May 15, 2023

The slowdown

The world has been pushed towards a slowdown. As much as we cross our fingers and hope for the best it is going to be bad for workers.

Publicly traded stocks are split along some interesting lines.

Tech and new productivity are up, everything that actually makes economy run for regular people is down:

As Robin Wigglesworth pointed out on Alphaville last week, AI-related tech stocks are doing much of the heavy lifting. He cites SocGen research finding that, if not for the AI trade, the S&P 500 would be down 2 per cent this year, rather than up 8 per cent.

They call this the value versus "growth" stock divide. High growth companies (read: new) are doing well. Companies that have been around for a long time and are holding technology they purchased a while ago are not doing well at all.

Why does this matter? Most people are employed in slower-growth companies.

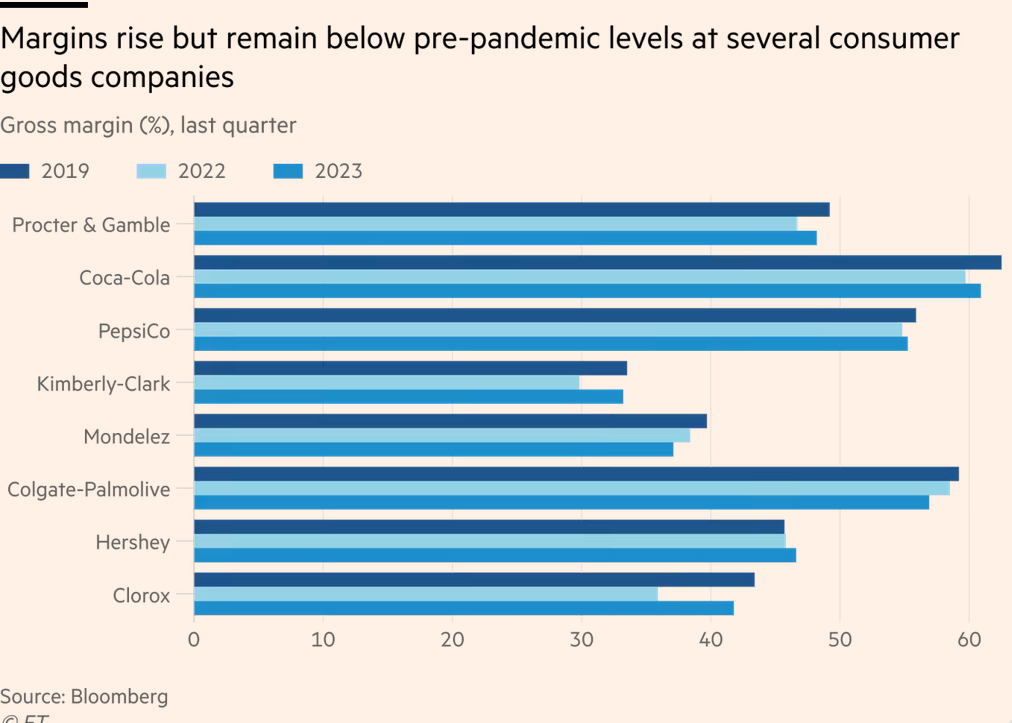

Contrary to perceived wisdom, companies are not back to their high profit rates of 2019.

It would be nice if the lower profit rates are because of sustained labour power and increased wage growth. Alas, it is not. It is because higher prices are affecting capital.

The lower profit rates and lack of growth in the wage bill indicates that there is just less money around to invest in growth. In fact, companies are even deciding to invest less in growth than they are in just giving profits back to shareholder capital.

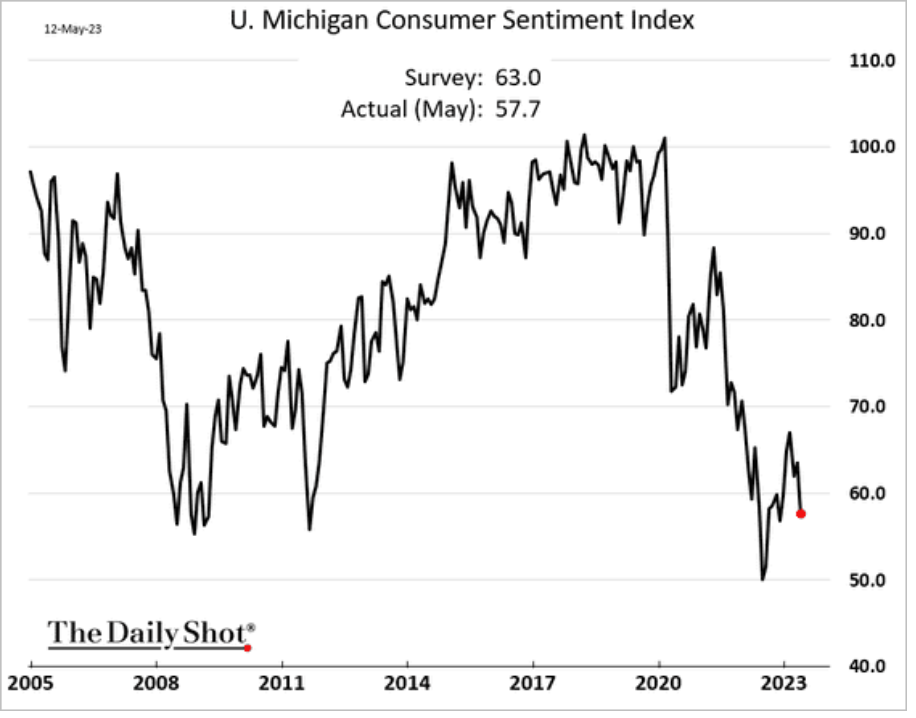

If you read the business press, they say that the "all mighty consumer" is holding-up the economy. This is only kind of true. Consumers might be spending, but they are not spending happily.

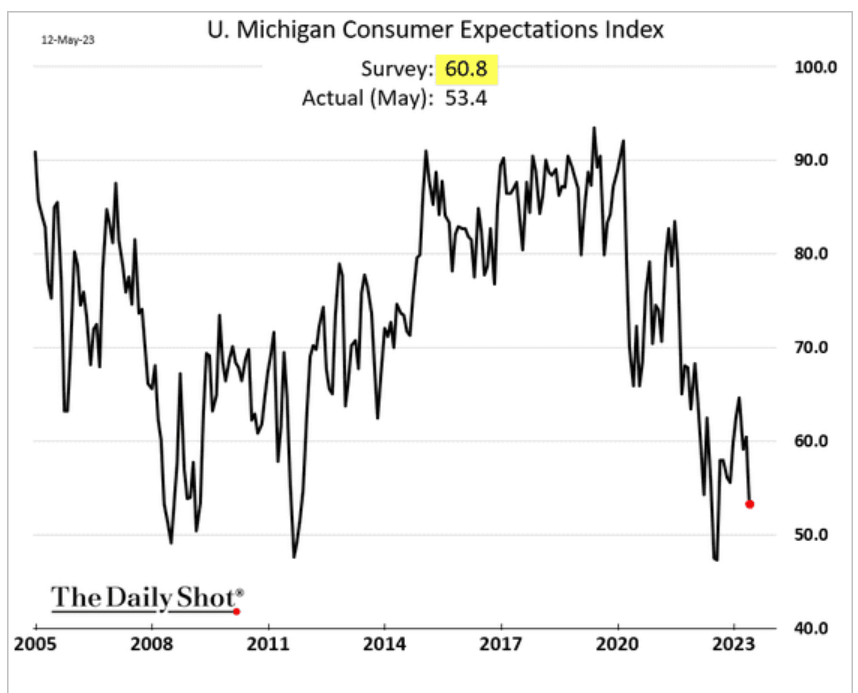

Consumers are also not positive about the future of their spending:

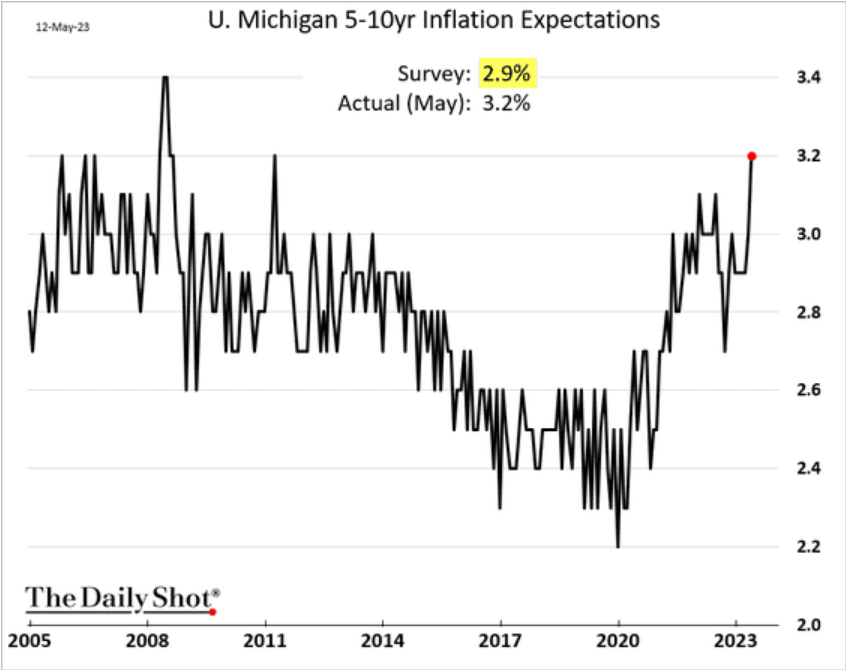

And, you can see why. USA consumer inflation expectations remain rather high. This indicates that, in the USA, people do not believe the rhetoric coming out of their central banks. The lack of trust of the public towards "getting inflation under control" is the fact that inflation has now been high for some time.

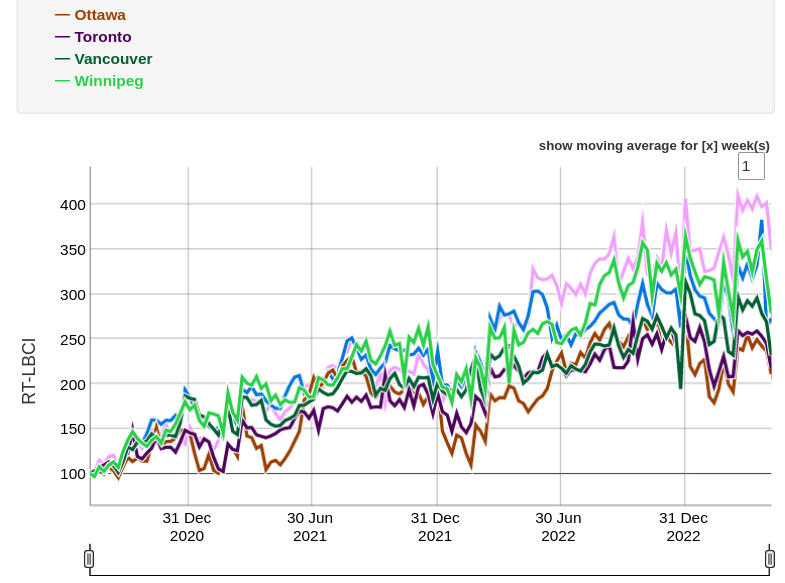

In Canada, we can see the start of some real slow-downs happening across the country in business buying and selling activity.

Growth

Contrary to everything written above, Germany is actually growing and inflation fell slightly faster than it grew last month. The ups and downs of 0.4%. It was a year-over-year drop for the first time since 2020.

However, overall European economic production fell 1.4% in March.

These numbers indicate a similar situation for Europe as for the USA: higher interest rates have resulted in a decline in economic growth.

Slower economic growth has meant more money being destroyed, more misery being created, and so inflation has been growing less slowly.

The other cycle going on in Germany is the local elections. They are not particularly exciting right now and they seem to be

The Greens received 12.5 per cent of the votes, compared with 17.4 per cent at the previous state election in Bremen in 2019 and the worst result since 1999, when the party received 8.9 per cent.

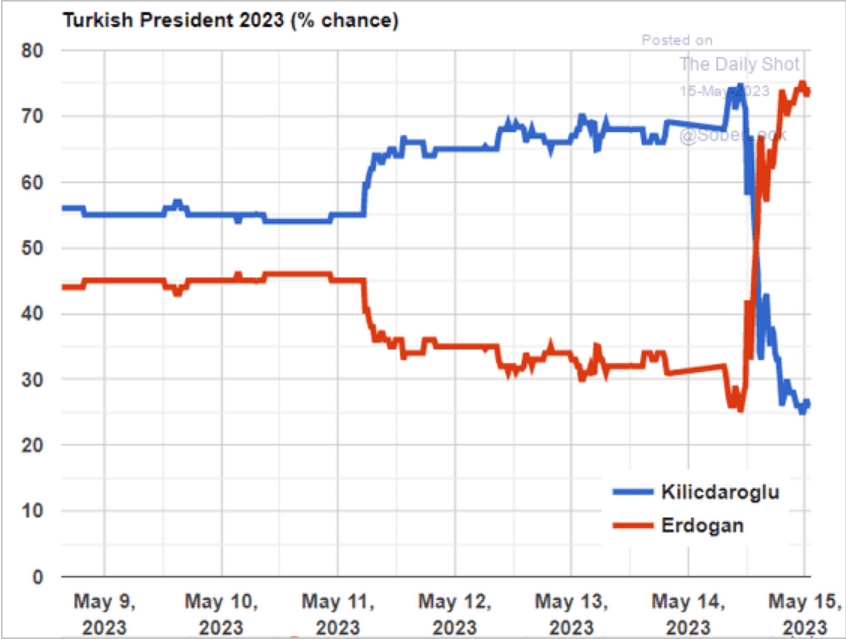

Turkey

After being "behind" for months in the polls, Erdogan is now expected to win the election.

After a hard-fought campaign that had raised hopes of an opposition breakthrough, Erdoğan won 49.3 per cent of votes in the presidential race, well ahead of his main rival Kemal Kılıçdaroğlu with 45 per cent, according to preliminary results from state media.

With no candidate securing more than 50 per cent, the tally as it stands would send Erdoğan and Kılıçdaroğlu to a second round of voting on May 28 but with the incumbent as the clear favourite. (FT)

- Outright majority for the right-wing coalition in government too.