March 26, 2024

Cocoa prices

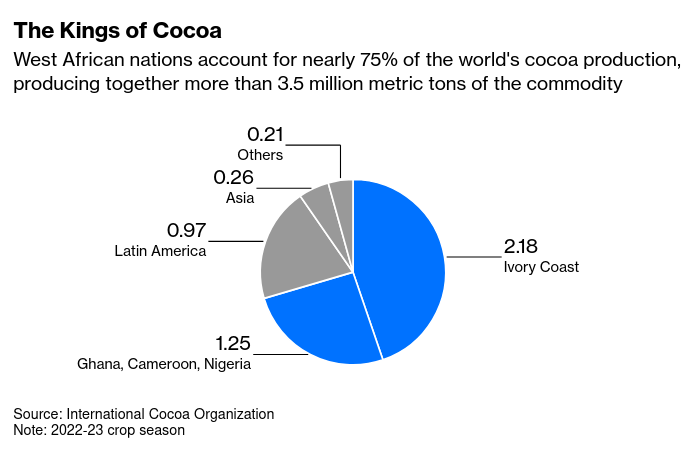

Most of the world's chocolate is grown in Ivory Coast, Ghana, Nigeria and Cameroon.

Ghana is heavily dependent on Cocoa exports.

The Ghana Cocoa Board (Cocobod) is an industry regulator that borrows at the end of the year before farmers are paid fully so that farmers can afford to buy seed. It then pays farmers this amount and collects the service fee through the year.

Ghana went through a massive restructuring of its debts because of the pandemic, poor revenue generation, and high interest rates, which forced the board to seek private financing.

- Loan from 2023: $800 million

- 2024 drawdown needed, but abandoned because of lack of beans: $200 million

- Bank: Cooperatieve Rabobank of the Netherlands, Standard Chartered, and Societe Generale.

- Cocoa harvest for 2023/24: 422,500 to 425,000 tons

- The harvest is half the country’s initial forecast when it sought the loan.

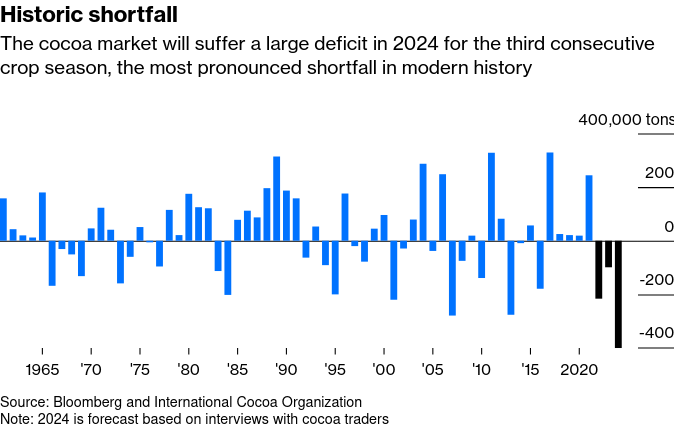

- It is likely this is going to be the fourth consecutive year of production shortfalls.

The private loan was supposed to be the alternative to higher rates from Ghana government loans. This loan is at 8%, which is much higher than a government loan.

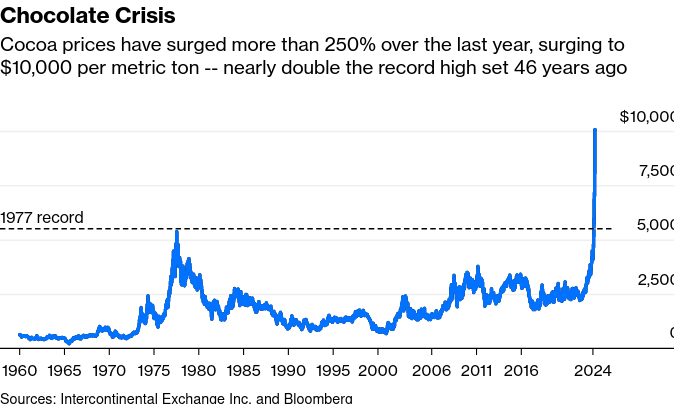

The surge in prices on the market are driven by the climate change and poor financing model for cocoa production driving down cocoa crop.

In finance, there is a mechanism to hedge against these sorts of situations, where farmers would reap at least some of the benefits of higher prices either through direct hedging or owning some piece of the sellers. But, both takes extra money, which Ghana farmers do not have.

Producers in Latin America are making a lot of money out of the price rise since their production and loans are not in the same shape. Also, government supported fairtrade programs have helped Mexico, Ecuador, and Brazil producers stabilize their own production prices.

The result for Africa is what used to be called imperialism, but is now called "investing". Many investors who own stockpiles of processed cocoa products continue to hedge the market (though those inventories are also collapsing). These investors have to have large amounts of money to hedge this long. Inevitably, the largest pools of money that hedge are the ones that win out. The investors with less money will either pull out and take losses or default.

Either way, Ghana farmers are not a large commodity trading house with these resources, so cannot hedge against price changes in either direction. And, they gain nothing from the increased prices on the market for the goods they produce.

Large commodity traders:

- Cargil

- Olam

- Barry Callebaut

- Touton

- Ecom Agroindustrial

Even these large players are running into a problem and the "market" is making a very bad situation much much worse. Some are losing over 30% of their investment. As prices rise, there situation for normal buying and selling of bulk chocolate because a huge problem.,

Watch over the next little while and we will see what problems an untethered market in cocoa can cause.