June 6, 2023

Economic indicators, the economy, and nonsense

One has to be a little put off by the inability of the economics community to figure out what is going on in the their field of study.

"[T]here are no signs of crisis or recession in the aggregate economy"

FT's Unhedged

Thirteen of 17 economists surveyed by Bloomberg say the Canadian economy is proving less sensitive to higher rates than previously believed.

Canada’s economy grew at a 3.1% annualized pace in the first quarter, stronger than projected, while employers have added 344,000 jobs in six months.

“It’s not what, intuitively, I would have thought would be happening at this stage” of the rate cycle, Dawn Desjardins, chief economist at Deloitte in Canada, said in an interview. (BN)

"Economists" (read: neoclassically trained folks with business degrees) are stumped, but they blame the government and immigrants. And, of course, demand increases in interest rates to punish them.

Nearly 70% of economists surveyed say Prime Minister Justin Trudeau’s generous spending programs and expanded targets for immigration have contributed to a need for higher interest rates this cycle… (BN)

The push is to raise interest rates even higher because consumers (read working families) are continuing to spend.

But, how are consumers spending?

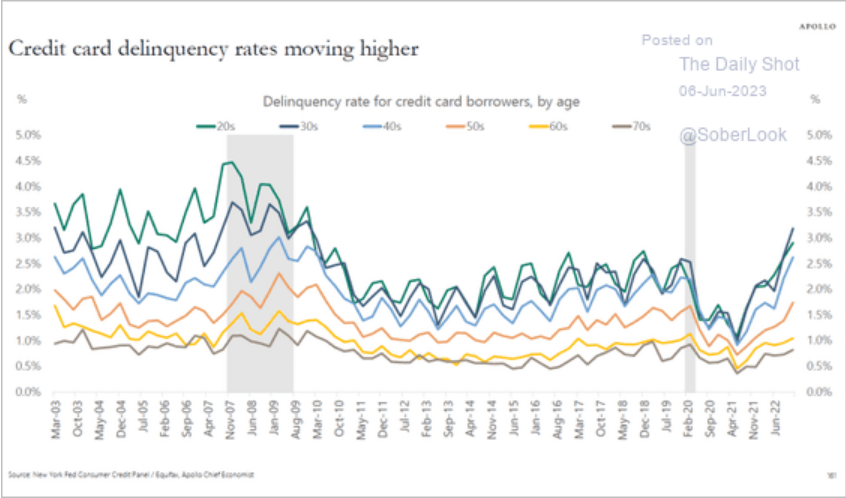

Here is the USA's credit card delinquency rate:

In Canada, it is about the same:

TransUnions says it expects delinquency rates in Q1 of 2024 to be back to pre-pandemic levels at 2.19 per cent.

So, how are consumers apparently "keeping their spending going"? Not with money they have, that's for sure.

The business media does not seem to read its own reporting from different sides of their paper. Debt is soaring to pre-pandemic levels, but with interest rates so high the amount families have to pay for that debt is multiple times what it was.

I think if you look at why consumers continue to spend in spite of increased inflation and increased interest rates is that they have to. The current spending is not as "discretionary" as economists think.

Earning expectations from companies continue to creep-up even though everything points to slowing economic growth. Where is that coming from?

The other part of the confusion is "expectations" that drive a lot of decisions on the economy these days. The expectation for consumers is that interest rates were not going to affect them too much. The expectation from economists was that consumer expectations was going to drive a "soft landing".

The expectations of the expectation forecasters in the expectation departments of the central banks were that they set expectations and those expectations were going to affect something.

Turns out, the expectations of consumers do not matter that much. Production is what matters and there is slowing production because of lower profits and increased costs. Even with earning expectations of some large publicly traded firms going up for this year, the average firm is not growing at all.

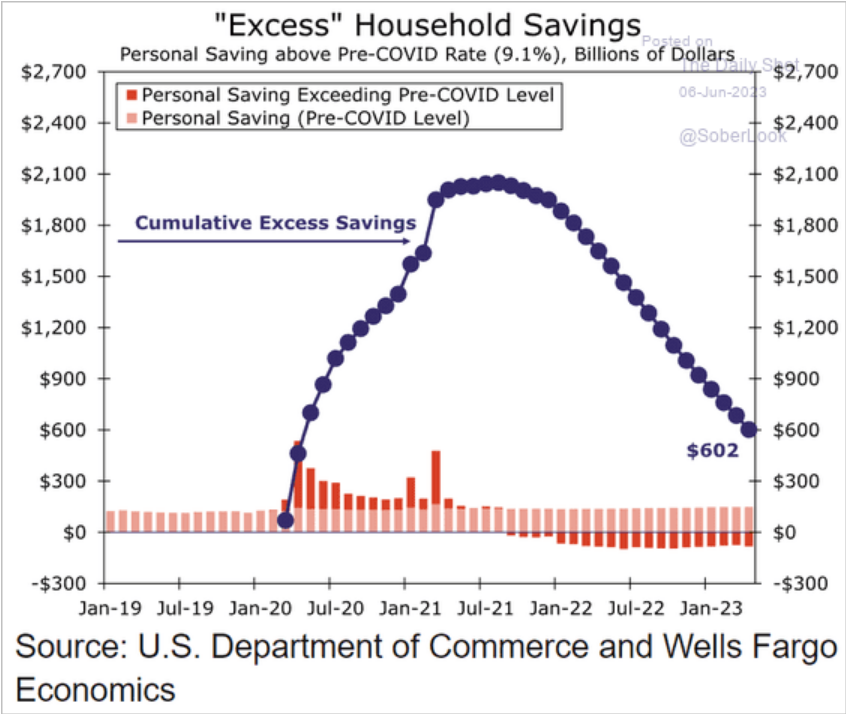

In the USA, the central banks are watching the "excess savings" of families.

And, it exposes some of the confusion. Just because there are savings in the broader working class's bank accounts that is higher than it was pre-pandemic, does not mean that they are the cause of price increases.

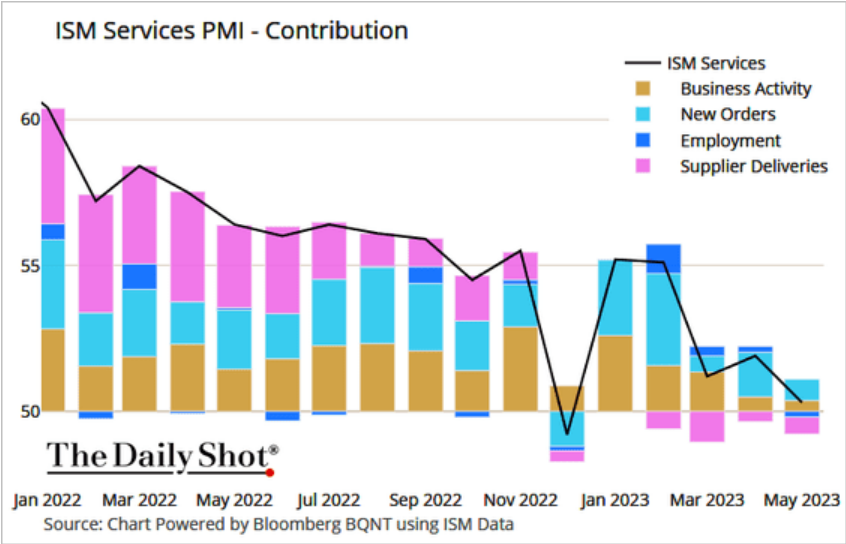

Business activity is very much down and employment indicators in the USA are negative—meaning reduction in hiring versus layoffs. Unemployment in the USA is up. Not surprising given most businesses are not growing.

In Canada, the "annualized GDP" numbers were reported as surprisingly positive. However, real GDP numbers are only up 0.8% quarterly. And, real final domestic demand was 0.7%. Business inventories are also very negative.

What is keeping the economy positive are exports—probably from the IRA in the USA—and household final consumption expenditure—high because of, well, high costs of living.

Grains of salt needed when reading the economic tea leaves.

Some other numbers

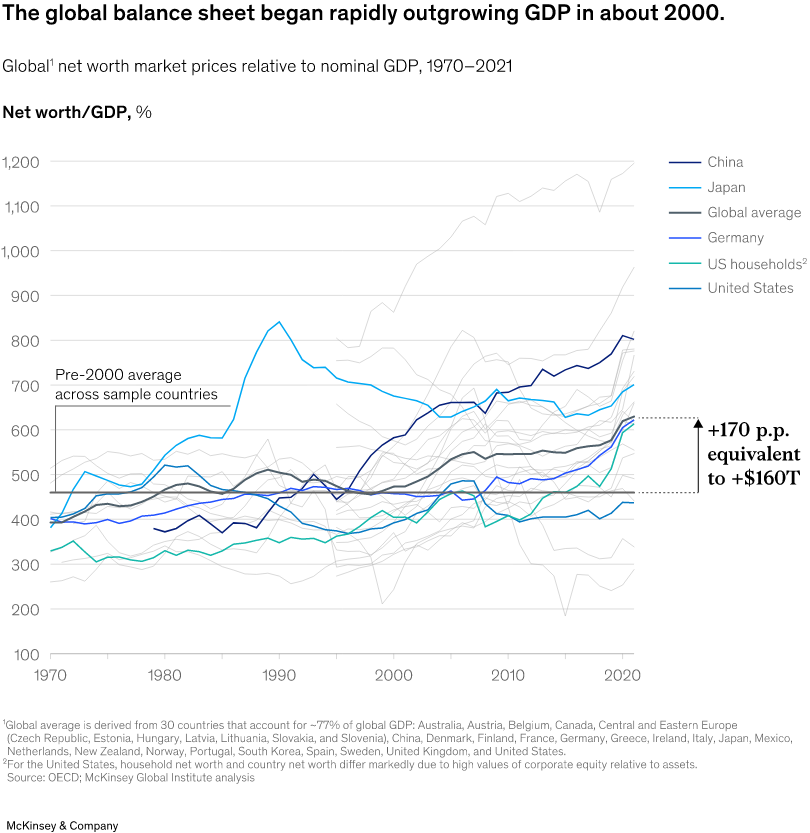

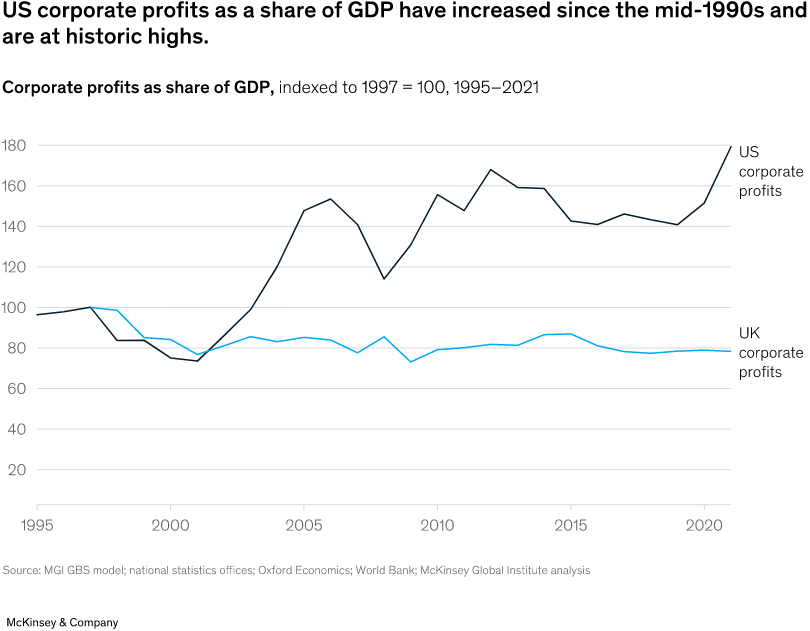

Why are workers in debt? Because everyone else has their money.

Don't plan on cheap airline tickets