March 7, 2023

Energy independence, by being dependent on the USA

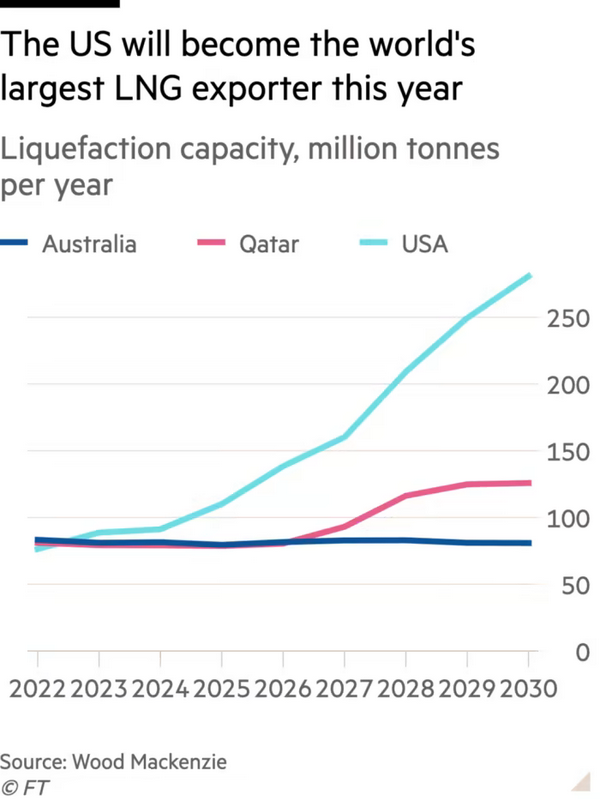

The growth in the USA liquid natural gas exports is dramatic. This is the effect of war in Europe, but it is also a sign that the energy "transition" is not really planned for anytime soon.

Chesapeake Energy yesterday announced a preliminary agreement with Gunvor to supply it with 2mn tonnes of LNG annually for 15 years, beginning in 2027.

It is an early-days agreement — and it’s unclear at this point where Chesapeake will be doing its liquefying — but it underlines the rush to fill the gap Russia has left in global markets. (FT)

The energy players are meeting in Texas right no. That's how much they care about showing they are serious about climate change.

The comments from the representatives of Europe and USA?

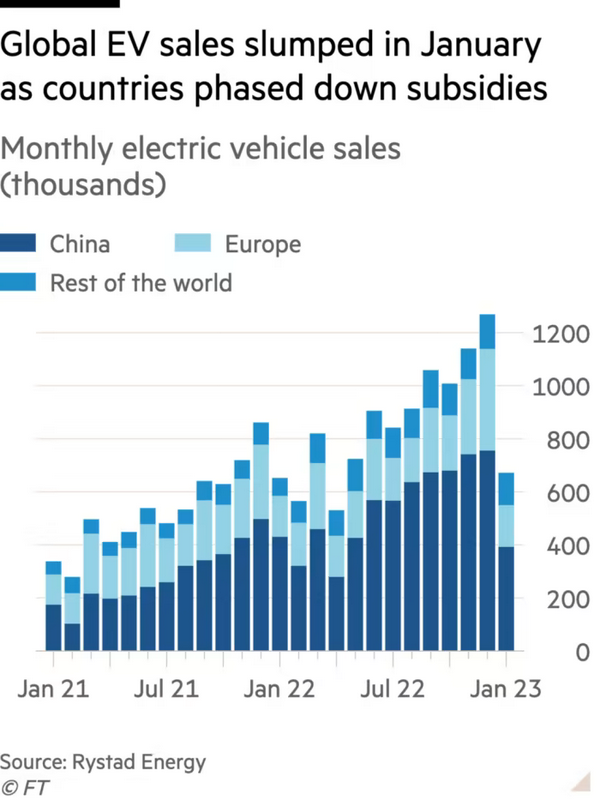

“We do want eventually to see a reduction in demand for oil, but we can’t afford that right now. So we want to have the supply today, as we accelerate electrification, as we have electric vehicles taking up greater market share.”

Amos Hochstein, US special presidential co-ordinator for international energy security

“All of these things we have to do to essentially stay energy-secure through this crisis were also aligned with the green transition. It was an acceleration of renewables . . . making sure that the diversification was to cleaner sources, but also making sure that the investments we make do not tie us into the past, but rather tie us into that energy transition that we’re going through.”

Ditte Juul Jørgensen, European Commission director-general of energy

This is despite the fact that global electric vehicle sales have slumped. Sales are down 50%

Also, the transition to "green" includes massive subsidies in Europe and the USA of "green fuels". Green fuels are just the same as dirty fuels, but are supposed to be more carbon neutral because they come from plants. Too bad about the price of your lunch as these compete directly with the food supply.

Read: National security over transition for the foreseeable future.

This is not really a surprise, but also means that they do not see the transition to an energy future that does not lead to global catastrophe as part of security.

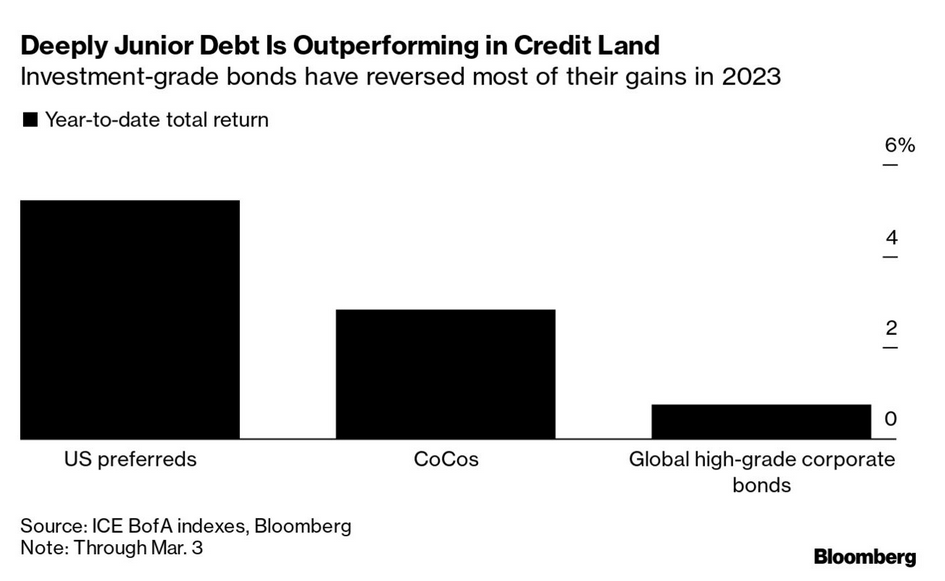

Bond buying activity constrains investment

No one wants an old bond paying, say, 3% when all the new bonds are paying 6%.

Those who buy bonds are looking for longer-term, higher returns investments. This means that they are avoiding (high-grade) corporate bonds and going for (lower-grade) "preferred" debt.

Why does this matter? Corporate bonds finance the making of things. Preferred bond/equity is used by banks to pretend they have cash on hand. This is borrowed cash, however, and while the risk is rather clear from the bank (it has a fixed payment rate), it is riskier from the investors' view since the repayment is affected by the economy and solvency of the bank.

Something to watch-out for is if there is a drag on the ability of corporations to find willing partners for their debt.

One more unintended consequence of the interest rate response to inflation.

This is all happening while depositors are moving their money out of banks. The impacts of these things is unknown right now.

After years of earning next to nothing, depositors are discovering a trove of higher-yielding options like Treasury bills and money market funds as the Federal Reserve ratchets up benchmark interest rates. The shift has been so pronounced that deposits at commercial banks fell last year for the first time since 1948, with net withdrawals hitting $278 billion.

China's top-level of government is meeting

There is going to be a rash of anti-China news stories in the West as the National People's Congress meets in Beijing this week.

True to form, the anti-China rhetoric will be in full swing. It will be called a "rubber stamp parliament". There will be lots of comments about "cementing power" by the president. There will be winded pronouncements made about Taiwan and democracy in Hong Kong. And, there will be comments about how China is constraining growth around the world by not focusing on profit generation for global companies.

The Canadian state is no different with the launch of the ridiculous investigation into Chinese involvement in Canadian democracy, ignoring every other countries' and international Capital's activities that collectively have a much higher stake.

The main focus for Capital will be how the changes to the Chinese government's structures are going to support "their" companies over "our" companies.

For the left, the analysis of this is not about "taking sides". It is about understanding the nature of imperialism and predictable responses to it.

The USA and Europe have engaged in very large economic actions/policies/investments to "counter" China's growing dominance in some areas of technology and production. The actions result in reactions from the Chinese state, all in the name of protecting each others' national interests.

The size of these investments and responses are making-up a significant portion of global GDP and focus. That is money and focus that needs to be put into solving our climate, health, and actual security crises we have, not creating new ones as they are want to do.

Our analysis must be based first in the principle of independence, self-determination, but most importantly peace.

Any increase in conflict with China and/or conflict between the USA and China is bad for working people. Geopolitics will play-out, but the only thing stopping full on war is some sensible counter narrative to the jingoism we are currently witnessing.

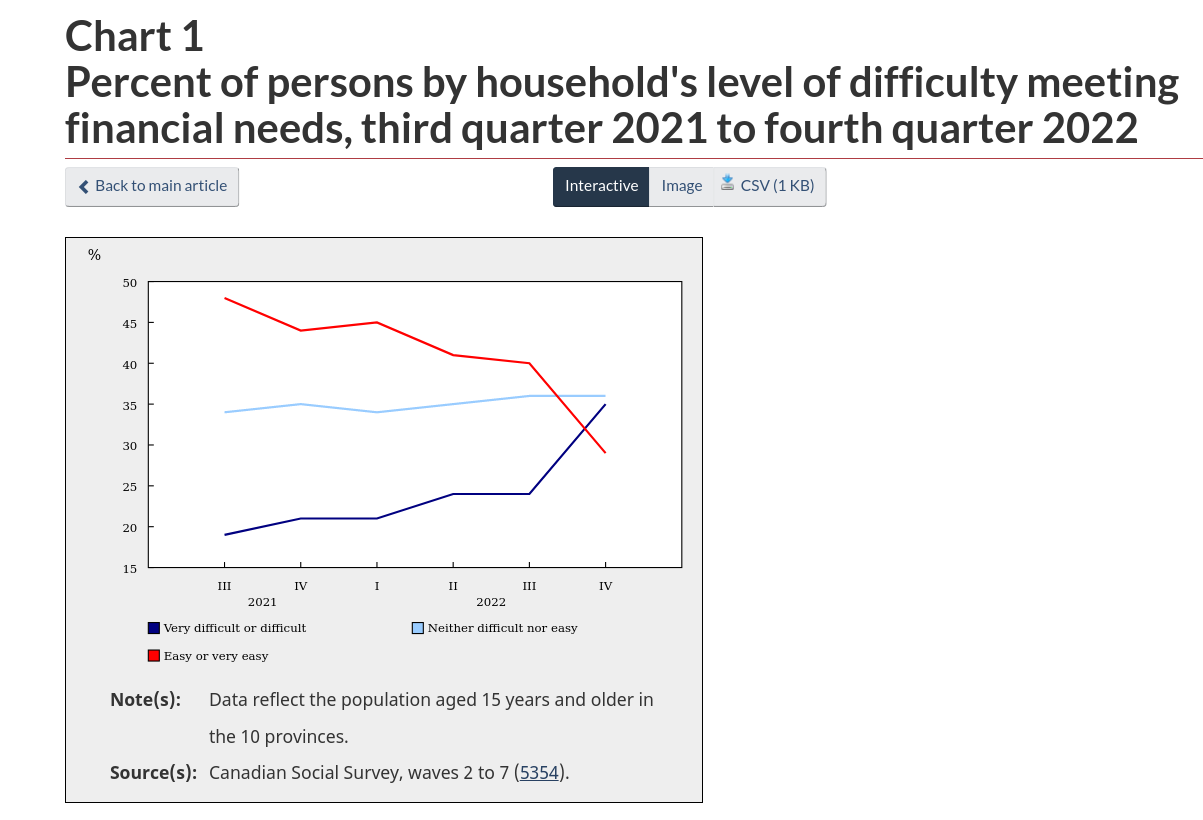

Having a hard time in Canada

Consumers are starting to show signs of stress. The latest insolvencies data shows a 33% jump in January filings from the year before. The share of indebted households behind on their interest payments also climbed to 2.07% in the quarter ending September 2022, the latest reading, from 1.86% in the 2021 quarter. (BN)

The debt-to-income ratio is 185% in Canada compared to 101% in the USA and 148% in the UK. Interest rates have a rather out-sized effect in Canada because of this.

All the things that make this worse for folks who cannot afford their lives to be made worse are present.