March 2, 2023

Losing the fight for the climate

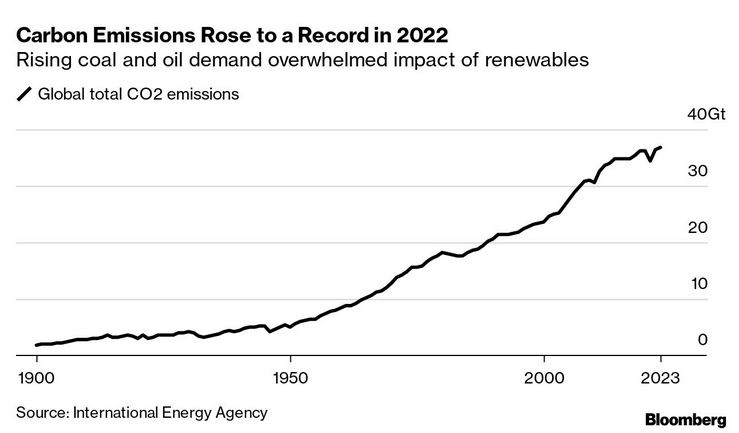

Only because China was fighting COVID with lockdowns does this graph not look even worse:

If anyone thinks that Capital is going to save us, you only have to look at the realities of global production to see that is ridiculous.

- Asia’s emerging markets lead increase due to coal-fired power

- EU (-2.5%), China (-0.2%) emissions retreat on weaker industrial production

- US emissions grew by 0.8%

- Global energy-related emissions rose 0.9% to more than 36.8 billion metric tons in 2022, IEA data show. (BN)

Oil and gas investment is still in positive territory. There is no worry that oil and gas will continue to increase in production.

On the flip side, we also see declining investment growth in renewable energy generation. Even with the billions of dollars being promised on "energy transition", it just is not profitable for most production to actually transition.

Worse, there are many predictions that there will be a shortfall in supply compared to demand in the coming years. This because the need for electrical energy is growing much faster than investment. The lag-time between market signals and the investment in new production is too large not to cause a crunch.

There are two results of this. Either coal and gas-fired energy production is turned back on (or not off, as it were) like in response to the Russian invasion of Ukraine. And/or, the prices go way up and there are shortages.

Either way, capital benefits from our misery.

There is an alternative, of course. The governments of the world could realize that The MarketTM is not going to save us and invest directly in publicly owned renewable energy production.

I know. Ridiculous idea.

Public vaccine production

Even when Canada "picks winners" in vaccine production, it cannot figure out how to do it correctly.

Novavax has warned there is “substantial doubt” about its ability to remain in business as the Covid-19 vaccine maker battles weak demand for its jab and uncertainty over government contracts.

Novavax shares crashed by more than 25 per cent in after-hours trading following the publication of its financial results. (Feb 28, FT)

This is just a game of handout demand. Novavax has $1.3B in cash on hand, but continues to lose money on its vaccine production because the global subsidies are "too low".

In November, Novavax Inc ended its agreement with Gavi (the privatized UN Vaccine Alliance), to sell its COVID-19 vaccine to low- and middle-income countries.

The company cited Gavi's failure to procure the 350 million doses it had agreed to buy in May last year for the COVAX facility.

Novavax received a non-refundable advance payment of $350 million from Gavi last year (2021) and an additional $350 million this year (2022) after the vaccine got the WHO's emergency use listing, the company said.

Canada, of course, signed a deal with Novavax to support vaccine production in the new government-financed facility operated with the NRC that was just certified to produce vaccine.

The NRC facility is specialized in biologic drug production, but the government continues to pin its hopes on public-private partnerships with drug companies. Unsurprisingly, the only companies that would go in with the government are ones that need handouts to survive while the funnel money into profits.

Gavi, for its part, claims that Novavax has no ability to produce what it promised:

"It is clear that Novavax will not be able to meet its commitment to manufacture" the doses under the agreement for COVAX before the end of 2022, a Gavi spokesperson told Reuters.

That's nearly a billion dollars of public money for drugs that have not been produced and hundreds of millions being used in a profit siphoning game.

This is not to mention the millions of dollars spent by government to support the research and development of the drugs, tax credits, and actually building production facilities.

Welcome to private pharma.

Manufacturing graphs

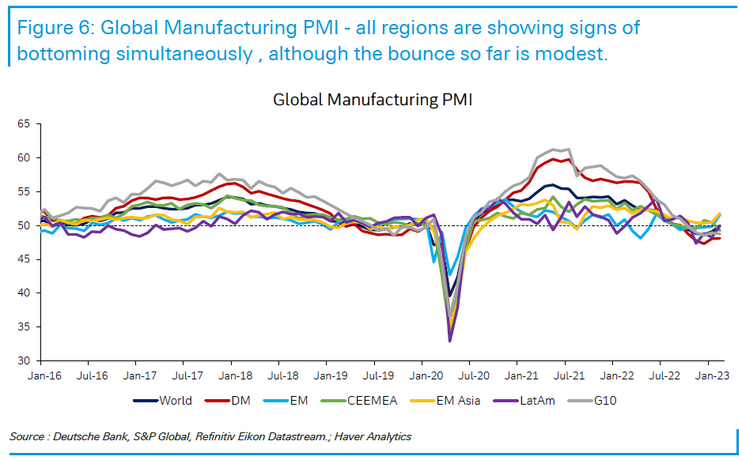

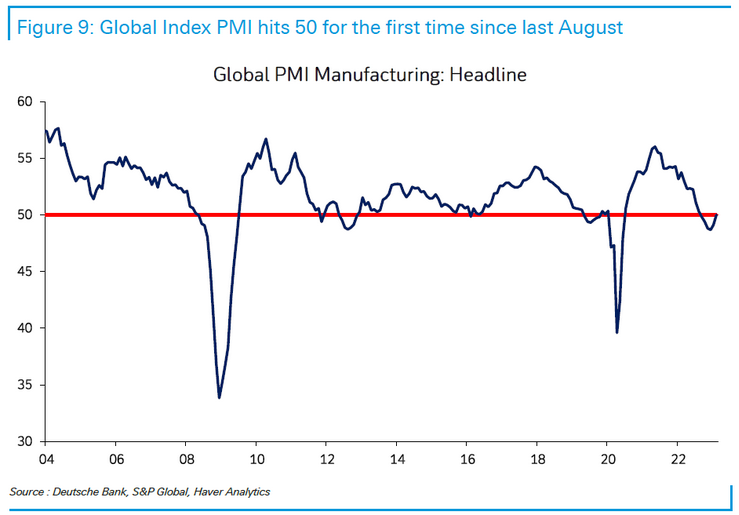

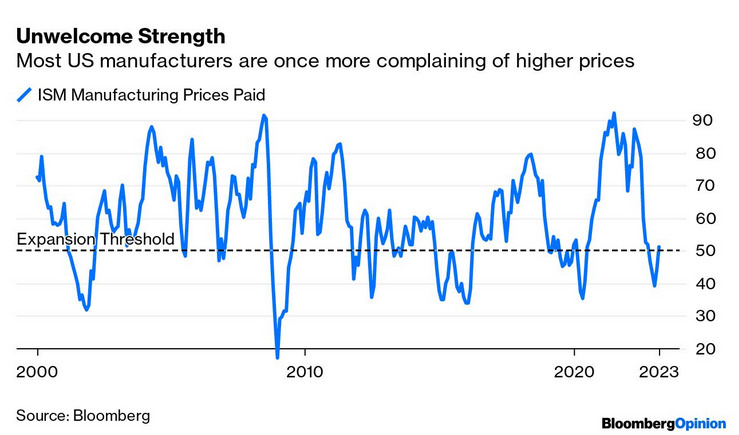

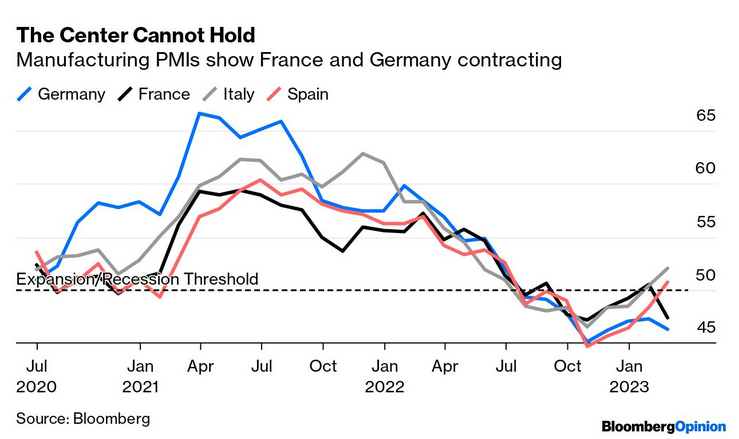

Some fun ones from Authers' this morning showing manufacturing picking up (mostly because China manufacturing is picking-up), but prices also rising for purchasers.

Not a great sign that inflation is done.