May 12, 2023

Jobs and Recessions

It seems pretty clear to me that capital has gotten what it wanted out of the central banks so far. Or, at least they think so.

The "markets" (read: the sum total of private investor activity), continue to predict a small recession caused by just the right amount of rate increase to cause unemployment, shore-up profits, and a quick reversion to cheap investment money (credit).

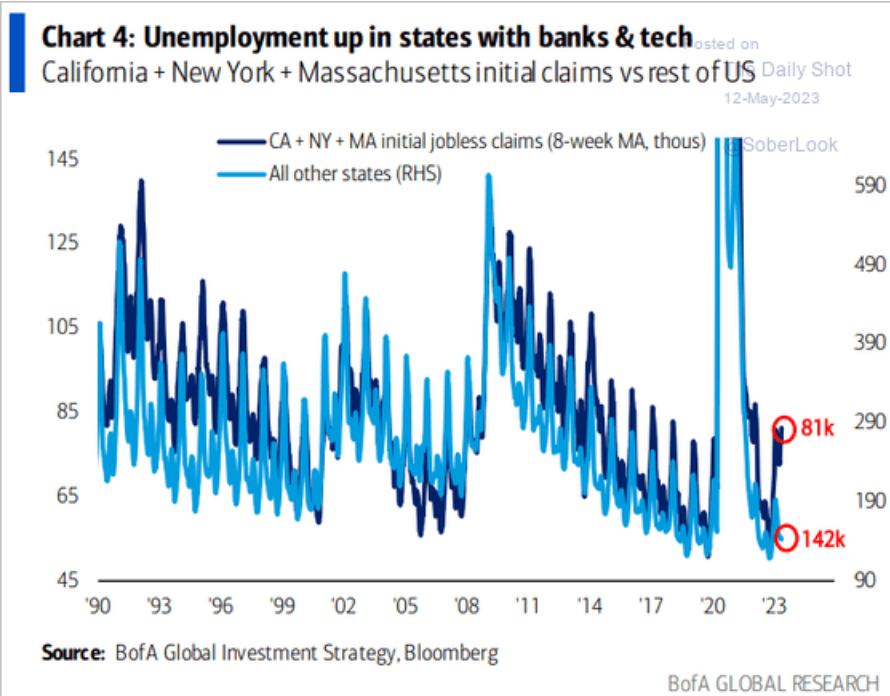

And, you can see why they think that. Banks themselves along with high-debt companies (tech) have laid off many thousands of workers. Enough to impact the unemployment stats in cities based on financial and tech services:

In the USA, the effect of central bank policy is being monitored closely.

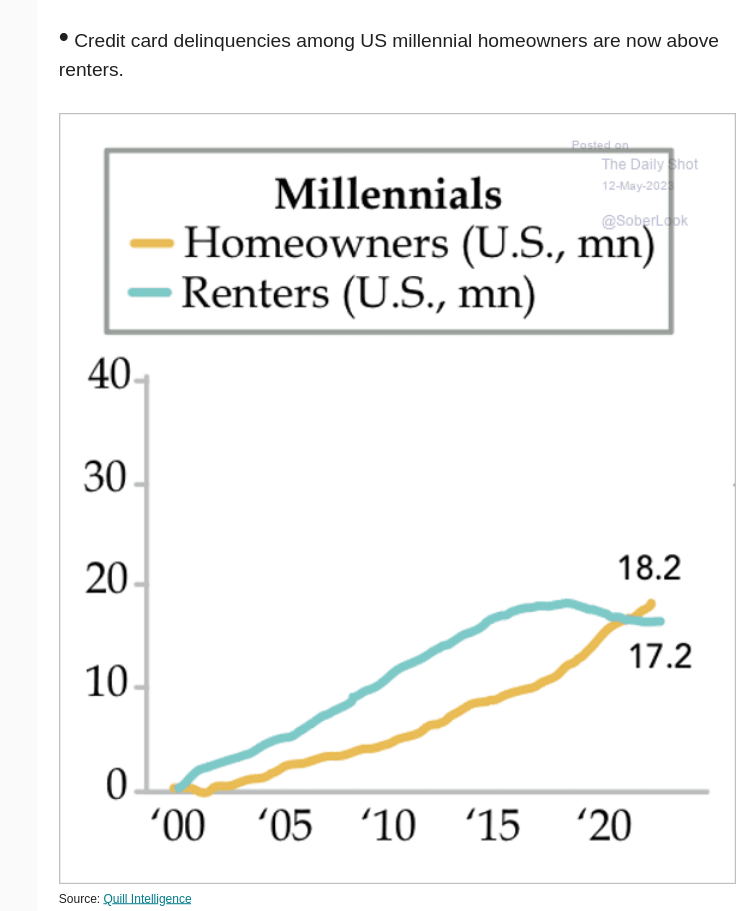

One knock-on effect of higher interest rates is workers having a harder time paying their debts and a squeeze on job moving behaviour of workers.

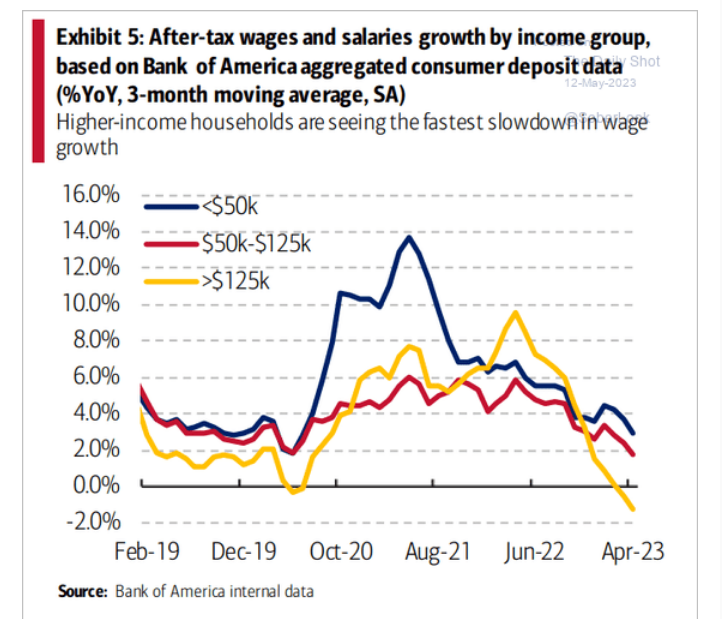

People with newish mortgages are having a hard time paying their other debts and this is happening because the income hit right now is at workers in the "affluent" category:

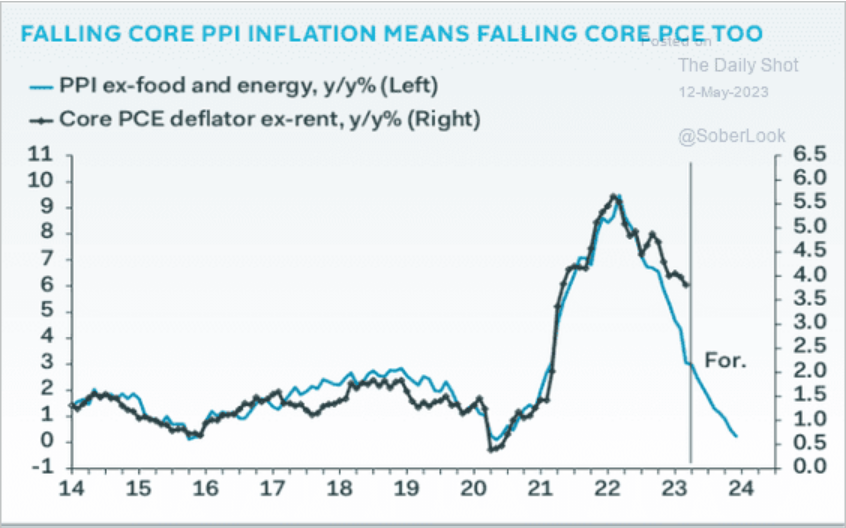

Prices for companies are coming down and are not dragging-down profit rates as companies continue to benefit of higher prices for consumers.

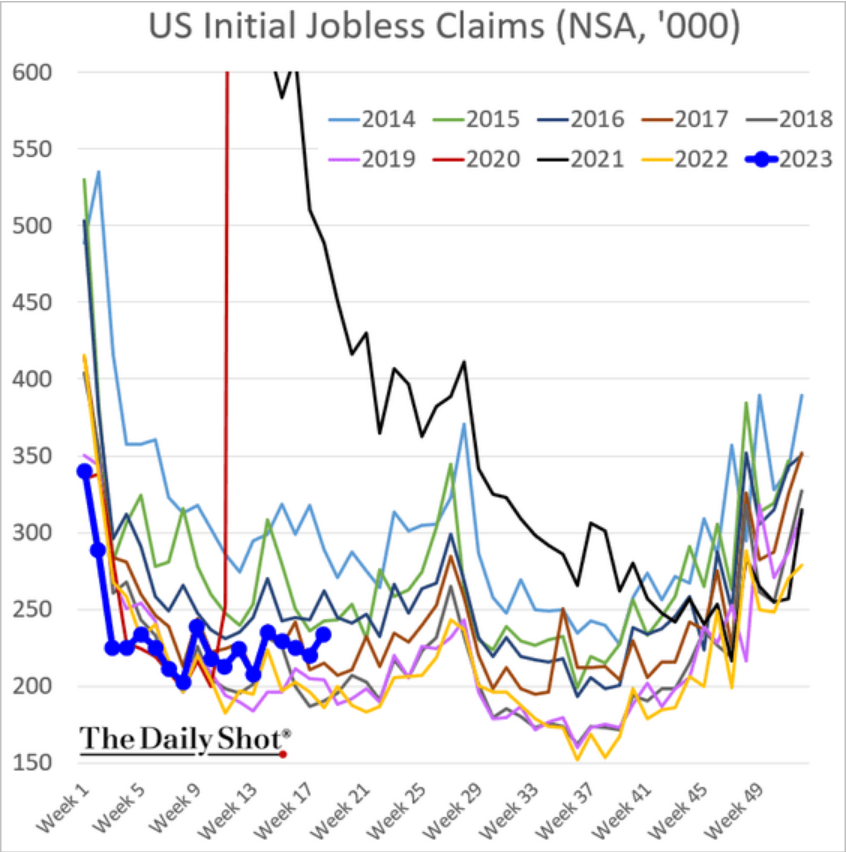

Now, there is a lot of noise in the data recently, so reading these graphs are only good if you squint and have both eyes closed. The reason for the noise is the bonkers activity in the government in the USA around raising the debt ceiling.

Many in the financial world are increasingly worried that it will take a large financial hit in real life to shake republicans awake to the realities of their games of chicken. Unfortunately, finance capital executives are already set-up to pass on any costs of political nonsense to the public.

What does this look like? Apart from looking for ways to profit from gyrations in the market (standard activity for an investment bank), investors are going to be looking at how to come out of any crisis with the government learning all the lessons they want them to learn. Writ large, this is "leave the economy to the experts".

Labour union leadership should to understand that the resources going into setting narratives around crises are almost as important as the policy response to the crisis. If capital thinks that a crisis is needed to reset the issue of borrowing in the US, workers need their voice to be front and centre on

- Why this is happening.

- Who should pay for it.

- What stops this from happening in the future.

We continue to lose the narrative around wages and "tight labour markets" causing inflation. We cannot afford to lose the narrative around democratic debate and economic policy setting.

Neutron Stars

You are small. The universe is very very big.

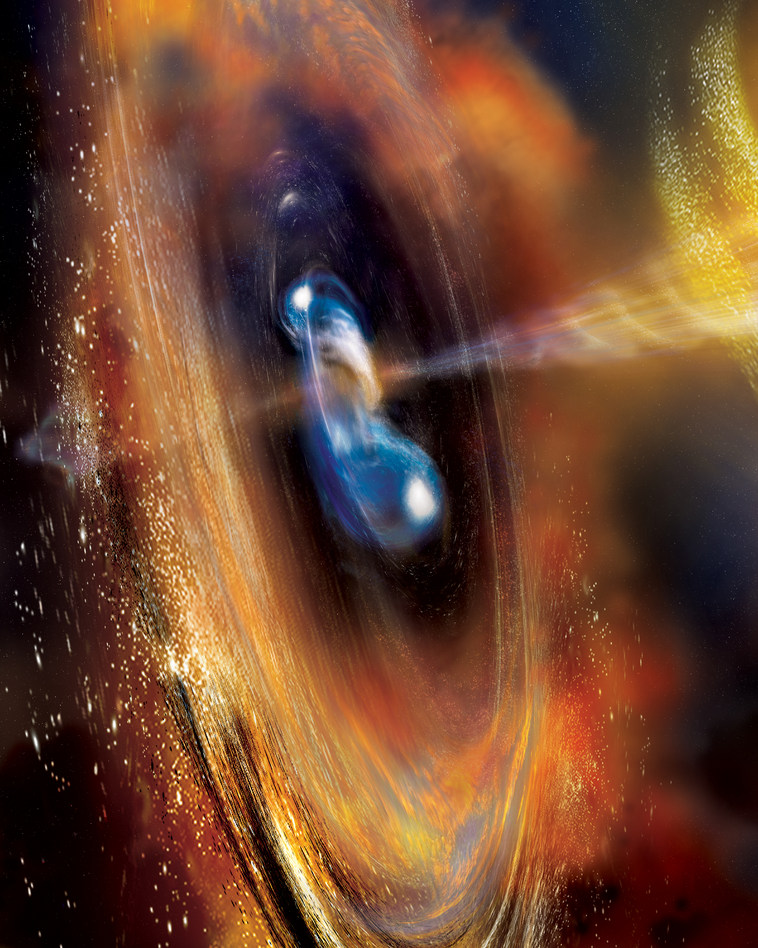

An illustration of neutron stars colliding. This from a recent observation that this seems to happen quite "frequently". More than many physicists thought.

A real picture of galaxies colliding. Neutron stars at the centre of these galaxies generally collide at the same time.