March 29, 2023

Federal Budget

The federal budget is, in a word, underwhelming. In two words: tax credits. And in the voice of the future generations "thanks for nothing".

I would be surprised if we expected anything else from the Liberal-NDP coalition than a budget that overly panders to the deficit hawks and the "state cannot do anything" crowd who seem to run our country.

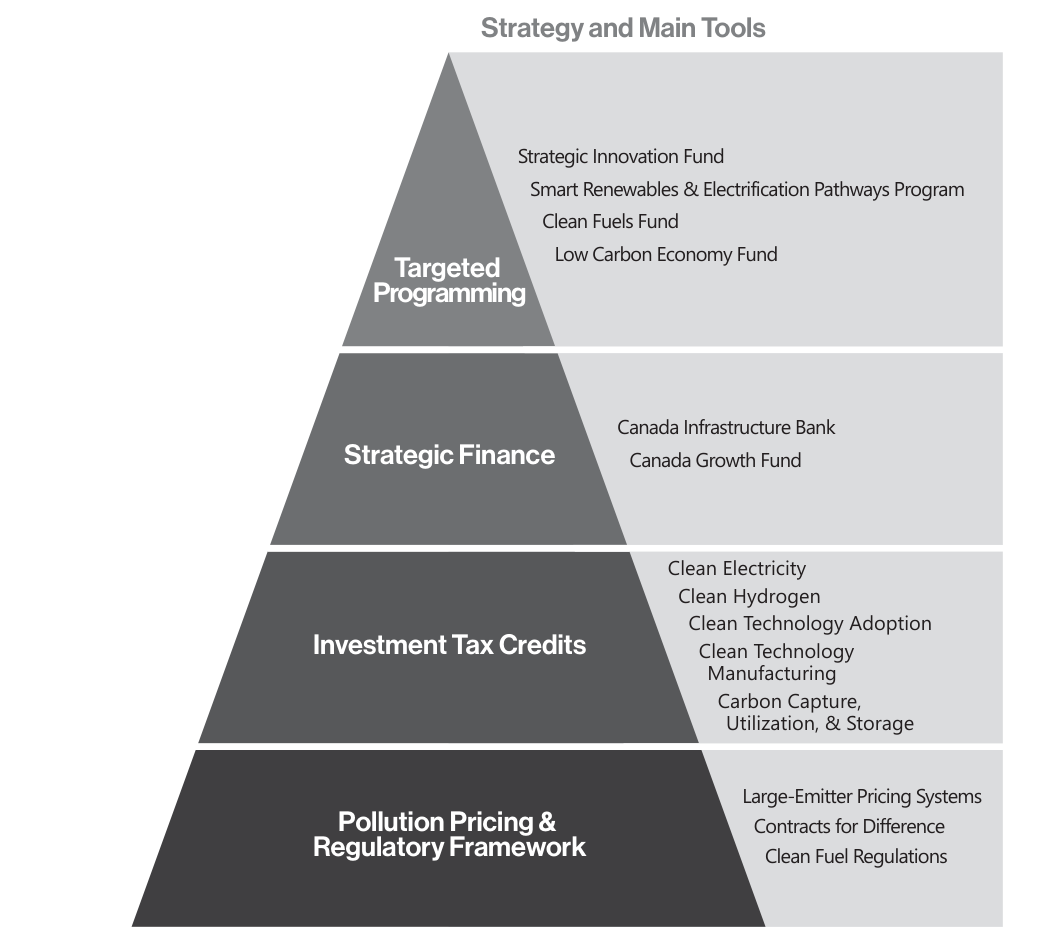

I think this graphic clearly articulates the entire budget priority structure:

Most of the money being spent is on tax credits—refundable and non-refundable depending on if you are a company or a worker. Most of these are structured in a way as a profit subsidy as opposed to an investment support. And, most of it going to capitals that are going to invest anyway.

I think it shows Canadian policy folks in government are stuck in the previous century where investment money was gained through small percentage increases in profits because there was free money lying around.

That is not the world we live in anymore and they are unable to see just how contradictory their policy statements and their investment program desires are.

Here is the contradiction:

The budget explicitly approves of the interest rate hikes by the central banks to bring down "inflation". The budget acknowledges that high rates will likely cause a recession.

The budget says that their spending is low and targeted so they do not cause inflation.

They explicitly say they are not going to pick winners and let the market decide, say they are going to crack down on monopolies

Then do this:

Announce their main spending it through tax credits (refundable) to those exact same "monopoly" industries they say are gouging consumers and raising prices.

The tax-cut support is a continuation of a profit subsidy regime—literally giving cash to profitable companies—is the very thing that has caused inflation in the first place.

The only limit on the profit subsidy is a—yet to be determined—labour wage regulation.

The government want input from labour unions. However, from the wording it is hard to believe that regulation will be "they must be unionized workers".

Labour should demand that every job created under a profit subsidy regime of tax credits be unionized.

The government will create some very small crown companies to manage oversight. But, when it comes to investment and money, they have contracted-out to private capital.

The Public Sector Pension Investment Board (PSP) will manage the Canada Investment Fund of $15 billion. The Canada Investment Fund is supposed to be a pile of money to attract private investment.

In a sop to labour unions, PSP will have two seats on their board "for unions". While these seats seem like something we need to be part of, those seats on the PSP will likely not be able change course of its history of destructive low-waged, non-union, no-pension workers investments.

Much of the budget is full of tiny tax credits on hoped-for investments in clean technology, "new" innovative techno-Utopian dreams, and support for small businesses.

On the flip-side, the profit subsidy is too small. Canada is competing against a subsidy regime in the US and Europe that is giving away huge amounts of money to private capital to establish production in their borders.

There is no acknowledgement that the only Canadian program for investment that has ever worked is where government thinks that it can, knows that it should, and then does build and invest in production in many of these things directly. From these direct state investments we usually get the "Made in Canada" off-shoots that the government so desperately wants.

Other things

My reading is that the Dental Care program is going to be a privatized insurance program run out of Health Canada. Any private involvement in the insurance coverage of only the uninsured means that the government is not even acting as the agent of redistribution any more.

There is reference to a PSW retirement "savings" program support. I don't know what this is in reference to, but unions who represent PSWs should seek clarification. A retirement savings program for workers who make next to nothing and have no ability to save is not going to be very useful. Certainly it is not a universal pension system.

Deficit through mis-spending

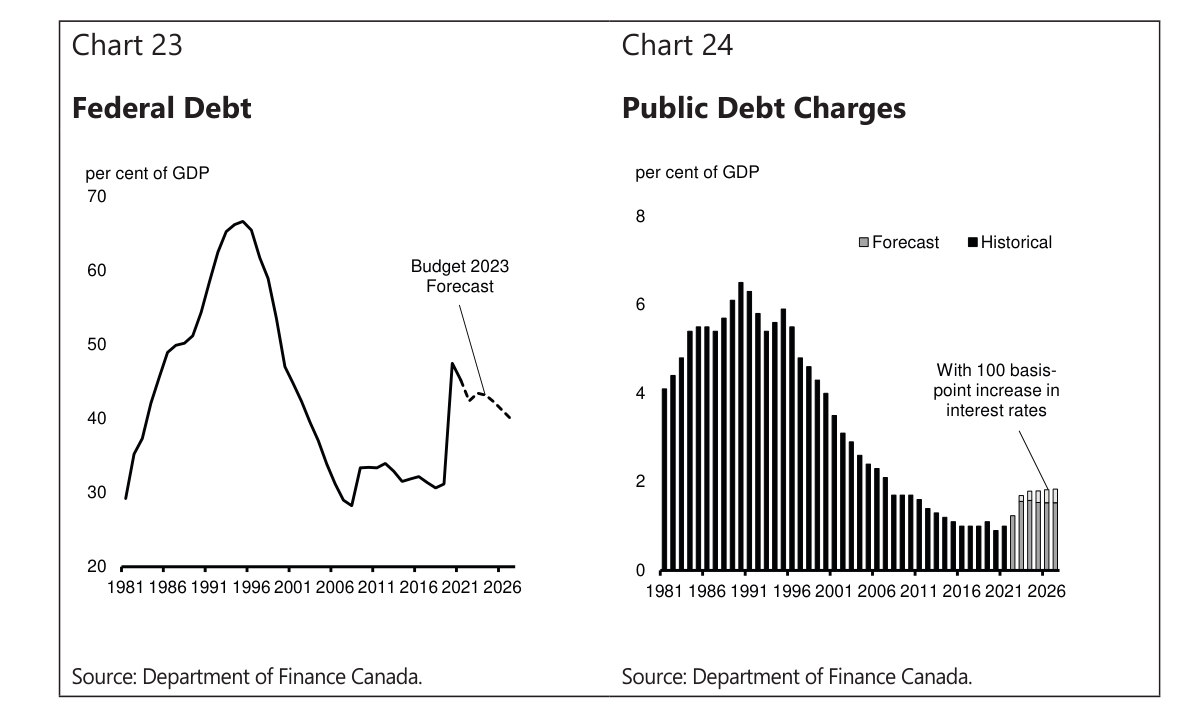

Their 2022 predictions of surplus by 2027 is well and truly gone now. It is now a $14B deficit by 2027.

All those tax credits and cuts really add-up.

The Liberals are usually obsessed with deficit elimination. They still are, but because the economic circumstances are different the focus on percentage of GDP instead of total deficit.

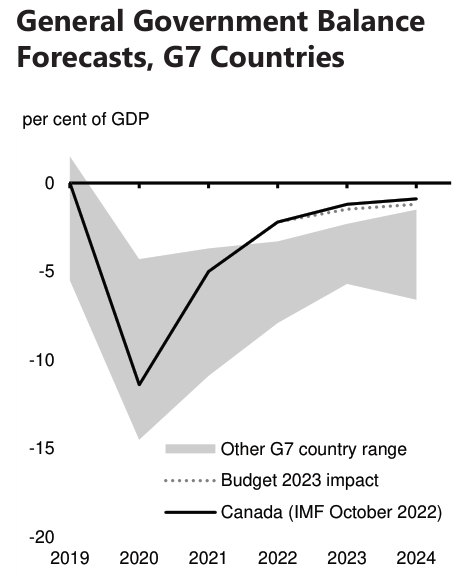

But, even here they do not realize that this shows that we are under-spending compared to the rest of the industrial capitalist world.

They are proud of this graph, but it shows exactly how far off the mark with the new economic realities of states supporting capital development we are.

They are focused on our debt spending, but it is still ridiculously low even after a global economic and health crisis.

Then they show this graph of debt reduction by 2055. Completely ignoring how stupid it is to even consider we will not have any economic crises between now and a future with massively changed climate we have done nothing to stop.

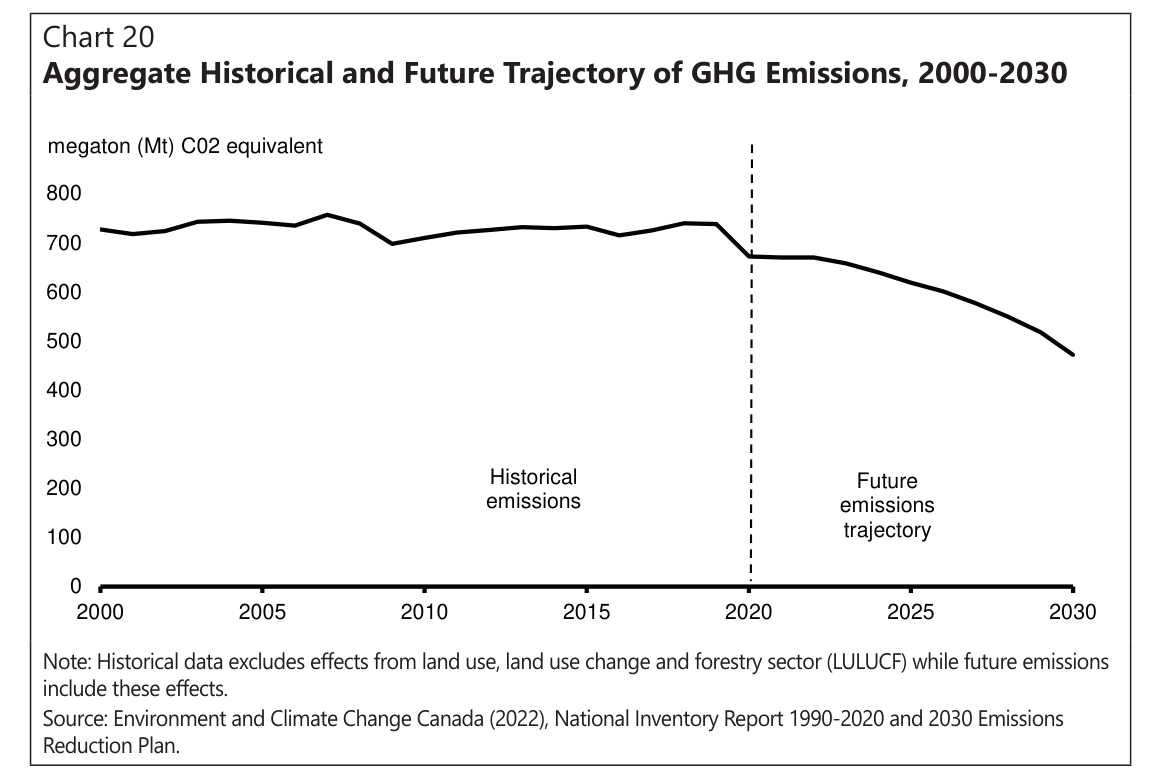

The Liberal-NDP government cannot even be honest about their complete failure of a carbon emmissions mitigation strategy.

Isn't it convenient that they start this graph in the middle of the pandemic shutdown and then extend it flat for the next decade? I guess we will do all the transition to lower-carbon production after 2030 and it will be done with no public borrowing. What a joke.

The questions Canadians need to ask are:

- Why are we not spending way more on what we need to make it through the coming climate, health, demographic crises or the current economic crisis?

- Why are we not serious about responding the threats of today and the near term on transition to green energy?

- Why are we not thinking about a diversified economy and instead focused on extractive industries that support USA production?

It is clear the government does not understand the current moment.

The fact they are proud to print these graphs shows how far from where we need to be we are. While the rest of the world has moved on, Canada has doubled-down on neoclassical banker economics that offers no solutions or hope for dealing with the future.