May 10, 2022

Heading for Recession?

The last week seems to indicate the central banks are getting exactly what they want: Recession with a side of class war.

- The elimination of fictitious wealth in the financial industry was rather large yesterday – ending a week of losses.

- The dead-cat bounce allowed some institutional investors to benefit when the market passed the ground, but the transition of wealth from retail investors to institutional investors has been significant.

- WARNING: retail investors cannot "buy the dip". Because, frankly, you don't know what you need to know to know when the bottom has been reached. Buying something cheap doesn't mean you are buying something that is valuable.

- Investors were buying staples: canned goods, toilet paper producers which are the only publicly traded companies that didn't shed a tonne of their price yesterday.

- The Tech Industry's darling NASDAQ is down 19.7% in 2022.

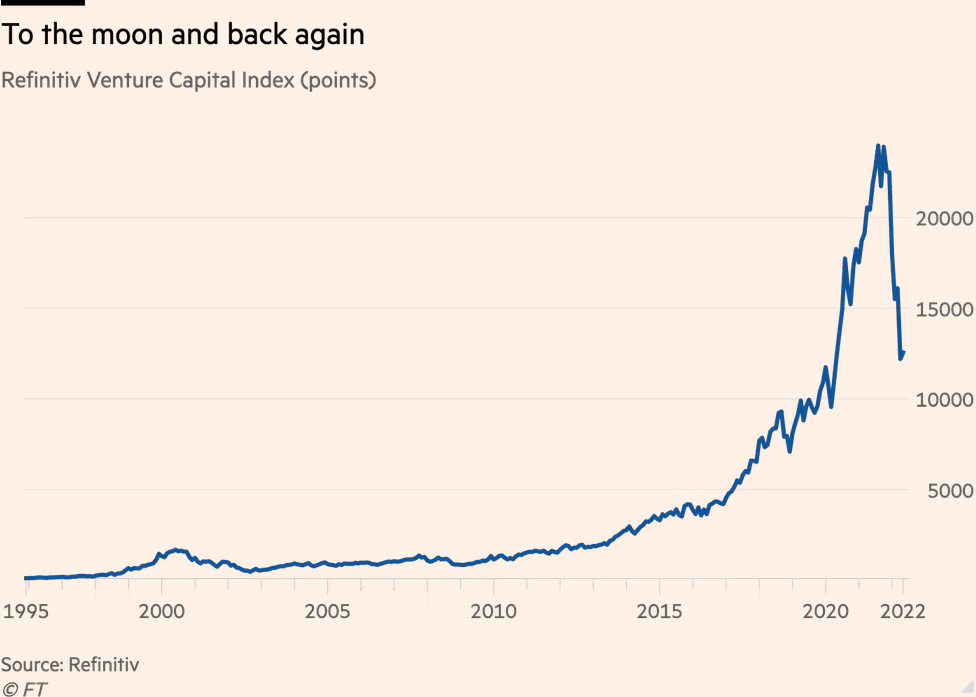

- Tech's Venture Capital Index (Refinitiv's measure of stupid tech speculation) is down 45.8%.

- There is plenty of room for continued falling or below-inflation growth of valuation as we still do not know what inflation (in the USA and around the world) is doing.

- The Vix index — known as Wall Street’s “fear gauge” — registered a reading of 33, well above its long-term average of 20.

- You could bet on it and "buy the dip", but you are likely just giving money to capital.

Investors’ attention now turns to the U.S. April consumer-price index print on Wednesday. The numbers may provide clues on whether inflation is nearing a peak, or increasing the threat of a 75 basis-point rate hike by the Fed, rather than the 50 basis-point move markets seem to have made peace with.

El Salvador's failed experiment using Bitcoin

- Bitcoin is down 50% from it's peak in November.

- President Nayib Bukele tweeted that El Salvador bought the dip.

- Leaning-in to failure and pretending it is not is a defining characteristic for entitled pricks.

A report on three economists — Diana Van Patten of Yale, Fernando Alvarez of the University of Chicago and David Argente of Penn State:

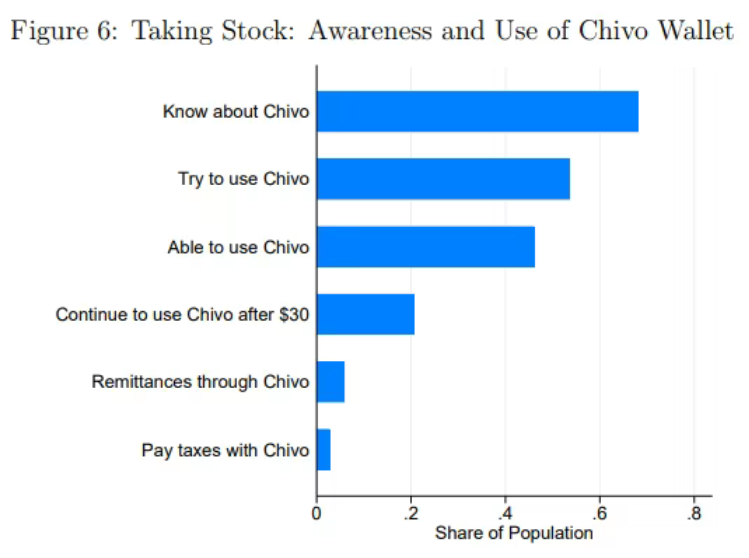

We document that bitcoin is not being widely used as a medium of exchange [despite] the big push exerted by the government.

The most important reason [people who knew about Chivo did not download it] was that users prefer to use cash. This was followed by trust issues — respondents did not trust the system or bitcoin itself.

The typical Chivo user was a young, high school-educated man with access to the internet and the formal financial system — undermining Bukele’s claims the tech would boost financial inclusion. The most common reason for using Chivo was cashing out the $30 bonus; 61 per cent of users abandoned the app immediately after.

Doomed (livable) planet?

- World on course to breach 1.5C warming threshold within five years

- Scientists believe it is increasingly likely that key temperature metric will be crossed between now and 2026

That's the "safe" average threshold we were supposed to keep the planet withing by the end of the century. Sure, we could bring the temperature down an equal amount between now and 2100, but do you really think that is likely without some very drastic changes?

- The obscenely optimistic Intergovernmental Panel on Climate Change report last year said long-term average temperatures were likely to reach 1.5C higher within 20 years.

“The 1.5C figure is not some random statistic,” said Petteri Taalas, WMO secretary-general. “It’s an indicator of the point at which climate impacts will become increasingly harmful for people and indeed the entire planet.”