was also weaker in the service-sector report (BN)

This even as labour costs were reported to have risen (for firms) the fastest in a year.

Firms are paying more for labour, but less of it generally. Why? Because minimum wage increased in a few states (including California).

Adjusted for inflation, private-industry compensation rose 0.6% from a year ago, while wages increased 0.8%. (BN)