March 6, 2024

Private insurance and climate change

What happens when the risk model that insurance companies use doesn't price in the new risks brought with climate change?

Bloomberg has taken an in-depth look at the costs in a multi-part expose on private insurance and state-owned "last-resort" insurance.

The outline of the story is clear:

Some 11 million people live in California’s high-risk wildfire zones, areas that include Los Angeles county, San Diego and the vineyards of Napa and Sonoma. Not long ago, they and homeowners in natural disaster regions around the US would have almost certainly had insurance through a big, national company like State Farm General Insurance Co., Allstate Corp. or Hartford Financial Services Group Inc.

But a growing number of insurers are cutting their business in those areas, deterred by more intense and frequent natural disasters, plus state-imposed limits on how much they can charge. Homeowners in the most risky places are now more likely to be covered by state-created, “last resort” insurance programs that provide protection where the private market won’t.

California is just one example of this. $1T and rising is the last-resort public insurance program covering what is becoming less an insurance and more of a saving for known future purchase account.

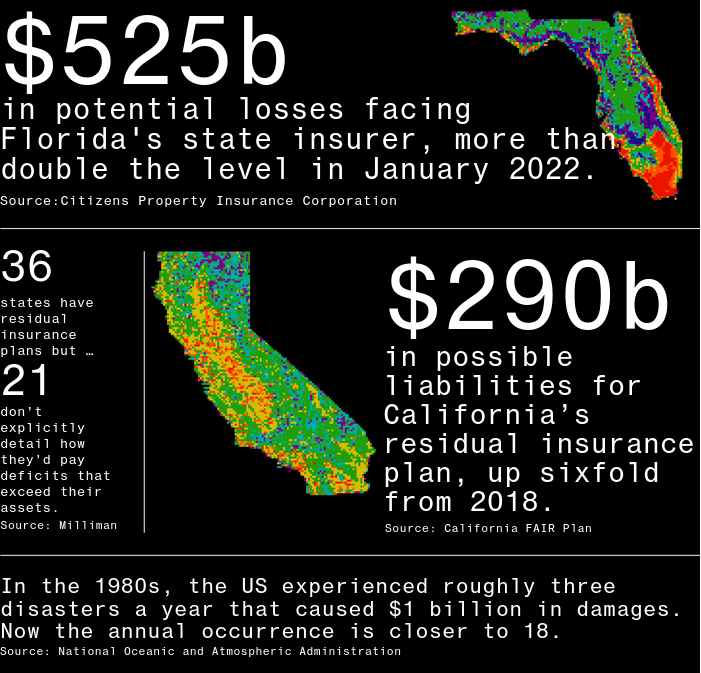

As of now, Florida’s plan could suffer $525 billion in losses; In California, it’s at least $290 billion, up sixfold from 2018.

If ever there was an example of clear limits of private capital's ability to deal with the effects of climate change, it is insurance. Modern capitalism relies on insurance to back almost every transaction. It is the outsourcing of risk valuation from large and small businesses so you don't have to do expensive calculations for every customer.

But, that doesn't work if it isn't the customer that is the largest risk factor.

The article is a response to the early start of the fire season in the USA with the massive fires in Texas.

The question for the public is at what point does the financial realities of living in zones bad economics has made essentially unlivable turn into real action? While you cannot insure against climate change, you can spend the money early and try to mitigate both it and its effects.

And, I guess this is the point. We cannot rely on the invisible hand in this battle. The market signal that you should have done something for millions of people will be their home or workplace on fire or washed away.

There is a solution that is supposedly unique to humans, we can study and predict our impact on our own environment. As thinking organisms, we must put that brain power to use and plan our way out of the problem.

And, to bring it fully circle, that's an economic problem more than anything else because it is our terrible economic "theories" that we hold onto that are holding us back.

Wage gains

A lot of talk over the previous few years over wage gains and inflation.

But, how about this for a splash of cold reality:

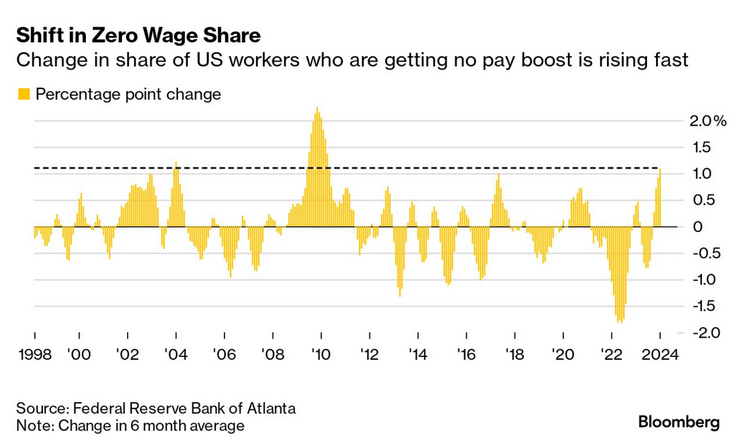

More than 12% of workers have not received a raise over the last 12 months, the most in more than two years, according to the Atlanta Fed’s Wage Growth Tracker.

The focus of the Fed paper that this comes out of was that there is, again, a corporate call of "skills mismatch". That is, workers with specific skills are needed, but are not available.

It seems impossible for most North American firms to understand that companies might have the obligation to train people to do jobs—mostly because it undermines profits. Instead, they call on states to try to drive people into debt getting those "needed" skills, only to over produce folks with those skill and under produce people with other skills. The state can manage investments and build an educated public. Filling jobs needs of employers, who consistently overstate their problem, is a bad business for the government to be in.