May 2, 2022

Forecasts

- Global economic growth to average only 3.3 per cent this year, down from 4.1 that was expected in January.

- The IMF downgraded their forecast for 143 countries that make up 86 per cent of global gross domestic product.

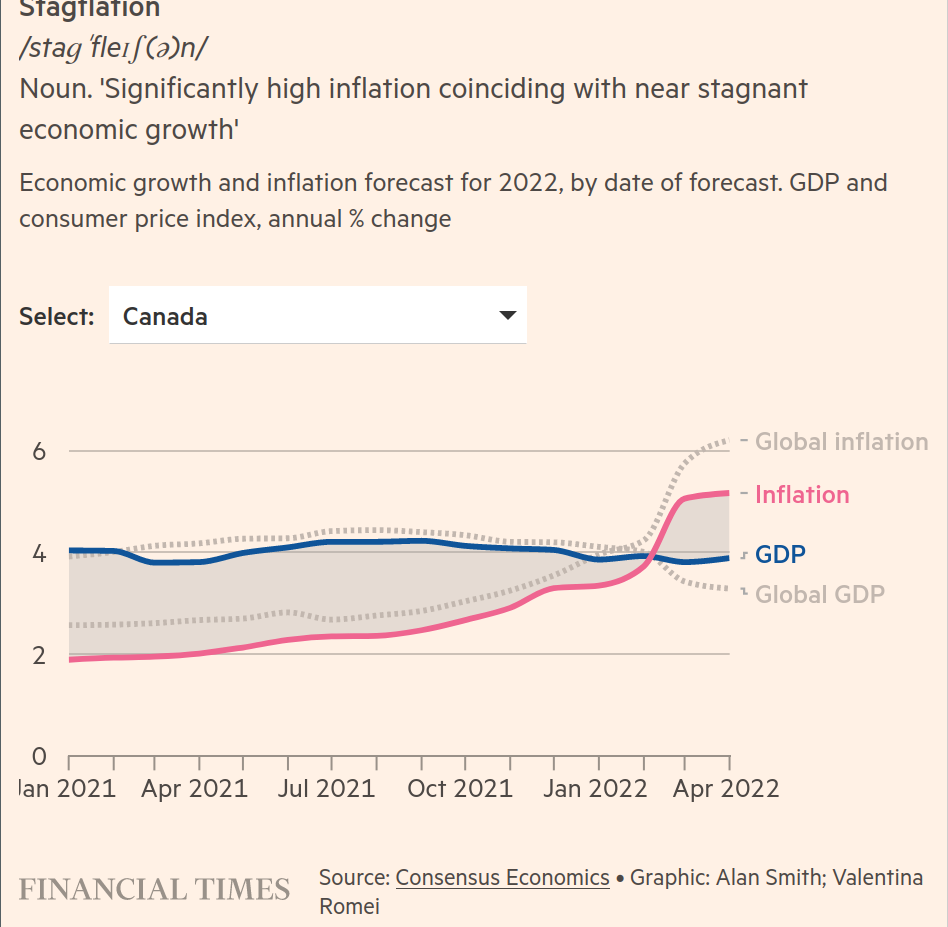

- Stagflation as a term describing inflation and lack of "growth" is back in fashion.

- The orthodox economists (who seem completely incapable to describe, understand, or predict the economy correctly) have moved their description of the economy from 1920s Roaring '20 to the oil crisis of the 1970s in about two months. Basically, from one end of the spectrum to the other in the time it takes to get your next "academic" paper published after your previous one was finally published.

- Many experts are warning that an EU ban on Russian gas would trigger one of the deepest recessions of recent decades in Germany and the eurozone.

- Wages are front and centre still as the "wage and price spiral" is trotted out to blame workers for everything – even when it is clearly out of their control.

“This combination of supply shocks and a tight labour market tends to give us more of a problem [of persistent inflation],” Andrew Bailey, the governor of the Bank of England

Larry Summers in a recent analysis, suggests “a very low likelihood that the Federal Reserve can reduce inflation without causing a significant slowdown in economic activity”.

- Canada will be bringing more international workers in to help "ease wage pressure" on companies:

As of April 30, the government will allow employers to increase the share of their workforce that comes from the so-called Temporary Foreign Worker Program if they can show that no workers in Canada want the jobs. In sectors suffering from major labor shortages – including manufacturing, retail, hotels and food services – the cap will increase to 30% of their workforce for low-wage positions. The cap for other sectors will increase to 20%. Both limits are rising from 10% currently.

Canada has sought to keep the program small because it’s extremely controversial. The residency status of these workers is tied to their employment with a specific company, which could expose them to exploitation. Miles Corak, an economics professor at the City University of New York and a former adviser to Trudeau, said in a Twitter post the loosening of rules was “shameful,” describing the program as something “pretty close to indentured servitude.”

- You never hear of the "profit and price spiral" (what we have been living through for 80 years)

- You also do not hear about the "profit subsidy through artificial low-priced corporate debt at all costs to sustain growth that suppresses real wages spiral" (the specific profit subsidy called neoliberalism).

- Instead the policy – even during "Stagflation" – is to slow the economy down even more.

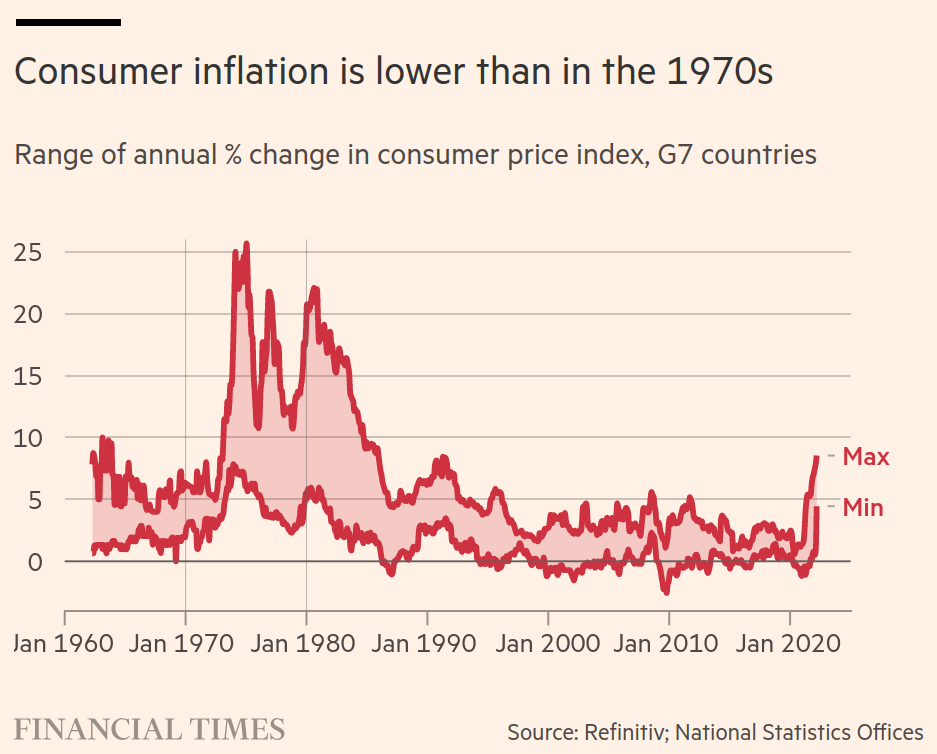

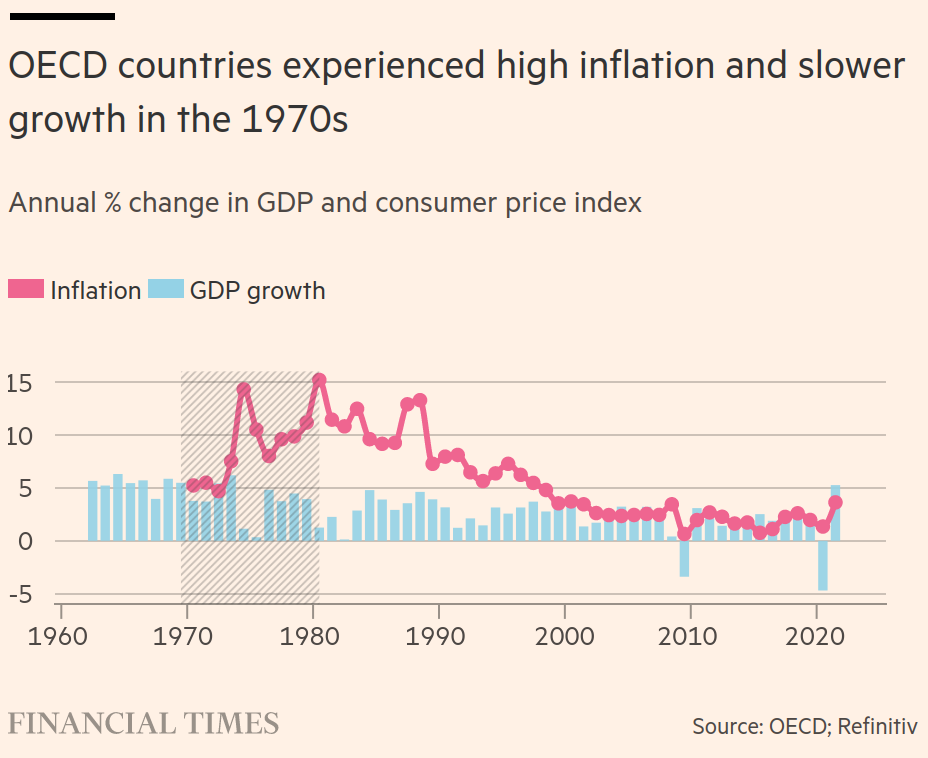

- Stagflation: "just like the 1970s" except not as bad and not really the same, but the graph is similar so economists call it the same thing:

- War is now being blamed on inflation too, even though inflation was a thing before war and the most affected countries seem to have the same (if not less) inflation than the USA and UK.

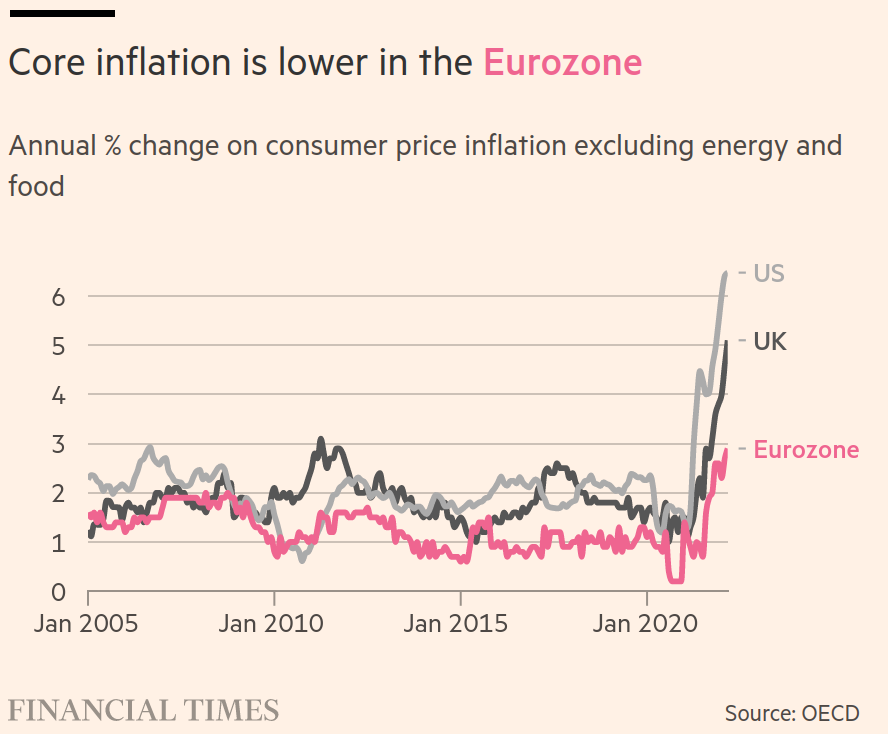

- Different "inflation" says Lagarde:

Christine Lagarde, president of the ECB, said recently that the US and Europe were “facing a different beast”. In America, it’s the tight labour market pushing prices up. In Europe, it’s surging energy costs.

- War does drive inflation, but that's not really what we are dealing with here.

- Interesting how it is all different, even from the time that we are supposed to think we are reliving:

- The money given-out during the beginning of the pandemic is going to be soaked-up by reducing the savings in workers' bank accounts.

- Energy price increases will be part of it, but so will forced under-employment, real wage suppression, and reduced public spending.

- None of this will support the move to profitability – which is the only capitalist way-out of the "spiral" – and avoid a recession and a "financial crash in debt and equity markets” (Nouriel Roubini's words).

- In addition to all this are the responses to the crisis/war in Ukraine/Russia/China.

- The realignment of global trade routes has happened much faster than can be responded to by capital.

- And, Western capital is very concerned with the China policy of putting COVID-19 health responses before their profits.

- All this means is that the price of things will continue to be an issue as investment lags needed production.

May Day rallies in France

- Were very large and focused on denting any sense that Macron "won" the elections – as opposed to just happened not to be the fascist.

- The main focus was opposition to pension reform (that will raise retirement ages), opposition to policies driving climate change, demands for wage increases, and opposition to Macron's ugly face.

- Many economists worry that without making older workers poorer, Macron will not have money for new fighter jets and profit subsidies for private energy companies.

Climate change

- Still a colossal threat to most species on the planet (including, our own).

- Major test of using green hydrogen in steel production happened in Canada.

- A mixture of 7% green hydrogen (produced with green nuclear radiation and more green hydro) and 93% (produced by Earth destroying) natural gas was achieved in a test.

- Green Hydrogen will save the planet about 100 years after it is no longer inhabitable.

- It is a big win for reducing industrial uses of coal.

Arcelor, Luxembourg-based, has so far invested $5.6bn in four such projects, in Spain, Belgium, Canada and France. In Europe, Arcelor has committed to reducing its CO2 emissions by 35 per cent by 2030.

- Canadian government donation to this cause: $400 million

- Arcelor investment in this new production process that will generate lower-taxed profits: $1.2B.

Fertilizer and food

In Brazil, the world’s biggest soybean producer, a 20% cut in potash use could bring a 14% drop in yields, according to industry consultancy MB Agro. In Costa Rica, a coffee cooperative representing 1,200 small producers sees output falling as much as 15% next year if the farmers miss even one-third of normal application. In West Africa, falling fertilizer use will shrink this year’s rice and corn harvest by a third, according to the International Fertilizer Development Center, a food security non-profit group.

“Fertilizer prices are up an average of 70% from last year,” said Timothy Njagi, a researcher at the Tegemeo Institute of Agricultural Policy and Development in Kenya, referring to prices in the country. “The fertilizer is available locally, but it’s out of reach for the majority of farmers. Worse, many farmers know that they cannot recover these costs.”

In the Philippines, urea — a key nitrogenous fertilizer — is now about 3,000 pesos (about $57) per bag, and even more when transported to the fields. That’s more than three times the price at this time last year, said Roger Navarro, president of Philippine Maize Federation Inc. “Farmers will tend to decrease the usual fertilizer dose of their crop and that will lessen the production,” he said, forecasting a 10% drop in yields. “It is rather sad, but this is reality.”

- Rice Research Institute predicted crop yields could drop 10% in the next season

- 36 million fewer tons of rice — enough to feed 500 million people

- In Sub-Saharan Africa, food production could drop by about 30 million tons in 2022, equivalent to the food requirement of 100 million people

- United Nations index of world food costs soaring another 13% in March.

-

Response from industrial (and non-industrial) farmers is

- more tech in their fields.

- precision planting

- slow-release fertilizers

- increased "compost" use

- In the USA: planting "not corn"

- More aggressive crop rotations

But, it isn't going to be enough fast enough as investment in new production processes does not jive with increased costs of debt.

The below is a critique of the FT's: The global stagflation shock of 2022: How bad could it get? article using the same data.