March 27, 2023

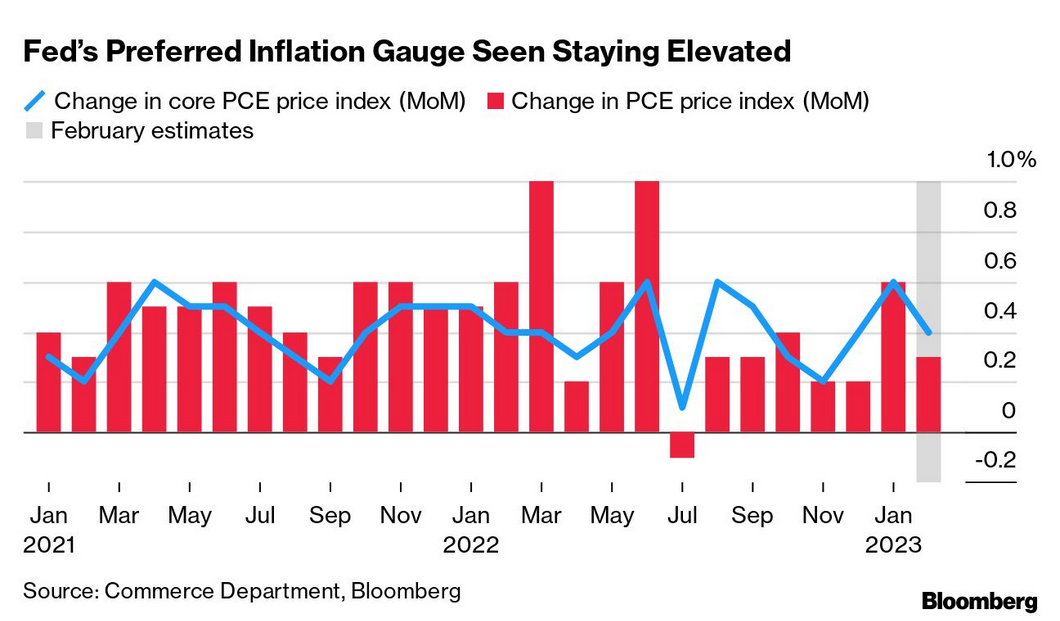

Price-increase measures still not falling

USA Federal Reserve measure of inflation continues to be high:

And, the European Core Inflation measure is not dropping like the headline inflation (headline inflation is coming down because energy prices have fallen from their highs).

Inflation, it seems is still with us even if the fastest growing goods are not getting as expensive quite as fast as they were in the winter.

All this is bad news for workers as central bankers are determined to maintain higher rates for longer.

The president of the European Central Bank last week declared getting euro-area inflation back on target is “non-negotiable” and won’t involve “trade-offs,” days after she boosted interest rates by 50 basis points.

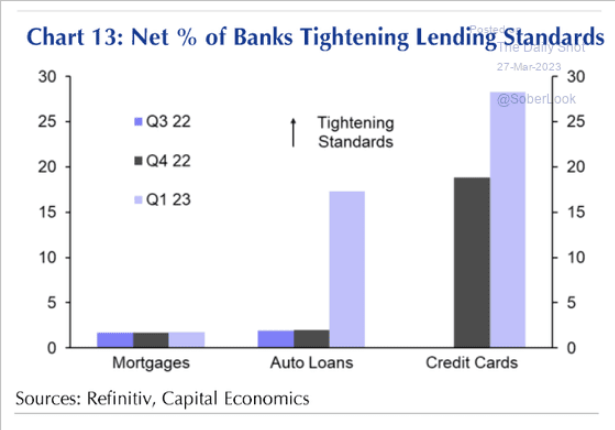

The rate that is more interesting to watch is the median private banking lending rate.

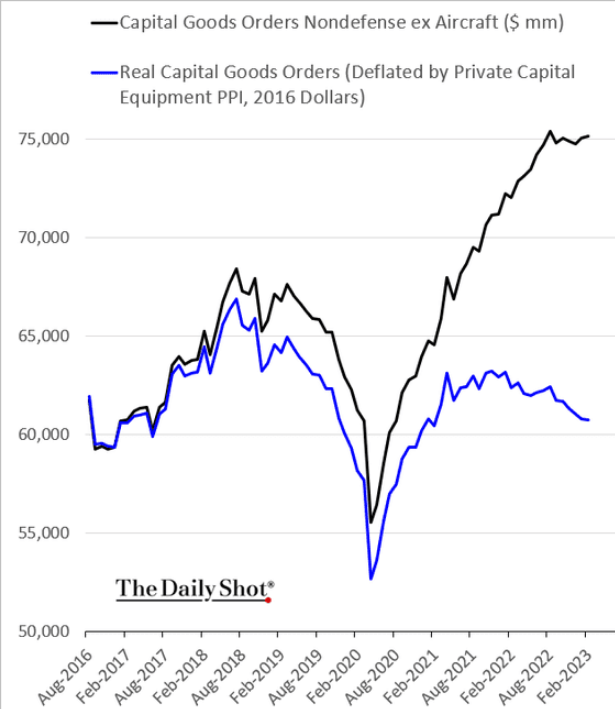

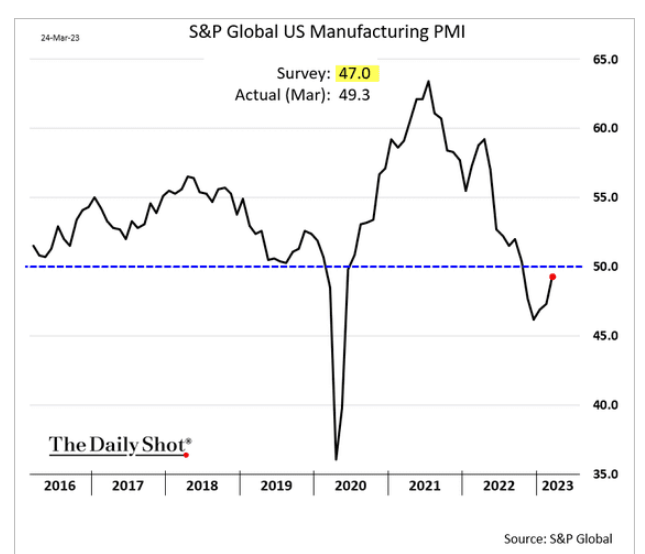

That rate is high enough to dent borrowing for manufacturing investment.

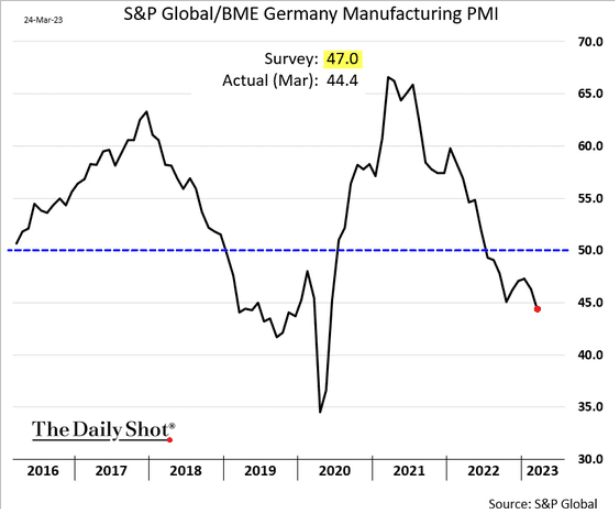

USA and across Europe saw manufacturing investments shrink.

Offices and working

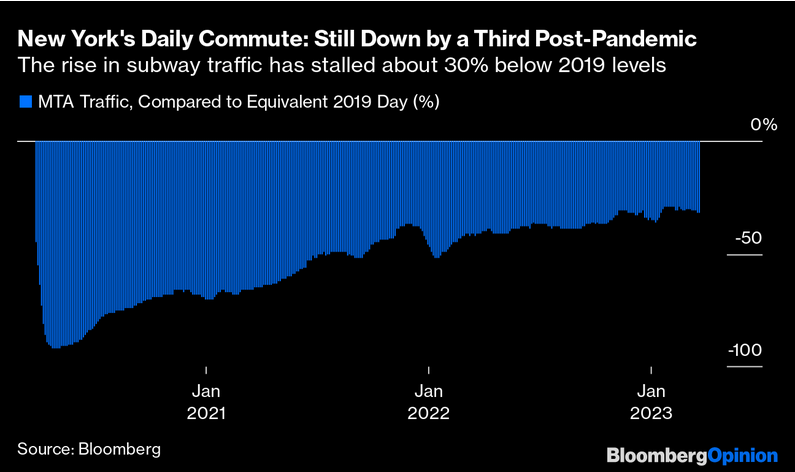

Anyone who believes we are returning to the office should look at the numbers. No matter what arguments folks make about office culture, white collar workers are voting with their feet and they are not walking to the office.

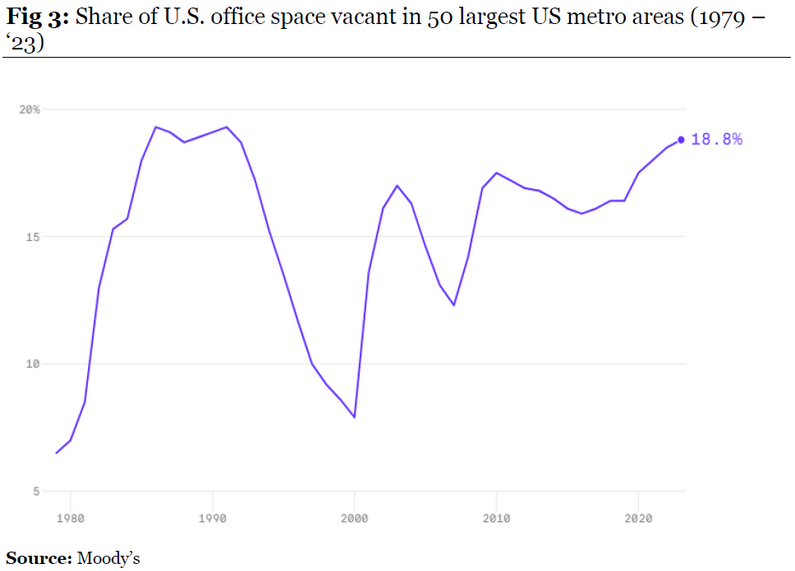

Office buildings are empty even as more and more are being converted into housing.

People are not comminuting to the office.

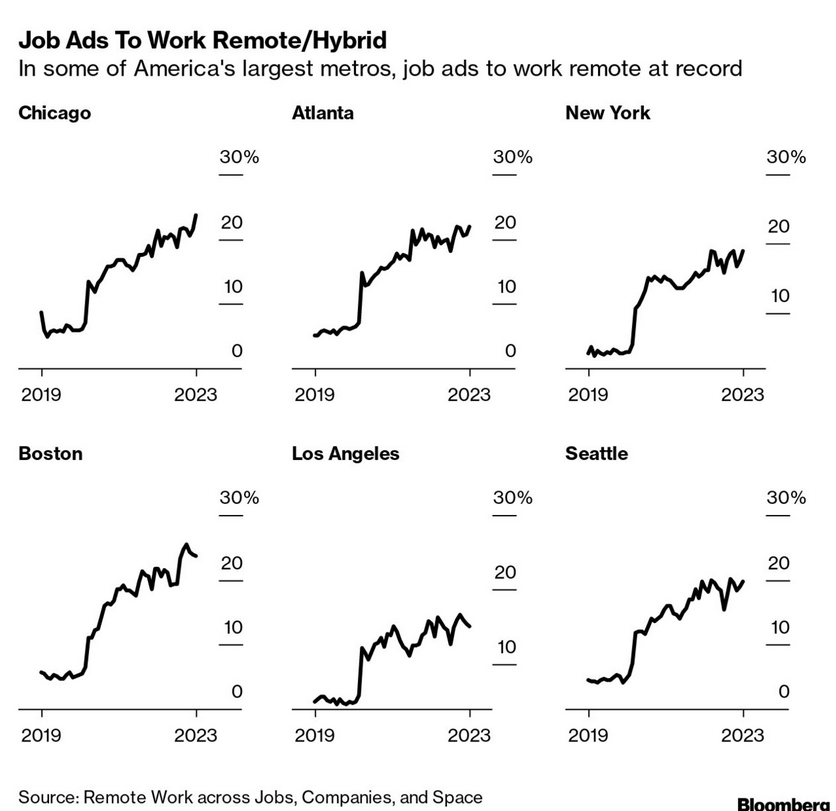

And, more new jobs are remote.

Forget pushing folks to return to the office. It just isn't going to happen. What we need to be thinking about is best practices and processes to build the work culture of tomorrow. Unions must take the lead here facing the true realities different workers face both in their membership and their own workforce.

Protests

From France to Israel, the masses seem rather upset at their governments doing unpopular things "for their own good". Protests have grown, not declined in 2023 already.

The previous few years saw a population angry at everything. That anger seems more focused now that cost of living and the negative prospects for the future are becoming the main issue.

I think governments that do not see the writing on the wall here are going to find themselves rather suddenly out of step and out of office.

Tough times ahead means there is much organizing to be done.

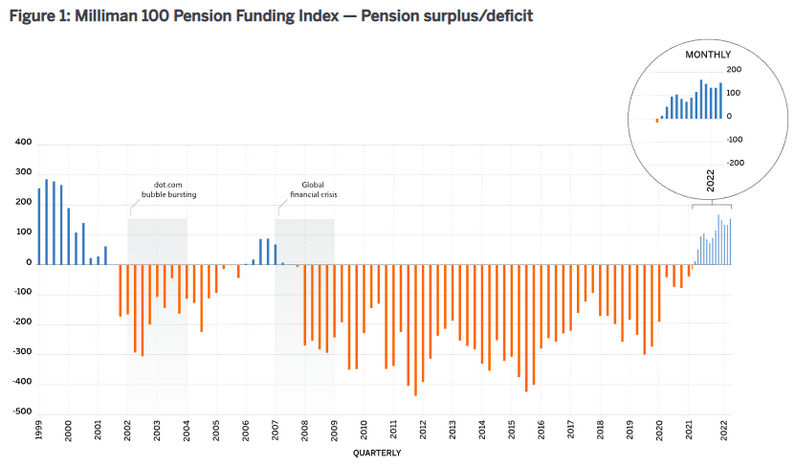

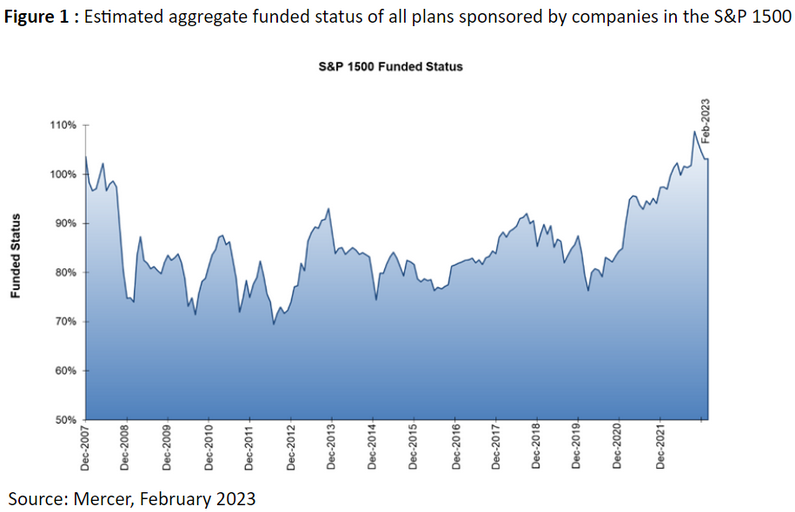

In France, there is no reason for the pension fight as pension funds and funding have flipped from the long recession years.

Now, this doesn't mean much for pensions funds that could easily see their fortunes change if central bank rates come down. But, even if we buy into the argument that is being proposed by capital in France, the data disagree with their pronouncements of a crisis.