March 1, 2024

GDP

GDP numbers are rarely interesting on a month-to-month basis.

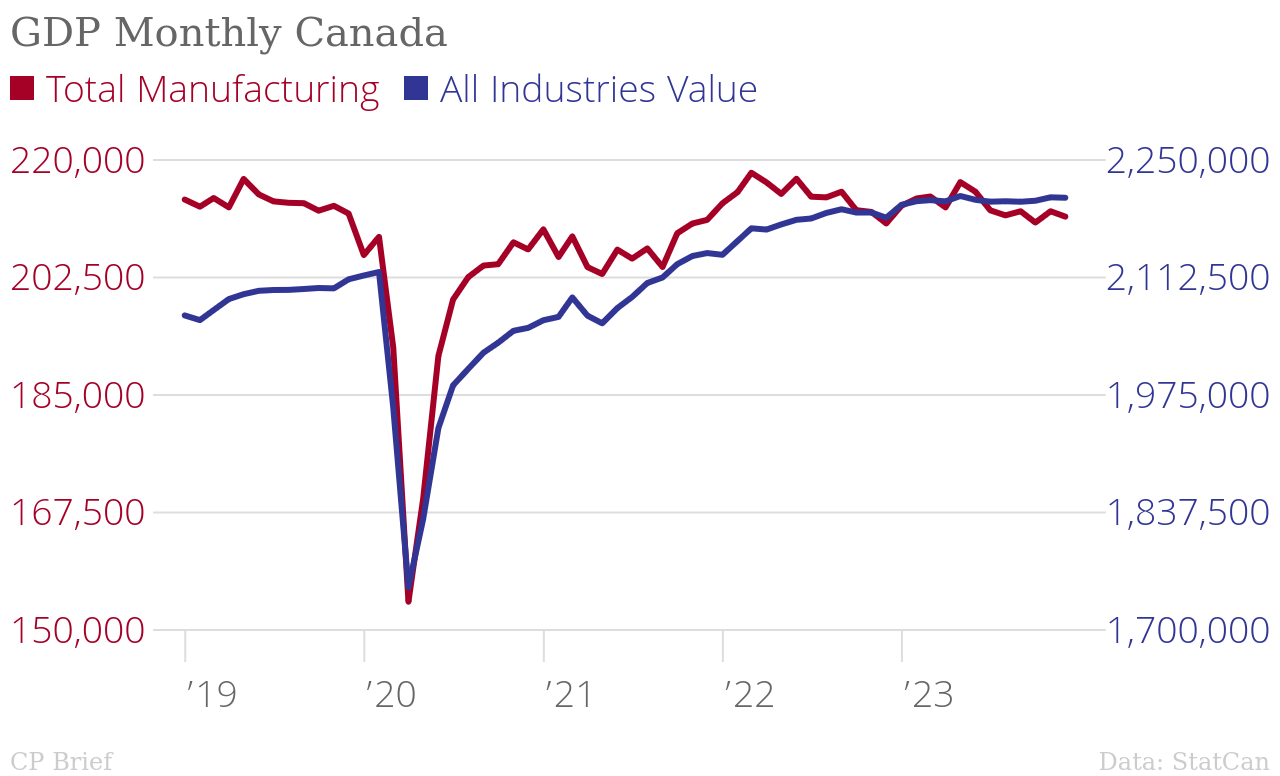

December numbers were released by StatCan and they show, well, not much.

Flat growth in the economy generally, mostly up-side, mostly better than earlier in the year. It is a good news story if you are a truthful politician and good news if you are a politician who likes to say stupid things. When nothing moves, everyone is correct.

What Bloomberg Economics Says…

“As expected, Canada has, thus far, avoided the technical recession that has befallen some of its Group-of-Eight peers. As such, the Bank of Canada has some space to keep policy rates restrictive in the near term.

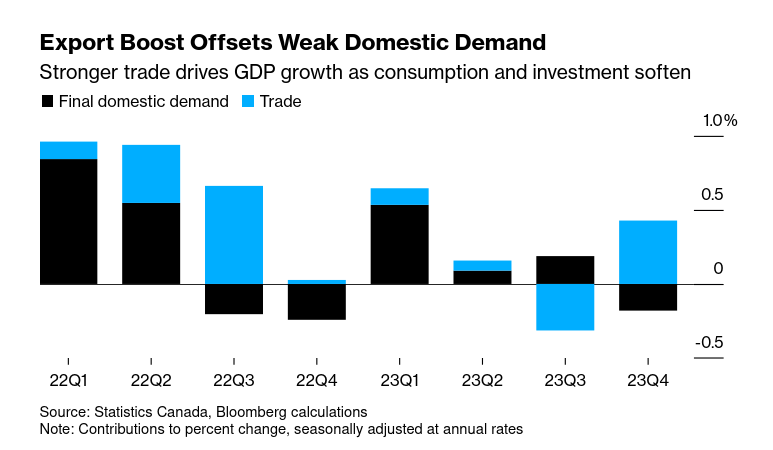

The details of the report paint a somewhat bleaker picture. Monetary policy is gaining traction in the real economy, as illustrated by declining fixed investment. And the primary source of 4Q GDP growth was an improved trade balance — due in large part to declining imports of goods as consumers tighten their belts.”

— Stuart Paul, US and Canada Economist

Huh?

It means that we exported more than we imported, a weird trick of GDP which has nothing to do with "production".

The exports were mostly oil and gas.

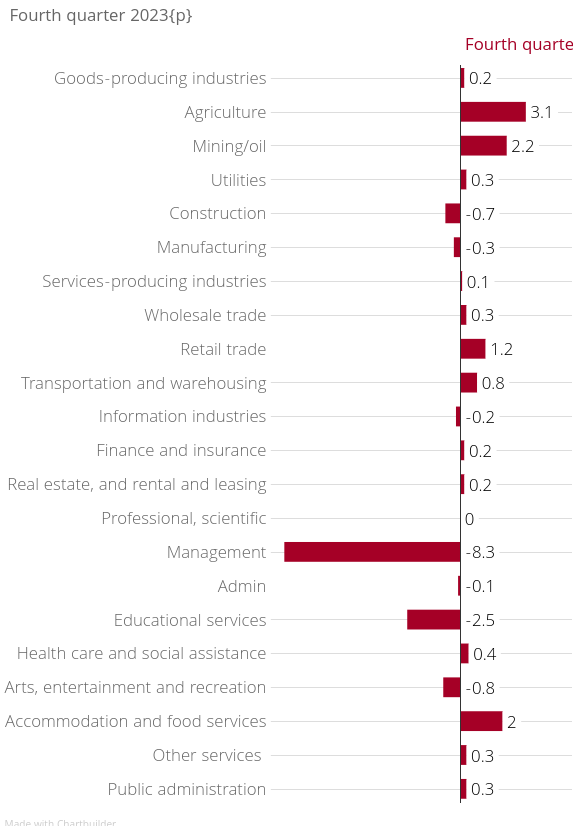

There was also a decrease in investments in real machines and a decline in manufacturing, which is never good, but not surprising given the rest of the year has not been so hot on investment in real manufacturing and people are buying less.

Utilities were not doing well because it has been a very warm December. Good or bad depending on who you are and what you think the economy should be driven by.

We live in the backwards world of neoclassical economics where people think interest rates have anything at all to do with inflation. So, of course good news of no recession means no early interest rate reduction from the central bank.

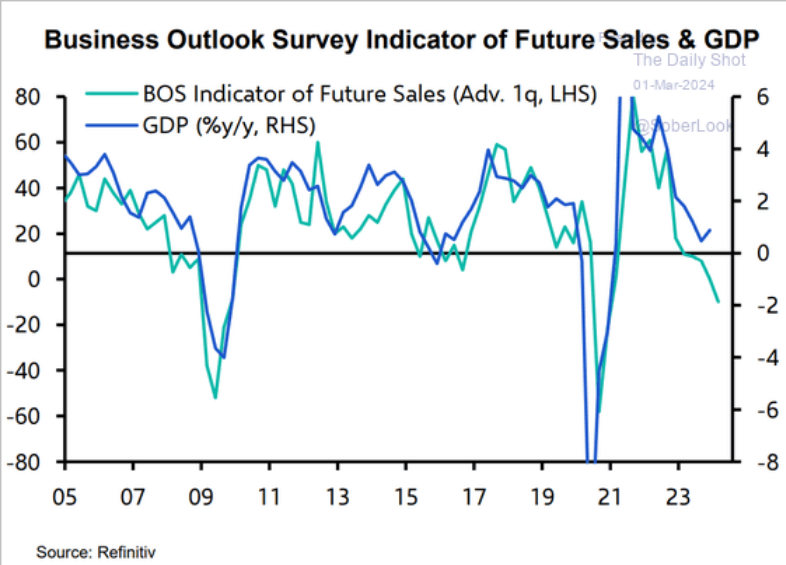

“Providing the latest preliminary estimate is not also revised down heavily, that means the economy should probably eke out another modest expansion this quarter and reduces the chance of the Bank beginning to cut interest rates as soon as April.”

Stephen Brown of Capital Economics wrote in a report to investors.

The business outlook actually was better than expected by business itself.

Overall, I think it is not a terrible end to a year. And, it is difficult to compare these numbers year-over-year because 2022 was such a strange year anyway.