March 16, 2022

CPI Numbers out

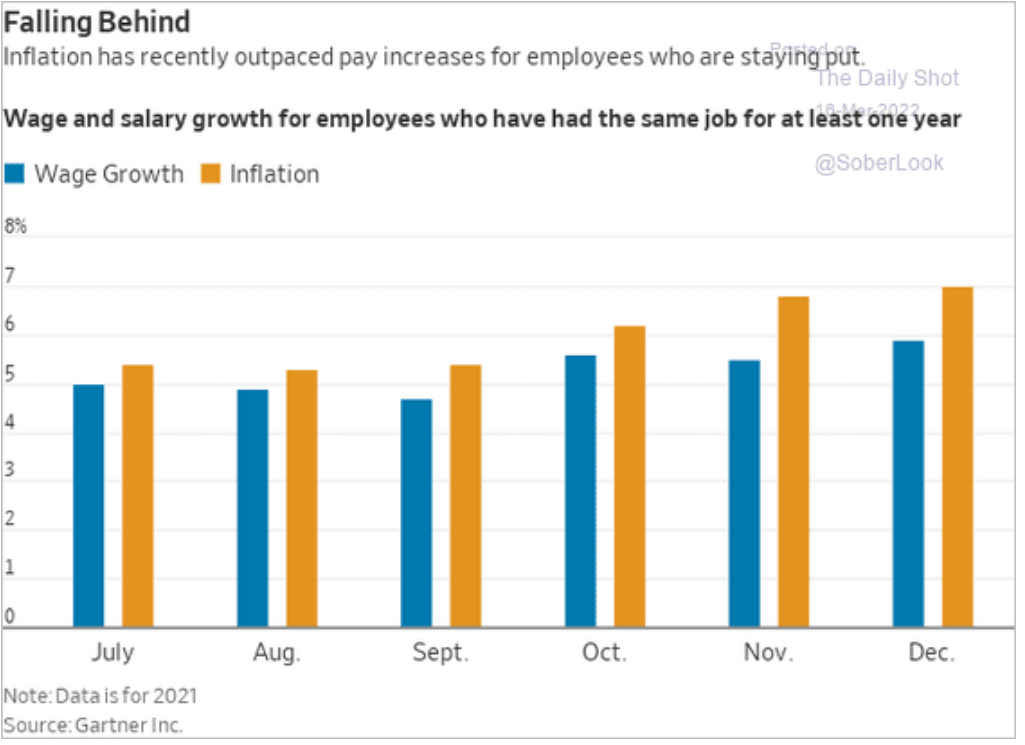

- 5.7 year-over-year increase in CPI

- CPI Numbers by Stats Can

- Grocery prices continue to climb in February (7.4%)

- Shelter costs rise at fastest pace since 1983 (6.6%)

15 Point plan announced to end Ukraine war

Ukraine and Russia have made significant progress on a tentative 15-point peace plan including a ceasefire and Russian withdrawal if Kyiv declares neutrality and accepts limits on its armed forces, according to three people involved in the talks.

The proposed deal, which Ukrainian and Russian negotiators discussed in full for the first time on Monday, would involve Kyiv renouncing its ambitions to join Nato and promising not to host foreign military bases or weaponry in exchange for protection from allies such as the US, UK and Turkey, the people said.

The nature of western guarantees for Ukrainian security — and their acceptability to Moscow — could yet prove to be a big obstacle to any deal, as could the status of Ukrainian territories seized by Russia and its proxies in 2014. A 1994 agreement underpinning Ukrainian security failed to prevent Russian aggression against its neighbour.

Watching the Chinese economy

There are several things going on:

- Lockdowns (45M people) and new COVID-19 infection growth (driven by low vaccination rates in Hong Kong and mainland)

- Housing slump (which doesn't mean the same thing as it would in the West, but is still bad)

- Chinese stock market slump with a pivot by the state to promise to secure financial markets

- Exports have been growing fast (indicating reduced local consumption or something else?)

Then there are the two things that make for interesting reading this morning:

- Saudi Arabia consideres accepting Yuan for Oil

- The status of the U.S. dollar as the reserve currency of the world is largely based on its importance in energy and commodity markets.

- According to an exclusive report from the Wall Street Journal, Saudi Arabia and China are now discussing pricing some Saudi oil exports in Yuan.

While probably not some real threat to the US dollar dominance in the medium term, it is something to watch. With all the other things happening around Ukraine and Russia sanctions, there is going to be pressure for companies in these countries to figure out trade in the East separate from the West.

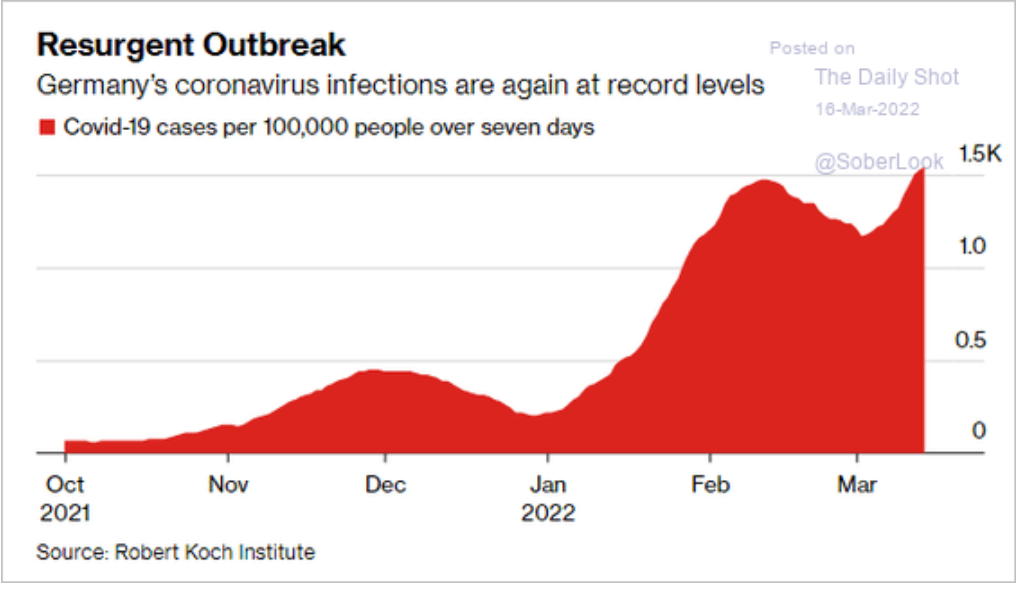

The German economic mess

- COVID-19 cases continue to rise after restrictions were eliminated.

- The economy is being crushed by the effects of the war in Ukraine

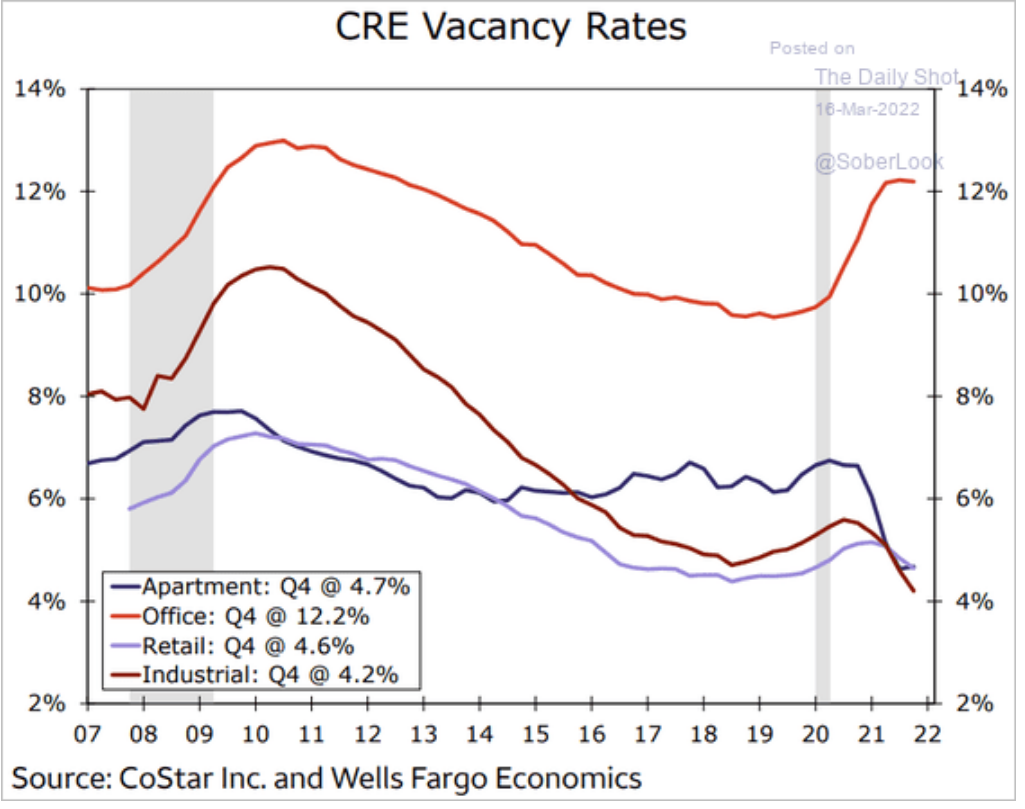

Office return?

One of the best measures of "return to work" (other than your manager demanding that they see your fingers move on your keyboard) for information workers is the price of their offices:

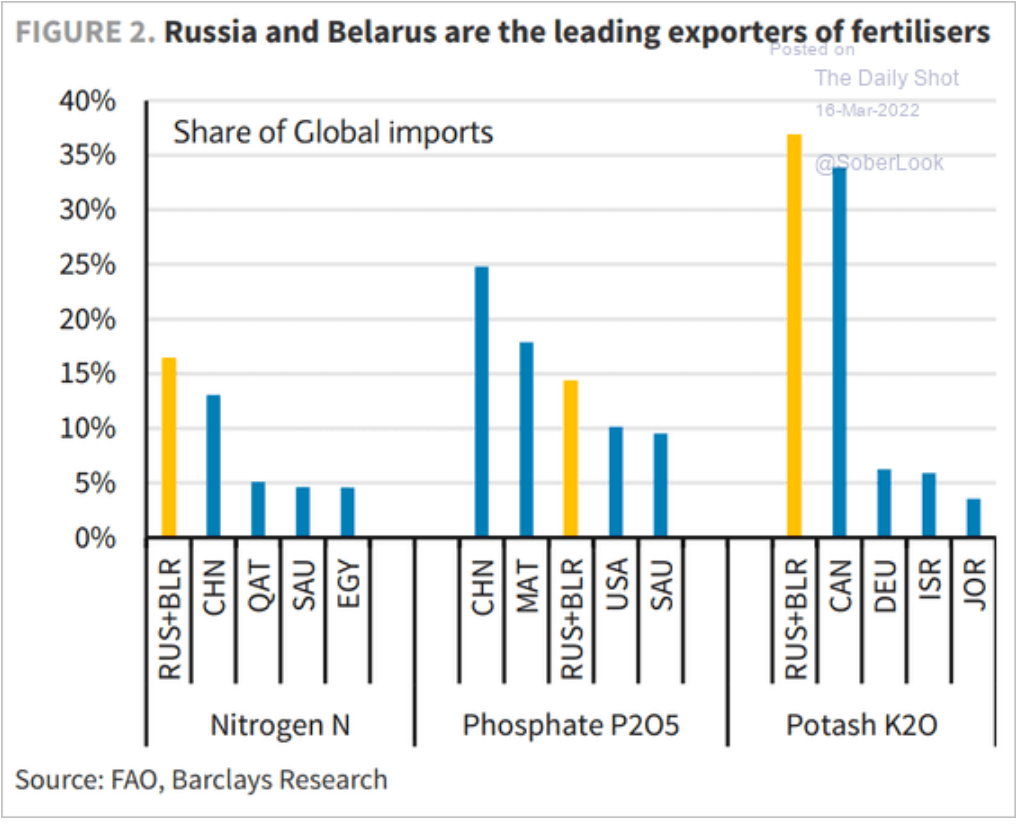

Fertilizer and other Russian commodities

The input costs affect output costs.

Canada competes directly with Russia and Belarus for potash production. I wonder if certain deputy prime ministers have a lot of money in potash and oil?

- Oil is falling from its high point trading price and is now below $100 a barrel.

- Russia produces twice as much oil as Canada.

- Coal is being turned on to replace Russian natural gas in Europe.

Is ESG not real?

You might read this and think that it could be good?

Sarah Bloom Raskin, Joe Biden’s pick for the top regulatory job at the Fed, was forced out of the nomination process in the Senate — partly due to her comments about climate change.

What were the comments on climate change?

centrist (sic) Democrat Joe Manchin joined Republicans in opposing her confirmation.

Republicans on the powerful Senate banking committee, which initiates the Fed’s confirmation process, had launched a campaign to block her advancement to become the Fed’s vice-chair for supervision after taking issue with her calls for regulators to more proactively address financial risks related to climate change.

The reality is that the financial system will not be regulated, it will simply respond to market indicators. Which means ESG, or at least the "E", will not be something that will be affected by regulatory shifts and thus is not an investment strategy beyond the normal.

Inflation in the US is eating wages