March 18, 2022

Russia default update

Russia seems to have avoided a technical default while still technically being in technical default.

People want their money. Russia paid the money, but the people that want their money didn't get that Russian money. So, it is sitting in the ledger of one of the intermediaries.

The strange world of money and how most "money" doesn't actually move when it is transferred has come into focus.

For those who are interested in how money is transferred across boarders, have a listen to this.

From Bloomberg:

Aside from the Fed, the big question coming into this week was whether or not the Russian government would be able to pay $117 million in interest on dollar bonds. During the U.S. day on Thursday, signs emerged that they would.

Bloomberg News reported that JPMorgan Chase & Co., the correspondent bank, processed funds earmarked for the interest payments and sent the money to Citigroup Inc., which is acting as payment agent on the bonds, according to people familiar with the matter. JPMorgan sent the money to Citigroup after it sought and received the required approvals from U.S. authorities on Wednesday, one of the people said.

There are still plenty of question marks — for example, European bondholders of Russia’s sovereign debt have received no sign of the funds, and the country’s corporate debt is another issue entirely — but investors seemed to breathe a sigh of relief. The implied probability of a default by Russia within the year inched lower to 57%, compared to a high of 80% last week, according to credit default swap pricing.

New word for you: "divergence"

The word in markets today is divergence, which is relating to how China and the USA are responding to the current state of the global economy.

The USA is focused on inflation. China is focused on the growth.

Investors worry that the USA central bankers are bad at understanding the economy and tend to drive it into recession. Investors are worried that China is becoming a poor place to put their money to drive profit.

There is a feed-back loop here that ends up no where good for anyone.

Then there are all the smaller players who are also "diverging" from the historically agreed path. Capital has international institutions that are supposed to set policy on things like this, but some major states are not listening to this orthodoxy anymore.

All this "divergence" is a result of the tacit acknowledgment that the theoretical economics orthodoxy is broken. That is, what was "true" is no longer able to hold up to reality. This has lead to a crisis of faith and therefore divergence as "political Capital" (central banks) seek new truths.

It would be all very entertaining if the consequences were not so real.

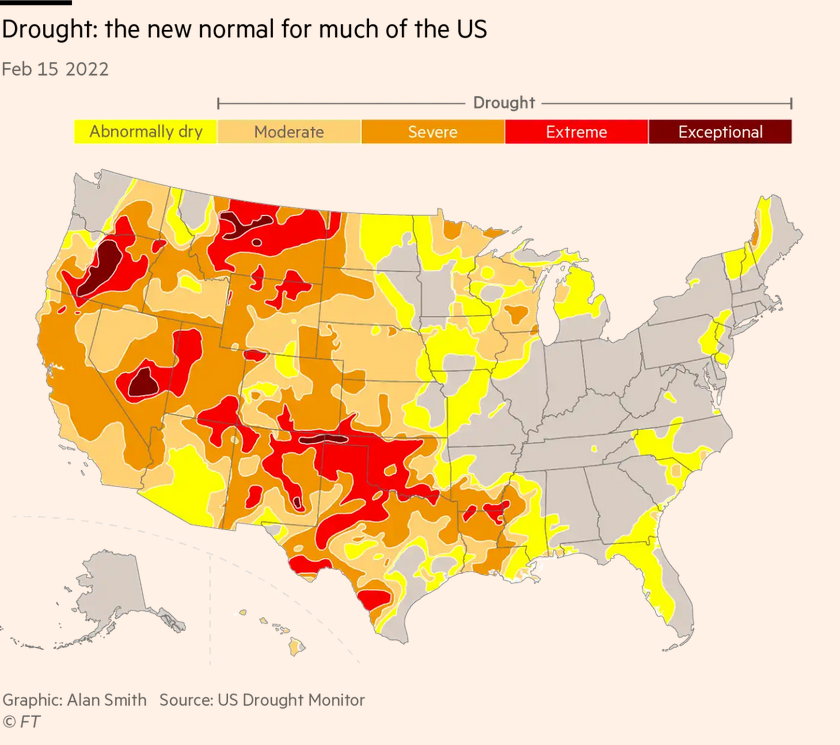

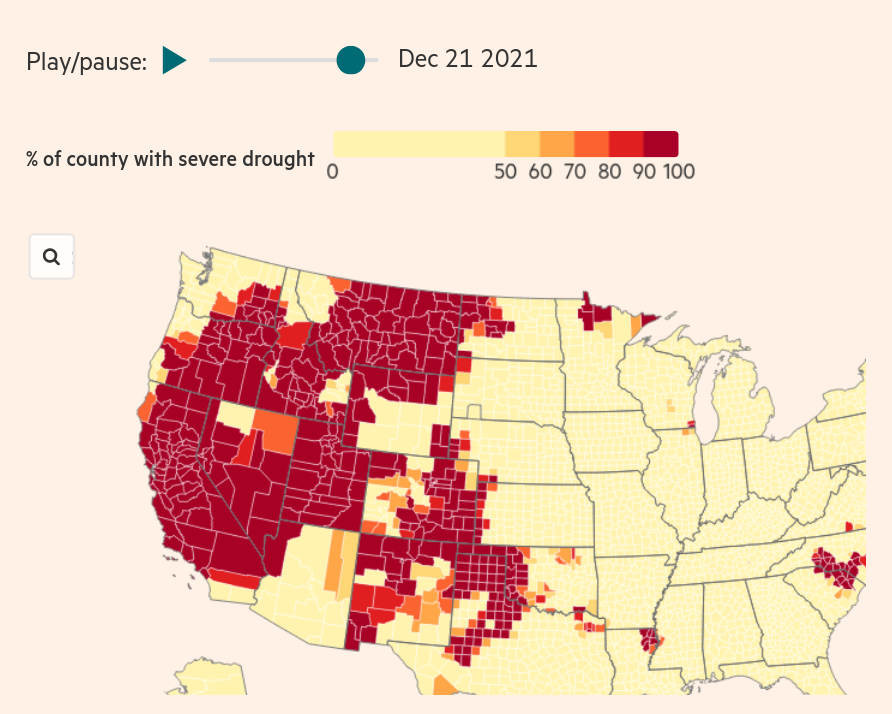

Drought in the US

Out of the news is the continued issue of climate change-caused drought in the USA.

A study published in the journal Science late last year estimated that people born in 2020 would experience between a two- and sevenfold increase in extreme weather events during their lifetimes, particularly heatwaves, compared with people born in 1960.

"State Owned" investment

Cutting-up investment between pension funds, capital funds, state-owned funds, direct state ownership, share-capital ownership, and private ownership is becoming a focus of "geopolitical" thinkers.

Here is a recent example from LSE in the UK. You will notice these papers are focused only on one part of the "type of ownership" question and basically leave out the logic of the market and profit-seeking (of which all the "types" above play the same game). Never mind that this "state-lead" investment is not at all new and is only interesting because of the historical low point of state-lead investment that we are in and that neoliberalism tells us that we should get rid of it.

The interesting part of these studies is the data. There is a tonne of public ownership (without the accompanying control) that exists in the world. Aligning this to who has that control is interesting from a Marxist perspective.

Costs of solar

In a rather big concern for people who care about the climate:

The [solar] industry has been slammed by a supply chain crunch, soaring commodity prices, tariffs and the Biden administration’s trade restrictions on panels and other equipment suspected of coming from the Xinjiang region of China — a big cog in the sector’s supply line.

Costs for new large-scale solar projects were up 18 per cent last year, breaking a long run of significant cost declines, and more than 10 per cent of projects due online this year have been delayed or called off as problems for the sector have piled up, the Solar Energy Industries Association, an industry lobby group, said in a recent report.