May 17, 2022

Back to the office is a failing push

- It is strange that the heads of companies, managers, and the bureaucrats of cities like NYC (really, are these folks different?) cannot understand why people are not going back to the office.

- The NYC mayor is in line with many mayors demanding that poor, inflation hit workers come and spend their money in NYC – while not addressing any of the issues of livability.

- NYC has had years of economic stability because the rich invaded downtown, but you need working people to keep a city economy moving.

- Also, getting super rich people to ride the subway is a funny way to convince people to get back downtown.

Mayor Eric Adams is urging JPMorgan chief executive Jamie Dimon and other New York City business leaders to ride the subway to work as he intensifies a campaign to bring employees back to Manhattan’s empty offices.

Only about 40 per cent of workers have returned to New York City offices in spite of repeated exhortations from the mayor, posing a dire threat to the city’s economic livelihood.

- The office is not how most managers think it is. Most of us do not like our coworkers enough and get so little out of "office culture" that the massive increase in costs and inconvenience is just not worth it.

- Pushing people "back to the office" is this centuries lament that the elevator operator jobs are disappearing.

-

There is also the issue of perceived safety, but I think that this is only an excuse. The real issue is that workers are not fairing very well. The fact that the management caste does not want to see this will not fix the issue.

Adams acknowledged that it was proving more challenging than he had anticipated to deliver on his promise of containing New York City’s rising crime. As of May 8, shootings were up 75 per cent from the same period two years ago, while hate crimes were up 103 per cent. Shoplifting is also rampant, say merchants.

- Forget luring white collar workers back to the office for hours of commuting hell and quality of life killing office culture.

- A socially responsible policy frame of increased public housing, public sector jobs, security, and wage increases for front-line workers is the only way that NYC and other metros will reinvent downtown culture.

Business threaten by Lula this time

- Lula was the "acceptable socialist" for capital when he was in office for eight years. Mostly because the alternative at the time included Chavez.

- Lula's rather pro-business economic policy was tolerated while his government used the lucky times of economic growth to fund anti-poverty programs.

- However, there was no systemic change in the economy which is why it has not been as resilient to recent economic challenges.

- The current campaign's rhetoric from the Lula camp has worried capital in the country.

- Talk of deficit spending, price controls, and anti-poverty policies are not what they are used to hearing from government.

- The politically charged corruption scandal that lead to far-right Bolsonaro.

“The kind of things Lula has been saying are really terrible,” said Paulo Bilyk, chief executive of Rio Bravo Investments, which has R$13bn of assets under management. “If he is trying to estrange himself from the mainstream, then he has done it very competently.”

“Lula is losing the trust that he had in the past because of a series of silly remarks. Today [the business community] has a negative perception of him,” said the head of a large investment bank.

USA has moved to remove Trump restrictions on Cuba remittances

- The move will help the Cuban economy a little.

- It isn't the heady days of the Obama administration where there was some promise of relaxing the embargo.

- The current softening of restrictions are more about immigration, remittances, and "support for Cuban entrepreneurs".

- The backdrop is Cuba's economy is being hit by Russia's Ukraine war of imperial aggression against Ukraine and a Summit of Americas meeting where a bunch of Latin American countries have refused to go unless Cuba is invited. Cuba has yet to be invited presumably because it could refuse to go.

ESG now means "invest in oil and gas"

- Mark Carney – the UN's climate envoy and celebrity green guy at Brookfield (one of the world's largest investors in fossil fuels – and other hedge fund investors are twisting themselves into knots trying to say that investing in fossil fuels is good transition policy.

- The backdrop is a faltering economy and few place for large investors looking for positive returns to store their money.

- There is a reason that private capital cannot save us from climate disaster and it is currently on full display.

- If only we had realized before they burned the planet.

Midway through his speech [at Net Zero Delivery Summit, Carney acknowledged his inner realpolitiker to argue that further investment in fossil fuels would be necessary to ensure “a smooth transition.”

Larry Fink has been a vocal campaigner for climate risk to be taken more seriously by investors. But the world’s biggest asset manager initially struggled to match action and rhetoric, rarely voting in favour of pro-climate or social shareholder proposals. That changed in 2021, when it backed 81 out of 172 votes. Last week, it backslid, though, arguing that environmental and social proposals were getting so “prescriptive” and “constraining” that it wouldn’t be able to support as many.

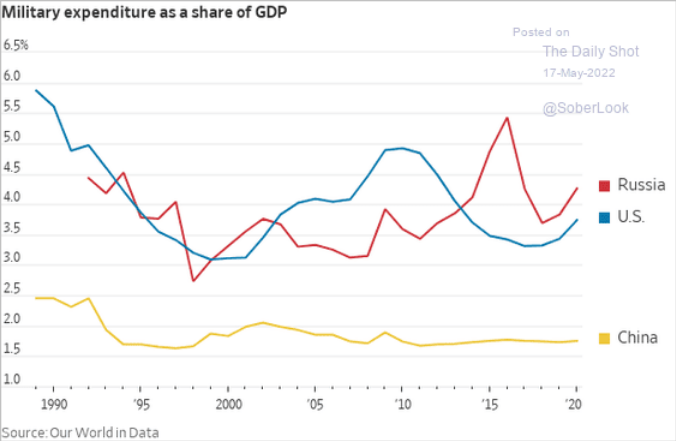

- ESG be damned, Carlyle is going for the profit from the benefits of destroying the planet and Ukraine:

Carlyle, the US private equity group, announced it was combining its energy and infrastructure businesses into a new integrated unit. Spanning renewables, fossil fuels and infrastructure, it will have nearly $14bn of assets under management.

Unlike rival firms, which have pledged to spurn fossil fuels in future funds, Carlyle boss Kewsong Lee is gung-ho about the opportunity. The fracturing world, particularly the war in Ukraine and the heightened geopolitical tensions between east and west, will present the firm with “a lot of investment opportunities”, he said.

Crude prices jumped again yesterday, with both Brent and US oil topping $114 a barrel. Yet fears of a looming economic contraction are also sharpening.

[Gas] Operators will rake in about $180bn of free cash flow — operating income minus capital and maintenance outflows — this year at current crude prices, according to research company Rystad Energy. That compares to huge losses amassed during a decade of fast supply growth that crashed to a halt just before the pandemic.

- All that money for war.

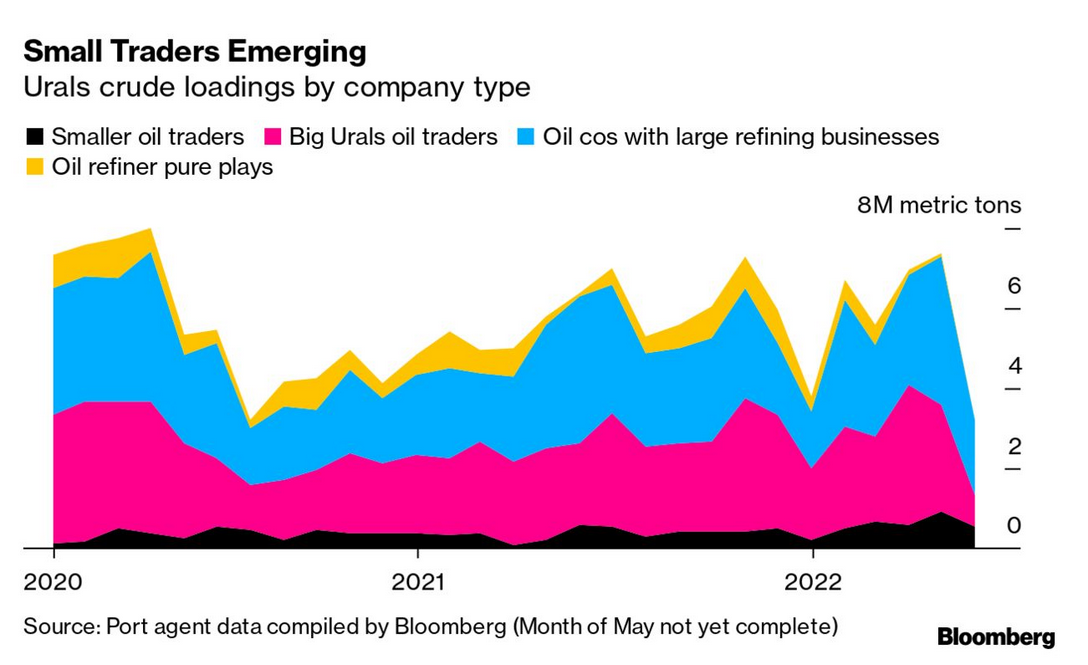

- And, all those sanctions are doing little to dent fossil fuel purchases of Russian crude.

Covid zero policies

- As the West continues to attack China for doing what the West did a year ago, the policies seemed to have worked:

Shanghai declared no community spread in all of its 16 districts, while Hong Kong will ease curbs even as it logs hundreds of cases a day.

- Capital is very angry at China for suppressing profit generation around the world by putting people before their profits.

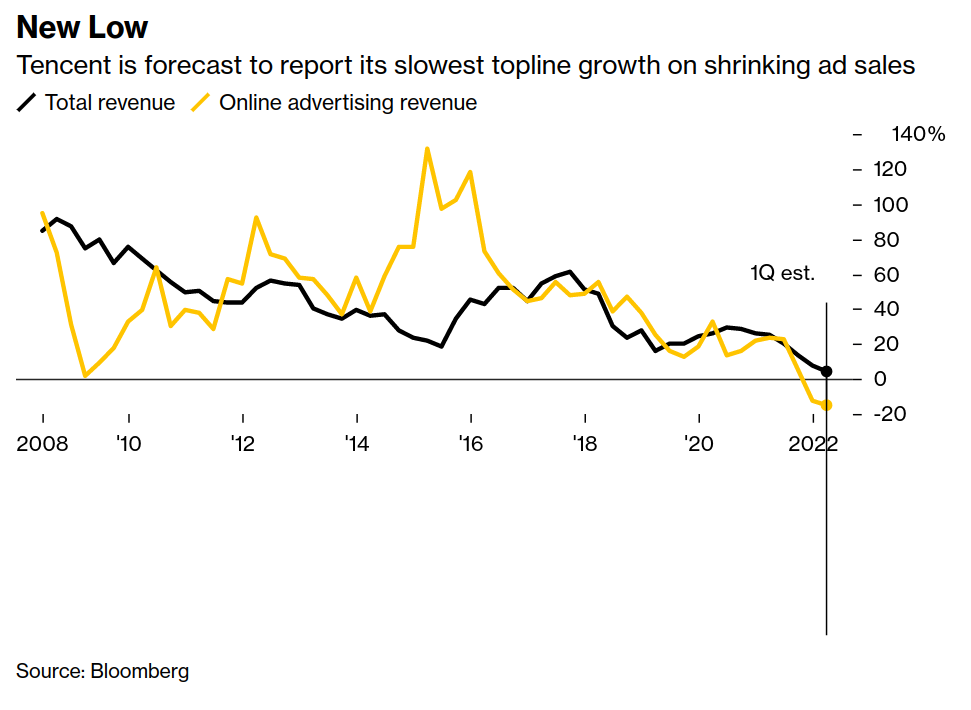

- Tech not a safe investment even in China: