March 18, 2024

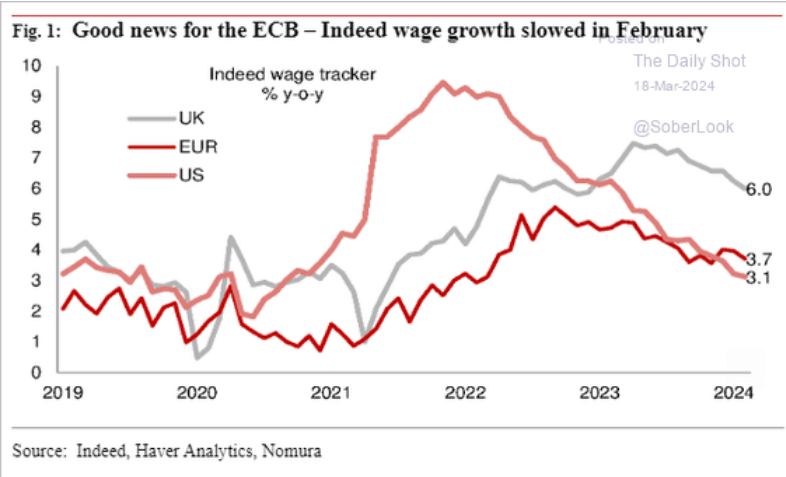

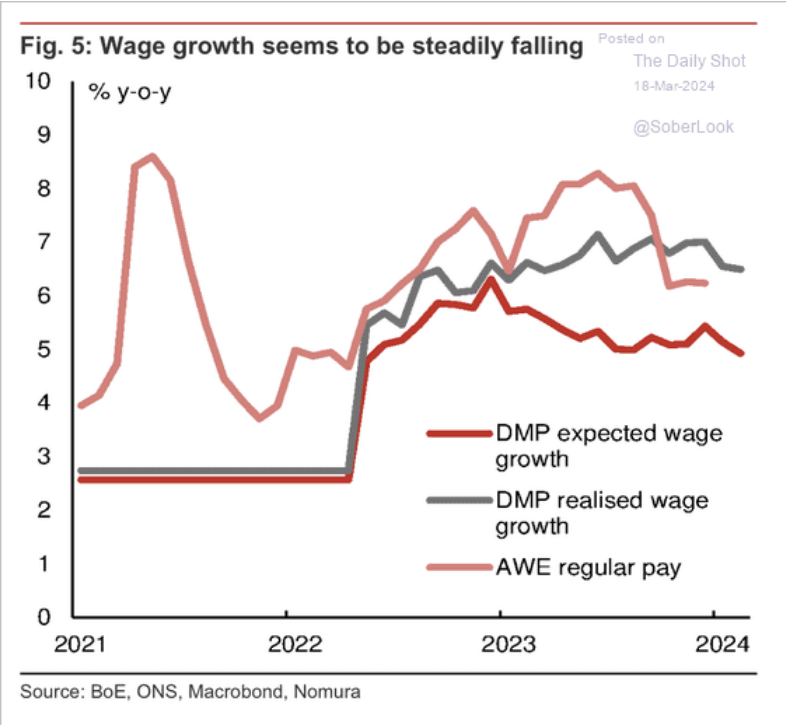

Wage gains in Europe are slowing

Wage gains are continuing to fall across Europe (and the UK) as inflation comes down.

This is bad news for workers who are still in the process of making-up some of the losses during the period of very high inflation. A period that continues for basic goods which affects those on lower income more.

For the UK, it is a period of the worst sentiment on the economy in a generation. Which is very bad indeed for the Tories, not to mention the population.

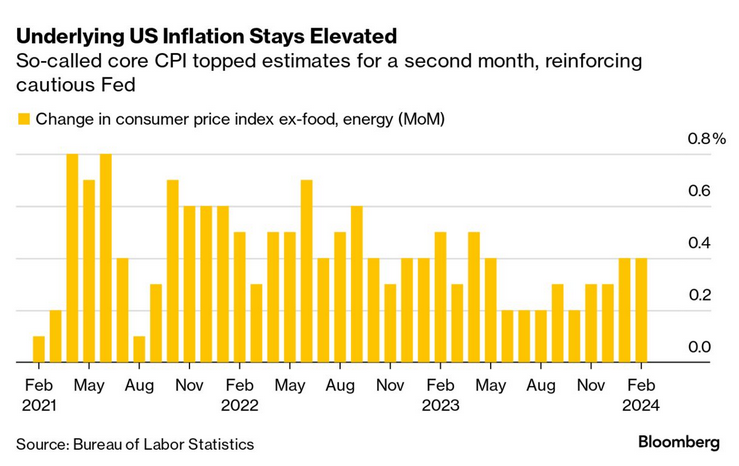

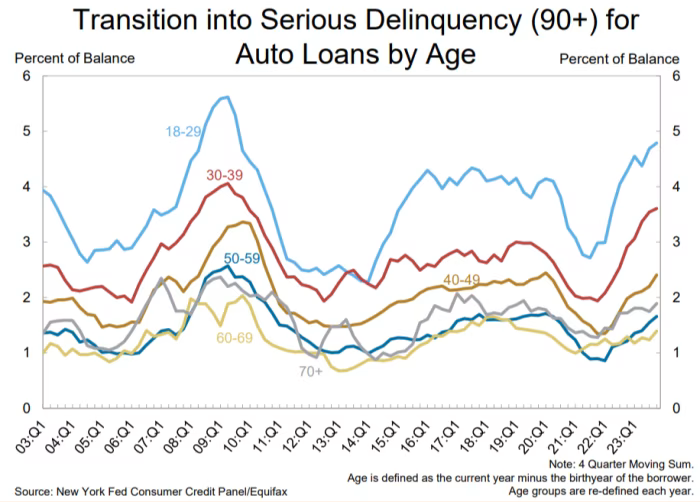

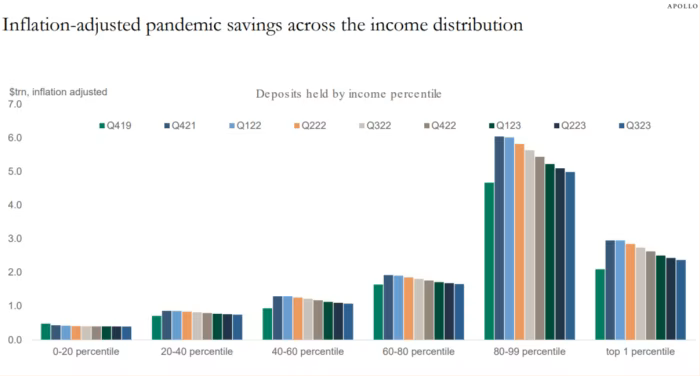

In the USA, we see a decline in consumption and an increased debt load for those at the bottom end of the income scale. This is a clear match to the lower wage gains:

In the USA, inflation adjusted personal consumption is trending down:

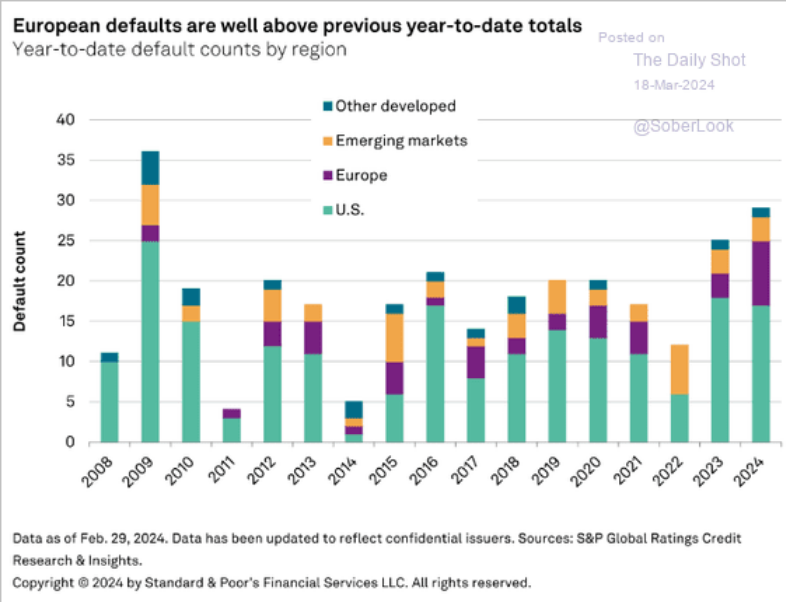

It is a situation that is rolling through the system with defaults way up in Europe as consumers and businesses are feeling the pinch of higher rates on purchasing.

As we have noted before, this is exactly what higher central bank lending rates are supposed to do.

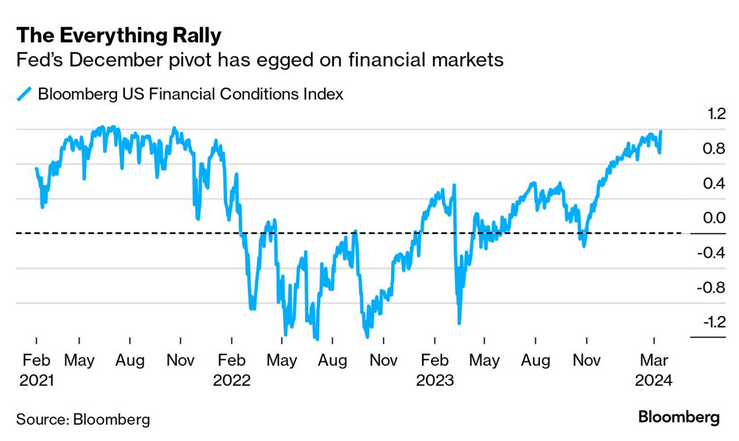

Weirdly, this is happening in the context of the ever present shine of the stock market. The USA equity markets are at an all time high. There is a lot of speculation why this is from "the economy is really just really great" to "its an AI bubble" to "investors are idiots". The issue is that it is all partly true.

There is growth in the real economy driven by all sorts of things from massive public procurement and profits subsidies to there still being lots of excess money in the pockets of wealthy people to investors really are just like plankton moving in the swell.

The USA consumer, even though they are drowning in more debt and wages growth is flat-lining, seems to have an increasing expectation their own wages will which is leading to more positive outlook on life generally.

It does seem like different parts of the system are looking to the previous year to make their pronouncements of how things are going to go for the rest of this year. I am not sure that is the best way to judge the situation.

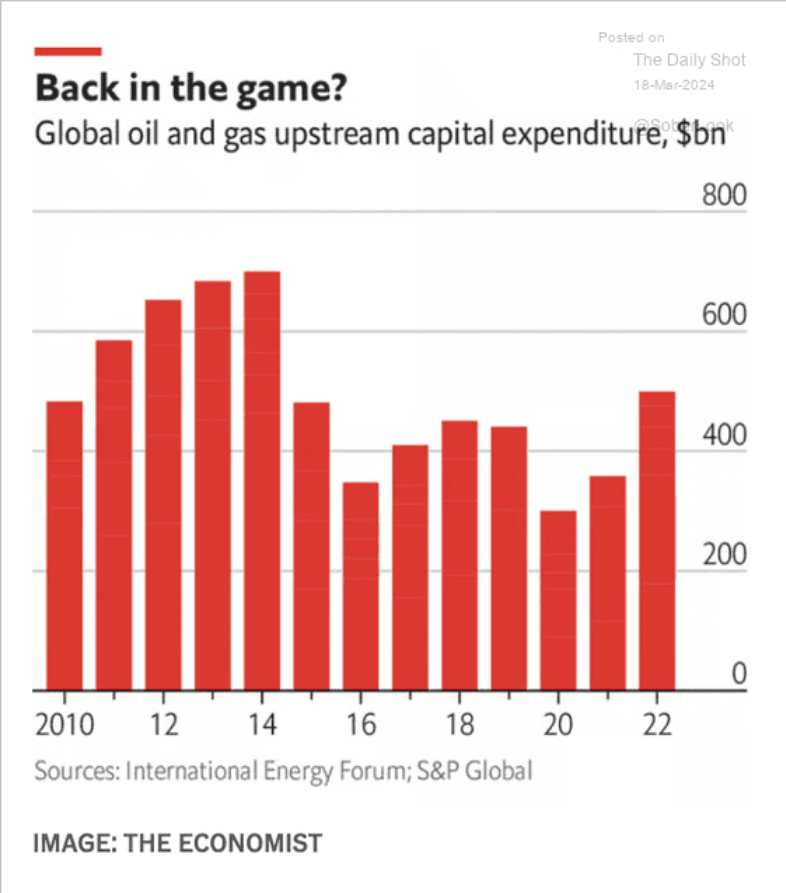

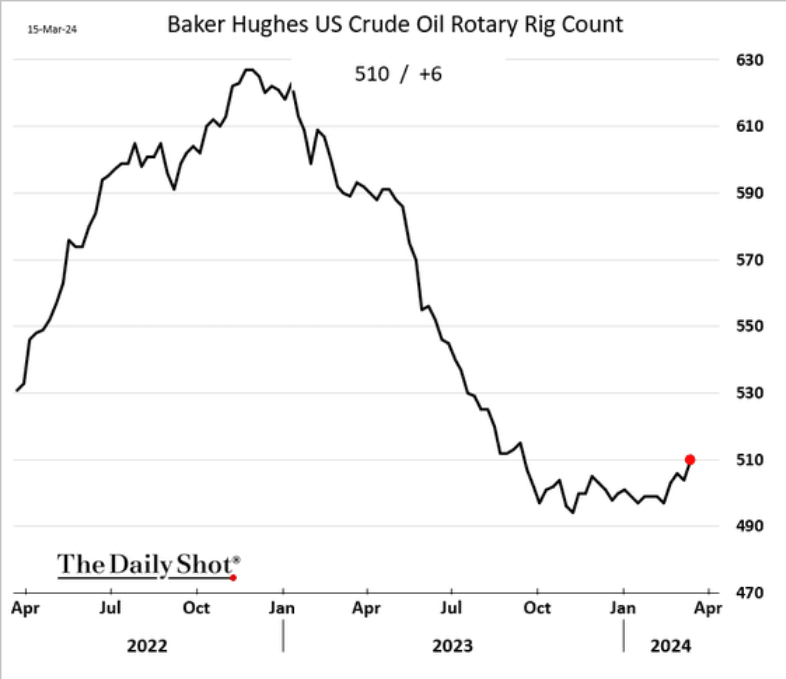

Energy

Oil and gas investment is up. Which is, of course, not great for the climate and an indication that we are not doing what we should be on investment.

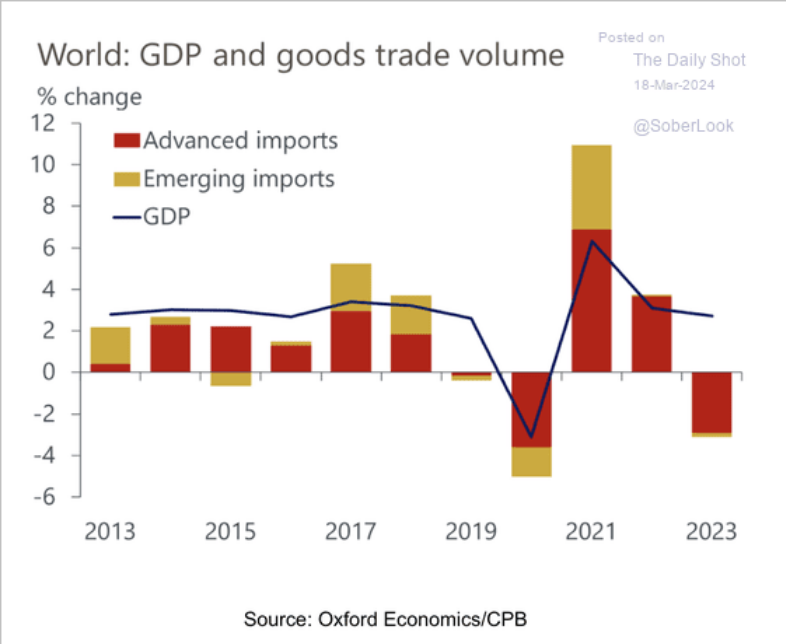

Trade

Trade took an unsurprising dip last year, but GDP stayed up because of subsidies.