March 10, 2023

Profit subsidies and USA innovation

The innovation balloon in the USA is deflating. And, rather quickly in some places.

The venture capital investment focused Silicon Valley Bank Financial Group (SVB) has a liquidity issue. As interest rates have increased above the profit subsidy rate set by the central bank over a decade, the entire venture capital machine funding "start-ups" is wobbling. The companies that SVB has lent to are having problems with higher rates and most of those companies are not profitable.

The value of SVB fell 60% Thursday.

It is dramatic because it is the first time a large USA bank has had financial trouble since the 2008 crisis. And, a run on a bank (as seen with crypto bank Silvergate) has not happened in a good long while.

SVB’s steps to shore up capital comes days after Silvergate Capital Corp., another California-based lender that targeted crypto firms, announced it would liquidate after what was effectively a bank run in the wake of FTX’s collapse. (BN)

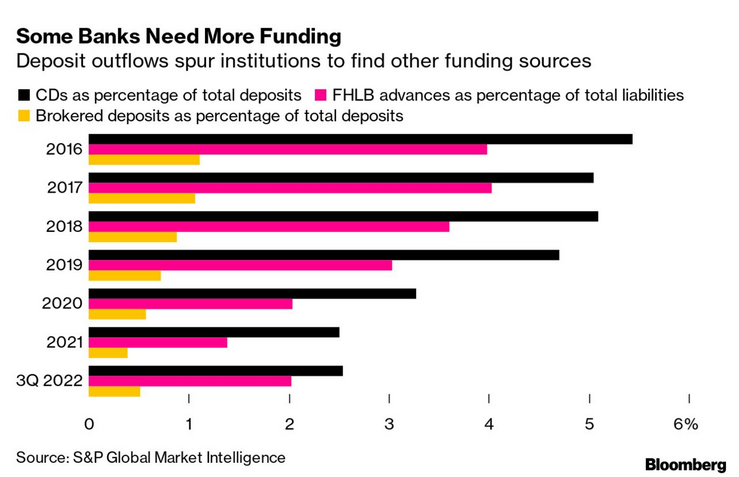

This is not isolated. All the banks in the USA are feeling the pinch as rates go up.

The bank index (KBW) which is a proxy for the banking sector's value declined 8%, knocking billions of dollars of (fictitious) capital value out of the system.

As we have stated, banks are dependent on the difference between the Central Bank interest rate and the nominal rate for profits since the nominal rate is their cost of operations. As the central bank rates go up, bank profits are squeezed. This, in turn, drives competition for depositors and other sources of revenue.

Unfortunately for the banks, just as they are in need of more depositors, the deposits are drying-up.

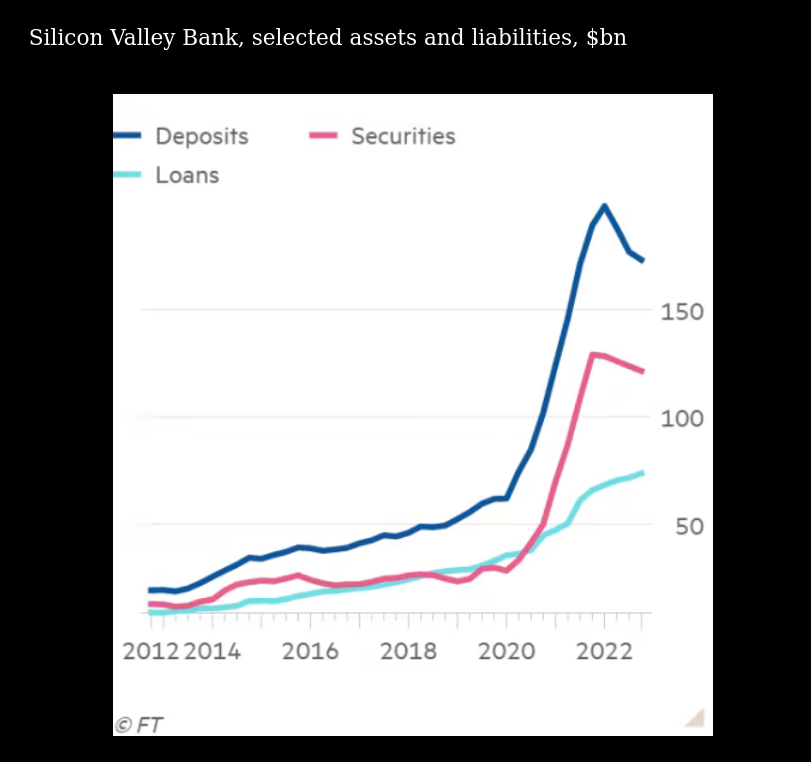

This from FT's Unhedged this morning:

It is not hard to see from this graph that things are rather upside-down. Loans get expensive as real money in the bank goes down. Inflation eats into all the value of the "money" that they have lent and you have that sound of bank value collapsing.

It isn't calamitous yet. However, these things are proxies for what is happening across the economy—at the very least.

Though markets-based measures may mask the extent, one of the big net effects of more-restrictive financial conditions is a higher cost of capital and more-expensive borrowing costs — both among the factors that befell SVB’s client roster. (BN)

There is a take-away that is not about banking.

Western economies have been restructured around the crypto-fantasies that Techno Utopianism sold government officials. Canada has moved hard into funding entrepreneurialism in universities and training. Ontario funds MaRS to support start-ups. We support "commercialization" activities for graduate students. Billions of dollars go into trying to support a model that has failed to deliver on promises of a Tech Start-Up EconomyTM.

Asteroid

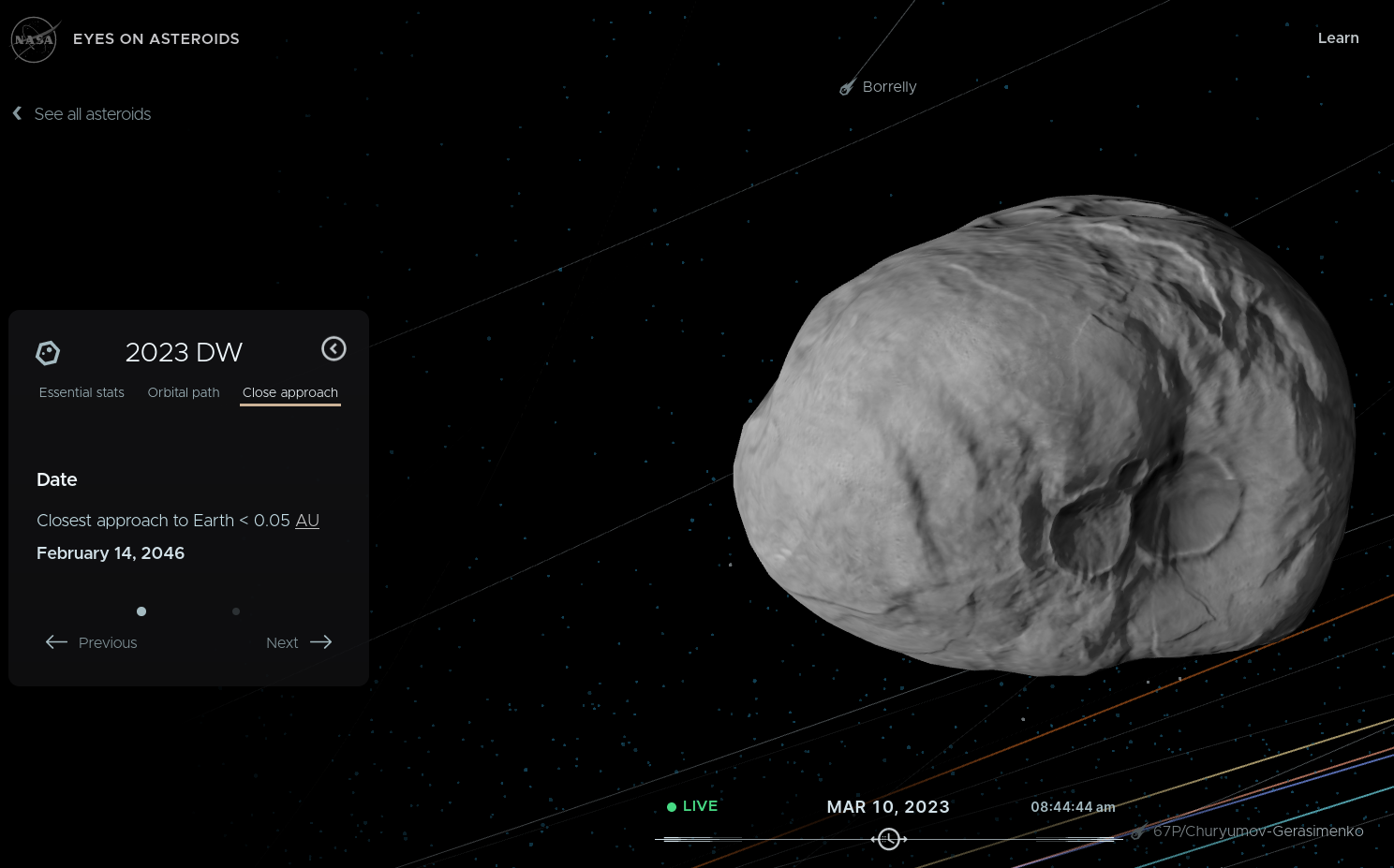

Ever wonder if there is one out there with our name on it:

- DW is making an attempt at a dive-bombing.

- NASA has a nice site for it.

- It is 50 meters wide.

- It is going to make a very large bang if it hits and blows up in the atmosphere like the Tunguska

- Date of potential impact: Feb 14, 2043.

High inflation, low chance capital can do anything about climate change

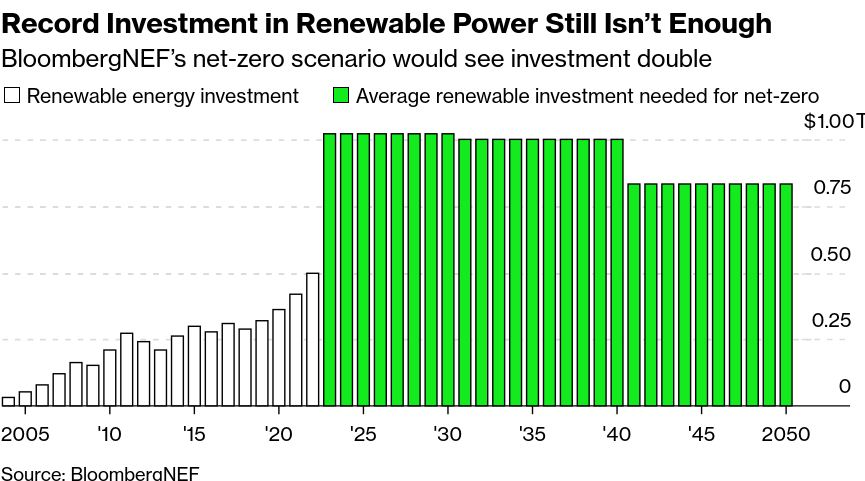

We have talked about how the private sector cannot be relied on to invest in climate saving energy transition. Well, just like the ridiculous Techno Utopia promised by Silicon Valley, the dreams of private capital saving us has ended for the same reason.

As investment foundations crumble due to rising interest rates and higher materials costs, developers in the US are delaying clean-power projects like the 1.2-gigawatt Commonwealth Wind development near Massachusetts, which would be one of the largest wind farms in the country and capable of powering 700,000 homes.

The Biden administration wants to build 30 gigawatts of offshore wind by 2030. But some of the biggest projects are in turmoil.

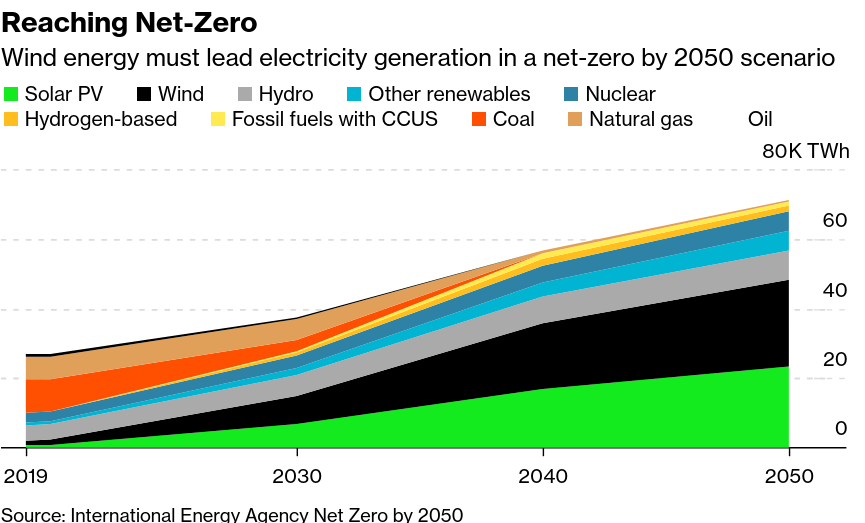

Without government direct investment, ownership, and operation of these green energy sources, we just are not going to make it to even Net Zero.

And, if you thought privatized nuclear was going to save anyone, the costs of building those plants is much higher.

The amount of new electrical energy generation (and use upgrades) that is needed just to make the transition away from natural gas and coal power generation is huge. To make the transition away from oil for transportation is a magnitude higher.

Every time interest rates go up, the capital dollars that were promised to global green energy disappear—just like they were never really there in the first place.

Unemployment and capacity utilization are unchanged

- Unemployment: still 5%

- Employment: no change

- Overall, capacity utilization, down 0.5 points over the previous quarter at 81.7%.

- Manufacturing capacity utilization is up again at 1%.

Alone, these numbers are not particularly meaningful. However, it does look like inflation on the industrial side is still a thing as the costs of investment keep industry from forming new capital.