May 25, 2023

Other things to consider around AI

AI is going to shake-up more than just the general computing and productivity (read: job losses) of white-collar work.

All work in the following areas will be directly affected:

- Logistics

- Defence

- City planning

- Pollution (every chip generates a slew of forever chemicals)

- Food production (from designed food to how and where it is produced)

- Energy use (lots of it)

- Privacy (AI sneaks into places without much help)

- Democracy (leveraged tools by parties and political organizations)

- Crime. UK's unregulated crypto industry clocked at £300mn in losses due to fraud over past year, up 40%. AI makes fraud much easier.

Privatization cannot be the answer to all of these issues like it has been with the data-side of things. Companies like Palantir, Anduril, Microsoft, and Google have ramped-up investment in these areas to suck-up all the data from the public sources. instead of regulating this industry, we have leaned into the privatization of our information.

If we also privatize the entire use and processing of that information, then we will be in trouble.

The power of these companies is not just on the software and data storage side.

AI chipmaker Nvidia is cashing-in (27% jump in its share price this morning) on the growth in AI after supplying the world with the chips for crypto.

The seriousness of Nvidia taking the lead can be seen in ARM's change in direction of research and production. ARM is a UK-based company that designs semiconductors. It has been attempting to float its shares for a while.

The main obstacle? It spends too much money on research. So, it closed-down Arm Research to focus on high volume chip production.

As companies focus on their profitable arms in the semiconductor space, the more monopoly control each company is going to get. This is going to be a big problem for governments along the lines of the list above.

Semiconductors are necessary for national security. And, like other defence spending, those companies need to be regulated (and/or publicly owned) and the impact of monopoly monitored openly.

South Korea has warned the USA's CHIPS Act is affecting their companies' investment in China-based semiconductor production. The impact they are concerned about is that it take a long time (and money) to move production. The result is a decline in profits as subsidies to move from China are not large enough.

The main geopolitical issue for South Korea? To lose out to endemic Chinese companies on chip production.

South Korean chipmakers are heavily reliant on their Chinese plants for a substantial part of their D-Ram and Nand flash memory chip production. (FT)

- 40-50% of flash memory and D-Ram chips of South Korea companies are produced in China.

The semiconductor field likes to claim they are magic. But, it is just a physical device produced in a place with inputs like any other tool. Those production facilities, workers, IP—if outside the country—fall victim to the whims of USA leadership.

If people are unswayed by the argument that we need to regulate the capital that are building advanced (and not advanced chips), then lets include the national security aspects into the discussion.

Anti-biotic resistance

In Europe, some asset managers, not the most progressive bunch, are concerned about McDonald's use of anti-biotics in their food supply chain. Amundi and LGIM (who cares what the acronym stands for) are trying to get the large supplier of junk food to stop borrowing so heavily from the health of future humans.

The call? For McDonald's to comply with the World Health Organization's guidelines on medically important antibiotics in the food supply.

Like I said, they are not radicals. But, this is a very important issue. Antimicrobial resistance is likely to get many of us before our time.

McDonald's response to this issue was to claim it is a responsible destroyer of future lives. The resolution is unlikely to pass as profits are more important.

The attempt does highlight the importance of global regulation of the use of these drugs. From a simple (and sociopathic) view, the risk of antimicrobial resistance to the global economy is about 3.4% of global GDP.

Add that to the impact of climate change and you have a very serious collapse of everything.

Of course, what that number does not tell you is that it is a result of many people dying and therefore not able to produce. But, capital doesn't care about that analysis.

Europe

- UK inflation was higher than expected.

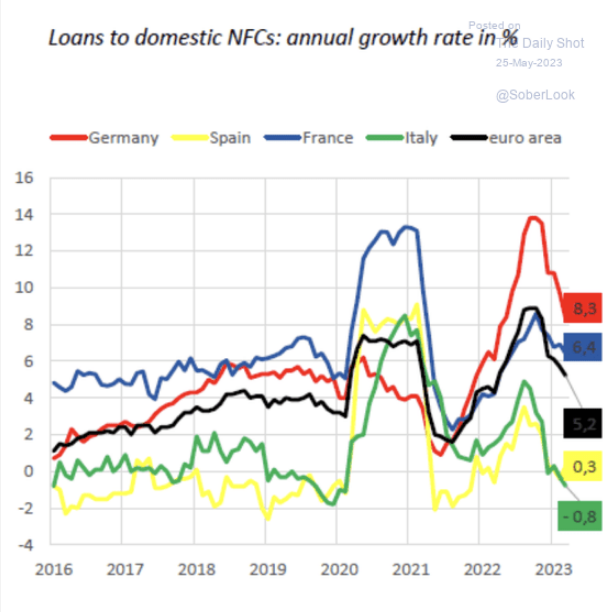

- Germany GDP numbers indicate a deep recession coming.

- Belgium business confidence is well below water.

- General slowdown across the continent