May 24, 2023

Two sides to the debt ceiling

- The political game of chicken to raise a debt ceiling. A stupid concept of debating settling the bill after you have already borrowed (and largely spent) the money.

- The selling of debt to the market. Less of a stupid concern.

We can only guess how ridiculous the debt ceiling talks will get in the US. So, instead let's look at the other side of it.

Selling debt to the "open" market is about selling bonds to investors.

When a government bond is sold, private money is spent on buying a "treasury bill" in the USA. This private money goes to the government and thus out of the private banking system (they get a bond that gives a certain amount of revenue over some time frame). This leads to less liquidity in the private banking system in the short term.

If that money is then spent on some activity that produces value, then that activity acts to sop-up excess money lying around in the banks. Depending on what the return is on that bond, the effect can actually lead to reduction in inflation.

However, if that money is spent on profit subsidies then it has the opposite effect. The inflation reduction aspect of this bill is not guaranteed.

Also, the selling of debt to the private market in bulk means that the cost of that debt works in tandem with the interest rate price and "Quantitative Tightening" the central bank (Federal Reserve) has been engaging in to pull money out of the private system.

Interest rate increase we kind of understand. The central bank increases the interest rate it charges banks to the actual cost of lending money, reducing the amount of free money from the central bank.

Quantitative Tightening is where the central bank sells its own reserves (private debt in this case) back to the private market. That is, it takes money out of the private banking system.

All three happening at the same time will remove cash from the system that could be spent on other things.

This will have the effect of reducing the amount of money spent on almost everything else.

The result is subsidized lending is reduced and liquidity is taken out of the private banking system. The result is less investment room for private capital.

The result is an economic slow-down unless the money that the government borrows is spent on value production.

The debt ceiling fiasco is about the USA "deciding" to pay its bill. But, that bill is paid for through credit lent to the government. That credit is found in the private markets.

The central bank is engaging in money market manipulation to bring inflation down by taking money out of the system. However, we also need massive amounts of money to be spent on new investments like climate change mitigation and response, new semiconductor manufacturing, health care, increases in the proportion of retirees, a war, and shifting geopolitical messes.

It all has to balance and it really depends on how that dollar is spent whether it will be good or bad for the working class.

I will let you decide what the outcome will be.

Road safety

It is not safe to be on the road. Or, even beside the road.

Percentage of type of road "users" in accidents resulting in injury of fatality:

| Road User Class | Fatalities | Serious Injuries |

|---|---|---|

| Drivers | 50.2 | 47.5 |

| Passengers | 14.9 | 16.8 |

| Pedestrians | 15.8 | 14 |

| Bicyclists | 2.5 | 4.7 |

| Motorcyclists | 13.1 | 13.9 |

Notice that it is as dangerous to be a pedestrian than it is a passenger in a car during an accident.

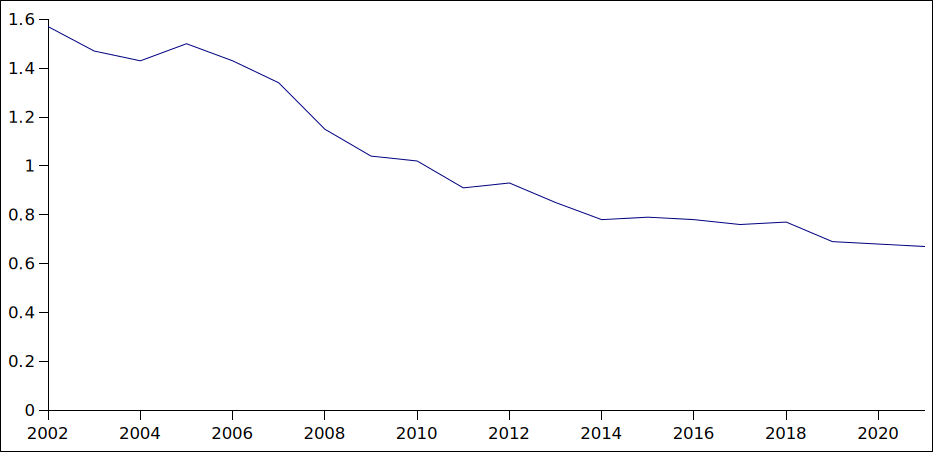

Fatalities per 100K drivers:

Fatalities had been declining since 2002, but that decline has been slowing recently. There is a lot going on here, but over one out of five fatal accidents resulted from distracted driving.

Put away your damn phones when driving and keep an eye out for those who do not.