June 4, 2024

Elections and markets

It is not that investors are all important when it comes to elections, but we have handed private markets enough power that it is impossible to ignore them.

There are several themes in the financial press this morning:

- Waiting for South Africa's government to be announced.

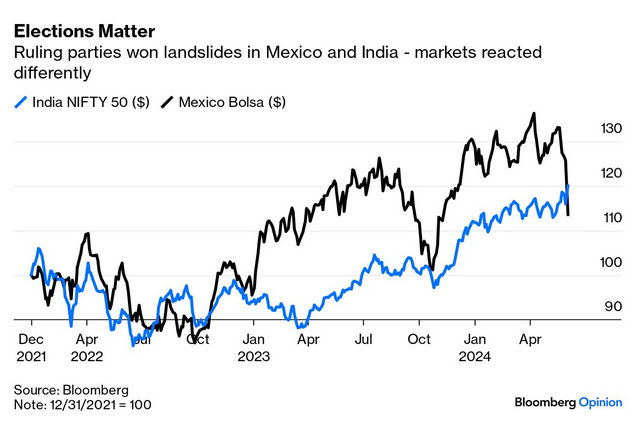

- Freaking-out over Mexico's potential super majority of Morena.

- Watching Argentina turn into a regular conservative government (centre-right by surprise) as Meili shows no interest in governing beyond hyperbolic statements about Spanish socialists.

- Capital is trying their best to ignore what is happening in the USA.

- Celebrating all the money that will be made in India with the re-election of Modi, but also clear worry that his massive support seems to be propaganda and sliding. Congress has had much better than expected returns. (ADDED: now Modi is looking at losing the majority)

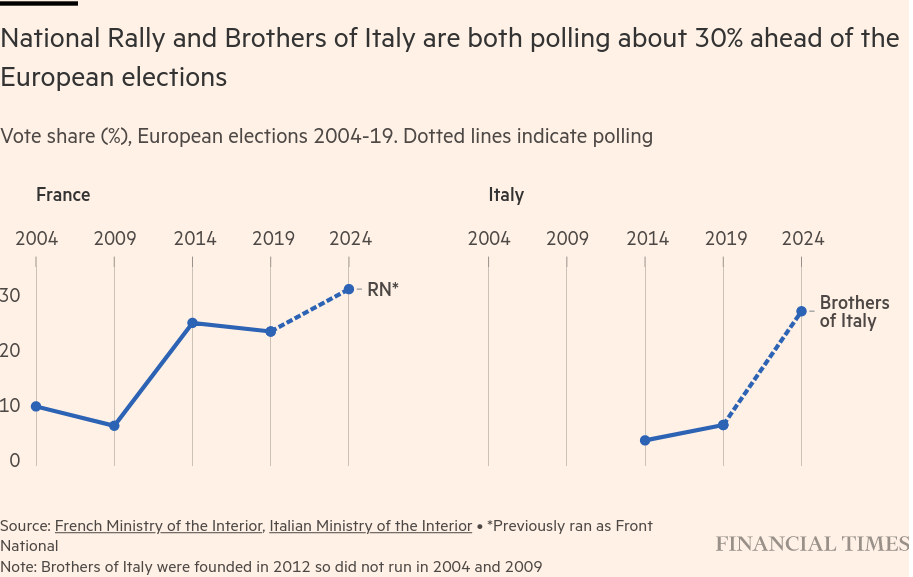

- Wondering if far-right politicians in the EU can be cozy profit companions just as they turn on long-time immigrants hours before the election. The far-right in Italy and France are set to gain more power than they have had in decades.

“This is the moment for us to join forces; it would be truly useful,” Le Pen told Italian newspaper Corriere della Sera. “If we succeed, we could become the second-biggest group in the EU parliament. I don’t think we should miss such an opportunity.”

Of course, capital's favourite parties are constantly trying to see if there is a way in. EU Commission president Ursula von der Leyen of the European centre-right has been meeting with Meloni which is an attempt to normalize these far right as "conservative" parties in the eyes of the public and investors.

The view is one of Capital without shame over its siding with autocrats and fascists and putting short-term financial profits ahead of everything. The "markets" here are simply the culmination of small moves, but it shows the sociopathic tendency inherent in the system.

Have a look.

There is a calm for South Africa after wild swings in investor activity during the election. Many thought that the ANC would be large enough to continue its pro-market reforms unabated. Now, the narrative is that the ANC is "done" and markets can rejoice over the inevitable rise of the centre-right Democratic Alliance.

In the meantime, the full weight of global finance is on the ANC joining with the DA and fully abandoning its members which saw MK and EFF as protest votes. The words are "stability", "smart", "sensible option" when describing alliances with the DA and "calamity", "nightmare", "economic implosion" if they align with the parties that are essentially ANC members who want the ANC to re-orientate to the people.

Everyone knows that a deal with the DA would be a real end of the ANC as they will never get those voters back, resulting in the fragmentation of the broad left coalition.

The outcome of the current political deal making will determine if the ANC will have a future.

Unfortunately, the ANC leadership seem keen on the belief that there is no alternative to neoliberal reform—even though that is now out of style in the advanced economies.

The problem is that South Africa has likely handed too much to private capital already. An abrupt turn to the left would allow finance to discipline the country's economy and its people harshly for making the "wrong decision". So, the ANC leadership are probably not wrong in being concerned about making a deal with the breakaway parties.

The answer is a program of reform of management in state and semi-privatized industry and to plot a course outlined by the original ANC program. One of national economic development through redistribution, expanded local production capacity, and endemic economic growth. That project is hardly even started, never mind finished.

No one is saying it is easy, but the alternative will not be easy either. Aligning with DA will make such a project impossible and it will look like modern retrenchment of race-based economic division under the guise of foreign direct investment and continued hardship for the majority.

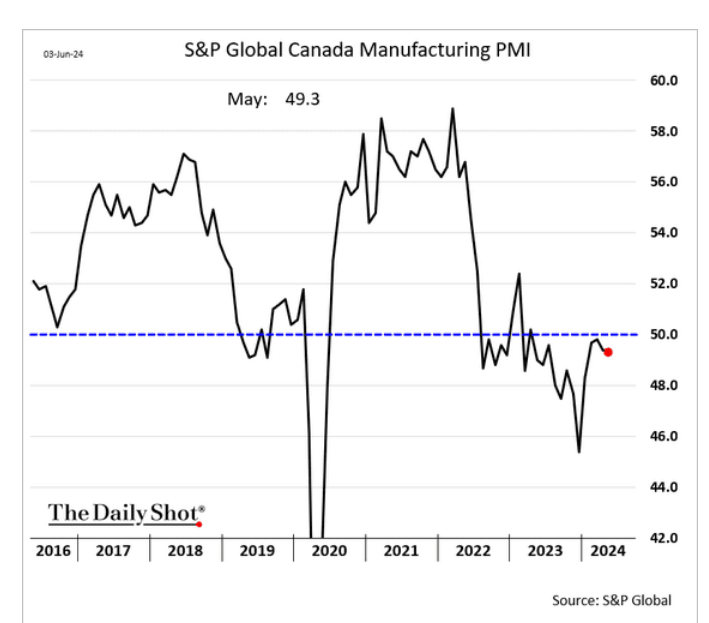

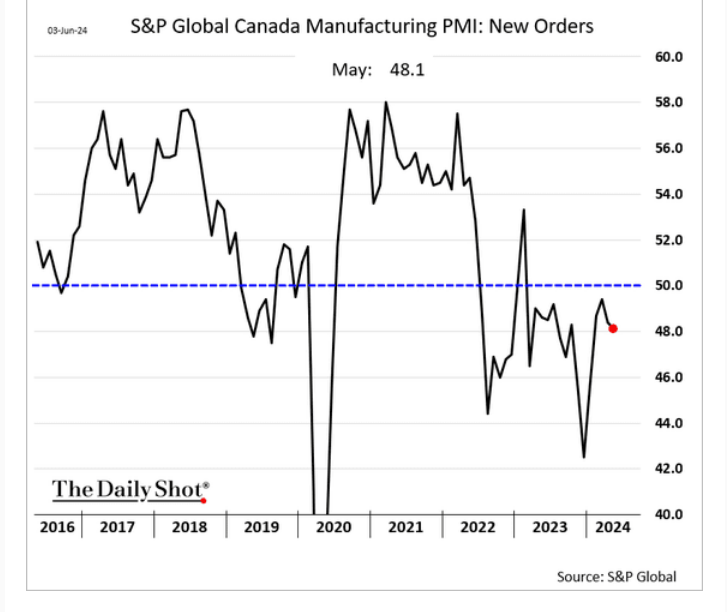

Purchasing and production

In Canada, the index that attempts to monitor factory activity shows continued contraction:

And, new orders by companies are down.

In the USA, inventory is above new orders indicating a slow-down in economic activity at the production end of the system.

Inflation is profit subsidy

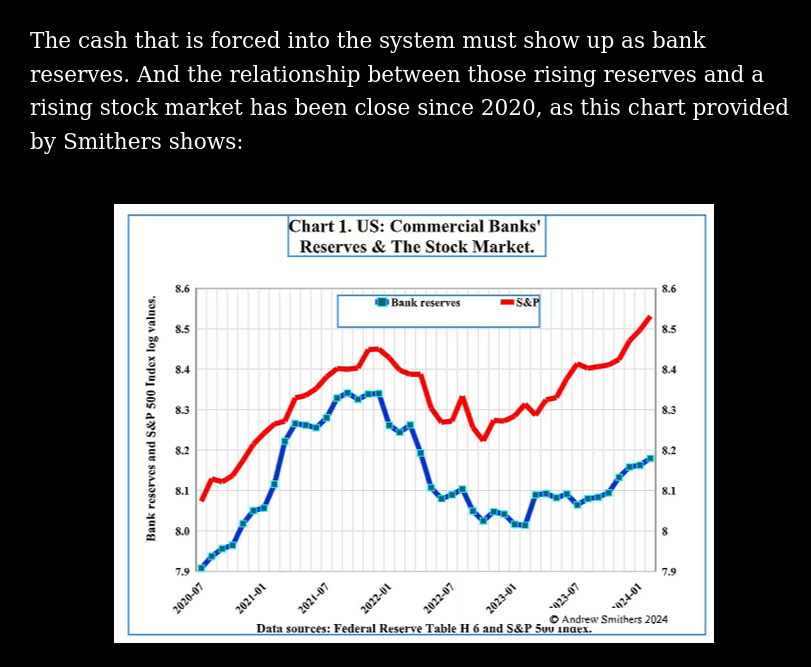

We have discussed how inflation was driven by profit subsidies which ended-up in financial markets. A graph this morning indicated some of this:

Printing of money by the central bank, not backed-up by selling of bonds, pushed the market way up and the cancelling of that money printing directed at capital brought them down again. Re-started bank printing to delay the onset of the inevitable recession at the start of 2023 drove the markets back up.

It does not explain all market fluctuations, but it is impossible to say that it has had no effect. The only way that this could have happened is if enough money was printed and in such a way that it made its way into the hands of capital very quickly.

Those are also the lines for inflation. Money printing without value backing cause devaluation of money across the entire economy. And, in this case, the economy is world-wide.