March 21, 2022

Public Sector Job Cuts to fight inflation

Here is where neoclassical economics' understanding of inflation really starts to hurt workers.

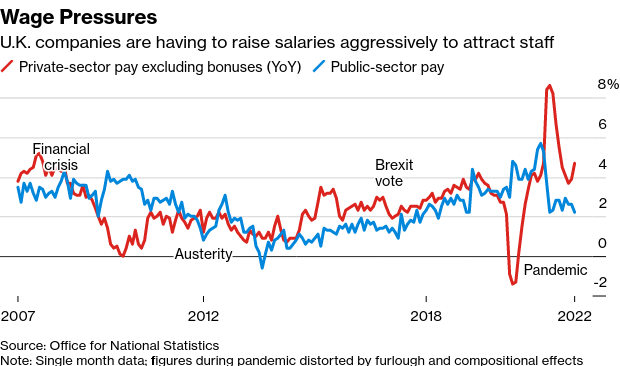

Their logic is that it isn't capital's fault that inflation is going up, it is the workers' fault for demanding too high wages. So, if we put more workers into the private sector labour pool, then inflation will go down as workers fight over reduced wages.

Which is, of course, nonsense.

It is amazing that high public sector workers' wages are the cause of literally every economic problem going in modern economics.

Sunak said Sunday that he would take steps to help. Philip Aldrick reports how the chancellor could take aim at the swollen public-sector workforce as he tries to ease the worst labor shortages in decades and keep a lid on inflation.

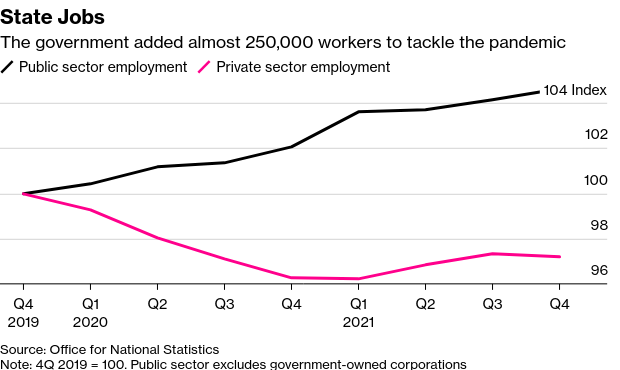

The Treasury and Bank of England have identified the surge in government employment during the coronavirus pandemic as a cause of the Britain’s tightest jobs market in decades, which has left companies struggling to get the staff they need.

Sunak has already made a commitment to cut public sector headcount and may address the issue in his Spring economic statement on March 23. It’s part of a broader effort to protect the economy from soaring energy and commodity prices due to the war in Ukraine.

“Public sector employment is contributing to the scarcity of workers, so there is a case for trying to support that transition to the private sector now,” said Tony Wilson, director of the Institute for Employment Studies. “After all, there has never been a better time to look for another job.”

BOE Governor Andrew Bailey has raised concerns about the public employment crowding out companies and contributing to an wage-price spiral.

“I would observe that public sector employment has risen during the Covid period, so that is competition for demand for labor,” Bailey said in testimony to members of Parliament last month. He made a similar point to in January, saying: “It is a very tight jobs market… The public sector has expanded, so that is creating more competition.”

A proposed tax cut on fuel prices, which motor groups are calling for at the Spring statement, would also restrain inflationary pressures. Releasing public sector workers to fill shortages in the private sector would be another example of policy co-ordination.

“Anything you can do to support high employment and keep prices down will help business and may reduce inflation,” said Wilson at the Institute for Employment Studies. “Next week, the Spring statement is a moment for the chancellor to decide whether now is the time to support the transition.”

War's larger effects starting to be felt

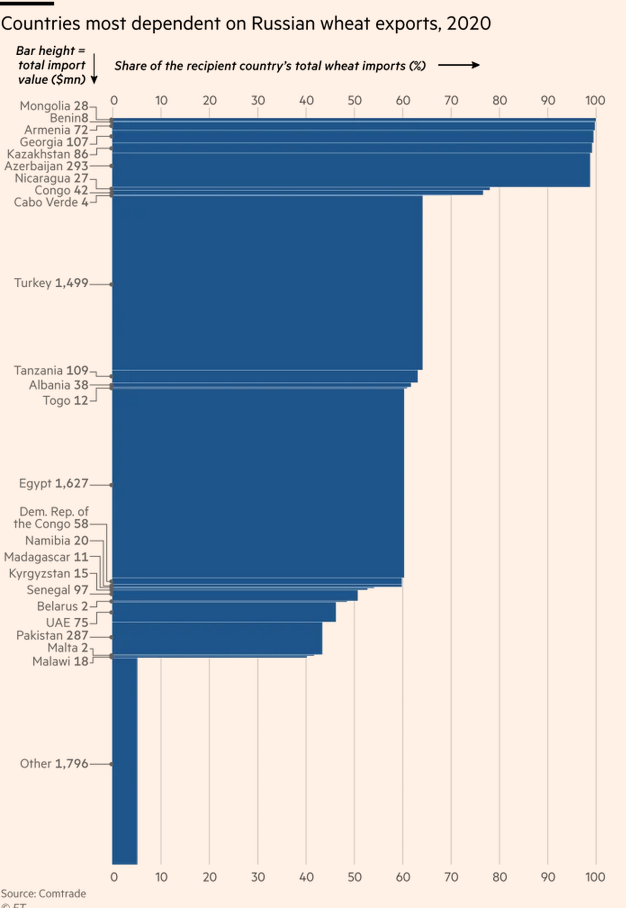

- Wheat prices in Lebanon, Egypt, across the Middle East and North Africa have skyrocketed.

- Wheat is already heavily subsidized by the state in many countries as it is a political and social protection strategy.

- Revolutions are started on bread price increases.

- Countries will not be able to afford to subsidize all increases in bread prices.

- Fertiliser prices have also increased to levels not seen since 2008/9. The impact on food is yet to be felt.

Having seized power eight months ago, suspending parliament and the constitution, Tunisian president Kais Saied has yet to come up with a plan to address the deteriorating economy. In recent months, the government has sometimes fallen behind in paying public sector wages and there were flour shortages even before the war.

“This is very dangerous to the president,” said Youssef Cherif, a political analyst who heads Columbia Global Centers in Tunis.

Egypt has adopted drastic measures to ensure that its subsidised bread programme, which feeds 70mn people, will remain on course despite the war. Officials say they have four months’ worth of wheat in their granaries, and the local harvest will start in mid-April.

On Monday, the government devalued its currency and raised interest rates as the central bank moved to contain the impact of the war in Ukraine on the economy. The country also set a cap on the price of unsubsidised bread, which had shot up in recent weeks. Chart showing countries most dependent on Russian wheat exports

Markets are down

- S&P is still down more than 6% this year after record gains in 2021 and bigger drops may be in the cards.

- Egypt devalued its currency and raised interest rates as the central bank moved to contain the impact of the war in Ukraine on the country’s economy.

- In stock markets, Europe’s Stoxx 600 were flat and the US benchmark S&P 500 dropped 0.4 per cent while the Nasdaq Composite declined 1.15 per cent in early trading

- Brent crude, the international oil benchmark, increased 6.3 per cent to $114.74 a barrel