March 13, 2023

Note

I start at Unifor's Research Department today.

Private Banks

Silicon Valley Bank is the second largest bank failure in USA history. The bank had a market capitalization of $6B a couple weeks ago. That has gone to essentially zero, of course, and the federal government has had to step-in to stop the "contagion" caused by bad loans (the vector for bad loans are "founders" and "Venture Capital") to the rest of the market.

At its base, this is yet another unregulated bond market issue.

- SVB is under federal government control. Who says you cannot nationalize a private bank?

- It seems SVB depositors will be fully repaid as the state shows why we should not have a private banking system. The banks assets will be sold and depositors will have access to most (if not all) of their money in the bank covered by the Federal Government's $128bn Deposit Insurance Fund that banks pay into.

- Some estimates put the shortfall at about $5B out of the $91B of uninsured deposits after SVB is liquidated.

- HSBC has purchased Silicon Valley Bank's UK unit for £1.

- BaFin in Germany has locked SVB accounts there.

- First Republic bank, considered at risk of contagion, were down more than 70 per cent in pre-market trading in New York. Shares in banks JPMorgan Chase, Citigroup, Wells Fargo and Bank of America fell between 1.35 and 5.85 per cent.

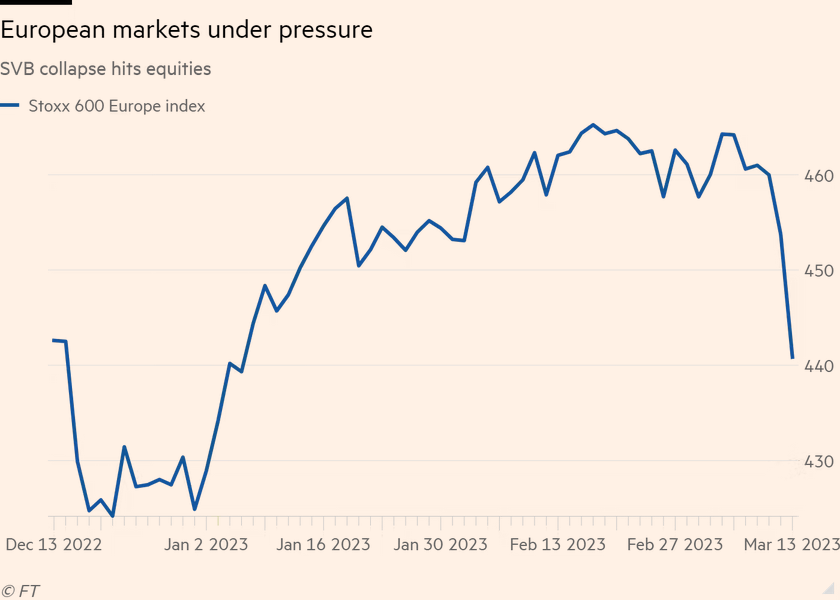

This is going to be a bad day for the private banking sector world-wide. The Stoxx (Europe) Banks index is down significantly this morning with some banks in Europe down 8% already.

We are in a high-risk area for unintended consequences as the USA government tries to shore-up its banking system. The Federal Reserve is going to make "liquidity" (read: money) available to private banks if they face runs. This is signal to depositors that they should not go after their funds because there is low risk their funds are gone. That is, unless everyone goes after their funds.

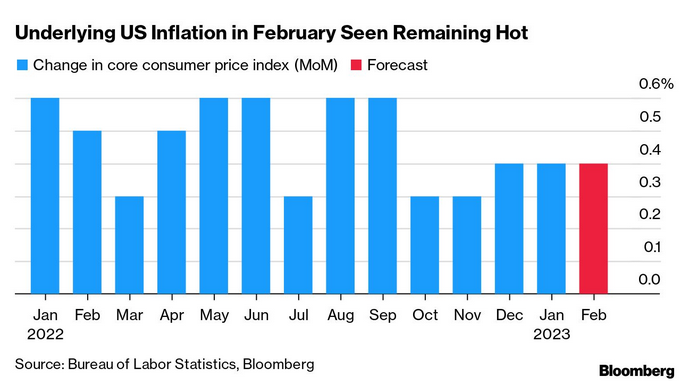

The bet is that the USA Federal Reserve is going to be busy trying to figure out how it can stabilize private bank profits while also putting up interest rates and workers out of work to "tame" inflation increases. Forgotten in the headlines is that the USA economy continues to outperform "expectations". This makes the Fed's One Lever a little strained as they try to both push interest rates up and have the other side pulled to stop banks from collapsing.

The left need to call for the federal government to make sure that supporting depositors does not turn into a giant profit subsidy to financial speculators—which it will be. And, obviously, we need to continue to call-out the nonsense that is the "innovation economy".

Why might everything be OK? Well, for one thing, bank profits are not just about loans to "entrepreneurs" (read: small business people) who cannot pay their bills, they are also about private loans to households. So, as interest rates go up, banks are able to pass on most of that cost to regular workers.

This is all the result of both poor regulation and wishful thinking that permeates the financial sector.