March 28, 2022

As rates are set to rise, investors change their tune

As the Fed announces moves to increase rates and recession risk increases, investors are starting to turn a little on the high yield sectors of tech and crypto.

Risky speculation in the markets is under scrutiny this morning with major investor news papers targeting tech exchange traded funds and crypto investments. The mood of "innovation at all costs" is starting to be replaced by seeking-out "longer-term" steady gains.

The concern is the loss of appetite from retail investors as they see mounting losses from making risky bets in the market.

Schroders’ chief executive has criticised the arrival of speculative “have-a-go” investors in the asset management industry for causing “massive destruction of wealth”.

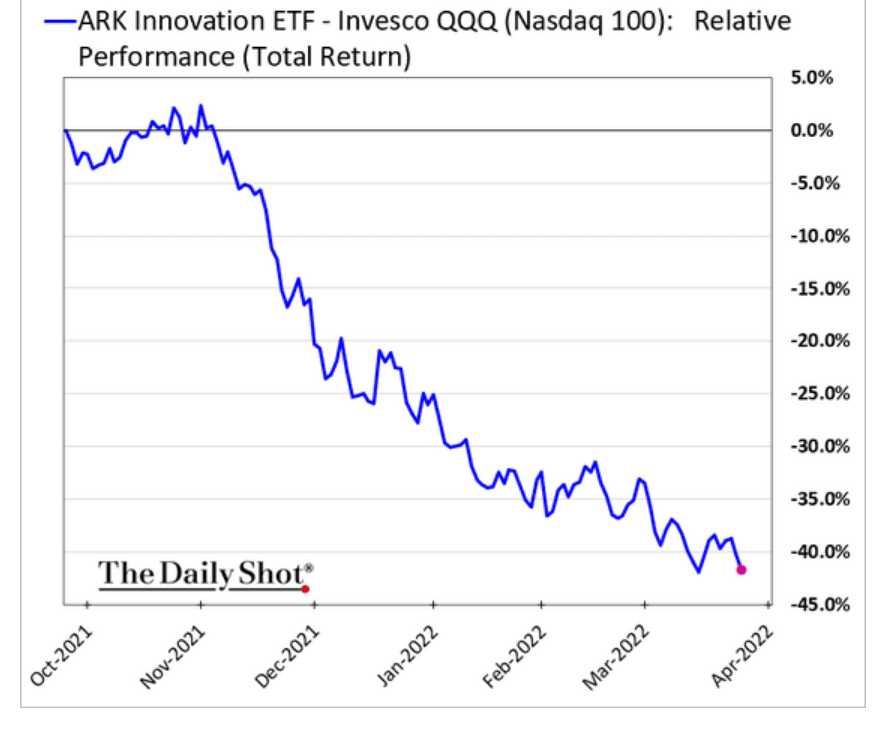

Peter Harrison singled out exchange traded funds managed by Cathie Wood, chief investment officer at Ark Invest, for producing “billions and billions of dollars of wealth destruction”.

- Ark is still up 13% or so over the previous 3 years, but it isn't really a good investment comparatively.

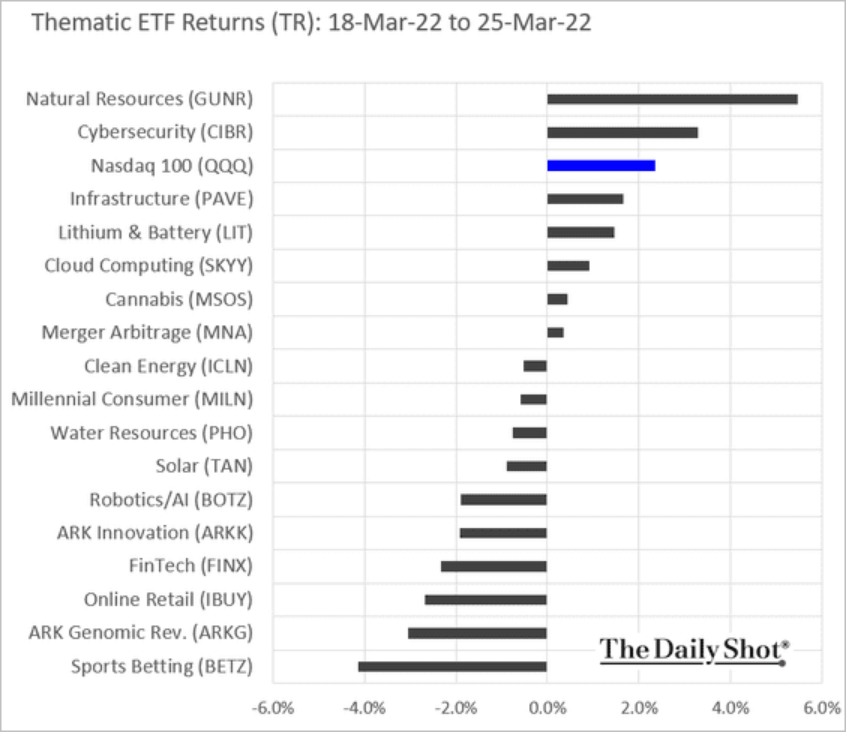

The magic of the market is that private sector clean energy linked investments are down too since they follow a similar "fast money" versus "longer-term returns" models.

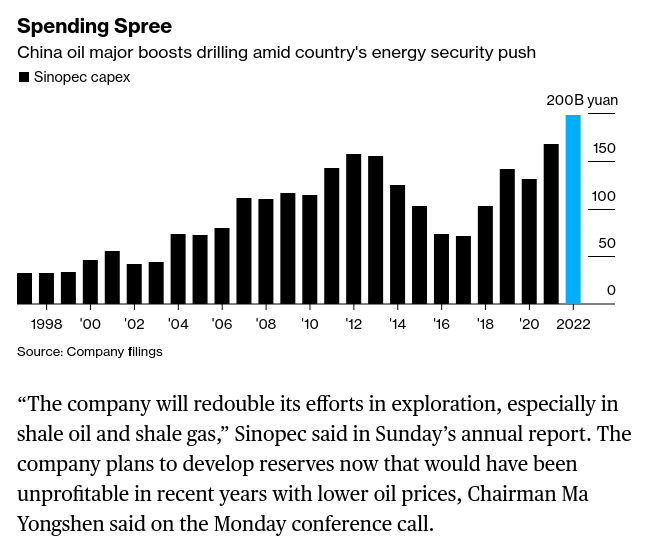

- And, don't forget that oil drilling is all the rage.

Cyber Security

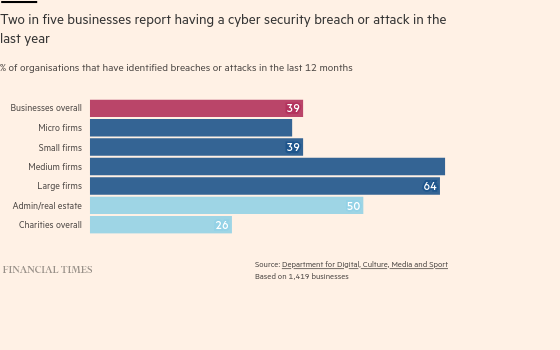

The other issue back in the news – because of the narratives around the war in Ukraine – is Cyber security.

A lot of money is going to be spent on this new area of conflict investment.

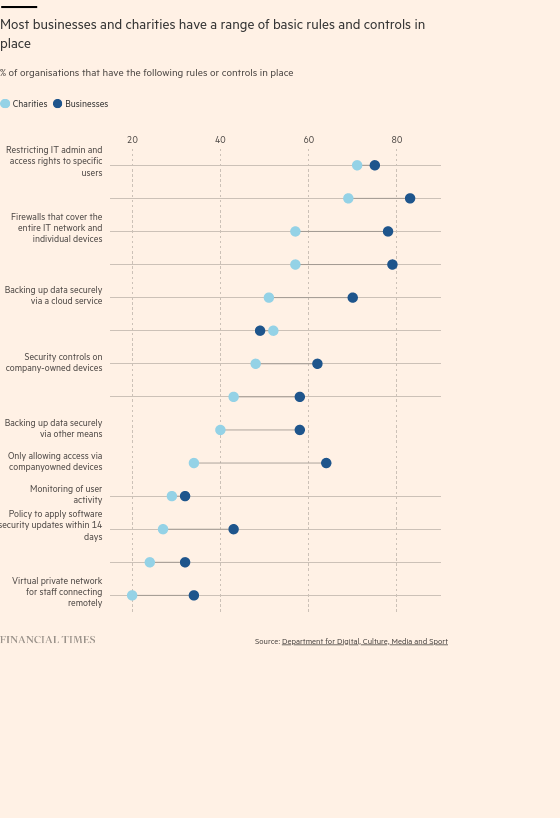

The pandemic has forced many organizations to adopt technologies that they have little information or in house knowledge about. The result is a much larger attack surface for criminals and state-associated attacks on infrastructure. As state-associated attacks increase, criminal organizations start using weapons and weaknesses exposed by those attacks to gain traction.

This is an area that I have written on before, but it is becoming mainstream now to talk about digital technology and security. Those in decision making spaces in larger organizations need to start strategic planning investment in tech workers with this skill and educating leadership on the risks.

Unions are especially susceptible because of their decentralized and relatively low-skilled leadership in this area.

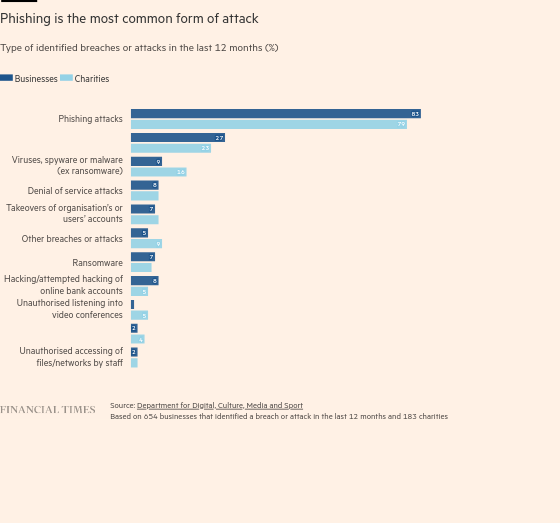

All unions are facing significant risk from phishing attacks to gain access to their networks. The centralization of information and the decentralization of access means they are particularly vulnerable to leaks of internal information.

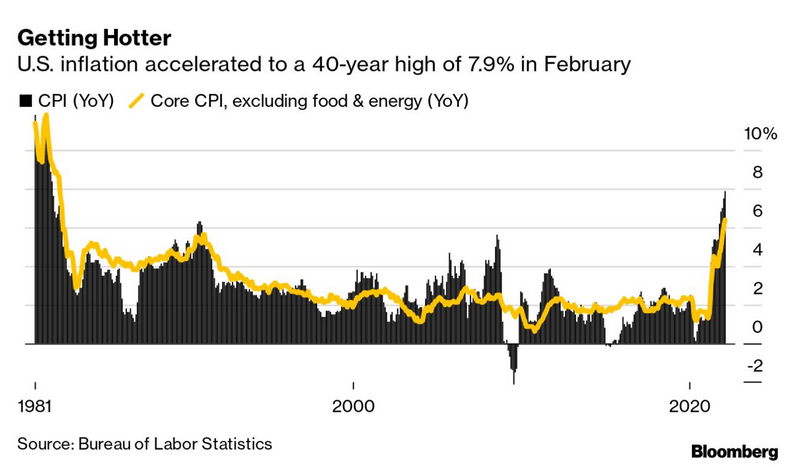

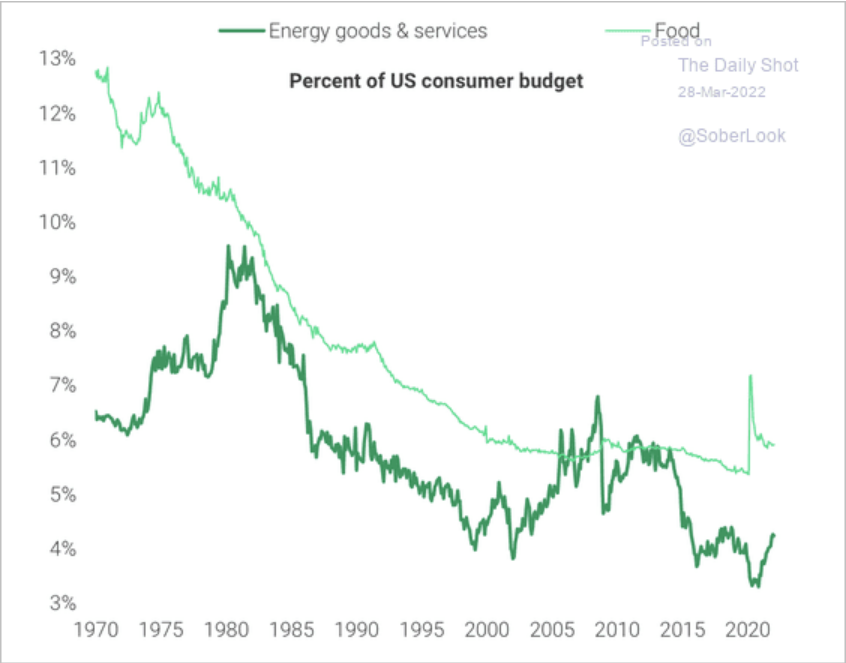

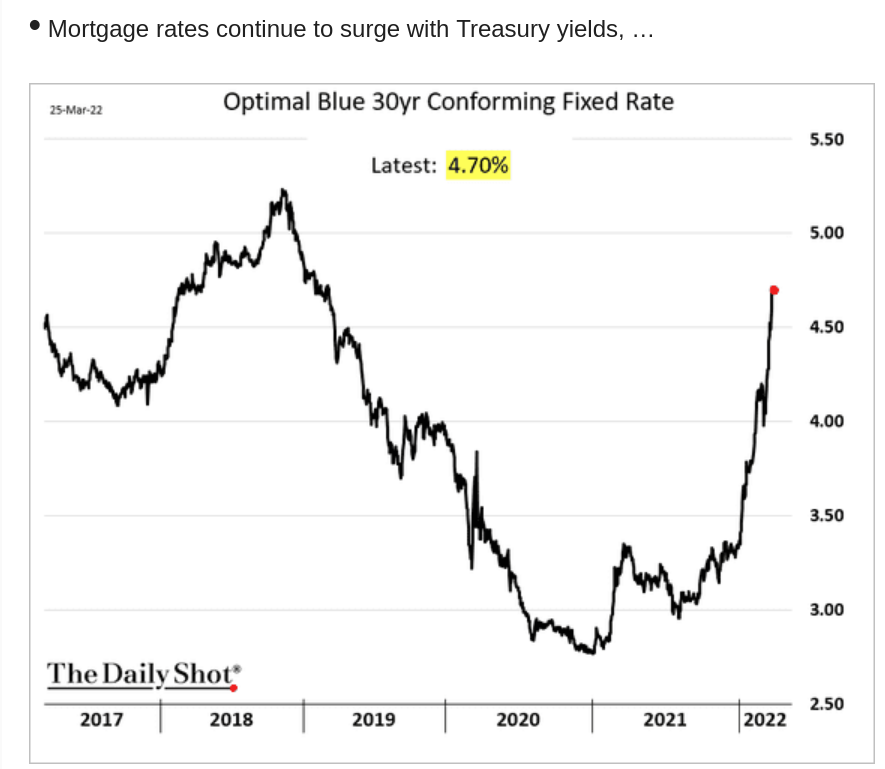

Inflation in the US and bad omens of recession

- This is really what is going to lead to a decline in economic growth. Investment in capital is down, which means profit expectations are down.

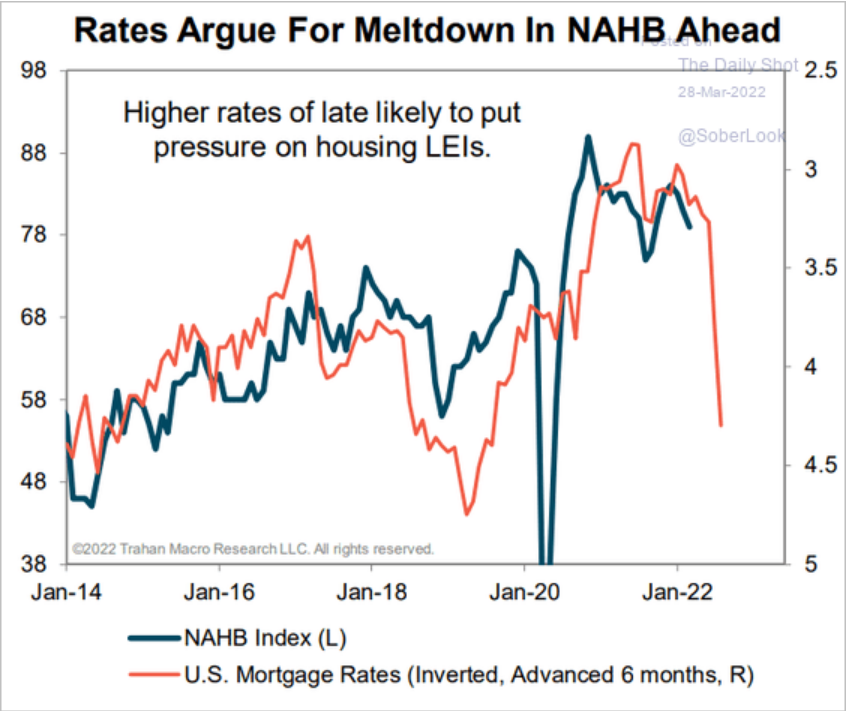

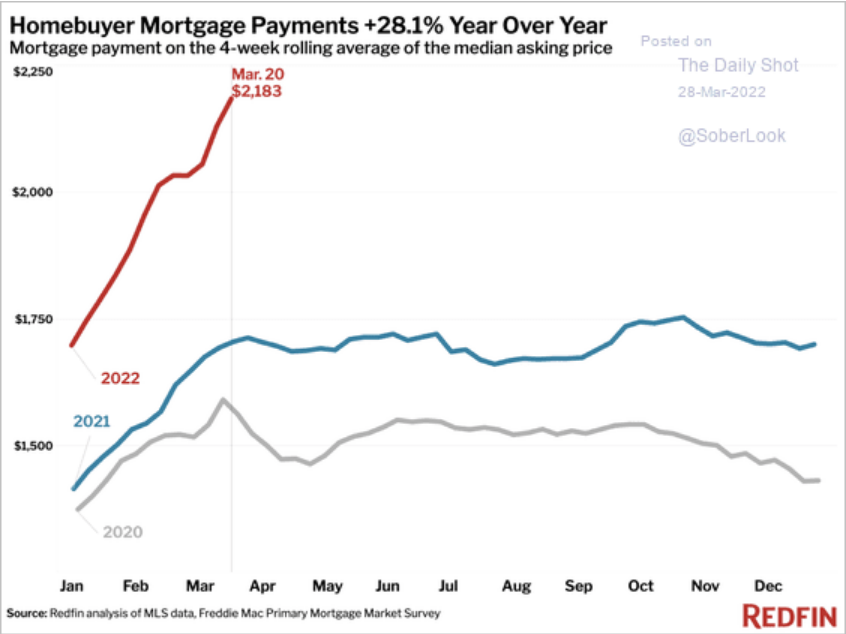

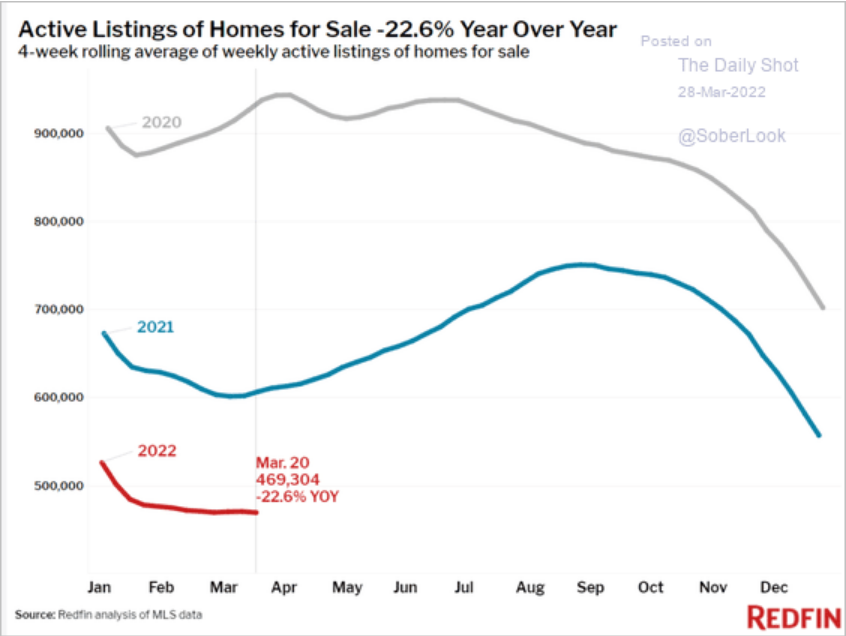

Housing in the US doesn't look great

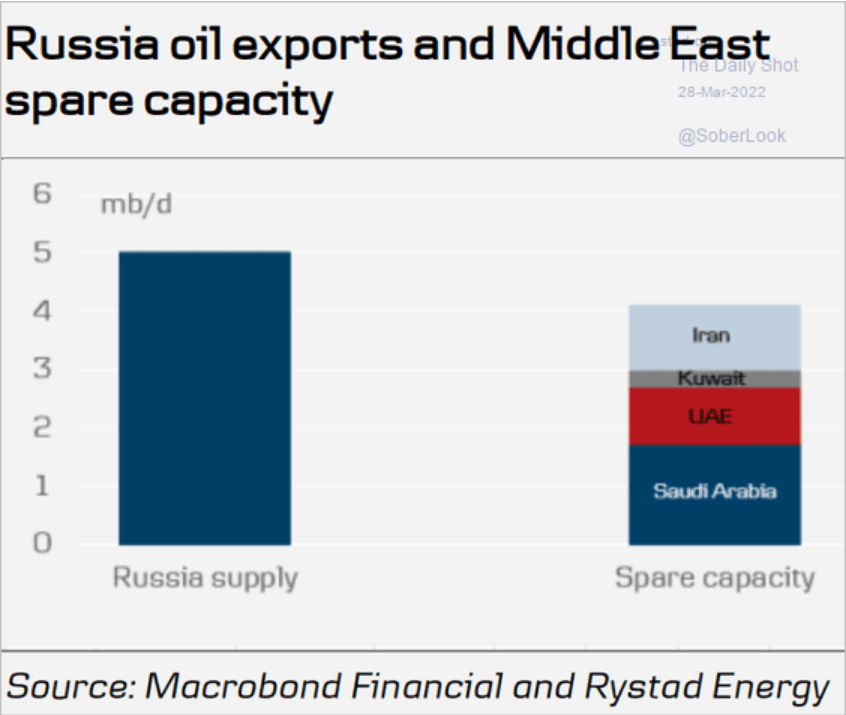

Russian Gas

- is not easily replaced

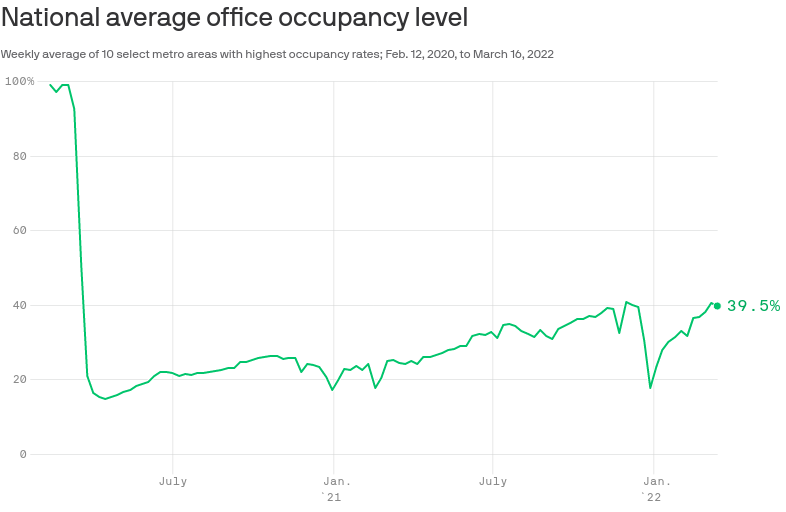

"Everyone is going back to the office"