March 15, 2023

Canadian Production

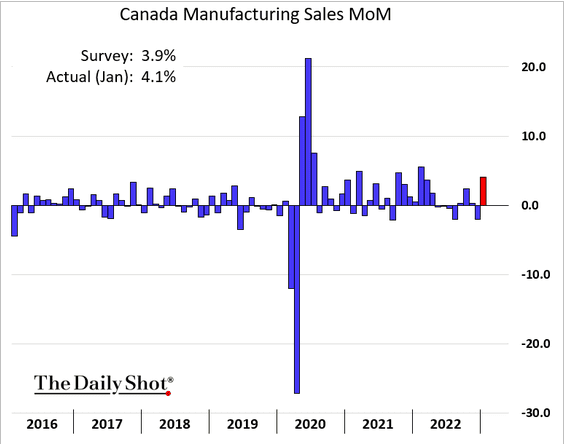

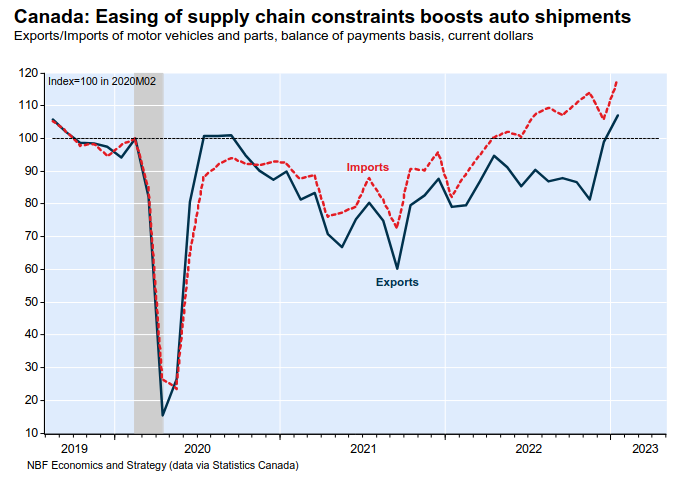

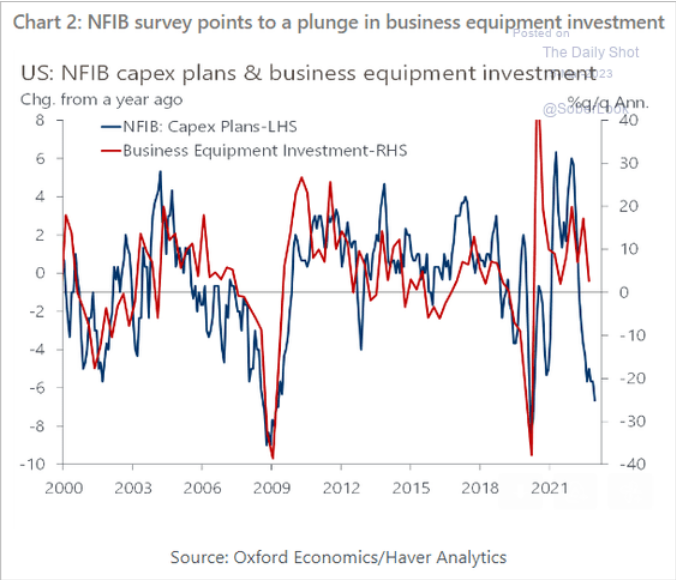

Auto production is back up along with all other manufacturing.

This is mostly due to increased utilization of capacity versus new capacity. Economists are calling it a bump from the easing of supply chain congestion.

As debt has gotten expensive, the investment in new capital is far behind what is needed to expand faster and further.

Banking monopolization

The opposite of what should be happening in response to the SVB collapse is happening. Instead of looking for systemic banking issues (say, in the issuing of debt at ultra-low costs), the banking sector is going to put a heavier burden on the small and mid-sized banks.

The result will be an increase in the size of the banking "too big to fail" oligopolies. Too big to fail is just another way of saying "always bailed out by taxpayers". This after even the SVB was bailed-out almost completely.

Bank of America Corp. mopped up more than $15 billion in new deposits in a matter of days, emerging as one of the big winners after the collapse of three smaller banks dented confidence in the safety of regional lenders. (BN)

Other banks have not released their numbers, but it is clear that reduced competition in the banking sector has already happened.

The private banking system saw a profit jump in their deposits arms during the covid pandemic as depositors put cash from stimulus cheques in their accounts. The large banks have had a problem with making money on this side as those supports stopped and the investment returns tumble.

The lead banks never let a crisis go to waste and have now figured out how to use the SVB debacle as a profit subsidy program.

The game is on for setting the narrative on the outcome of the SVB collapse. Some calling the market response (which hurt bank financial valuations) an over-reaction and a "unique" event. Others saying that it is a systemic issue of regulation. Keep an eye out for First Republic, Zions, and Comerica.

Barely anyone is commenting on the fact that the general policy of lending to companies that make no money (and are proud of that fact) is obviously a systemic risk to the lending system.

There is still a lot to unwind in the VC investment market of zombie companies and a system that is addicted to low-rates and central bank supports.

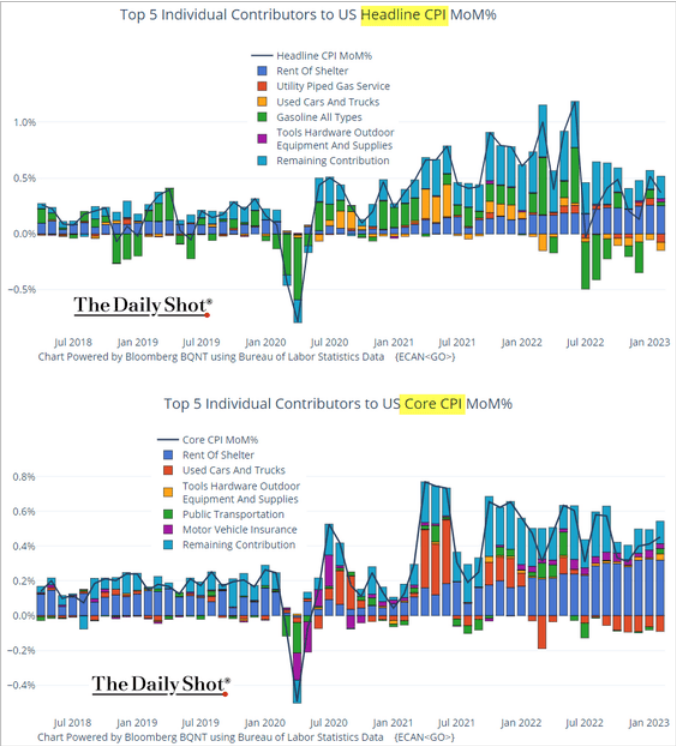

USA inflation

Throw away yesterday's paper's prediction of what the Fed will do. After inflation surprised on the up (read "growth) side, folks are now predicting that SVB's debacle will not affect the Fed's rate.

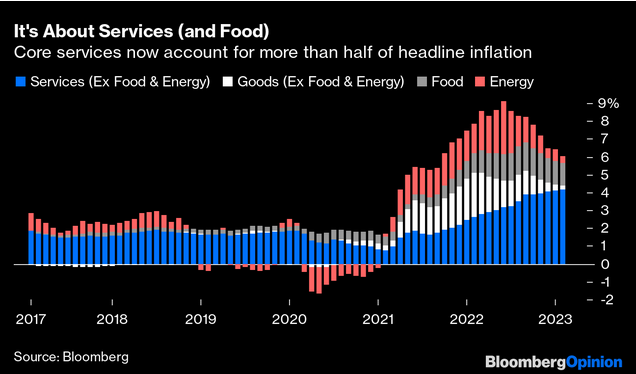

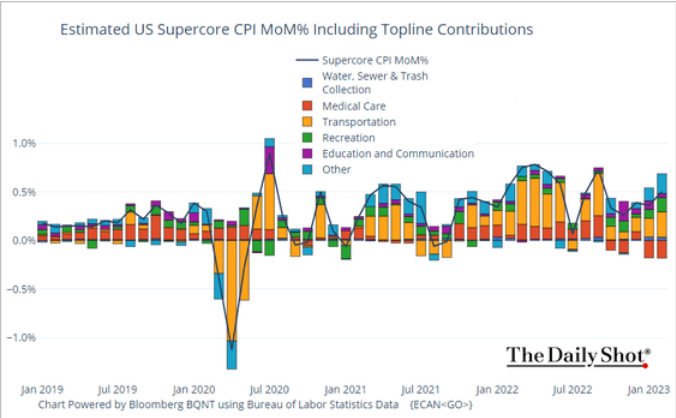

Core inflation, as we have discussed previously, is now the focus of inflation watchers. And, it is not coming down.

Now folks are talking about "supercore" inflation which neoclassical economists think is driven by "wage growth". Isn't it fun how they consistently look for validation of their theory?

How is the "supercore" more a measure of wage-growth lead inflation? Well, it isn't. Supercore inflation is just "service" inflation with some tailored sectors that have seen wage growth because they are at the bottom end of the wage scale.

It has been clear that wage growth does not drive inflation throughout this inflation episode. The constant focus on wages is partly a vestige of bad early 1900s economics and because no one wants to focus on the real causes of inflation growth (central bank provided profit subsidies and the threat of recession).

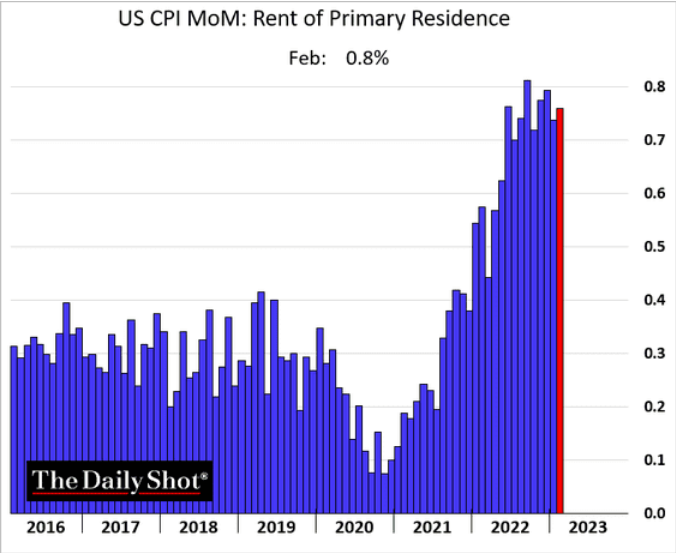

Also, not included in this is a real cost for "service" companies and workers: rent.

The reality is that we are in a recession right now. Setting-aside bank failures, the labour market is not as "hot" right now, wages are stagnating, personal debt is up (since consumption continues), and the future investment in capital has slowed considerably.

While the neoclassicals might not think it is a technical recession, society knows better. In fact, we are just back on the long recession we have been experiencing since 2009.

Political and economic pundits

It what can only be described as an own goal:

The WSJ does not understand that it is a economic and political pundit rag, I guess.

The move to political punditry done by those who have a financial stake in what they are talking about is akin to seeking truth in advertising.

Of course, CPress is completely neutral and unbiased opinion and analysis.

Women making 100K+

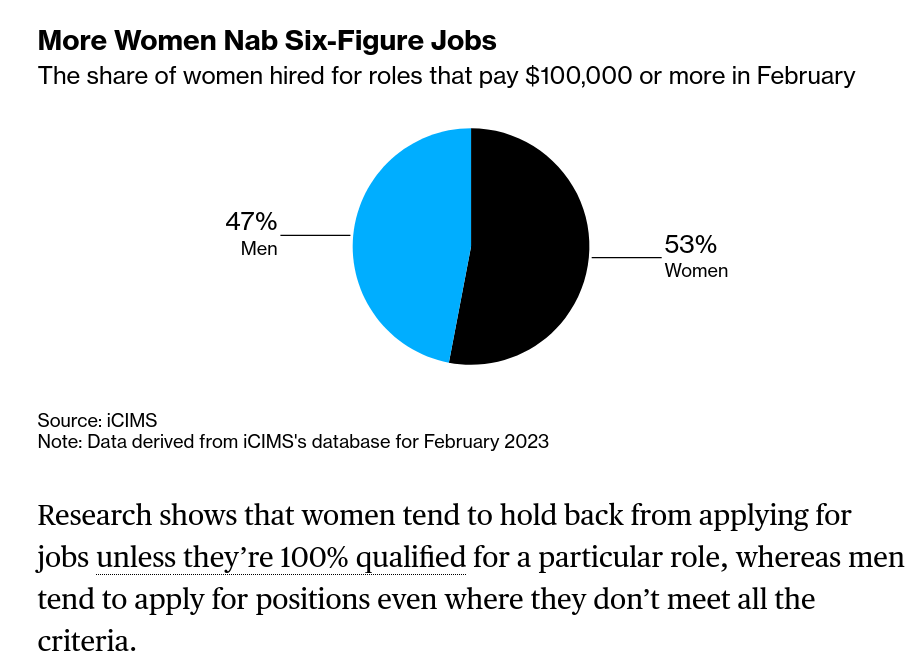

Bloomberg has this wisdom today: at the higher income bracket over $100K, women are getting hired more often for jobs they are qualified for even as men apply for them more often (but, are generally not qualified for them).

This is a tautology in a non-sexist world. It should not be surprising that qualified people get hired for jobs they are qualified in over unqualified people. But, we will go with the graphs today because sexism still exists in hiring.

ICYMI increasing for-profit private care does not reduce wait times

More private for-profit care in your province? You are going to be waiting longer:

Not causative, but neither is the data the arguments the pro-profit folks are using.