March 8, 2023

International Women's Day

The struggle continues around the world

- The UN link https://www.un.org/en/observances/womens-day

In the side-bar of that page there is a statistic that should be worrying:

- By 2050, 75% of jobs will be related to STEM areas. Yet today, women hold just 22% of positions in artificial intelligence.

Now, the 75% number is ridiculous. By 2050 most of the planet will be unlivable and most jobs will be building biodomes for food production.

But, in the meantime, the dude-bro culture of SillyCon Valley has meant that women are not getting access to these jobs. This is bad for numerous reasons, but one of the most important is the inherent bias being built into most AI algorithms. Without diversity in tech jobs, the inherent biases of dude-bros will infect all automated systems.

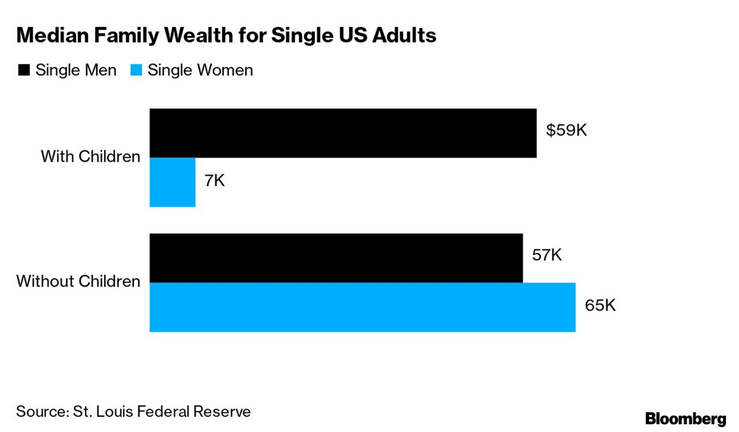

The heart of capitalism also has this great statistic:

Now, I would never suggest people should not have children. But, if you live in the USA, women should clearly think twice because the people in power clearly do not like it.

Rates, Rates, Rates

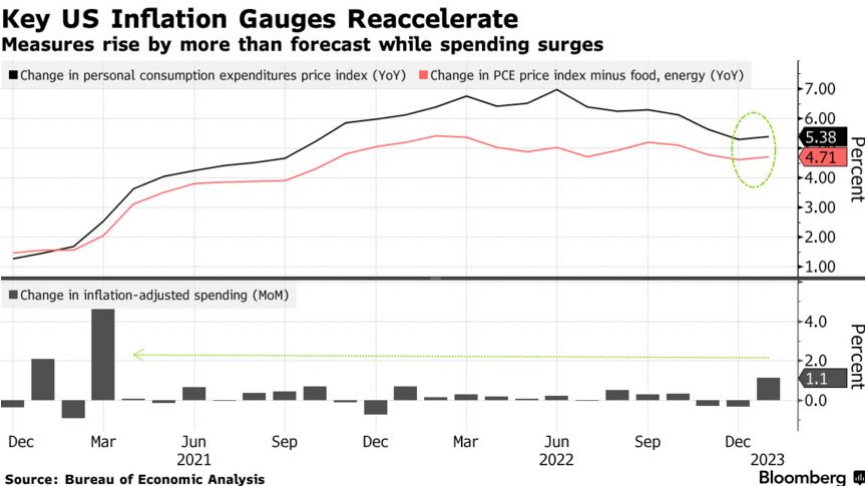

That's all anyone is talking about today since the head of the USA Federal Reserve has made announcements that they are thinking of "accelerating" increases in the central bank rate.

They are saying inflation is "sticky". That is, it is at a constant rate of increase near 5%.

Bankers blame workers, of course. Especially now that profits of large companies have come down from their 2022 highs.

The debate around it would be amusing if it did not affect real employment so much. Finance capital investors are trying to figure out if it is just a threat of increased rates (which central bankers think will slow the economy itself) or they will actually increase rates (having the same effect).

“Every time they take the foot off brake — or the market perceives they’re taking the foot off the brake — and the job’s not done, they make their work even harder,” said Ken Griffin, the hedge fund billionaire who founded Citadel, said in an interview with Bloomberg Tuesday. (BN)

The announcements by the Federal Reserve Chair that rates will go up higher and faster has driven up the chance of a "hard landing". Hard landings are where more people go out of work faster.

As a result, the closely-watched spread between 2- and 10-year yields this week showed a discount larger than a percentage point for the first time since 1981, when then-Fed Chair Paul Volcker was engineering hikes that broke the back of double-digit inflation at the cost of a lengthy recession. A similar dynamic is unfolding now, according to Ken Griffin, the chief executive officer and founder of hedge fund giant Citadel. (BN)

It will all depend on numbers on Friday in the USA to see if unemployment is up or down.

If you want to watch two old white dudes "debate" about the rate issue, the Peterson Institute for International Economics hosted Summers and ex-International Monetary Fund chief economist Olivier Blanchard. I am not recommending it, but if you are into this kind of thing, it is here.

For an international women's day activity it is a bad one. But it is a reminder that these two dudes represent a particular world view that is in power deciding the best to put working class women out of work. All in the attempt to save capital.

All of the economists can talk about is the "neutral rate" that interest rates need to be at to calmly get inflation back to just hurting workers and not capital.

For Canada, this means the loonie will fall more and travel outside of Canada will be more expensive and we will get less for exports of Canadian goods.

From a classical perspective, the debates are on par with a bunch of 8th Century monks debating the correct level of incense to burn for good crops next year.