March 25, 2024

App Notifications

If you used to get notifications and don't any more, you may have to re-install the app.

The notification provider has changed the way that push notifications go through in response to policy changes at Google and Apple for web apps.

Simply delete the app icon from your main list of apps. Then follow these directions to re-install and sign-up for notifications.

Jobs, economy, and aging assets

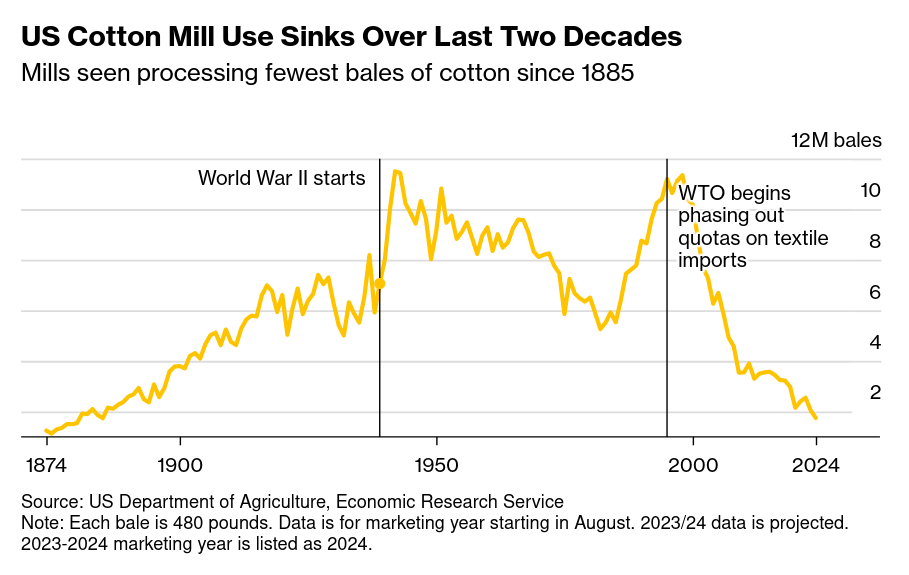

The jobs market is not as good as it looks, according to household surveys in the USA. The main national survey of employers differs significantly from the metrics from job holders themselves.

Americans do seem to be hurting more than the national stats indicate:

has time on its side.png)

It isn't too strange for these metrics to be out of alignment, as you can see from the wild swings in the difference metric since the pandemic.

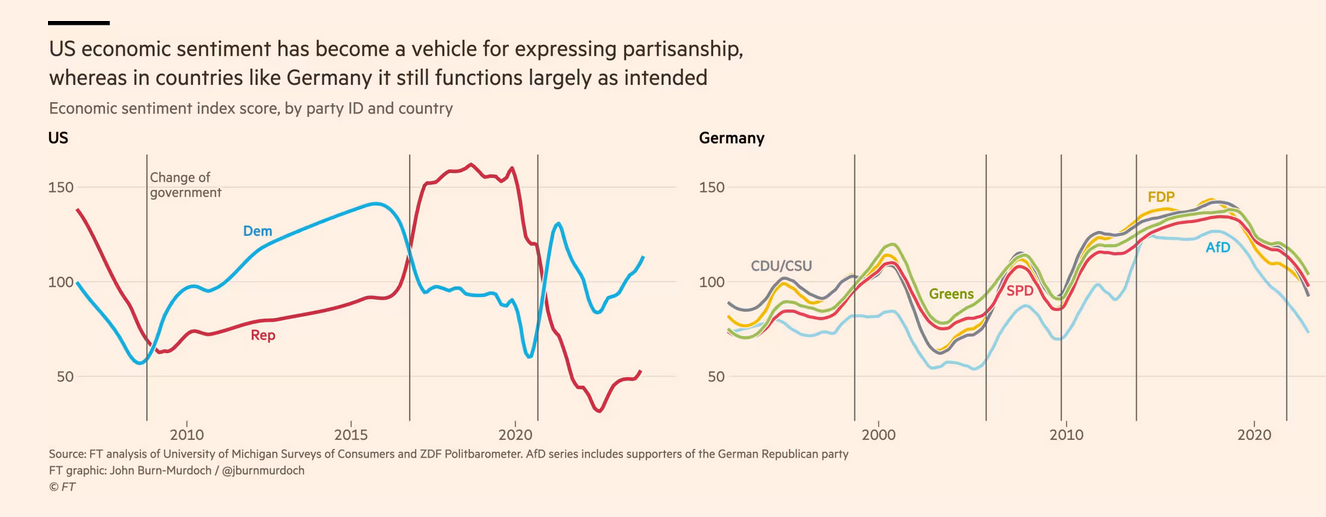

The reduction of quality sampling is something that should be considered in this data (as discussed before). But, also the politically-aligned sense of reality could be driving it consumer/worker/household sentiment.

They could also both be wrong and it is difficult to know who to listen to on jobs.

If we look at actual economic activity, things do not look rosy from a capital investment side.

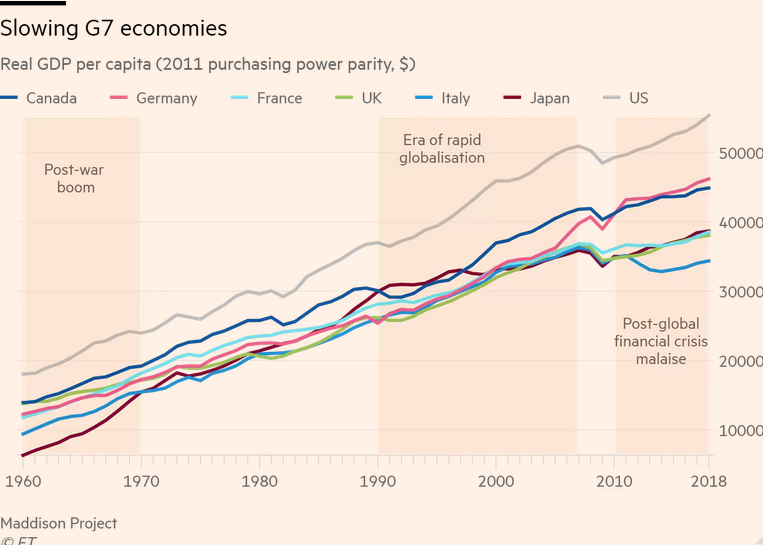

While the USA has been able to prop-up its economy, the whole world is on a rather slow growth path. Canada is steady along the trend.

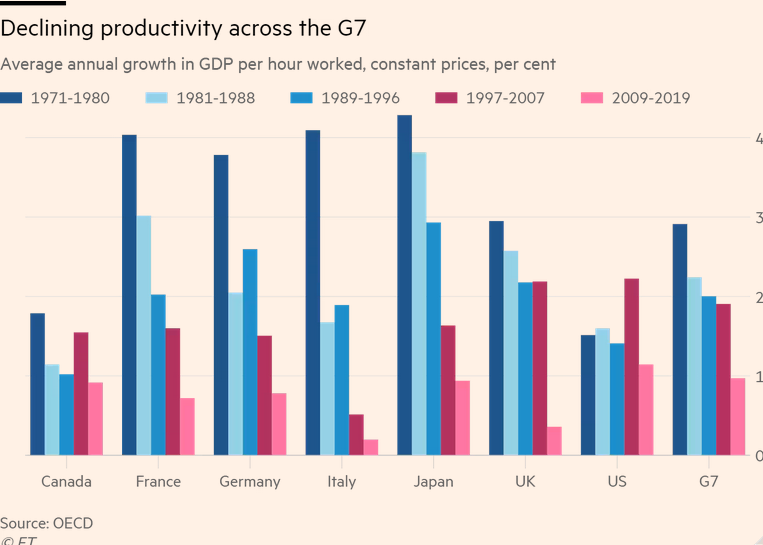

Productivity plays a large part in this story. As you can see, Canada has always had low productivity, but it is getting worse along with all of the advanced economies. And, since Canada has a long-history of low productivity (because of the nature of the extraction/export economy), it is actually looking decent compared to some other countries.

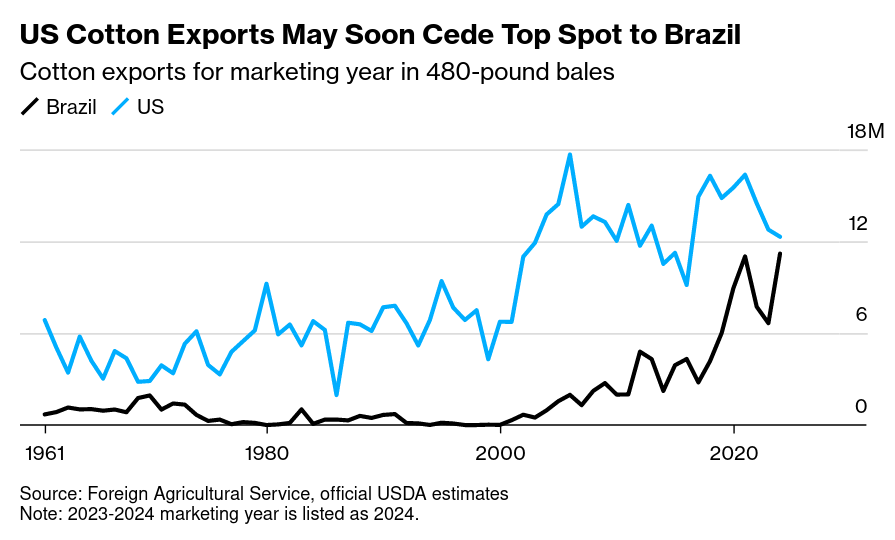

This does not mean that Canada's economy is doing well, it just means that neoclassical economic policy programs around the world are failing as reality reasserts itself. It turns out that you cannot outsource all production (via free trade) and lean on "service" sector economics to sustain a national economy.

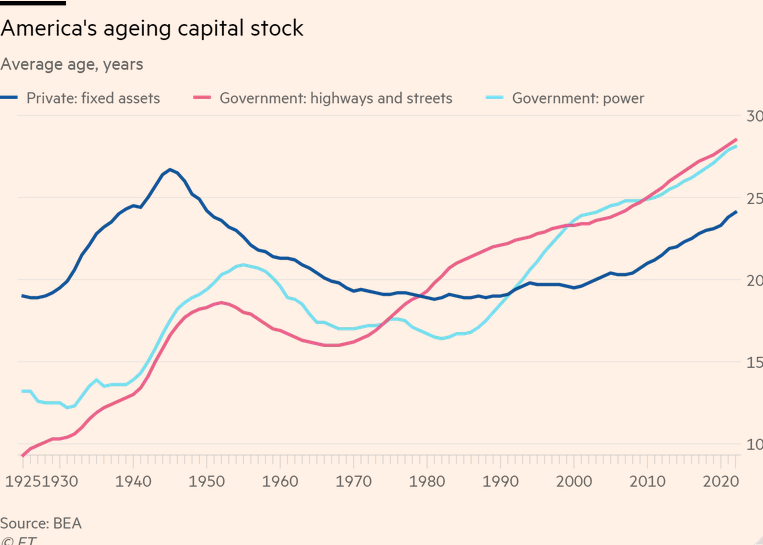

In the USA, we can look at the age of infrastructure and productive assets and see what the problem is.

Capital profitability has been just high enough through downward pressure on wage growth over the previous 30 years to offset aging infrastructure. This means a reduction in investment in new machines, instead relying on investment elsewhere.

The response is clear and the USA is attempting to drive it there. We need to re-examine the free trade program of pushing capital to invest elsewhere.

Even neoclassical Paul Romer (Economics Nobel-ish Prize winner) has stated that free trade hurts the vulnerable.

Nobel Laureate Paul Romer argued US policymakers need to take a more nuanced view toward trade in order to protect the jobs and living standards of those left behind by globalization.

While foreign investment and the flow of ideas are important to stoking growth and innovation, there is a role for tariffs and subsidies on goods trade and production in order to ensure the US remains competitive, he said.

Canadian policy folks are stuck in the dogma of neoclassical economics and are unable to see the alternative.

Also, obviously, Romer's idea of information is important, but for Canada local information isn't even being used to advance its own economy.

It is part of the reason that Industrial Strategy is necessary here if we want to see investment in production.

It is clear to me people want more investment here in productive activities. There is even a well meaning, but incorrect, push to have government push public pension plans to invest "at home" more than away (hint: they should not). While this will have no impact on productive investment and will push to privatize infrastructure, the sentiment is clear.

We need more investment in certain productive ends to meet the needs of Canadians. The way to do that is by the government getting more involved in productive investment. Directly involved, not just attempting to hope to foster it.

Otherwise, we will continue to see graphs like this:

Total tax revenues are up 1.1% fiscal year-to-date, driven by personal income tax and other excise taxes. Corporate tax revenues are down 14.7%, reflecting a slowing in economic growth. (BN)

Global trade and cotton

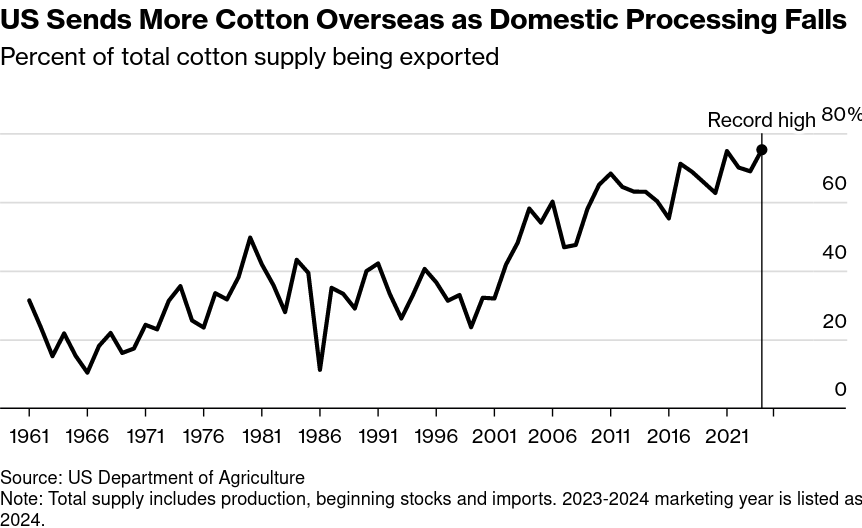

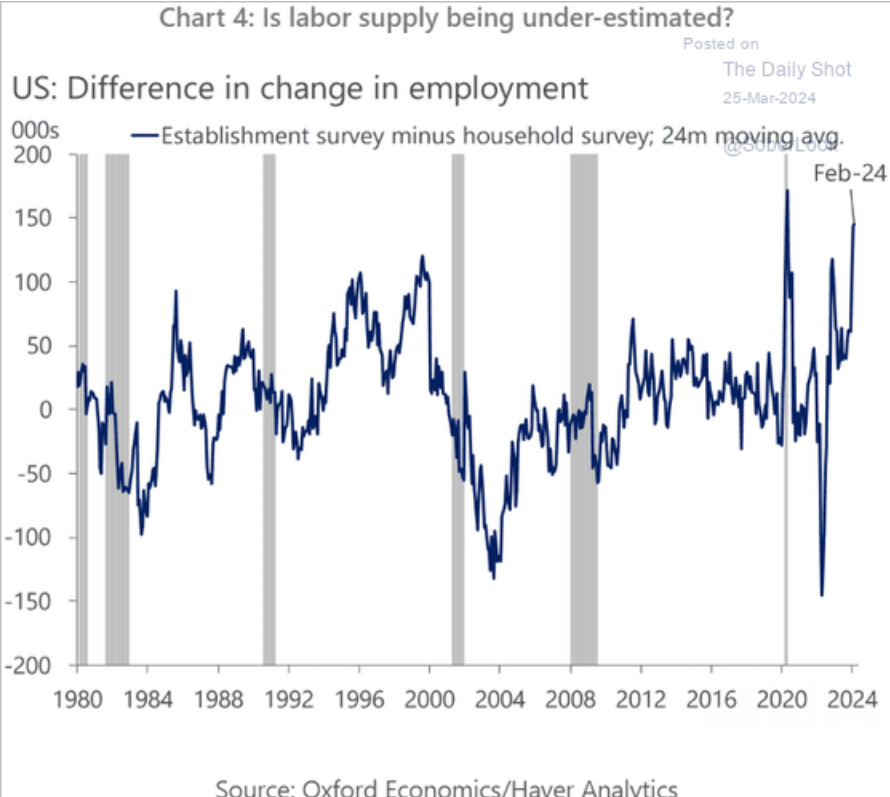

One example of free trade and bad investment policies destroying the planet and local economies is cotton in the USA.

The decline of USA cotton is driven partly through underinvestment in new capacity in the USA (because of outsourcing production), but also by "fast fashion".

Fast fashion empires are built on controlling low-quality cotton at the fabric production level. This requires constant investment and upgrades in production facilities to cut costs (and value) of the fabric.

These costs mean that driving labour costs through the floor are essential to compete. As such, we have an environmental, labour, and economic disaster intertwined.

We see similar things across productive industry where we see a rapid decline in quality per unit.

Fast fashion is the next target for intervention against "China" as government's who loved declining costs of consumer goods are starting to see the problem with that model.

In Brussels today, EU member state representatives are set to discuss a French proposal to ban exports of used clothes — which have been surging in recent years with the growing popularity of ultra-cheap, in effect disposable, garments from the likes of Shein. Much of the exported clothing has ended up being dumped as waste in countries such as Ghana and Kenya, causing serious environmental problems. “Africa must no longer be the dustbin of fast fashion,” France’s environment ministry said this month.

This is just part of a larger French assault on the fast fashion business model. On March 14, members of the French parliament’s lower house unanimously approved a bill that would impose new restrictions on companies such as Shein. (FT)

Because environmental risks for the sector remain largely unpriced, they have so far not weighed materially on our credit ratings. Should these risks become financially more material, fast-fashion players could be most exposed. We foresee increasing regulatory scrutiny, notably regarding waste, albeit in the distant future. We also believe physical climate risks can increasingly affect the industry's supply chains. (S&P Global)