March 9, 2022

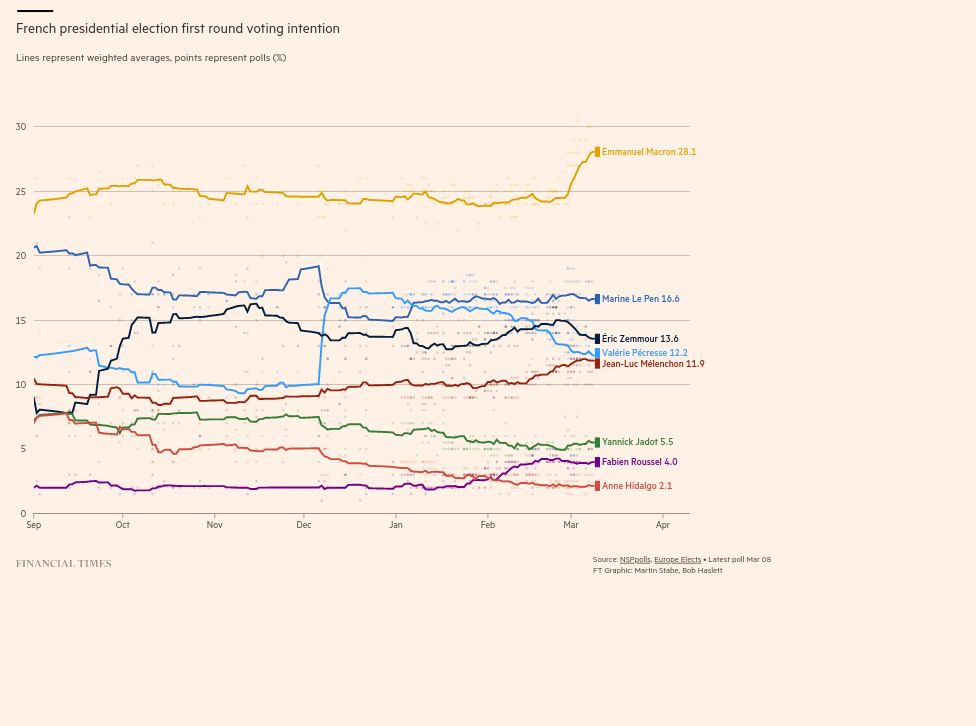

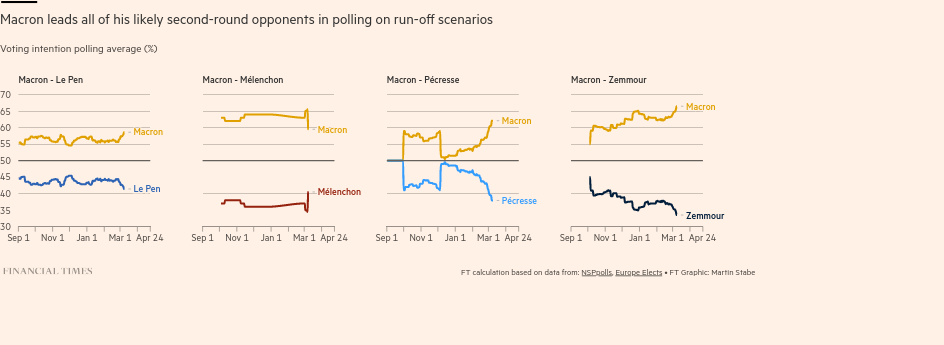

French Elections

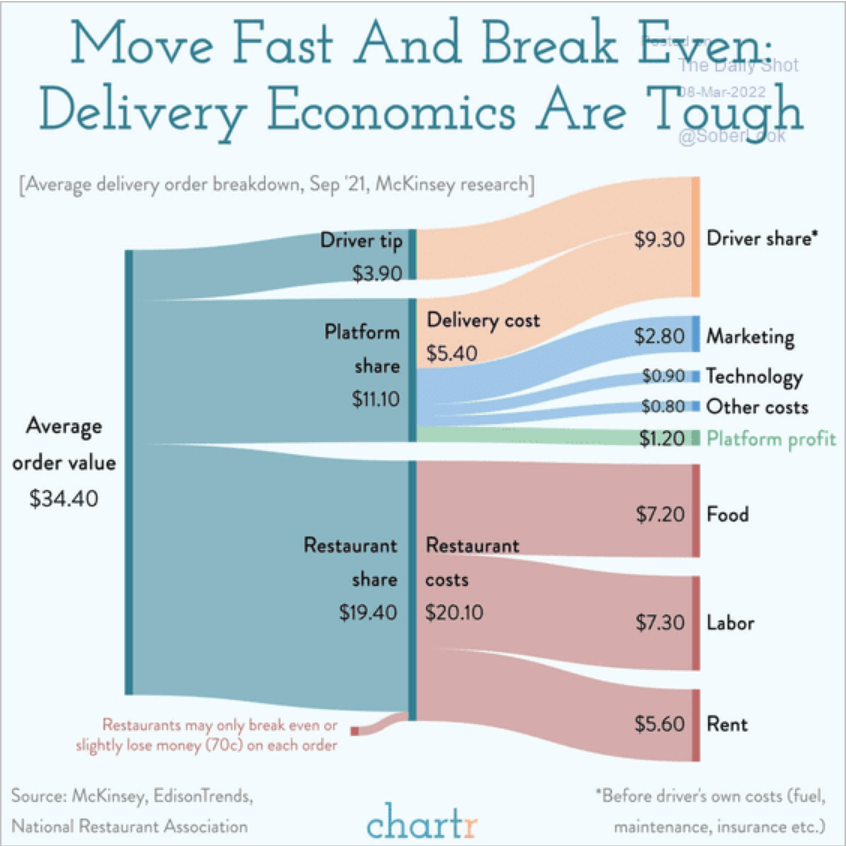

Food Delivery Costs Breakdown

Not sustainable.

EV Battery Costs

There is a reason that the government in Canada is subsidizing cobalt mining and GM's new cathode plant. They have given away the lithium mines, but kept the most expensive parts:

Cathode 51% of costs

US has moved to establish crypto regulations

Might all come to nothing, but crypto folks are making money on the idea that something might be done before November. The size of the market is ridiculous.

The Treasury will partner with other agencies to compile a report on the future of money and payment systems, according to the statement. The department will also convene the Financial Stability Oversight Council to examine potential risks to financial stability and assess whether necessary safeguards are in place. It will also work with international partners “to promote robust standards and a level playing field.”

Congressional committees have in recent months stepped up hearings on cryptocurrency, which has ballooned into a nearly $2 trillion market, to examine some of the areas that might have to be addressed through legislation. Those topics include stablecoins, private tokens typically pegged to the U.S. dollar and other fiat currencies.

Russia has kept the planes

Some of the largest leveraged leasing investors for planes are in trouble. There was a large "financialization" of plane leasing since 9/11 and it hasn't worked out so well.

Aircraft owners are coming to grips with the loss of hundreds of Airbus SE and Boeing Co. jets that Russian carriers have effectively shielded from seizure behind a new incarnation of the Iron Curtain.

With the window just about closed, foreign leasing firms have succeeded in repossessing only about two dozen of the more than 500 aircraft rented to Russian carriers, according to Dean Gerber, general counsel for Valkyrie BTO Aviation. The planes in limbo have a market value of about $10.3 billion, aviation analytics firm Ishka estimates.

Technically, lessors have until March 28 to retrieve the planes under European Union sanctions. But state-owned Aeroflot PJSC and other Russian airlines have already gathered the vast bulk of them back inside the country, out of reach of their owners. The government aided the effort by instructing carriers to stop flying internationally and return the jets to Russia by Tuesday.

War is ESG

What a difference a war makes. Barely a year after Sweden’s SEB bank adopted a new sustainability policy that excluded defence stocks from its funds, the group has made a U-turn. From April 1, six funds will be allowed to invest in the defence sector.

SEB says it began to review its position in January as a result of “the serious security situation and growing geopolitical tensions in recent months” which culminated with Russia’s invasion of Ukraine.

- Leaving Russia for Morals or Money (Matt Levine)

Applied to Russia that means: If everyone is divesting Russian assets to signal their morality, somebody is, in expectation, getting rich by buying them. People have noticed:

Investors are starting to buy Ukrainian and Russian bonds that plummeted to discounted prices, betting that they will recover if the war between the two countries comes to an end.

The trade is high-risk, given uncertainty over what Ukraine will look like after the war and how long the financial cordon around Russia will last. It also poses reputational dangers because of the human cost of the conflict and the increasing unwillingness of many financial institutions and corporations to be associated with Russia in any way.