May 27, 2022

Has inflation peaked?

-

Bloomberg economists seem to think so.

-

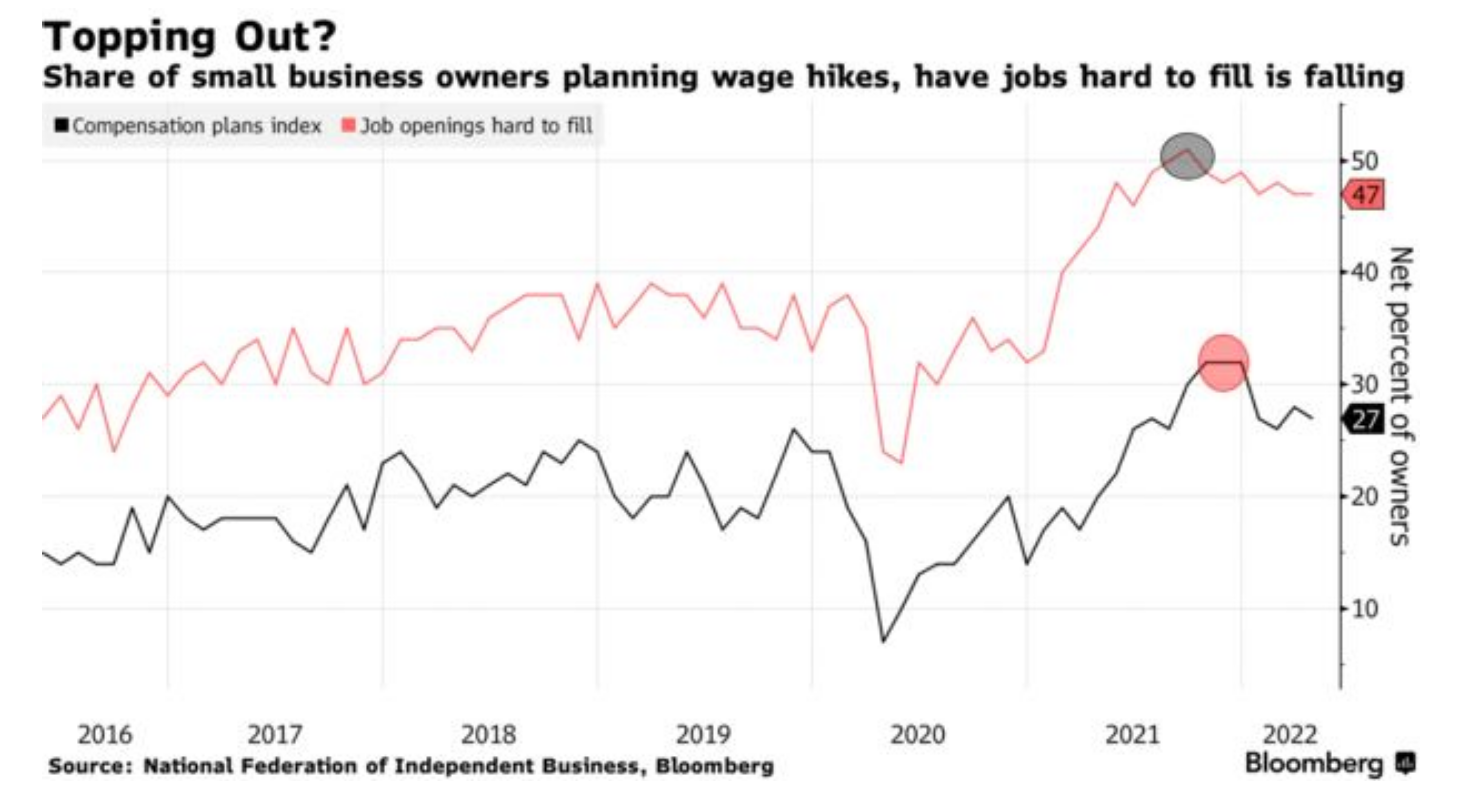

They measure wage growth as one indication. Wage growth as completely stagnated.

Economists see annual earnings growth slipping to 5.2% in May from 5.5% in data next week.

- The other measure is the ability of companies to raise prices without affecting sales. This pricing pressure also seems to becoming to an end.

- Finally, it is the pressure from demand, which is declining as prices increase and people have purchased what they didn't purchase last year to deal with the "reopening" after covid.

-

The reason that Bloomberg economists think this way is because they look too closely at numbers that are barely even proxies for inflation.

- Profit growth is collapsing, that's true and rather unsurprising given that there is a high point for prices that will be reached. But, this is just correlative. The reason that they have reached their max – along with profit rate increases – is that the economy is heading to recession.

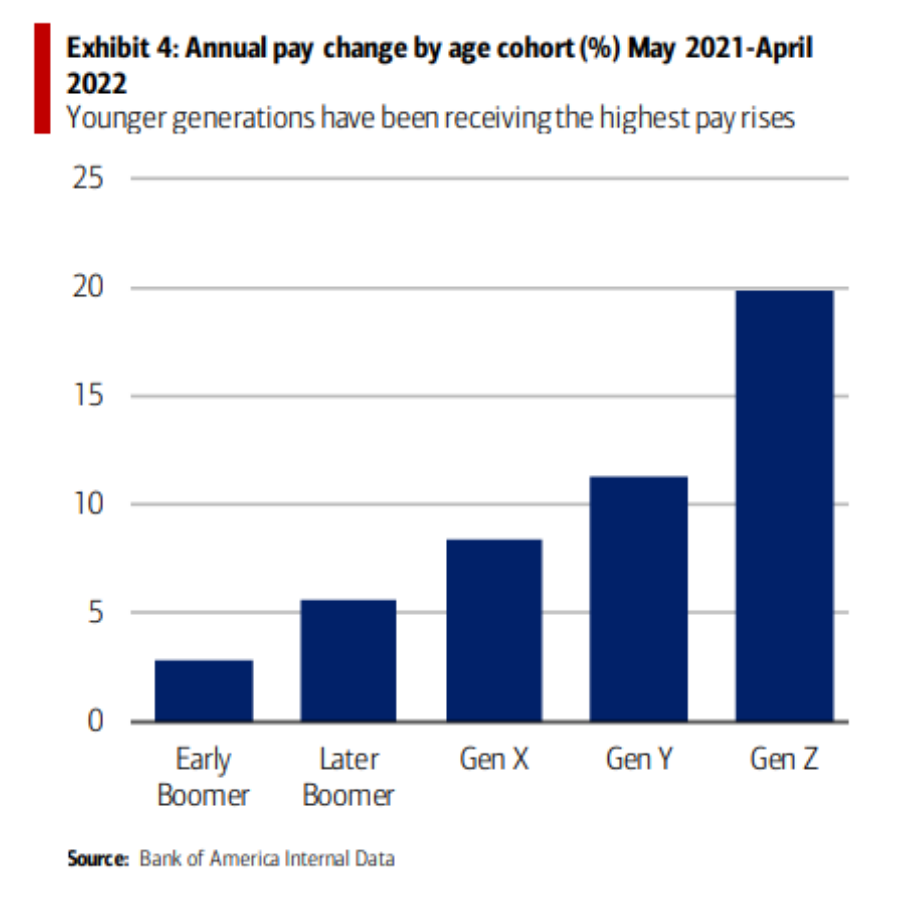

- Wages stagnating is not a good thing at this point as it means profits were earned by capital, but wages will not catch up. As profit rates collapse, workers will have paid for inflation totally.

- All of the "short-term" measures like tax cuts are about to catch-up to the governments that thought that was a good idea to deal with price increases.

So, has inflation in prices peaked? Probably. Does that mean it will come down as fast as it went up? Probably not.

- Current "inflation" is caused by excess profit subsidy by capital. Much of that has dissipated rather quickly in the financial markets and the "crypto" markets that transferred a lot of wealth from workers to capital.

- The high prices that are being maintained have little to do with "inflation" and are mostly caused by things actually being more expensive. This is unlikely to resolve itself quickly as "supply chains" (an ever expanding category of blame) and production are not easily solved quickly.

-

Prediction Warning: Price levels (and their growth in certain areas) are here to stay for a while longer.

- Food: much of the processed food of the West continues to have the same issue as we have had the rest of the year. Grains are still expensive. Fertilizer is still expensive. This means food will be expensive this year and next.

- Energy: we are not done the transition yet and leaning more on fossil fuels right now is not going to help that price issue. Oil prices could come down, but then what?

- Earning forecasts of major retailers have declined this quarter. There will be a general slow-down in investment and hiring – which is what gives a recession.

- Equities are still declining.

- The one thing that could save Capital right now is if the state does nothing to stop worker wealth collapsing (highly likely given the state is currently trying to destroy worker wealth as fast as possible). This will result in sustained profitability for some sections of the economy.

- Tech is unlikely to rebound – there are few innovations about to be launched and cheap debt has evaporated (and unlikely to return soon).

The alternative profit growth areas are:

- energy infrastructure (all kinds)

- mining

- plastics production

- companies able to innovate around supply chains and relocalized or cheap Westernized production

- cheap local leisure services (workers are set to spend their gains quickly)

Investors and consumers alike appear to be picking up on a change. Gauges of future inflation derived from bonds linked to consumer prices have tumbled, with the so-called five-year breakeven around 3%, versus a high of 3.73% in March. A New York Fed survey Thursday similarly pegged consumer expectations at 3% inflation over five years.

“Medium-term inflation expectations appear to have reached a plateau over the past few months,” researchers wrote in a blog post co-authored by New York Fed President John Williams.

Monopolists are back in fashion

- The data is nice now for those who rely on correlation (instead of causation) to make predictions.

- Current trends in prices and costs allow monopolists to suddenly claim they are correct. They were not correct last year and they won't be correct next year, but that never stopped them before.

-

Report out of the Federal Reserve Bank of Boston shows the economy is "50% more concentrated to day than it was in 2005".

- And, they blame (some) rising prices on it. Of course, Amazon's monopoly resulted in lower prices. So did Walmart's. And Google's. But, they conveniently ignore those "outliers".

Guns and their licensing ownership

- Obviously the US is an outlier for several reasons, but licensing is probably one major one.

- The NRA – an organization you think you know about, but probably do not – is meeting this weekend to make sure more kids (and their parents, teachers, and others) are murdered.

Don't forget about the other global war

- Our War in Eurasia will pivot back to our War in Eastasia very soon.

- All that war spending has to be for a reason and mid-terms are coming-up, and nothing gets votes for the sitting president like the fear of others.

US says China is greatest threat to international order In the first broad articulation of the Biden administration’s policy toward Beijing, US secretary of state Antony Blinken said China was the most serious threat to the international order despite Russia’s invasion of Ukraine. It came as Fiji became the first Pacific Island nation to join the US’s new Asian trade initiative.

While the speech was largely a summation of previous policies, Blinken said the state department would create a new China-focused team because of “the scale of the scope of the challenge posed by the People’s Republic of China”, which would test US diplomacy “like nothing we’ve seen before”.