May 24, 2024

Purchasing Managers Index (USA)

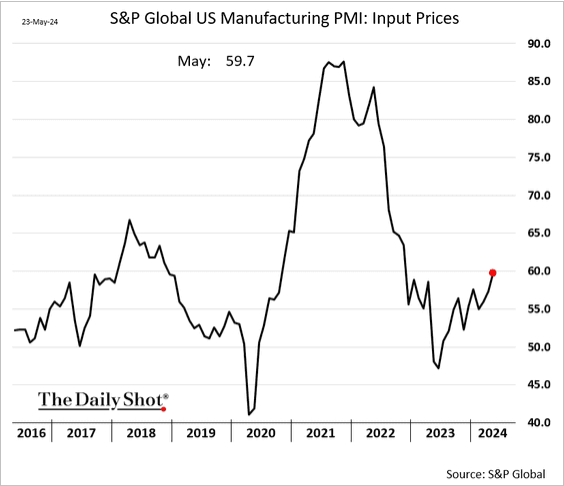

There was a general unease that floated across the markets yesterday. That sense of dread was caused by the PMI for input prices increasing along with production, but at the same time some sense of over-supply of manufactured goods.

Input prices affect prices of goods sold.

Why is this bad? Well, markets are concerned with what the Federal Reserve will do with its interest rates. The signs are looking more and more like there may be an increase (or at least no move) in interest rates in June.

Employment in manufacturing and services are well up in the USA, but that is not great for capital if the prices of that labour is high, the price of debt is high, and the price of other inputs are growing faster than expected.

Service sector growth is nice for workers, but that is where orthodox economists think inflation is coming from (because of wages). More workers who are more expensive means inflation of prices in the services is not going to slow.

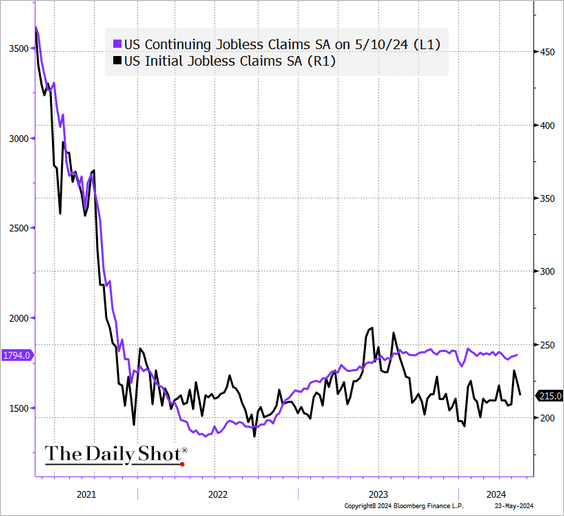

The other side of the coin when it comes to supposed increases in service sector activity is that unemployment claims are up and longer-term unemployment is higher than recent years as well (in the USA).

So, something strange is going on and it is likely to do with automation and capacity utilization. That is, companies are deploying technologies or running machines harder to make their products than hiring more workers to do the job.

There is more to the economy, of course. But, for the Federal Reserve that is increasingly want to justify why it is keeping its interest rates higher, these provide some difficult narratives.

Yellen has inserted herself into the conversation as well, speaking on behalf of the elected executive part of the government:

“They see it when they shop for food. They see it in terms of rentals. With higher mortgage rates, it’s tough for young people who would like to buy a house to enter the market,” Yellen said in an interview with the Financial Times on Thursday.

“Although wages have gone up significantly, and, at least on average, more than prices have gone up, there are substantial increases in prices that are important to people — and it’s substantial increases in a relatively short period of time that are very noticeable to people,” she said.

- CPI is up more than 19 per cent since Biden was elected.

This is all in the face of the conversation about interest rates. If inflation is too high, then that means higher rates according to the central bank logic.

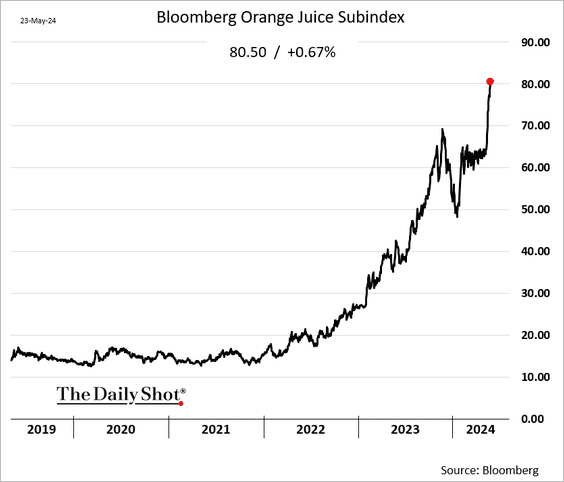

Speaking of "inflation". Check out the commodity traded prices for wheat and orange juice in the USA:

That's looking a lot like chocolate and coffee.