May 23, 2024

Canada, Europe, and USA inflation and rates discussion

This week saw inflation numbers and discussions around what the central banks will do around interest rates heat up. We are no almost half-way through 2024 and we have enough data to see if the end of the year is going to bring some changes to interest rates.

The answer depends on where you live.

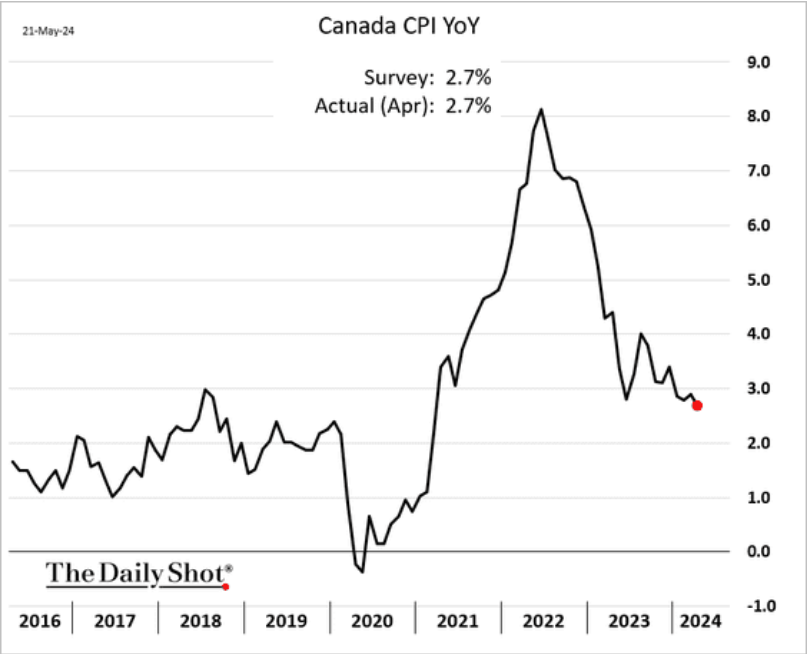

- Canada's inflation number was "expected" by the "market". It is not that the inflation numbers were down significantly, because they were not. It is just that the economic indicators showed little to no change in growth trends of the economy or wages, so investors figured it no change in inflation. And, they were mostly proved correct as even investors are correct some of the time.

The highlights are:

- CPI Trimmed mean: is down to 2.9%

- CPI without food and energy: down to 2.7%

- Rent CPI: 7.9% (has been stuck around 8% for 6 months.)

- Services CPI: 4.2% (has been stuck around 4% for 6 months.)

Overall, not great, but could be worse. Which means that the market is betting on two rate reductions this year. The first one in June. Doesn't mean it will happen because of what is happening in the USA.

-

The Federal reserve in the USA ut out a statement that included this line:

Various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate.

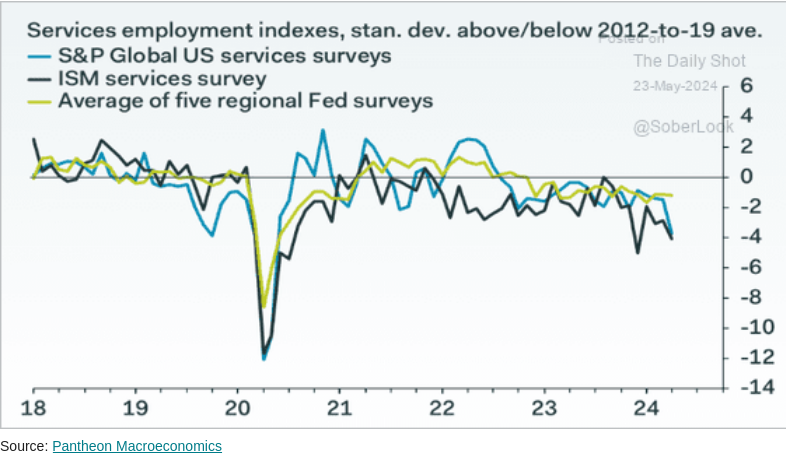

That doesn't sound like they are going to reduce interest rates in June. But, there has been a gradual slowdown in hiring across industries in the USA, so while inflation might be higher than the Federal Reserve folks want, the economy is not in a great spot. Higher for longer, but also, maybe not "even higher than now".

- Europe is on a different path. The strident orthodoxy that runs through the veins of their financial manager class is strong. Most on the centre right over there want "decoupling" from the USA's central bank and policy framework and a made in Europe decision making system. Unfortunately, that means looking even closer at wages when it comes to decisions on inflation and interest rates.

- The UK had higher than expected inflation.

- Europe is exporting more than they thought, but investment in production is down. The exports might be because of discount pricing of warehoused goods in Poland and Denmark where the economic growth prospects are really bad, but industrial production continues with cheaper labour. Not a great sign for the economy across Europe, but really strange for those two countries.

- Europe's labour costs continue to be "elevated" according to the business/economics press. Their focus continues to be on "services", which they think is being driven by wage growth.

- Germany production continues to be affected by the war in Ukraine.

_ X.png)

Much of the slowdown across Europe can be firmly placed on the austerity minded budget decisions. Most governments are squeezing their social spending to bring down debt to GDP ratios. The problem is that such contraction in spending is dragging down not just government spending growth, but also general economic growth.

This is the opposite policy than the USA which has expanded its government spending in an attempt to pump-up the economy.

_ X.png)

While ideological business groups like it when government graphs point downward, it is generally bad for everyone when they look like this.

You can see how the decoupling has progressed. The call now is to not reduce interest rates as quickly as we might see in the USA. While I cannot say that there is a good reason to "couple" policy decisions like this, to pretend that the prices of currencies in Europe are unaffected by Federal Reserve decision in the USA is rather fanciful.

We shall see in June where all this lands.