March 22, 2022

Canada Green Bond and climate

- Nuclear energy, oil, and transport are excluded from the green bond.

- Unfortunately, all revenue for the government goes to the same place, so a green bond does not guarantee any additional money for green investment policies by the government.

- Hidden from view is the increase in usage of fossil fuels for energy that is happening around these announcements.

- EU facing diesel shortage

The world’s fourth largest oil and fifth biggest natural gas producer is marketing C$5 billion ($4 billion) of December 2029 bonds which may yield 2.5 basis points over the Canada bond due June 2029, according to people with knowledge of the matter. The transaction is expected to be priced as soon as Tuesday and dealers have already gathered orders totaling over C$9.5 billion, said the people.

Last month, Tamarack Valley Energy Ltd. priced the first sustainability-linked bonds by an oil and gas driller in North America. Pipeline giant Enbridge Inc. sold the securities last year via a bond sale that penalizes issuers with higher borrowing costs if they don’t meet certain environmental, social and governance metrics.

It would be “madness” if countries “become so consumed by the immediate fossil fuel supply gap that they neglect or knee-cap policies to cut fossil fuel use,” Guterres said in a pre-recorded address to the Economist Sustainability Summit on Monday.

In the U.K., Prime Minister Boris Johnson has suggested the government will seek to revitalize oil and gas production in the North Sea and is open to boosting all forms of energy, including fracking.

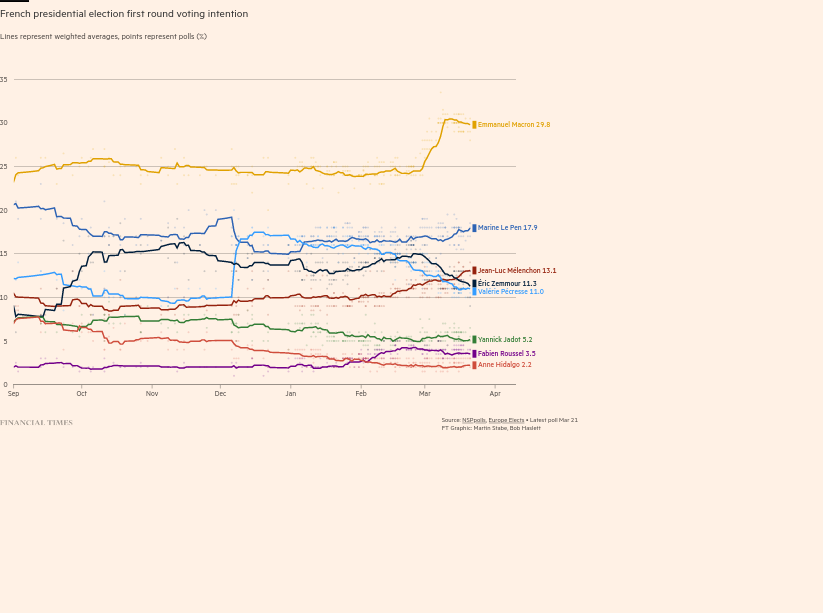

Mélenchon has steady rise in polls

Russia has avoided default, but money still slow

Russia’s latest interest payment on its dollar debt has been processed by JPMorgan, according to a person familiar with the situation, in a sign that Moscow is servicing its foreign currency debt and avoiding a default.

The $66mn coupon on a Russian government bond maturing in 2029 was due on Monday, and was handled by the US bank after it sought the necessary approvals from the US Treasury Department, the person said. The cash has been passed to Citigroup, which as the payment agent is responsible for distributing the cash to investors.

The payment follows a $117mn coupon paid on two of Russia’s dollar bonds last week, with Moscow confounding many investors’ expectations of an immediate default. The finance ministry had previously said western sanctions could push Russia into an “artificial default”.

Food disruption responses

- The impact of the war in Ukraine are global.

Ireland’s government plans to pay €400 per hectare to farmers for them to grow grains such as barley, wheat and oats under a €12mn “wartime tillage” programme to help alleviate a food supply crunch caused by the war in Ukraine.

The tillage plans are focused on production of more native crops that have a low demand for chemical fertiliser. Ireland is heavily reliant on imported fertiliser from Russia and Belarus

Market

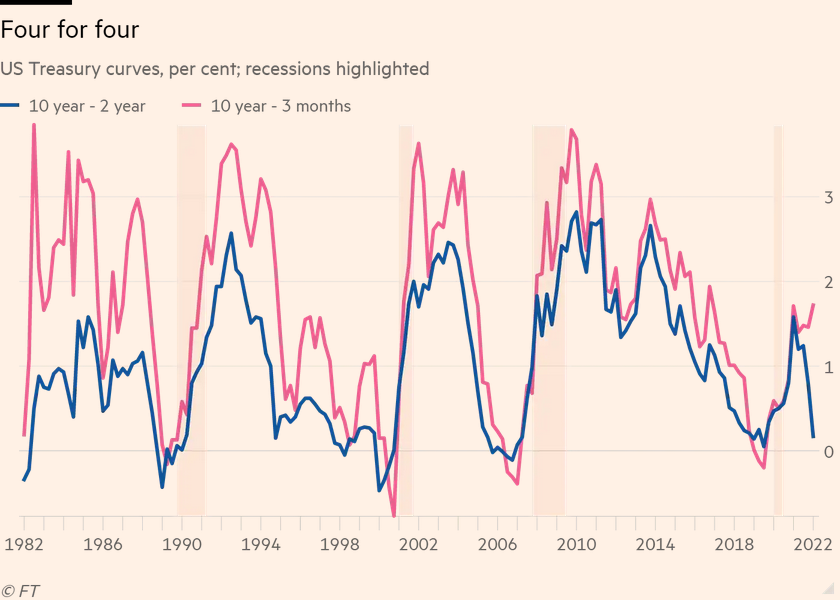

- The US government bond market is suffering its worst month since Donald Trump was elected president in 2016.

- Brent crude, the international oil benchmark, rose 2.6 per cent to $118.64 per barrel.

- “The marginal higher-risk company is having a more difficult time accessing capital than they would have a month ago,” said Steven Oh, the head of credit and fixed income at asset manager PineBridge.

- Powell on Monday reiterated that the Fed could soon reduce its $9tn balance sheet. He exacerbated the sell-off with a hawkish speech, in which he left open the possibility of 50 basis points rate increases in the coming months.

- The drop-off in flotations has been prompted by high volatility across financial markets and a sell-off that has wiped more than 31 per cent off the average company in the Russell 3000 index — one of the broadest US stock market gauges.

Some supply chain disruptions self-inflicted

-

Supply chain disruption in Australia as government builds subs instead of ships.

The number of Australian-owned ships is set to wither to just nine by 2024, according to data from Maritime Industries Australia Limited, an industry association. That comprises six roll-on, roll-off ships used in the Bass Strait and three cement ships but no container ships or oil tankers. In the 1980s, the country boasted about 100 Australia-domiciled ships.