March 23, 2022

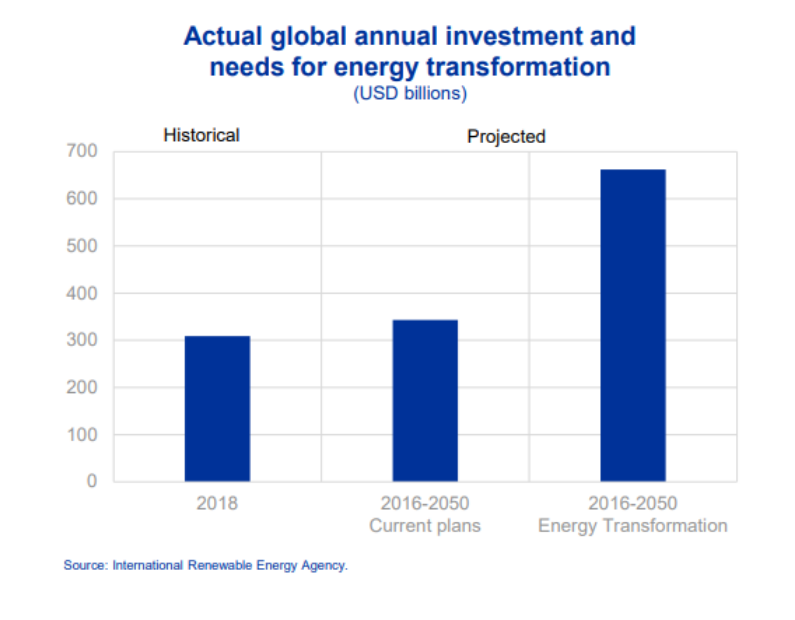

Climate change funding leads to inflation?

Mark Carney thinks that spending on climate change will be inflationary (over the next decade), but less inflationary than not spending on climate change (over the longer term). But, only if the price of clean energy production goes down (something that doesn't really happen).

So, no real help there, Carney.

Meanwhile, we are not investing in green energy.

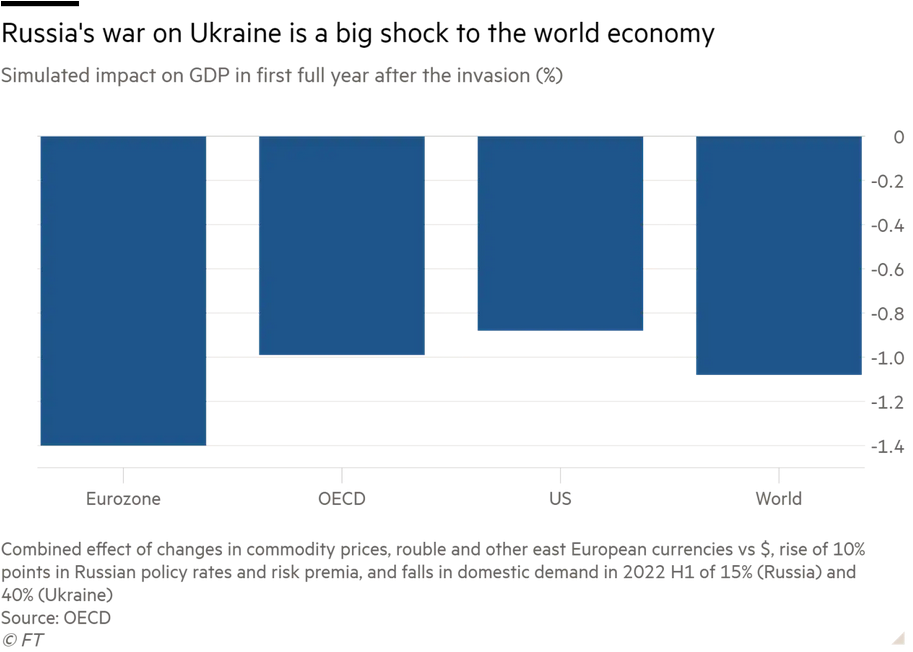

IMF Recession expectations

- The war in Ukraine (and the corresponding economic war through sanctions) is going to be a large drag on the global economy – some places more than others.

- The world economy is still set to expand in 2022, though by less than the 4.4% previously expected by the IMF

“Some economies that have been fast to recover from Covid are in a stronger position” to cope with the reverberations from Russia’s invasion of Ukraine, Georgieva said. The U.S. in particular has “fairly strong fundamentals,” she said. “But those that were not yet coming out of the Covid crisis, that were falling further behind, they’re going to be hit even harder,” with the “possible risk of recessions.”

Tighter financial conditions, as the Federal Reserve and other developed-world central banks raise interest rates, will be a “big shock” for many countries, according to Georgieva. About 60% of low-income countries are in “debt distress’ or close to it, double the number that the IMF was worried about back in 2015, she said.

Recession and Yield curves

- Bets are on a coming recession in the next year or so. Much of the debate has been on "signs" in the market like the "inverted yield curve". Unhedged has quoted this to say that it is more than a sign:

Banks and other lenders fund themselves at short-term rates, most often through deposits, and lend out the money at long-term rates. The spread between short and long rates is therefore the profit margin on lending. An inverted yield curve means short rates are above long ones, so lending becomes uneconomic, banks lend less, businesses have less capital, and the economy contracts.

- Basically, the loss of credit available in the economy which means everything gets more expensive because so much of the market is funded on credit.

- This is not really an explanation of the cause of increased credit costs. The reality is that there is less profit to be gained here so they invest less money to high risk bets on profitable production.

- Everyone doing this across the economy at the same time that debts come due and you have a problem.

- This is all assuming that the past predicts the future in markets, which is not really something that is guaranteed. This is why there is "only" a 20% bet of recession in the next 12 months.

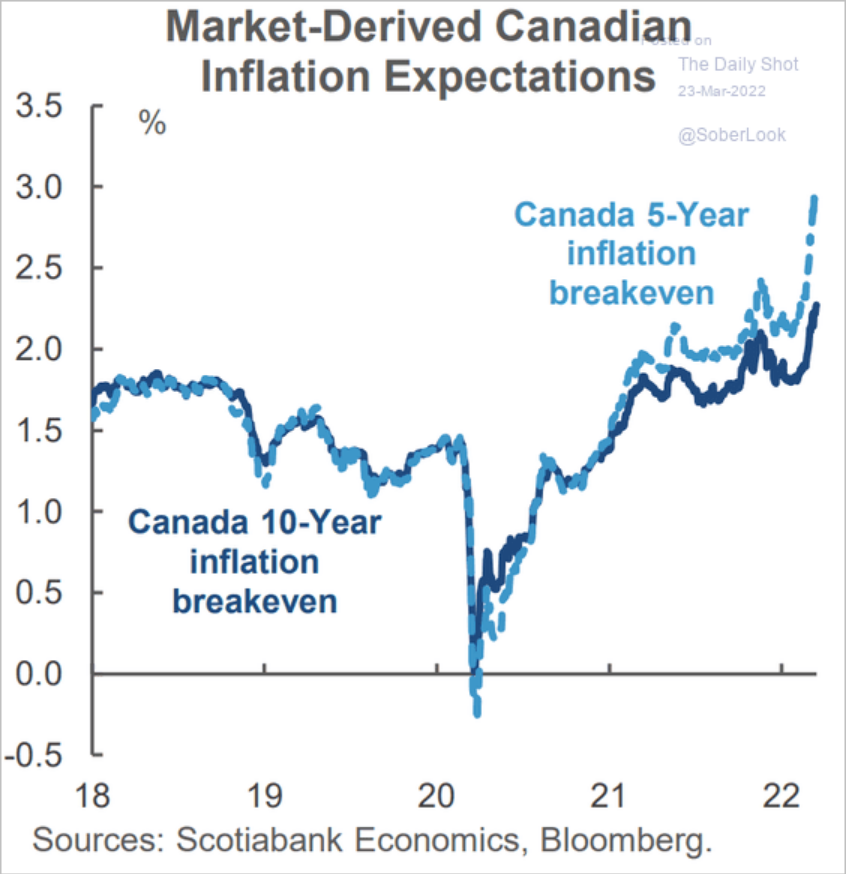

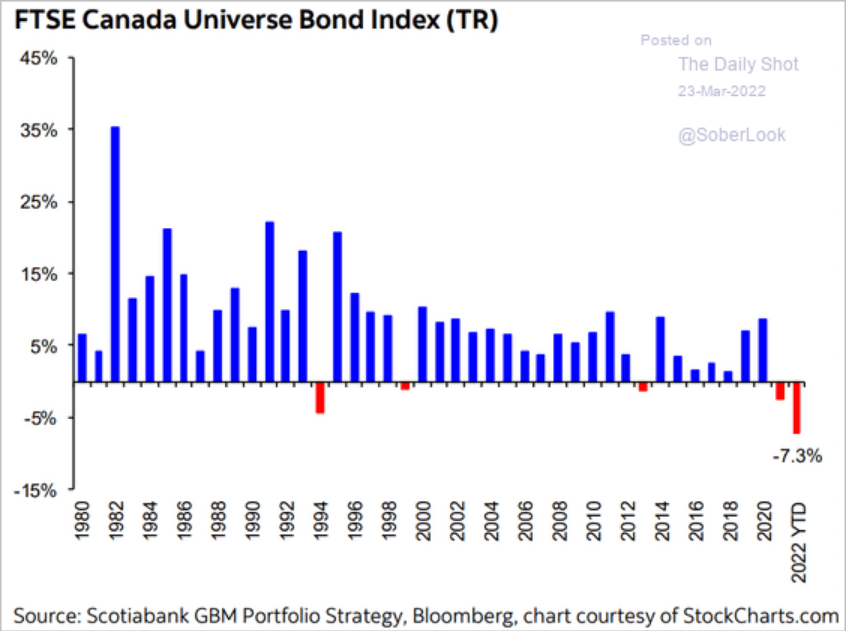

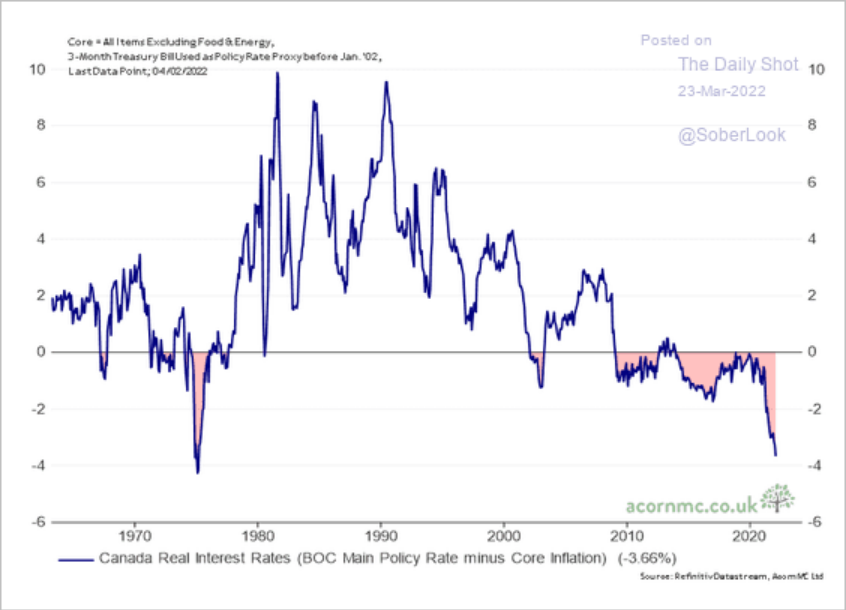

Canada inflation bets

Canada is having a hard time when it comes to inflation and economic growth. The economy is not well. This is leading to a growing worry "in the markets" of low growth and high inflation that is persistent over the next couple of years. The use of the word "stagflation" will hit new highs, but the real question is how are we going to deal with it?

The Liberals and NDP signing a deal means that there is going to be some spending on social programs, but probably matched with the NDP looking the other way on privatizations.

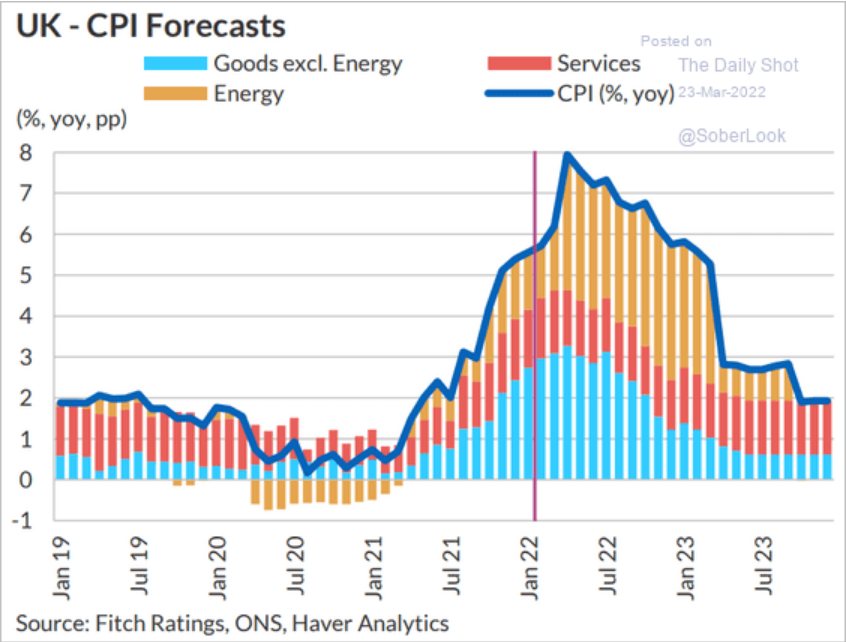

UK Inflation

Going up.