March 1, 2023

Wage growth slows in the USA

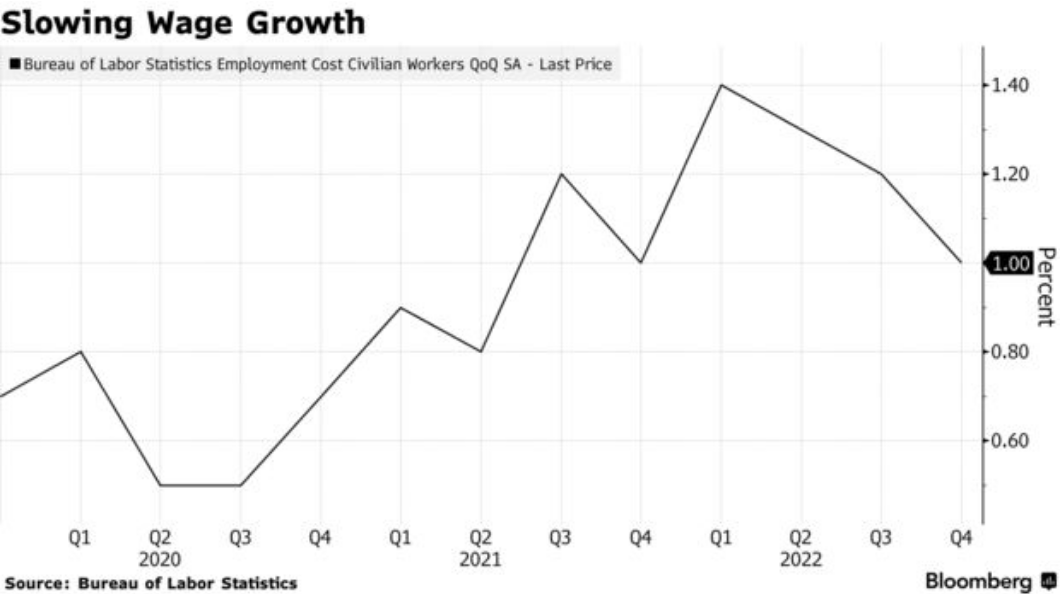

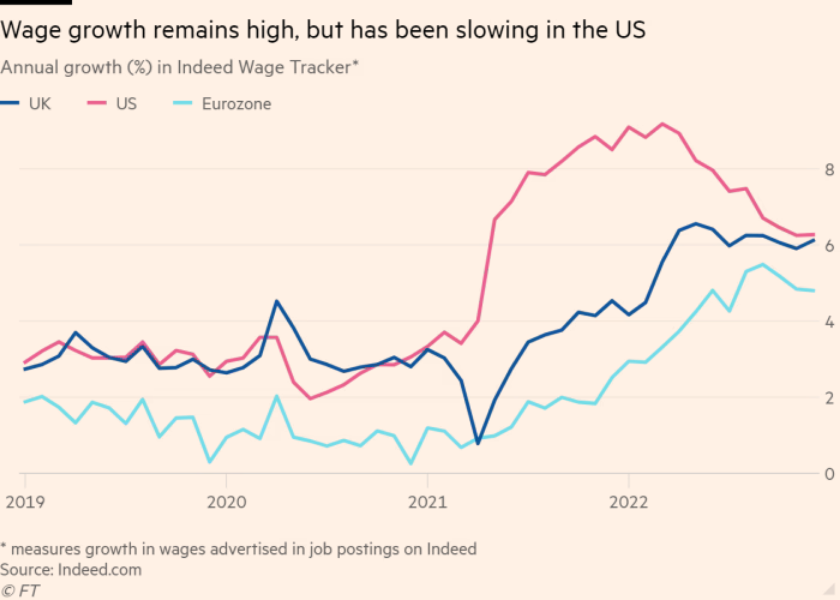

Even as inflation has eaten away wages, wage growth has slowed significantly in the USA.

The incorrectly educated MBA crowd are calling this a "reverse wage-price spiral"—even though there is no evidence at all that there is a relationship between wages and prices.

What is actually happening is that employers have been very good at wage suppression to maintain their profits.

What we usually see during times of inflation is that there is a lag in wage growth after inflation goes up. Not so this time.

Low union density means that workers did not get a wage boost when inflation went up, and they do not get the delayed wage boost to make-up for the difference either.

The lack of catch-up in wage growth should worry unionists. It means that they have failed to even boost the expectation that wages should follow inflation.

The cental bankers are giddy. They think this is a sign that their strategy of talking about wage-price spirals has worked as they increased interest rates. What they call a "soft landing" is really just making sure that workers pay for inflation. Inflation that was caused by financial profit subsidies.

The real reason that wages are not growing is because of low union density in the USA and a rise in the number of unemployed workers looking for work. Both these have worked together to decreased overall pressure of employers to increase wages.

The analysis that wages are shrinking is actually surprising to neoclassical economists because the stats show it should be doing the opposite. Instead of pointing out how terrible their ideology is at explaining reality, neoclassicals are claiming victory and hoping no one notices the contradiction.

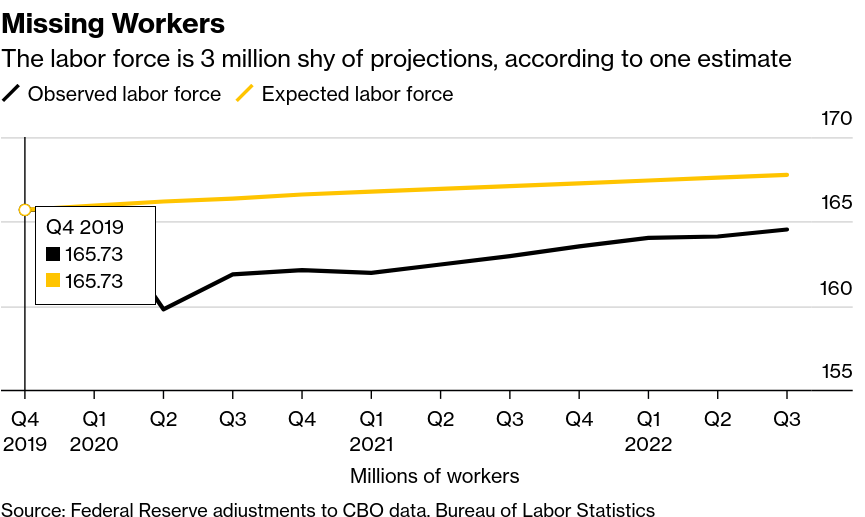

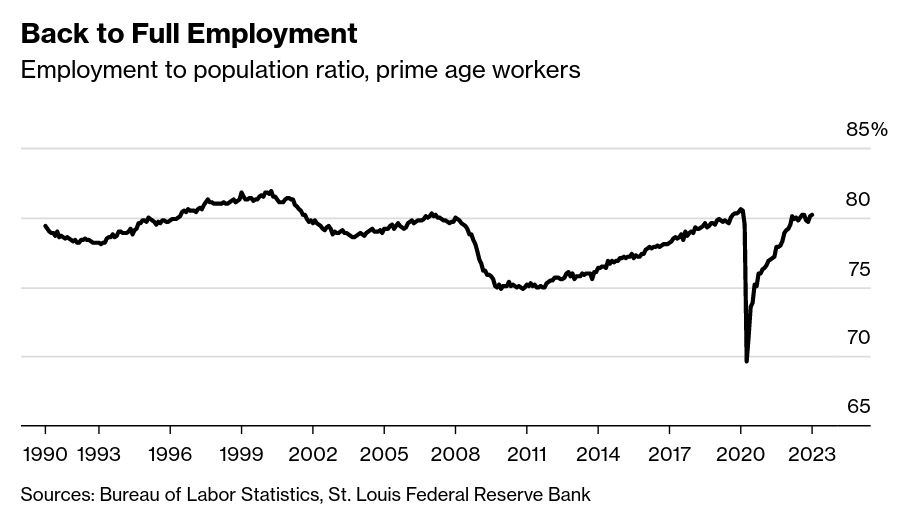

Here are some graphs they look to. The expected labour force numbers are way down.

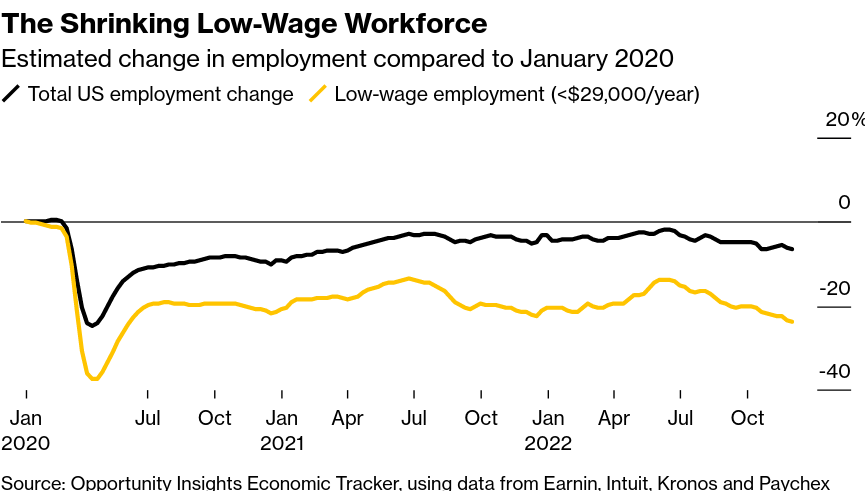

And, the number of low waged workers is also down:

According to neoclassical economists this should mean a very tight labour market and fast growing wages. Which was why central bankers were concerned with wage-price spirals.

Why is it not working out this way? Because these numbers mean nothing on their own. You have to look at the work that is being done and actual hiring.

There is also some question about where the wage declines are happening

The private sector economy is much more diverse in wages right now. The tech sector has seen very large layoff numbers and there has been a large slow-down in hiring in some service sectors as work from home, eating-out prices, and other productivity increases affects roll through the economy.

The additional reason that there are so few workers?

Reduced immigration, Long Covid and increasing mental health and physical disability is a big factor. And, some of these factors are not included in economic models yet.

immigration slowed to a trickle during lockdowns. This led to 2 million fewer working-age immigrants in the US by 2021

Last August, she estimated long Covid reduced the US labor force by the equivalent of 1.6 million people when accounting for those who either worked fewer hours or left entirely. That’s probably now down to somewhere in the range of 500,000 to 1 million (BN, Brookings)

Then there is this.

So, while the number of workers has flat-lined so has effective labour market tightness.

There is just simply less being produced now with fewer workers. So, wages are not actually under pressure at all via wage competition.

I would argue that all this points the fact that we are actually in a recession right now. A long and deepening one where workers are getting poorer, less stuff (and services) are being produced, and real growth drivers in the economy have stalled.

So, while there is no technical recession here, workers are feeling it all the same.

Has this resulted in a "recession is not needed" position from policy makers at central banks?

No. No, it has not.

“A recession will eventually be necessary” to get inflation back to the Fed’s comfort zone, said Bruce Kasman, chief economist at JPMorgan Chase & Co. (BN)

“Even after energy and pandemic factors fade . . . wage inflation will be a primary driver of price inflation over the next several years,” Philip Lane, chief economist at the European Central Bank, warned in November. (FT)

The reason? The profit subsidy by the central bank is not enough for capital to flourish yet:

The Fed’s favorite measure of labor expenses, the employment cost index, has shown three straight quarters of smaller advances. A narrower measure — average hourly earnings of employees — has also slowed, with a year-on-year gain of 4.4% in January, down from 5.9% last March.

How the government is engaging in profit subsidy is the question for this decade. I think we are witnessing the success of policy option one: wage suppression using inflation.

China

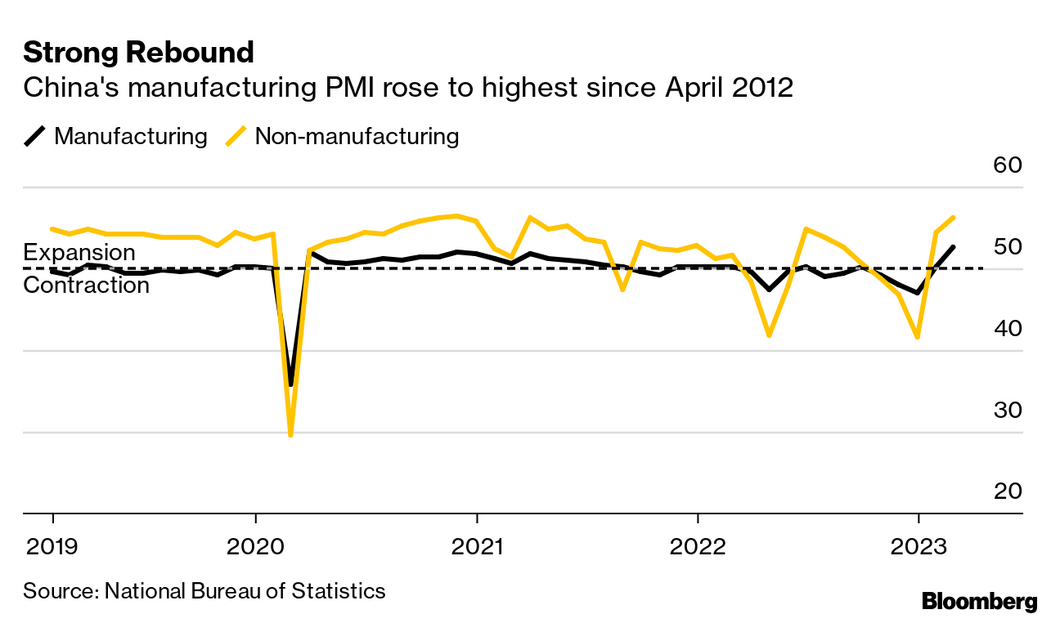

Not top of news, but the Chinese economy seems to have bounced back very quickly:

Negative Equity

The build-up in negative equity — or the amount that debt exceeds a vehicle’s value — is rattling consumers and raising alarms within the industry. Though it’s not unusual for drivers to carry negative equity, some dealers say more people are arriving at their lots up to $10,000 underwater, or “upside down,” on their trade-ins. They’re buying at still-sky-high prices and rolling debt from one car to another and even onto a third. Loans are commonly stretching to seven years.

- Average new-car interest rate rose to 6.9% in January from 4.3%

- high demand

- low inventory levels

- higher automotive profits, poorer people.

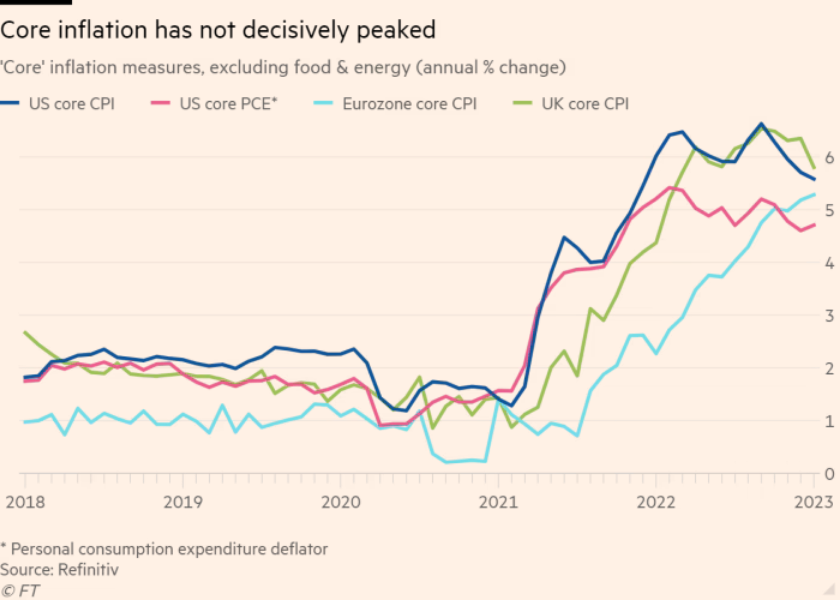

Core inflation