March 14, 2023

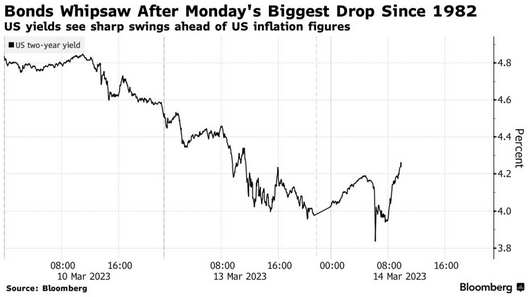

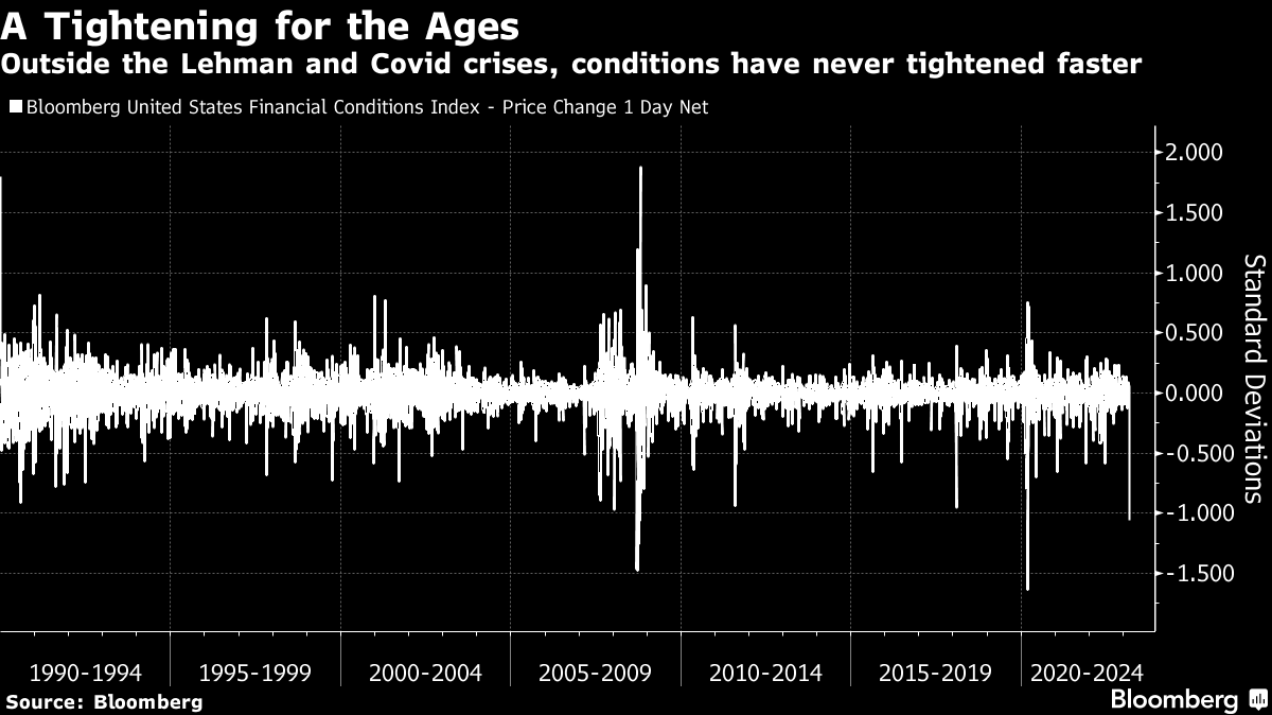

Bonds and Crisis

Capital is convinced that the Federal Reserve will relent after this (ongoing) banking crisis.

Bloomberg's Authers has a list:

- Largest single day fall for the two year Treasuries (61 basis points) since 1982

- Fastest increase in the USA yield curve (48.2 basis points) in the last 40 years. The only other time like this was Sept. 11, 2001.

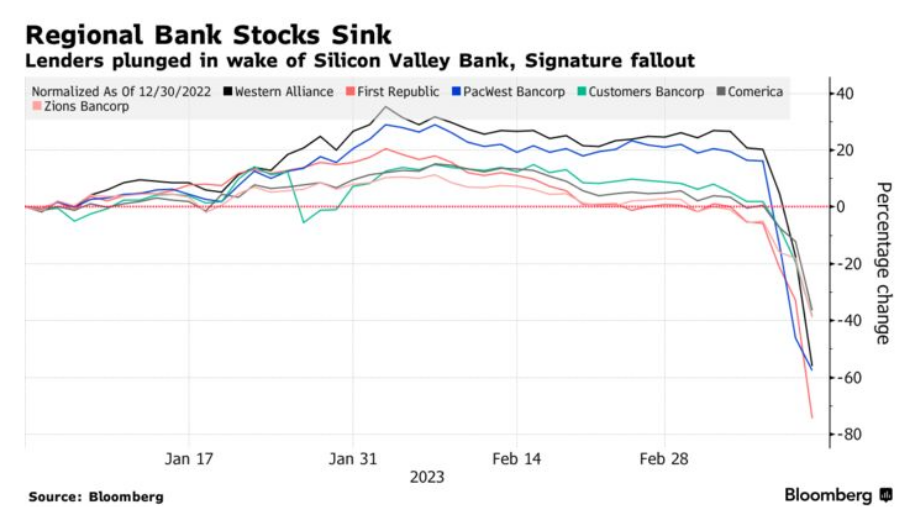

- The KBW index of big US banks had one of the top three collapse in thirty years. The other two were Covid lockdown and the Lehman bankruptcy;

- The KBW index erased all its gains of the last 25 years. It is now at the same level it was on March 11, 1998;

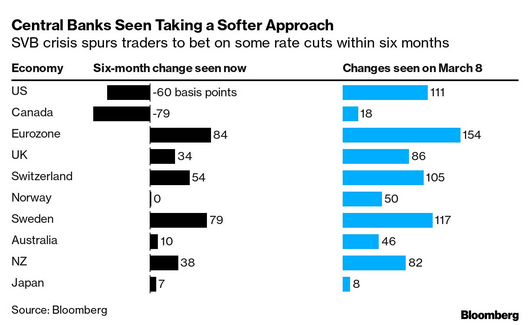

The expectation of the market on central bank rates is now inverted according to Bloomberg polls of investors. Last week folks were debating .25% or .5% increase. Now it is whether the Fed will increase their rate at all.

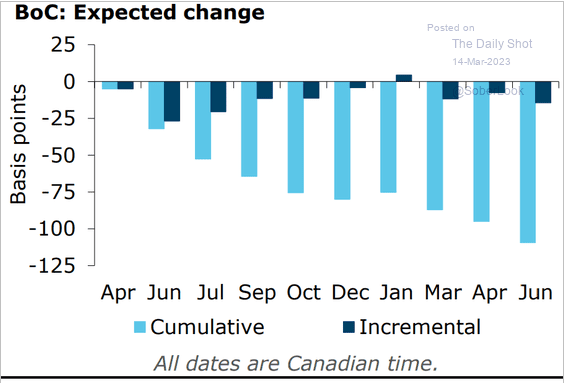

In Canada, the soft orientation to increasing rates has now all but disappeared. The expectation is that Canada will quickly reduce pressure on the economy by reducing rates. This is early hours, however. Things may change as new data (USA inflation) comes in today.

This is where we are at yesterday morning:

Solid banking?

And, all of a sudden people are noticing that the banking sector is not as solid as stated in the ads for Venture Capital. As is usual for hindsight crowd, it seems many understood this even as they were talking as if it was not the case.

Even Moody's downgraded the governance grade at SVB before it collapsed. And, in a related note outlined that it had borrowed to invest in companies that owed it money.

Is this a larger trend?

Moody's put First Republic bank's ratings under review for a similar downgrade today.

This from an National Bureau of Economic Research supported study:

The U.S. banking system’s market value of assets is $2 trillion lower than suggested by their book value of assets accounting for loan portfolios held to maturity. Marked-to-market bank assets have declined by an average of 10% across all the banks, with the bottom 5th percentile experiencing a decline of 20%.

10 percent of banks have larger unrecognized losses than those at SVB. Nor was SVB the worst capitalized bank, with 10 percent of banks having lower capitalization than SVB.

Even if only half of uninsured depositors decide to withdraw, almost 190 banks are at a potential risk of impairment to insured depositors, with potentially $300 billion of insured deposits at risk.

The effect is the movement of depositor money from regional banks to "large banks".

European capital is smug. The head of Germany's banking group has stated that financial regulation in Europe would have stopped this collapse. That's probably true, but it is hardly the point. Global capital benefited from poor regulation of USA banking that allowed loose debt rules for banks.

The other unintended consequence of saving SVB is that Bitcoin and Ether are doing very well. Many of the underlying banking that Crypto relies on was tied-up in companies doing business in SVB. And, since the government has pledged to save all depositors, those swindlers have been saved by real bank insurance.

VC companies are also trying to save face. Some very large VC funding sources are worried about contagion and collapse of their empire of cards. General Catalyst, Andreessen Horowitz and Khosla Ventures are all supporting an effort to help other VCs weather reality now that it is asserting itself.

UK zombies

While the banking system is front and centre, the slow recession is grinding along:

Corporate insolvencies rise 17% in England and Wales in year to February

There were 158 compulsory liquidations in February 2023, which is more than twice the number in February 2022. (FT)

This is happening as wage growth slows. When you see this happening, you just have to remember that the profits were made—taken from lower wages—as the companies walk away from their workers.

Volkswagen is announcing large battery plants

Yesterday, VW announced a battery assembly plant in Ontario.

Today they have announced €180bn over next 5 years on China, US and battery plant

- 2/3 of the money will got supporting electric vehicle sales and software development.

It predicts that 1/5 cars sold by 2025 will be all electric.

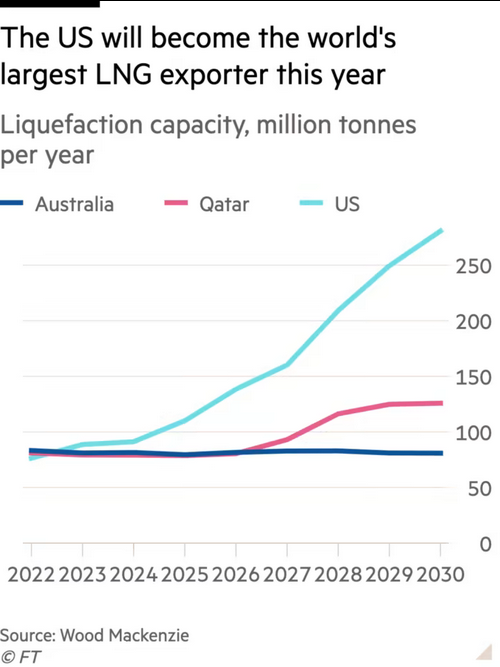

USA is the new LNG super exporter

Yep. Forget about saving the climate, drilling is where it is at.

This is coming at the increased capacity utilization rather than investment in new wells. However, there is a tonne of money coming from the USA government to support expansion.

Expected to produce about 180,000 barrels a day at its peak, Willow would account for roughly 1.5 per cent of current US oil production. The project would help to reinvigorate the oil industry in Alaska, a state where production has slid to less than a quarter of the 2mn b/d produced in boom years of the 1980s. (FT)

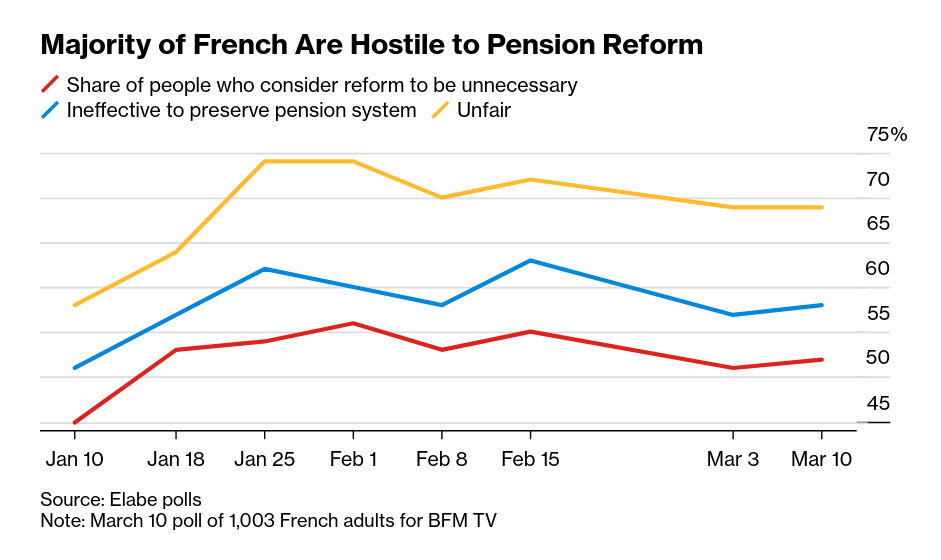

Macron is forging ahead with the pension attacks

- Vote could be Thursday.

- Wednesday is the closed-door meeting

- Things may go poorly if it is passed