March 17, 2023

Macron has resorted to dictatorship to rob workers of their pensions

- Macron failed to get support in the parliament. This even with the full support of the conservatives and his "centrist" party.

- The far-right, far-left, and reasonable people who are not bankers are opposed to the reform.

- Is going to use a decree (which over-rides parliament)

- Parliament might sack the government through no-confidence vote.

- Workers are continuing their actions in the street.

Macron does not have support and is ruling as a dictator without even backing in the parliament.

Let's hope the continued protests against the cynical of "we know best and you deserve less" of capital shores-up the vote of non-confidence.

The government has now resorted to using the 49.3 clause 11 times during this parliamentary session, making it the second-most frequent user of the tactic since 1958 when the Fifth Republic began.

Banks. Still.

The slow-moving banking crisis continues.

A good picture is emerging outlining what the classical economists have said for a while: the banking sector was sucking value out of the economy.

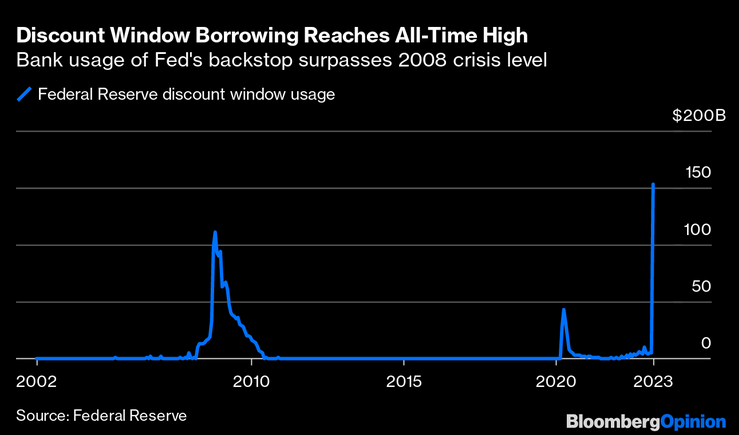

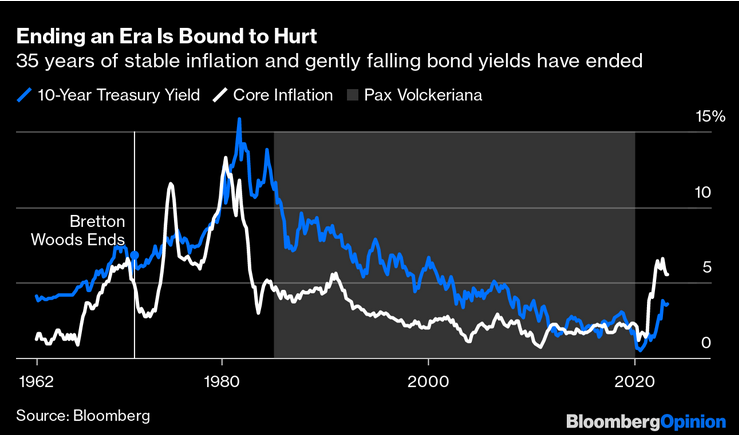

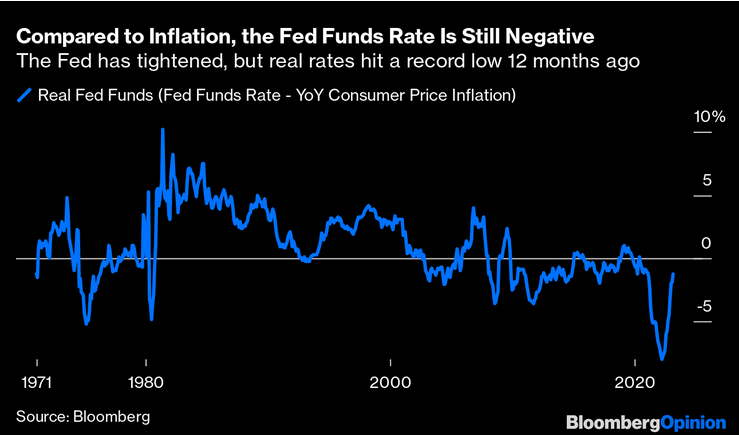

These images from Authers' post this morning in Bloomberg show a very clear indication of where the banking sector has been for 20 years and that there is value to make-up with inflation and "value" losses:

The question, of course, is: "What now?"

It is unclear how the central banking system and government intervention is going to evolve over the next little bit. The two options available to finance have sort have been played:

- Central banks (read: governments and taxes) have bailed-out finance through their pumping money into the banking system. But, governments are now saying it isn't going to be a 100% bailout. Apparently they only said that before they saw what the number was going to be.

Data published by the central bank showed $152.85 billion in borrowing from the discount window—the traditional liquidity backstop for banks—in the week ended March 15. It was a record high and a staggering increase from the $4.58 billion borrowed the previous week. The prior all-time high? It was $111 billion during the 2008 financial crisis. (BN)

- The large private banks (read: oligopoly and user fees) have bailed out First Republic. This is a risk-spreading operation used to slow-down the collapse. The time will allow banks to make sure capital does not pay for all their mistakes.

Bill Ackman is not impressed with the risk-spreading.

Spreading the risk of financial contagion to achieve “a false sense of confidence” in First Republic Bank is “bad policy”, Pershing Square’s Bill Ackman said in a tweet.

The activist investor said moves by the largest US banks to deposit $30 billion with First Republic “raised more questions than it answers.” The plan was devised with US regulators and included contributions from JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc., Wells Fargo & Co., Goldman Sachs Group Inc. and Morgan Stanley.

Ackman does not like it because he wants the government to bail the system out and not charge finance for it at all.

But, no one listens when there is money at stake. JPMorgan head Dimon is on the board of First Republic. If you want to look at a real "conspiracy", this is the time to stare:

Then there are headlines like this:

This roll-over of derivatives tied to stocks and indexes is about to happen in one of the most precarious times in recent memory. And, it is all debt priced well before the current turmoil.

It might be a fun day for market watchers because the cost of options is up. Where is all that current "value" going to go? Or, is a lot of it just going to disappear into the fictitious smoke of "financial crisis".

People think this is real money, but it is just bets on the direction of real money.