March 5, 2024

MethaneSAT in orbit

Slashing methane emissions is one of the fastest ways to fight global warming. Experts estimate it is responsible for almost a third of global emissions-induced increases in global temperatures since the start of the industrial era. The invisible gas is more than 80 times more potent than carbon dioxide at trapping heat in the atmosphere over a 20-year timescale. (FT)

MethaneSAT (launched yesterday) can supposedly detect leaks as low as three parts per billion in the earth’s atmosphere. Mapped over natural gas infrastructure, that should be able to show small leaks.

Will they be fixed though? The answer is unfortunately dependent on a few things.

Companies know where their leaks are without using satellite mapping data. Exxon uses pressure sensors, ground monitoring, and its own aircraft to spot leaks. So, it isn't like the industry does not have the technology to know where the leaks are.

Enbridge reclassified leaks a long while ago to allow small, continuous leaks in Ontario just run and not be fixed. Why?

Fixing leaks takes spending money on labour and companies would rather not do that if they do not have to.

It is more that the regulations on leaks and the state's monitoring needs to be matched with the desire to affect profits of gas companies. All those pieces are missing right now.

Then there is the fact that finding methane leaks is not just about looking at pictures. It takes a tonne of technology and that takes money. Google has offered-up its machine learning systems to the MethaneSAT group, but that is very expensive.

Antoine Halff, co-founder and chief analyst of Kayrros said: “We could not do what we do without machine learning and AI. We process tens of terabytes of data every day so this could not be done by hand.”

So, why are we not doing it at the state-level? You could ask where these cameras are going to be pointed and what areas are going to be focused on for data analysis?

Research by Kayrros was instrumental in detecting one of the worst methane leaks ever recorded: a blowout and fire at a remote oil well in Kazakhstan last year that leaked 127,000 tonnes of gas (an environmental impact comparable to driving 717,000 petrol cars for a year).

Buzachi Neft denied that large amounts of methane leaked into the atmosphere, a rather odd kind of statement given the evidence.

But, they do not all look like this one:

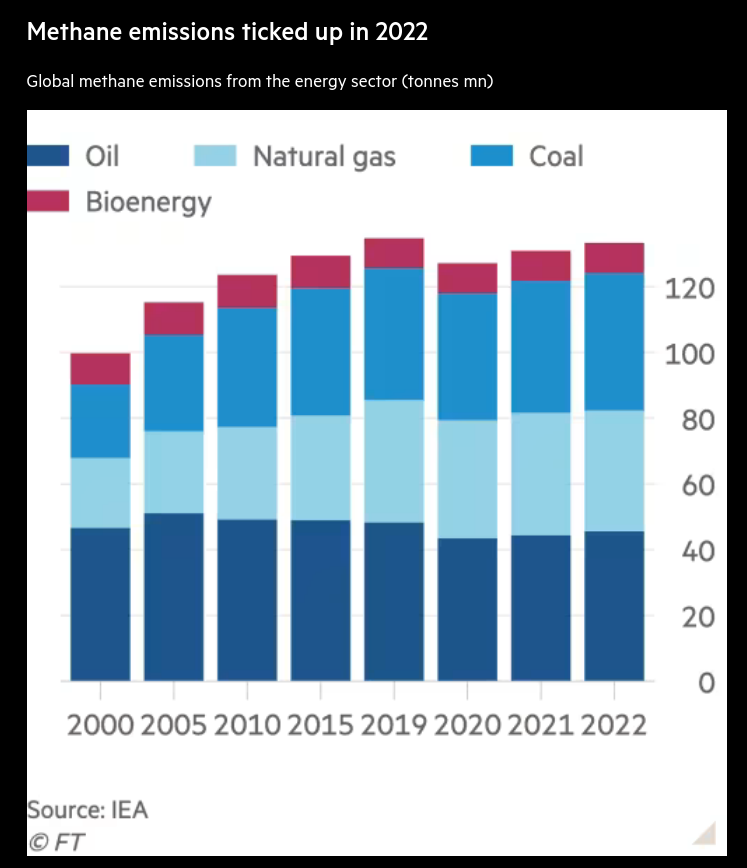

As you can see, there is plenty of currently measured/estimated methane leaking going on:

There are new global methane leak commitments agreed to at COP, but you have to wonder why it has taken so long to implement these changes. Or, maybe you don't have to wonder because the answer is so obvious.

Banks greenwashing

There is lots of greenwashing going on all over the place. Banks have been on the forefront of the practice from framing investment programs that transfer wealth from workers to very elaborate funding ownership regimes for receiving climate subsidies.

The latest is a push against regulators' limits on their lending, the kind of lending that lead to the global financial crisis.

The financial sectors is attempting to link Basel III (Endgame) regulations that force banks not to be over-leveraged for undermining investment in large green energy projects such as nuclear build-outs.

They even have the International Atomic Energy Agency whipped up about it.

World leaders will attend a first-of-its-kind nuclear energy summit in Brussels later this month where they are expected to discuss how to overcome opposition from a small number of nations such as Germany to using development banks to fund nuclear projects, said Rafael [Grossi, director-general of IAEI].

Germany does not just have limits on lending for international development banks, but also opposes the development of more nuclear power. There are many reasons that Germany opposes nuclear power and we are not allowed to say they are tied-up in their opposition to all things French. However, using international development banks to loan to government so they can buy Western tech is not exactly a "development" program.

In addition to not wanting to fund huge mega-projects, banks are not happy about lending rules and are demanding more profit subsidies:

Banks find clean-energy allies in fight against stricter capital rules

- Concern risk-weighting for renewable-power projects would rise fourfold under Basel III endgame proposal (FT)

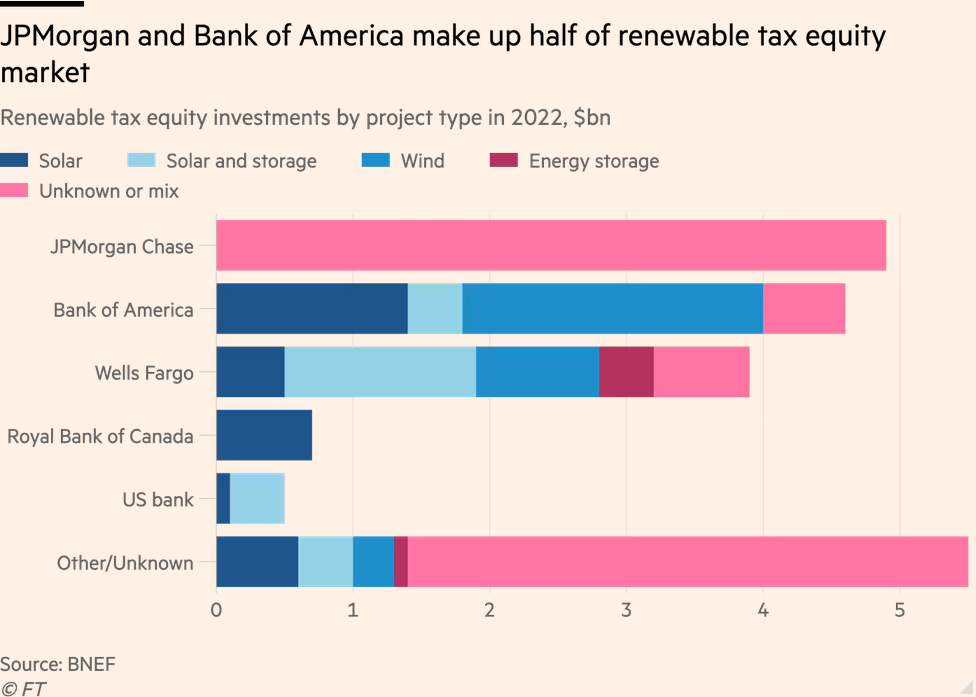

Industry groups and the largest US developers have submitted letters warning that the proposed requirements “threaten to derail the clean-energy transition” and could shrink the tax-equity market by 80-90 per cent.

Oh, no!

These kinds of tax credit markets go all the way back to the 1970s at the start of the privatization of energy systems through renewable energy. The promise was that private equity would be able to spend on smaller projects where the government did not have the money to do so.

The subsidies where and are ridiculous:

The energy credit for solar is 30% of the amount invested in solar projects that start construction before the end of calendar year 2019.

To extract the full value of the tax credit before it was all paid to companies, the banks started treating the tax credit as a bond and started trading them, making money on the trade and on the bet on the trade.

And, we wonder why we cannot find the money to spend on renewable projects.

It is a common refrain from us: we gave them all our money, we given them more money through "incentives" (profit subsidies) to then spend that money, then they want to be able to bet on that money or they will not spend the money how we want.

There is always one more profit subsidy that is needed before banks spend money on projects humanity needs.