March 22, 2023

Canada Inflation

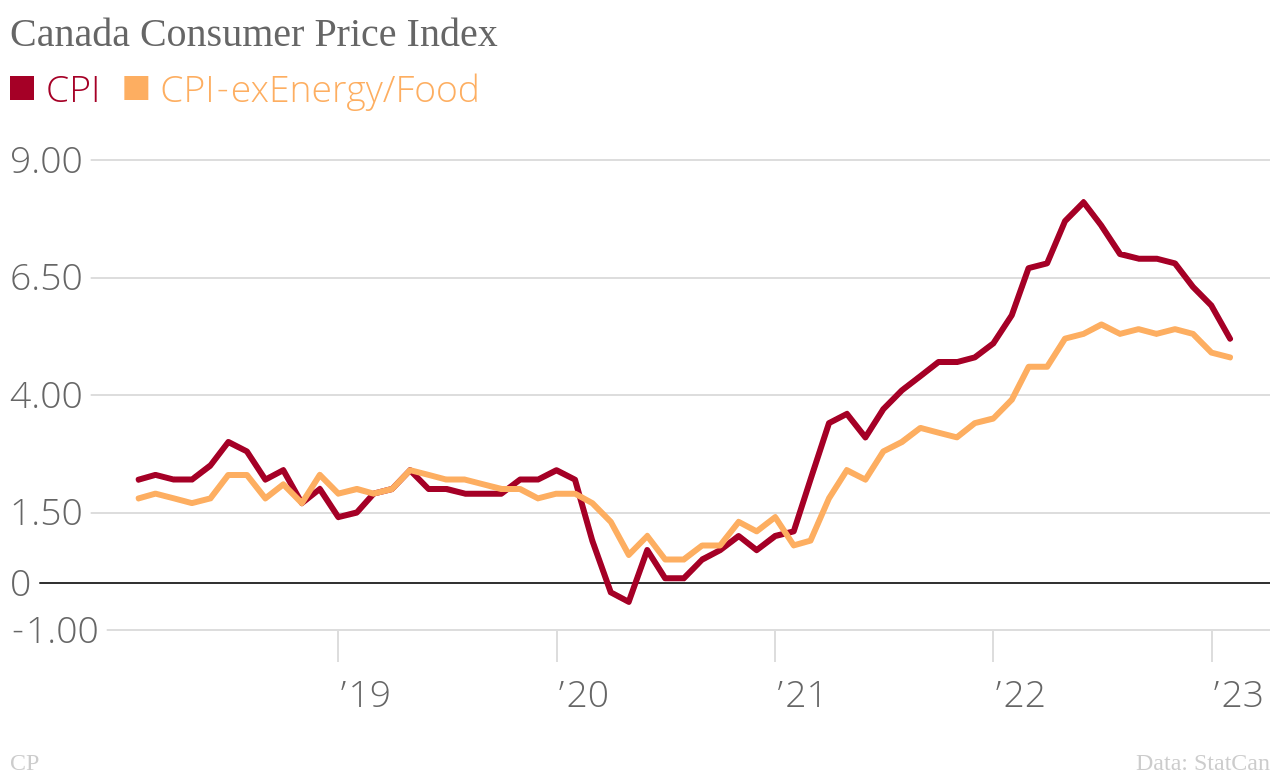

- Softer headline inflation than "expected" by the market.

- 5.2%

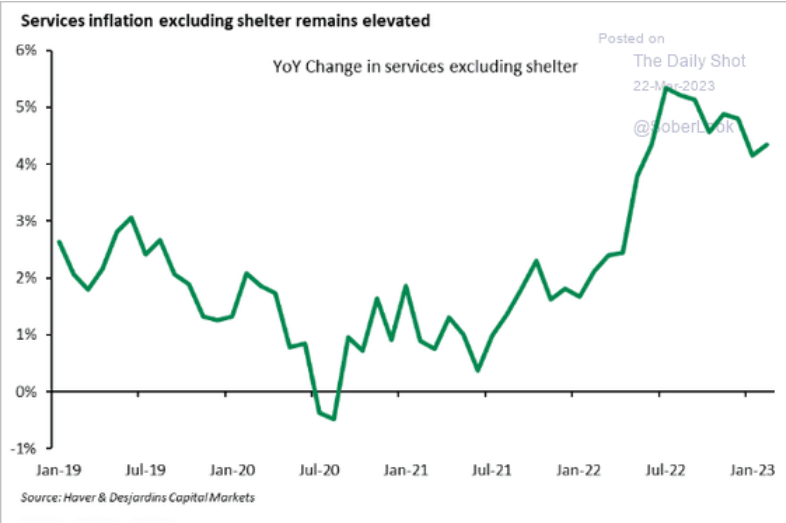

- But there is nothing indicating a collapse of growth of the core price drivers and "services" inflation continues to hold.

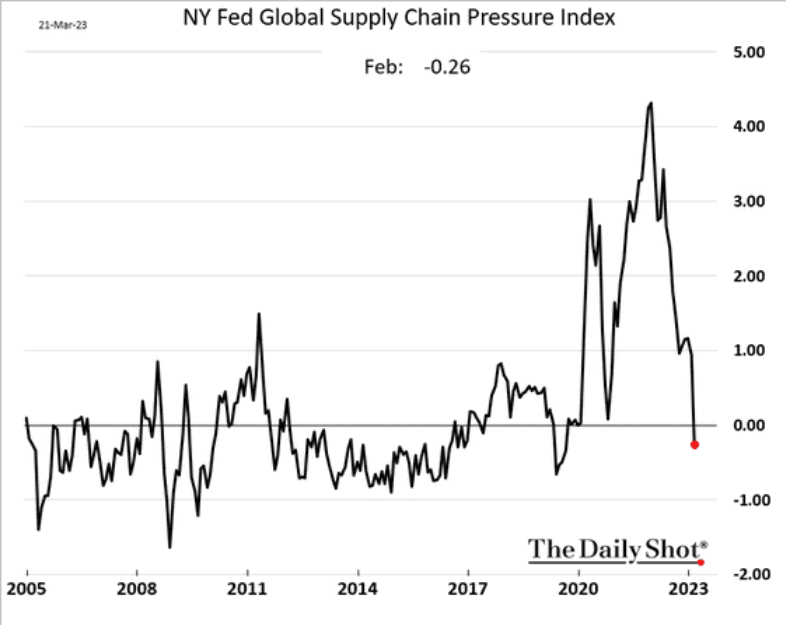

- Supply chains have eased entirely which accounts for some of the slowing of price increases.

- However, new investment continues to be strained in Canada as firms look to when the bottom of the recession cycle we are in is going to come to an end.

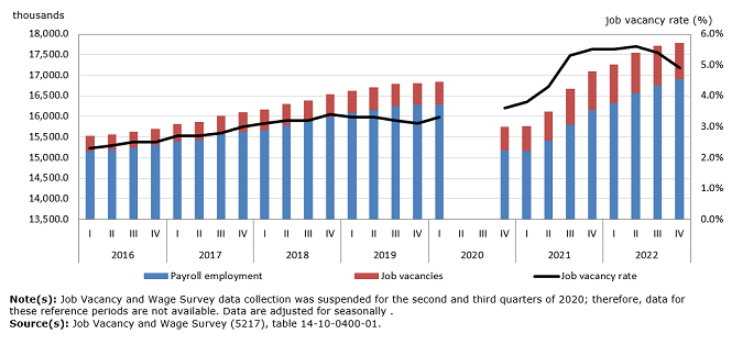

- Wage growth continues to lag.

- The Job Vacancy Rate has been decreasing across the economy since mid-2022 as more workers come back into the market and immigration picks up.

- The above means there is little reason for the governments to be pushing so hard to get people into the labour force.

Ontario Skilled Trades

Ford's PC Government in Ontario has cynically selected its favourite type of worker (skilled trades workers) as a focus for new spending.

- Click here for my (still draft) briefing note on the Ontario budget and Skilled Trades and why it is cynical (and incorrect) to keep talking about crisis shortages of skilled trades workers. It is my long-held position that the government should not be pushing specific job classifications in response to short-term, employer-identified job market desires. Employer, instead, should raise wages and do on the job training to attract talent instead of the government trying to slow wage growth by pushing too many people into a particular trade.

In a series of announcements, the Ontario government has focused on a supposed labour market crisis in skilled trades in their "Working for Workers" (sic) Act. Yesterday's announcement added to this with $224 million to build and upgrade skilled trades training centres. This money is on top of the $90M announce in 2022 and $75M promised over the next three years.

This money is for "training and re-training" schemes for workers moving into apprenticeship programs run by the craft unions. The newly announced money is capital funding to build training centres and leverage federal money assigned to "future skills" building.

While union-run training centres are something that has happened for years, it is an odd process of privatization of college and publicly funded trades programs. Colleges can apply if they form a partnership with one of the unions, but the announcement was clearly focused on giving money to unions with members likely to vote for Ford's PCs in the next election.

The announcement was made in a LiUNA-run training centre. But, every private sector union that represents construction-sector skilled-trade has these centres.

It follows a program in the USA that the Democrats (and sometimes Republicans) use to gain skilled trades unions endorsements. Both the Workforce Innovation and Opportunity Act (WIOA), the Trade Adjustment Assistance Act (TAA) both finance the trades unions training and apprenticeship centres.

It is usually successful at getting their endorsements.

Picking winners

There is a new game in town where the government is picking winners. For years, neoliberal governments around the world were vocally opposed to supporting specific industries and specific companies. The new geopolitics and recent shifts in USA-styles of capitalist support means countries are scrambling to respond.

In Canada those investments are unfortunately going to be carbon capture, electric-vehicle supply chains, hydrogen production, and clean electricity production.

It is too bad that both carbon capture and storage and hydrogen have no future in the battle against climate change. Carbon capture is a technology that does not exist and (the blue) hydrogen production supported by Trudeau's friends in the oil and gas sector is not clean at all. Indeed, both are loss-leaders in a sector that should instead be financing government-directed transition to readily available technologies.

The Canadian government seems to have been taken-in completely by the sales pitch of the oil and gas sector.

Things are a little better in the Auto sector. However, it is going to be difficult to get continued private sector investment in Canada under the current program.

In an analysis released by "Clean Prosperity" (no, I do not think they are a great source of information) the gap between the USA and Canada is large because of the IRA:

US tax credits for a battery plant equate to around C$2 billion ($1.5 billion) annually over what Canada currently offers.

The direct support for capital-intensive industries, especially the auto sector, is not new. What is new is just the blatant profit subsidies with barely any strings attached coming from the state creating a situation where there is competition for public assistance.

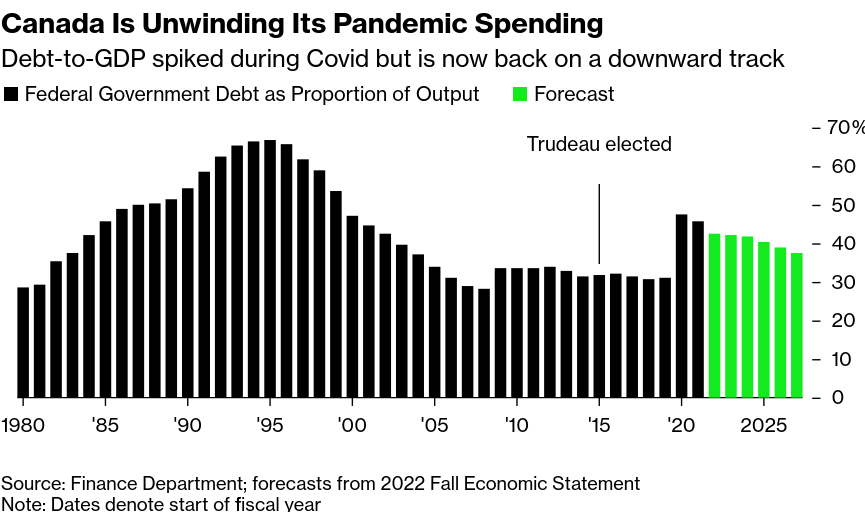

There is still plenty of room for the government to spend on public-support services and production. Even at the height of the pandemic, public spending was restrained compared to the 1990s. And, now that the health crisis spending has retreated, Canada has basically nothing to show for it in terms of new production and excess spending on profit subsidies was one of the reasons for inflation we are experiencing now.

If the government shifted to continue sustain spending, but put it into supporting endemic production Canada would be able to compete with the USA.

Unfortunately, choosing industries with no future is a good way to ensure failure.