May 29, 2023

Green Hydrogen Fantasies

A niche market product, if ever there was one.

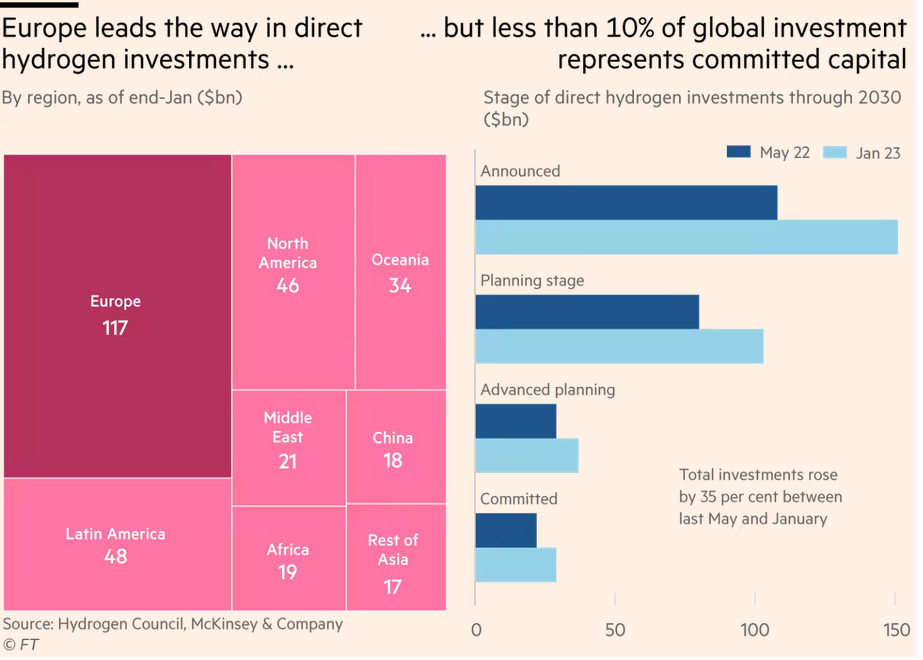

Even looking at using hydrogen just for replacing coal in steel production would require:

$20tn of investment by 2050 [to produce 500M tonnes]—and globally, we are only about 0.15 per cent of the way there. (FT)

This is compared to the (low estimate) of $100 trillion of capital needed by the end of 2040 (ETC) to make the transition.

If you read energy company reports into hydrogen production, you may be confused by this number. Most business reports mention hydrogen as a way to replace natural gas for many uses.

The hydrogen that energy companies are talking about is grey hydrogen. Which most scientists outline as even worse than natural gas—since it is made from natural gas.

Green Hydrogen is made from renewable resources and thus competes directly with consumers over access to electricity.

The other issue facing hydrogen is that it is terribly inefficient compared to direct battery storage. 20% loss of energy vs nearly 50% loss with hydrogen.

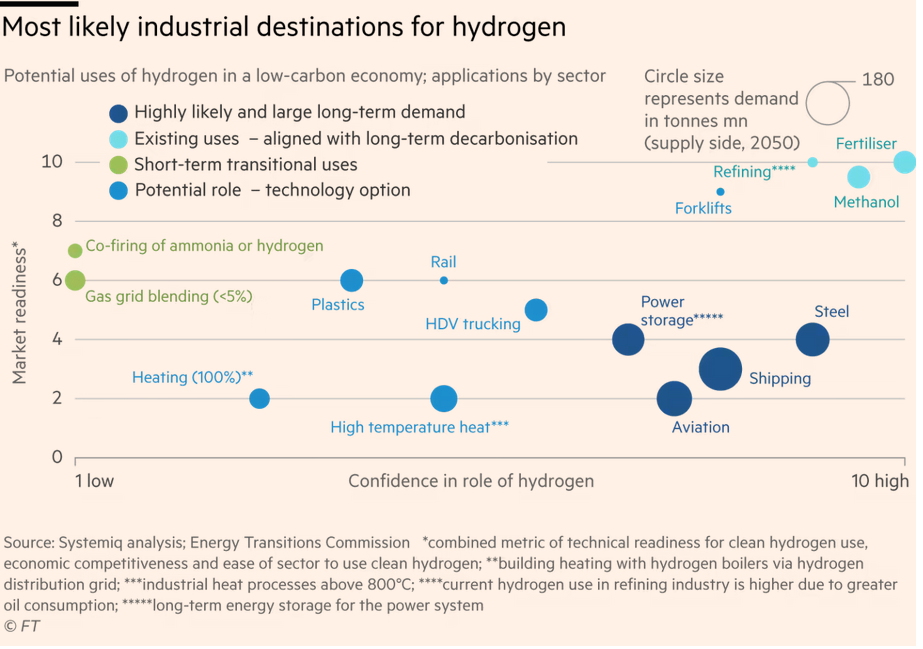

Hydrogen fuel cells are not the answer to very many problems. As such, the infrastructure will not be built for mass use. Thus, it is a loss leading technology.

The only place it hydrogen will be used is in niche markets like steel production, some power storage where batteries are inefficient, and some marine shipping. And, making Ammonia.

Rail companies are playing with hydrogen in a similar way as aviation. But, I think that it will go nowhere fast as the infrastructure investment for refueling seems too high. Electrification of the rail system is cheaper for the most part. Though, there is some talk of it being a bridge fuel from diesel.

Aviation? It is just climate killing and there is little to be done there in the medium term. Best to replace it where you can with some other form of travel.

The other issue is that hydrogen is way more expensive than natural gas. So, the market will not make this transition. At least not without massive subsidies (about 1/5th the cost of investment).

The amount of subsidy for moving this market is so high that it should be clear to anyone that profit subsidies are not the answer. We need direct public investment in the infrastructure that is going to work.

We need to be clear-eyed when talking about energy transition, which means doing the math and abandoning ridiculous ideas. Among them are mass use of hydrogen, carbon capture and storage, mass adopted individualized battery-based transport. And, we need to acknowledge we are nowhere near where we need to be in generation capacity.

Only when we acknowledge where we truly are does the future direction of investment and the challenges we all face become clear.

Inflation in the rest of the world

Countries outside OECD rich club are still facing massive increases in inflation. Prices are up for food and energy—since they pay the same price as everyone else.

The global market in basic products means that local economic decisions barely affect the prices of these goods locally. The only effect is competition over access to these goods and the local wages.

It is a difficult balancing act. Rich countries are demanding poorer countries not reduce interest rates and stay with the global effort to make workers pay for inflation. Some countries are wondering why they are listening to broken economic programs.

But, the central bank club is a tight one all marching in lock step.

It remains to be seen if some countries with better political control over their central banks can game the system and boost their own economies without getting hammered by geopolitics.

The big country to watch is Brazil. Neoclassical orthodoxy continue to lead its central bank decisions. But, the new government should start questioning the value of forced impoverishment.